Note: This article is for reference only, not specific advice for any case.

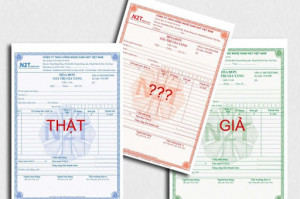

What is illegal use of invoices?

Thus, using invoices of businesses that give up their business addresses and run away is one of the cases that can be concluded as using illegal invoices. The fine for using illegal invoices is from VND 20,000,000 to VND 50,000,000 (Average is VND 35 million).

>> See more: Update 2023: Everything you should know about invoice processing

Principles of handling when meeting the purchase invoice of a runaway business?

According to the guidance of the Ministry of Finance, this content is specified in Official Letter No. 13706/BTC-TCT and Official Dispatch No. 1179/BTC-TCT dated July 22, 2014.

Case 1: Enterprise has not declared VAT deduction

1. Tax authority

- Notify the enterprise in writing to suspend the declaration of withholding VAT for invoices that violate the law.

2. Enterprise

- Only input VAT withholding declaration can be made for invoices that do not violate the law.

- With invoices from absconding enterprises, enterprises temporarily stop declaring VAT withholding, waiting for official results from competent authorities.

Case 2: The enterprise has declared VAT deduction or the business has been refunded

1. Tax authority

- Notify the enterprise to declare adjustment and reduce the deducted value-added tax.

- Inspect and re-check to conclude and handle violations, verify some contents(*)

- In case of detecting signs of crime, the dossier shall be sent to the relevant investigating agency.

2. Enterprise

- Declare the reduction of the deducted value-added tax amount.

- Commit to the purchase and sale of goods and input invoices in accordance with regulations and still be able to declare invoices. Enterprises must commit to take responsibility before the law if any violations arise. Tax authorities will conduct inspection and examination to verify and handle violations.

Case 3: The enterprise has not yet received a tax refund

1. Tax authority

- Proposing to suspend tax refund for pending applications with invoices showing signs of violations.

- For invoices that are not subject to signs of violation, normal tax deduction and refund will be made.

2. Enterprise

- Comply with the decision of the tax authority.

Case 4: Detecting serious violations and crimes

1. Tax authority

- The tax authority will transfer the file to the competent agency for investigation and criminal prosecution.

2. Enterprise

- If using invoices of intermediary enterprises with signs of violation, the tax authority will notify the enterprises to self-declare and adjust value added tax.

In addition, according to the guidance at Point 2.2 of Official Letter No. 7333/BTC-TCT dated June 24, 2008, in case the business establishment uses the invoice for the purchase of goods and services from the business establishment running away to declare it. VAT is deducted and included in expenses when determining taxable income, but the time of purchase of goods or services arises before the date of determination of absconding business establishments according to the notices of tax authorities and tax authorities, or If other functional agencies do not have enough grounds to conclude that the invoice is illegal, the tax authority must conduct an inspection to determine whether the purchased goods or services are correct and request the business establishment to prove and take responsibility before law for the fact that the purchase and sale is real, there is a purchase and sale contract, a written document of contract liquidation (if any), an ex-warehousing note, a warehouse receipt, and a money payment voucher; If the goods and services purchased from a runaway establishment are used to serve business activities, which have been sold and declared and taxed, and have adequate and correct accounting records, the business establishment is entitled to deductions. input VAT according to such purchase invoices and included in expenses when determining taxable income.

Above Here is information on how to handle illegal invoices from runaway businesses, hopefully useful to you.

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam