Downloading and storing electronic invoices (E-invoices) has become a mandatory requirement and an important initial step in the entire process. business cost management. (Updated according to Circular 78/2021/TT-BTC and Decree 123/2020/ND-CP, up to 2025).

There are 4 How to download electronic invoice in Vietnam: via the General Department of Taxation's Information Portal, via the seller's email, via the portal of the e-invoice service provider, or the business's own lookup website. Mastering these methods not only helps businesses comply with the law but also serves as the foundation for building a transparent financial management system, strictly controlling expenses and optimizing the payment process.

This article will guide you through each step in detail. How to download electronic invoice, clearly distinguishes the legal value of XML and PDF files, and points out common errors and safe, effective storage solutions, helping businesses lay the first bricks for effective expense management.

1. 04 How to Download Electronic Invoice Most Popular and Easiest

For businesses to be able to do How to download electronic invoice quickly, creating the premise for effective cost management, Bizzi guides the 4 most popular methods today:

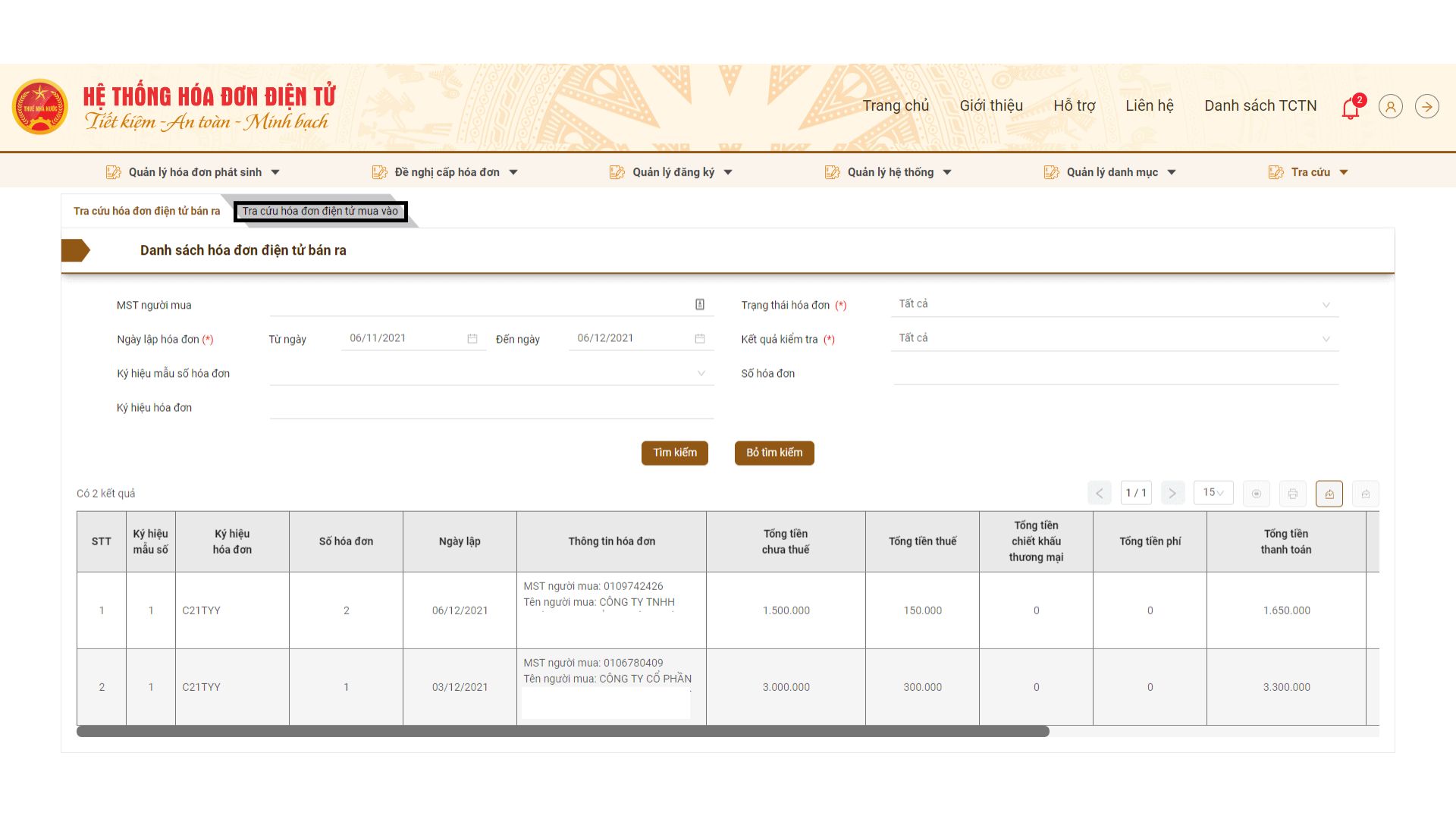

1.1. How to download electronic invoice from the General Department of Taxation Portal (hoadondientu.gdt.gov.vn)

This is the most official and reliable method, as the information is taken directly from the tax authorities, and is the original data source for all future audits and cost control activities.

Prerequisites:

- Account to log in to the Electronic Tax system (authorized by the tax authority).

- Install a digital signature plugin (e.g. HDDT Plugin) for authentication when needed.

Steps to follow:

- Step 1: Visit the official website:

hoadondientu.gdt.gov.vn. - Step 2: Log in with your business's e-Tax account.

- Step 3: Navigate to “Lookup” and select “Lookup Bill”.

- Step 4: Enter complete lookup information: Seller's tax code, Invoice symbol, Invoice number, and other required information.

- Step 5: Click “Search”. The system will display the corresponding invoice results.

- Step 6: Select the invoice you want to download and click the “Download” button.

- Step 7: Select download format (XML file download required and PDF download optional).

Advantage:

- Accurate, reliable information, original data source from tax authorities.

- Ensure the legality of invoices, creating a solid basis for cost recording.

