Financial planning is a strategic process that helps businesses and individuals effectively manage financial resources, thereby achieving short-term and long-term goals. For businesses, this is a roadmap for financial management and optimization, in which controlling operating costs is an important pillar. For individuals, it is the construction of a detailed map of cash flow usage from income, spending, accumulation to investment to achieve financial freedom.

first. Financial planning What is that?

For businesses: Corporate financial planning is a comprehensive strategy that includes analyzing current financial situation, forecasting cash flow, setting specific financial goals and determining resource allocation options. An integral part of this plan is the development of a budget and spending control mechanism, ensuring that all expenditures serve the common goal.

For individuals: Personal financial planning is a detailed roadmap on how to manage cash flow, from income, spending, saving to investing and protecting assets. The ultimate goal is to ensure financial security, achieve life goals (buying a house, retirement) and move towards financial freedom.

2. Core Benefits of Financial Planning

Job financial planning A systematic accounting is not only an accounting practice but also a strategic step, creating a solid foundation for sustainable growth and minimizing risks for both individuals and businesses.

2.1 For Businesses: Optimizing Resources and Sustainable Growth

- Build a clear financial strategy: A professional financial plan helps businesses map out a transparent capital usage roadmap, identify optimal investment options, manage debt effectively and allocate resources accurately. According to a PwC report, businesses with detailed financial plans achieve 15% higher revenue growth than their competitors.

- Ensure stable and continuous operation: A detailed financial plan helps businesses closely control cash flow, maintain solvency and ensure uninterrupted operations, avoiding sudden capital shortages.

- Proactively minimize financial risks: This plan acts as a protective “shield”, helping businesses forecast and respond to market fluctuations such as interest rates, exchange rates, and inflation, thereby minimizing damage and maintaining stability.

- Optimize costs, increase competitive advantage: Comprehensive financial analysis helps businesses easily detect cost bottlenecks, thereby adjusting processes and optimizing operations. Applying solutions cost management Automation is key to achieving this goal, directly contributing to improved profit margins.

- Increase transparency, attract investment capital: A professional financial plan, in compliance with the regulations of Accounting Law 2015, demonstrating outstanding financial management capacity, creating absolute trust with banks, investors and strategic partners.

2.2 For Individuals: Building a Foundation for Financial Freedom

- Building a solid financial foundation: A clear plan helps you control your income and expenses, build an emergency fund (equivalent to 3-6 months of living expenses) and start a long-term investment journey for the future.

- Be proactive in facing risks and seizing opportunities: Planning helps you prepare financially for unexpected situations (illness, unemployment) and have resources ready to seize attractive investment opportunities when they arise.

- Reduce financial pressure, move towards financial freedom: When cash flow is managed scientifically, you will worry less about money, thereby being able to focus on developing your career and improving your quality of life.

- Manage expenses smartly and effectively: Tracking and analyzing your spending helps you identify waste, thereby adjusting your spending behavior to match your financial goals.

3. 7 Steps Financial Planning Business Standards

Below is a standard 7-step process to help businesses build a financial plan detailed and effective, with a particular focus on how to turn plans into action through cost control.

- Step 1: Analyze and evaluate current financial situation: Perform a comprehensive financial “health check” by analyzing core reports: Income Statement, Balance Sheet, and Cash flow statement. Collecting accurate spending data at this step is extremely important to get an honest picture.

- Step 2: Identify financial goals and needs: Set goals using the SMART principle. For example, reduce operating costs by 10% by automating processes, or increase gross profit margin by 5% through controlling cost of goods sold.

- Step 3: Collect data and financial forecast: Gather historical data and forecast key metrics such as revenue, variable costs, fixed costs. Build financial scenarios (optimistic, baseline, pessimistic) to anticipate market fluctuations.

- Step 4: Build a detailed financial plan: Create budgets for each department and project. This is where a system is needed to ensure spending proposals adhere to the approved budget and avoid overspending.

- Step 5: Present and approve the plan: Design a visual, easy-to-understand plan with illustrative charts. Present clearly to the leadership and board of directors to gain consensus and approval.

- Step 6: Deployment and assignment of implementation: Assign specific tasks to each department. For example, the accounting department is responsible for tracking actual costs against budget, and department heads are responsible for approving spending within the allowed range.

- Step 7: Monitor, measure and adjust: Continuously monitor key performance indicators (KPIs). Having real-time spending data helps businesses quickly detect deviations and adjust plans in time, instead of waiting until the end of the accounting period.

