Invoices are important legal documents recording economic transactions, especially when issued under contracts. Mastering how to write invoice content according to standard contracts not only ensures compliance with the law but also helps businesses avoid risks and penalties for violations.

This article by Bizzi will provide detailed instructions from definitions, principles, to how to write each criterion and important notes.

What is a contract invoice?

Contractual invoices are created to prove that a transaction has taken place and are the basis for the buyer to declare and deduct taxes.

Definition and nature

Contractual Invoice is understood as value added tax invoiceg (VAT), also known as red invoice, is issued according to the contract between the enterprise and another entity. This is a type of document created by the seller to record information about the sale, distribution of products, or provision of services in accordance with the provisions of law.

Subjects and forms of application

Contractual invoices only apply to business units, organizations, and individuals who declare and calculate taxes using the deduction method in activities such as selling goods, providing domestic services, international transportation, exporting goods/services abroad, and exporting to duty-free zones.

Currently, VAT invoices under contracts exist in 3 main forms: electronic invoices, self-printed invoices and printed invoices.

Important notes before learning how to write invoice content according to contract

Before proceeding to record invoices according to the contract, businesses need to pay attention to two main points: the time of invoice creation and the principles of invoice creation to ensure legality and accuracy.

When is the time to record invoice content according to the contract?

Invoice timing varies depending on the field of activity:

- For the field of selling goods: The time of invoice issuance is the time of transaction of transferring ownership or right to use goods from seller to buyer. regardless of whether the money has been collected or not.

- For service provision sector: The time of invoice issuance is when the service provision is completed. regardless of whether the money has been collected or not. However, in case of collection during the process or collection before completion of the service, the time of invoice is time of collection.

- For construction and installation: The time of invoice issuance is the time of acceptance and handover of construction works and project items to the customer. regardless of whether the money has been collected or not.

Special Note: If there is a collection of money according to the project implementation progress or the collection progress stated in the contract (applicable to real estate business, infrastructure construction, house construction for sale), then The collection date is the invoice date.. Construction contract advances that are not included in the payment schedule are No VAT invoice required.

- In case of multiple deliveries or handover of each service item or stage: Each delivery or handover must be invoiced for the volume and value of goods and services delivered respectively.

General principles in writing invoice content according to contract

When writing an invoice according to an economic contract, you must ensure that the invoice is written in accordance with the regulations of the Ministry of Finance:

- The biller is the seller.. Invoices must be issued when selling goods or providing services, including goods/services used for advertising, promotion, samples, gifts, exchanges, and in-kind compensation for employees, except for goods/services used or circulated internally to participate in the production system.

- The content on the invoice must be complete and accurate. with the arising economic transactions. For paper invoices, avoid erasing or correcting, use a single ink color (do not use red), do not write over pre-printed parts, and cross out parts that do not have content on the invoice.

- Contractual invoices must be set up in the correct order and from small to large.

- Ensure the security requirements, avoid changes or loss of accounting data for electronic invoices or using invoice printing application software.

- In case of use paper bill, need to make many different copies and must have the same invoice number, each copy can only be printed once, from the second time is a copy.

Detailed instructions on how to write invoice content according to the contract

A contract invoice must contain the same content as other invoices.

Required information on invoice

The content of the invoice according to the contract includes:

- Invoice date (Day/month/year): Must comply with the regulations on invoice issuance time of the Ministry of Finance.

- Seller information: Your company's name, tax code, and business address (usually available on the invoice).

- Buyer information: Fill in all the criteria including buyer's name, unit name, address, tax code.

- Payment method: Write symbol TM (cash), CK (transfer) or TM/CK (payment method not yet determined). Note, for invoices with a value of over 20,000,000 VND, if the buyer wants to deduct VAT and calculate it into the reasonable expenses of the business, the buyer must choose the payment method CK.

How to write detailed list of goods and services

In the detailed list section, the bill writer must complete the information in the following columns:

- Numerical order.