Disadvantages:

- Manual, time-consuming lookup processes can become a bottleneck in the payment process if the number of invoices is large.

- The interface is not really user friendly.

1.2. How to download electronic invoice from the supplier system (MISA, Viettel, VNPT, BKAV...)

Most sellers use the services of an e-invoice provider. Uploading invoices through these portals is an integral part of the interaction and payment flow with the supplier.

Steps to follow:

- Step 1: Open the invoice release notification email from the seller and click on the lookup link provided.

- Step 2: Enter the “Invoice Lookup Code” (this code is usually included in the email or printed on the PDF version of the invoice).

- Step 3: After entering the code, the system will display the invoice details. You just need to choose the option to download XML and PDF formats.

Advantage:

- Very popular, convenient and fast for buyers.

Disadvantages:

- Each vendor has a different interface, creating fragmentation in expense documentation collection.

- Depending on whether the seller sends a lookup link or not, there may be a delay in recording the expense.

1.3. How to download electronic invoice from Transaction Email

This is the simplest method, but it also poses many risks to centralized cost management without an automated email processing process.

- Form: The seller attaches the invoice file (usually in both .XML and .PDF formats) in the transaction confirmation email.

- Steps to follow: Open email -> Find the attached file -> Click download button and save to the business storage system.

- Advantage: Extremely fast, no need to perform additional lookup operations.

- Disadvantages: Easily lost, overlooked, leading to under-recording of expenses. It is necessary to carefully check the validity of invoices before entering into the payment process.

- Security Note: Always double-check the sender's email address to avoid fraudulent emails that pose financial risks to your business.

1.4. How to download electronic invoice from Seller's own Website/Portal

Many large suppliers build their own lookup portals, helping customers be more proactive in collecting documents, an important factor in ensuring the uninterrupted flow of cost information.

- Form: The seller provides a portal on their website.

- Steps to follow: Go to the seller's website -> Find the invoice lookup section -> Enter authentication information (order code, customer code...) -> Find and download the invoice.