4. 6 Steps Personal Financial Planning Simple, Effective

If you are a small business owner or self-employed, personal financial planning is the foundation for ensuring long-term financial independence.

- Step 1: Assess your current financial situation: List all your income sources, assets (cash, savings, investments), and liabilities (consumer loans, credit cards, mortgages). Calculate your net worth (Assets – Liabilities).

- Step 2: Set specific financial goals: Identify short-term goals (buy a new phone in 6 months), medium-term goals (pay off credit card debt in 2 years) and long-term goals (buy a house, retire).

- Step 3: Build a spending budget: Apply popular personal budgeting methods like the 50/30/20 rule (50% for necessities, 30% for wants, 20% for savings and debt repayment) or the 6 jar method.

- Step 4: Make a debt repayment and savings plan: Prioritize paying off high-interest debt first (the “avalanche method”). Automate your savings by setting up automatic transfers to your savings account as soon as you receive your paycheck.

- Step 5: Develop an investment and protection plan: Research investment channels that suit your risk appetite and long-term goals. Also, consider insurance products (life, health) to protect your finances against unexpected risks.

- Step 6: Discipline implementation and periodic review: Stick to your plan. Review and adjust your plan every 6-12 months or when there are major life changes (getting married, having children, changing jobs).

5. 5 Golden Rules To Financial Planning Optimize

- Principle 1: Tightly manage cash flow: Cash flow is the lifeblood of any business. A good financial plan must be coupled with an effective expense control system to ensure that cash outflows are always under control.

- Principle 2: Build an emergency fund: Always set aside a reserve fund equivalent to 3-6 months of operating expenses (business) or living expenses (personal) to deal with unexpected situations.

- Principle 3: Prioritize paying off high-interest debt: High-interest debt can eat away at your assets quickly. Focusing your resources on paying them off first will save you a significant amount in interest costs.

- Principle 4: Harness the power of compound interest: Start saving and investing as early as possible. Time is of the essence for compound interest to work and grow your wealth exponentially.

- Principle 5: Periodic assessment and adjustment: Markets and circumstances are always changing. An effective financial plan needs to be reviewed and adjusted periodically to ensure it remains relevant to your goals.

6. Factors Affecting Financial Planning In Vietnam

To financial planning To be effective, businesses need to rely on four fundamental elements, ensuring that plans are realistic, flexible and legally compliant.

6.1 Based on internal financial situation

Analyzing financial statements is the first and most important step. These reports, prepared in accordance with the standards of Accounting Law 2015 and Decree 174/2016/ND-CP, providing an objective view of a company's financial health, thereby identifying short-term priorities such as liquidity management or cost cutting.

6.2 Based on strategic operating objectives

Financial planning must go hand in hand with business strategy. If the short-term goal is to optimize profits, the plan will focus on cutting costs and improving operational efficiency. This requires tools to track and execute the spending policies that have been set.

6.3 Based on scale and scope of operations

There is no one-size-fits-all financial plan. Small businesses need to prioritize controlling cash flow and fixed costs. As a business grows, manual expense management becomes complex and risky, requiring automated solutions to ensure accuracy and compliance.

6.4 Analysis of business and legal environment

Macro and legal factors have a direct impact on financial planning. Businesses must consider factors such as the monetary policy of State Bank of Vietnam, fluctuations in interest rates, exchange rates, inflation, as well as changes in tax policies from Ministry of Finance.

7. Compare Support Tools Financial Planning Popular 2025

Planning is just the beginning; execution and control are the keys to success. Choosing the right tools will help your business turn plans on paper into real results.

7.1 Excel Spreadsheets – Flexible but Potentially Risky

Excel is a familiar tool but it is not enough to manage costs effectively at scale. Manual data entry is prone to errors, difficult to track budgets in real time, and has no clear approval mechanism, leading to the risk of overspending and lack of transparency.

7.2 Bizzi specialized management software – Automation and efficiency

Dedicated software like Bizzi is the bridge between financial planning and execution. Bizzi not only helps in planning but also focuses on controlling the spending process. The platform automates processes from automatic invoice processing, approve payment request to real-time budget tracking. This reduces manual processing time, ensures all expenditures comply with policy, and provides accurate data for management to make quick decisions.

In particular, features such as per diem management Helps businesses control one of their most complex expenses in a clear and streamlined manner.