- Advantage: Proactive, can be looked up at any time, useful when dealing regularly with a supplier.

- Disadvantages: Not every business has this system, and having to access multiple systems increases the administrative burden.

2. Distinguishing Electronic Invoice File Formats (XML vs. PDF): Which File Is Correct to Download?

When performing How to download electronic invoiceChoosing the right file format is not only about legal compliance, but also directly affects the ability to automate and analyze cost data later.

2.1. Clearly Distinguish Two Important File Formats

| Criteria | XML file (.xml) | PDF file (.pdf) |

| Nature | Is an original, structured data file containing all information according to the standards of the General Department of Taxation. This is a “clean” data source for cost management systems. | Is a visual representation of the invoice content, making it easy for users to read and print. |

| Legal value | Has the highest legal value. This is a required file to be stored for tax declaration purposes and is the basis for accounting. | For reference only, not legally valid enough to replace XML files when settling taxes. |

| Readability | Specialized software is required to read and extract data, facilitating automation. | Easy to open with popular software. |

| Intended use | Storage, tax filing, accounting, and most importantly, input to automated systems for cost processing and analysis. | View, print, and quickly compare information. |

2.2. So Which Format Is Correct and Sufficient to Download?

- Obligatory: Always have to load and save XML file. This is the original document and the golden data source for financial digitization.

- Should have: Download included PDF file for quick viewing and internal circulation.

Keeping both files is a best practice that helps businesses stay legally compliant while optimizing internal cost management processes.

3. Instructions for Checking the Validity of Electronic Invoices After Downloading

After applying How to download electronic invoice, validation is an important risk control step in the expense management process, ensuring that businesses do not pay for invalid documents.

Step 1: Check Integrity and Digital Signature on XML File

Use iTaxViewer software or automated expense management platforms to open the XML file. The system will automatically check:

- Digital signature: Make sure the seller's digital signature is valid.

- Integrity: Verify invoices are not edited, ensuring cost data is accurate.

Step 2: Look Up Invoice Information on the General Department of Taxation Portal

This is the most important cross-reference step to validate an expense:

- Access

https://hoadondientu.gdt.gov.vn/. - Enter the information on the invoice into the lookup section.

- Click “Search”.

The result returned from the tax authority is the final proof of the invoice's legitimacy.

Step 3: Compare Information Between Invoice File and Search Results

Compare important information (tax code, total amount, tax rate…). All information must match exactly to ensure the expense is recorded correctly.

4. Why Must Electronic Invoices Be Downloaded and Stored Correctly?

Properly uploading and storing electronic invoices is not only a legal obligation, but also a core foundation of effective financial management and cost control.

4.1. For Buyer (Paying Business)

- Basis for input cost accounting: Invoices are the original documents for recording expenses, providing input data for expense analysis and reporting.

- Proof of valid expenses when calculating corporate income tax: This is the key to ensuring that every expense is reasonable and valid cost, helping to optimize the tax obligations of the business.

- Basis for declaring input VAT deduction: Reduce taxes payable, directly impacting the company's cash flow.

- Archives for tax inspection and examination: Provide legal evidence, avoid financial penalty risks.

- Reconcile debt with suppliers: Ensure accuracy in Supplier Payment Process, avoid incorrect or duplicate payments.

4.2. For Sellers

- Store copies of issued invoices: Comply with regulations on storing accounting documents.

- Serving internal management work: Easily check and reconcile revenue, debt and business situation.

5. Common Problems When Downloading Electronic Invoices and Instructions for Handling Them

Problems during implementation How to download electronic invoice can disrupt and delay the entire expense processing process. Here are some common problems and solutions:

- Did not receive email/search link: Contact the seller immediately. This delay affects the timely recognition of expenses.

- Enter error code: Double check the information. This error may delay the invoice verification.

- Download only PDF file, no XML: Require the seller to provide additional XML files to ensure validity for tax accounting and deduction.

- XML file is corrupted and cannot be opened: Require the seller to resend the standard file to ensure cost data can be processed automatically.

- Invalid/expired digital signature: Notify the seller immediately. An invalid invoice will be removed from the payment process. Learn more about the regulations cancel electronic invoice to process.

- Difficulty in manually downloading from multiple sources: This is the biggest problem for the accounting department, wasting time and increasing the risk of errors. The optimal solution is to automate the entire process. input invoice processing.

Businesses can save up to 80% of time by learning how Bizzi helps automatically detect and process error invoices. Sign up for a free trial now!

6. Regulations on Safe and Legal Storage of Electronic Invoices

Once completed How to download electronic invoice, systematic storage is the final step in ensuring cost data is readily available for retrieval, auditing and analysis.

Legal requirements and best practices:

- Storage format: Required to save original file XML.

- Storage time: Minimum 10 years as prescribed by the Accounting Law.

- Storage media: Cloud storage services are recommended for their security and flexible access.

- Safety and integrity: The storage system must be safe, secure and allow easy data extraction when needed.

Good Storage Practices:

- Scientific directory organization: Organize invoices by supplier, month, quarter, year to easily track expenses.

- Name the file clearly: Helps find documents faster.

- Periodic Backup: It is a mandatory requirement to prevent the risk of losing important financial data.

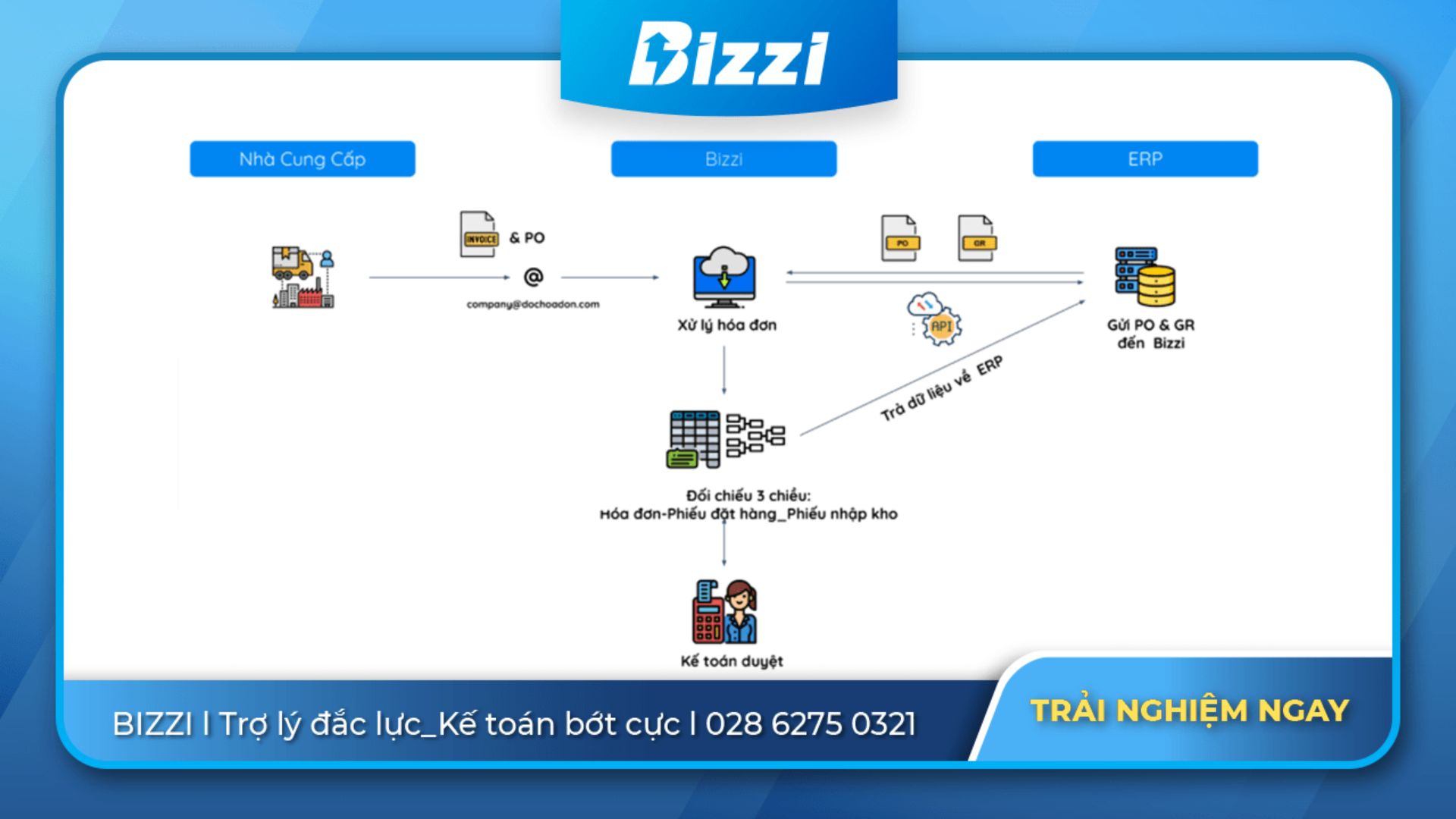

7. Automation How to Download Electronic Invoice and Comprehensive Expense Management With Bizzi

Manually uploading each invoice is just the beginning. To truly control expenses, businesses need a comprehensive automation solution. Bizzi goes beyond invoice collection to provide a comprehensive expense management platform.

7.1. Smart Solution for Billing and Expense Management

Bizzi turns manual invoice processing into an automated, intelligent and transparent workflow:

- Automatically collect input invoices from all sources: Bizzi automatically fetches invoices from email and supplier portals, ensuring no expense is missed.

- Automatic checking and reconciliation: The system automatically compares invoices with purchase orders, contracts and checks their validity with tax authorities.

- Centralized and secure storage: All expense documents are stored on a single platform, easy to search and audit.

- Create and approve automatic payment requests: Data from the invoice is used to automatically generate a payment request and send it through a pre-established approval flow.