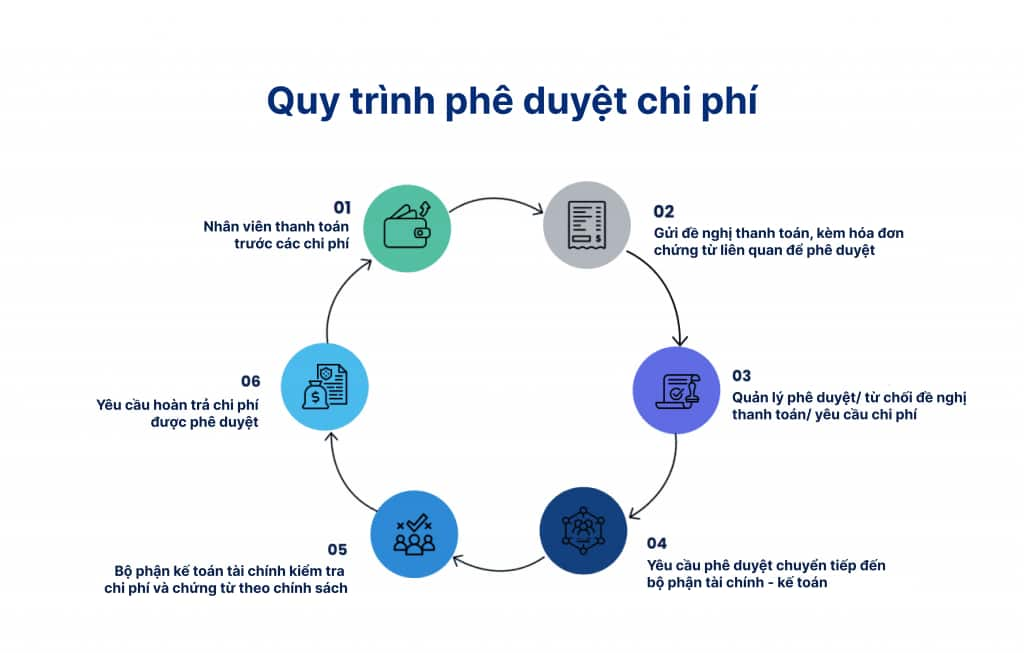

Flowchart of the payment request process from creation to approval and execution on the Bizzi platform.

7.3 ERP (Enterprise Resource Planning) System – Comprehensive for large enterprises

ERP is a comprehensive solution, integrating finance with other departments. However, the cost of implementing and operating ERP is very high, and their cost management modules are often not as flexible and in-depth as other ERP solutions. Dedicated ERP integration solutions.

7.4 Financial Advisory Services – Specialization for Complex Strategies

Hire a financial advisor to help your business develop a strategy. However, to execute that strategy, businesses still need a powerful internal tool to manage and control day-to-day financial operations.

Sign up for a Bizzi trial to automate your financial processes and control your budget in real time: https://bizzi.vn/dang-ky-dung-thu/

8. 5 Common Mistakes When Financial Planning & How to Fix

- Lack of specific and measurable goals: A plan without clear goals has no direction. Fix: Always apply the SMART principle to determine detailed goals.

- Overly optimistic about revenue and cash flow: Over-forecasting leads to capital loss when reality is not as expected. Fix: Develop three scenarios and prepare an action plan for each scenario.

- Ignore hidden costs and volatility: Many businesses focus only on fixed costs and forget about small, unbilled expenses. Fix: Use a centralized expense management system like Bizzi to record every expense, ensuring no expense is missed.

- Not tracking and updating the plan: Making a plan and then "putting it in the closet" is a fatal mistake. Fix: Use real-time dashboards to compare actual spending against budget, helping to spot and address issues immediately.

- View financial planning as the sole responsibility of the accounting department: Financial planning requires the participation of all departments. Fix: Implement a transparent expense management system where every department can see their budget and spending status, thereby enhancing accountability.

9. Conclusion

Financial planning is the foundation, but effective cost control is the lever that helps businesses realize that plan. Building a methodical plan combined with an automated expense management tool is the formula to optimize resources, minimize risks and achieve sustainable growth.

With the help of digital platforms like Bizzi, turning financial planning into concrete actions through spending control is easier, more transparent and more efficient than ever. Start building a solid financial roadmap today to master the future of your business.