- Seamless integration with ERP/accounting software: Bizzi helps synchronize data two-way, completely eliminating manual data entry, ensuring cost figures are always accurate.

7.2. Outstanding benefits that Bizzi brings

Automation How to download electronic invoice and the entire expense processing process with Bizzi helps businesses save up to 80% of time, reduce 90% of errors, provide a 360-degree view of spending and ensure compliance with 100% of legal regulations.

FAQs – Frequently Asked Questions

Question 1: Is there a fee to download an electronic invoice?

Absolutely not. Invoice lookup and download are free. Costs may only arise when businesses invest in automation solutions to manage and process these invoices more efficiently.

Question 2: Can I save only PDF files?

Are not. By law, the only legally valid file is the XML file. This is the basis for recording valid expenses and tax deductions.

Question 3: How to open an electronic invoice XML file?

You need to use specialized software like iTaxViewer, or expense management platforms like Bizzi. These tools not only display but also help extract data from XML files.

Question 4: Where can I get the invoice lookup code?

The lookup code is usually printed on the PDF version of the invoice or included in the invoice release notification email.

Question 5: What should I do if I lose the downloaded electronic invoice?

You can contact the seller to request a reissue or look it up and download it yourself. Using a centralized storage system like Bizzi will completely eliminate this risk.

Question 6: Can I download electronic invoices in bulk?

Conventional portals do not support bulk uploading. To collect and process thousands of invoices automatically, businesses need specialized solutions like Bizzi.

Conclude

Master the How to download electronic invoice and storing XML files properly is a basic requirement. However, to improve management, businesses need to look further: automating this process is the key to freeing up resources, minimizing risks and building a smart, efficient cost management system.

Experience Bizzi's automated invoice processing and expense management solution to transform your accounting department from a cost center to a strategic partner of your business.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/

Contact Bizzi today for detailed advice on automating financial and accounting processes, helping your business move faster in the digital age!