- Name of goods and services:

- Must be presented in Vietnamese, with details for each type if there are many different types (for example: Samsung phones).

- If the goods or services have a code, both the name and the code must be recorded.

- For goods that require registration of ownership/usage rights (e.g. cars, motorbikes, houses), the required numbers and symbols must be shown according to legal requirements (frame number, engine number, address, building level, length, width, number of floors).

- If it is necessary to add foreign words, the foreign words are placed on the right in parentheses ( ) or placed immediately below the Vietnamese line and have a smaller font size than the Vietnamese words.

- Unit of measure: The seller determines the unit of measurement (for example: ton, kg, piece, box, m3) based on the nature and characteristics of the goods. For services, on the invoice It is not necessary to have the "unit" criterion. The unit of measurement is determined for each service provision and the content of the service provided.

- Quantity: Record in Arabic numerals based on the unit of measurement. For specific goods and services such as electricity, water, telecommunications services sold in a certain period, the period of provision of goods and services must be specifically recorded.

- Unit price, total price.

- Once completed, if there are still extra lines in the list, cross out all blanks there, starting from left to right.

Total and signature

- Total part:

- Total cost.

- VAT rate.

- Total payment amount (is the sum of Total goods price and VAT rate).

- Amount in words: Rewrite the figures in the “Total payment” line in words.

- Sign the invoice:

- Shopper: Whoever directly performs the transaction will sign. If the customer does not purchase directly (by phone or fax), the person who makes the invoice only needs to clearly state the method of purchase on the invoice and does not need the buyer's signature. With electronic invoices, the seller needs to have a digital signature, the buyer does not need to unless there is an agreement and the technical requirements are met.

- Salesman: The biller will sign directly.

- Unit Head: The Director of the unit must personally sign, stamp, and write full name. In case of authorizing another person to sign, the above requirements must also be fully implemented.

Processing long list invoices (with schedules)

If the contract contains too many categories of goods, services or finished products, the seller can choose the following form of invoice:

- For Electronic invoice: Can export a multi-page invoice.

- For paper invoices: Multiple invoices can be issued in series or invoice with statement.

- When using a statement, the invoice must clearly state “with attached list number…, date… month… year”.

- The list must include the name, tax code and address of the seller, name of goods and services, quantity, unit price, total amount of goods and services sold, date of preparation, name and signature of the person preparing the list.

- If the seller pays VAT using the deduction method, the statement must include the criteria “value added tax rate” and “value added tax amount”. The total amount paid on the statement must match the amount stated on the VAT invoice.

- Note: In case of using a statement, on the invoice No unit price required.

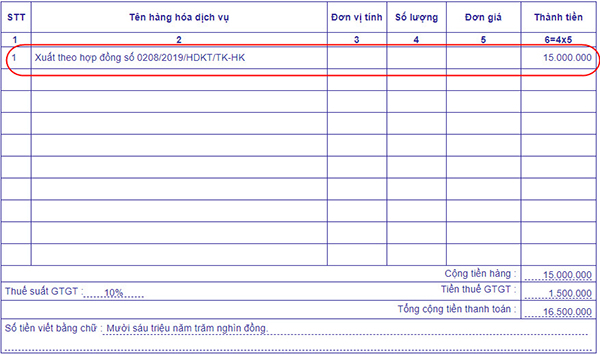

Cases where it is not required to record unit, quantity, unit price

There are some specific cases where an invoice is still considered legal even if it does not show these criteria:

- Stamps, tickets, electronic cards have available face values.

- Invoices for construction and installation activities; activities of building houses for sale with payment collection according to progress according to contract.

- Invoice used for Interline payments between airlines.

- For construction, installation, production, and provision of products and services by defense and security enterprises serving defense and security activities, the name of goods and services must state "providing goods and services according to contracts signed between the parties".

- Invoices issued by air transport companies to agents (according to the reconciled report and summary table) do not necessarily have to have unit prices.

How to write invoice content according to contract when paying multiple times

In many contracts, payments are made in installments. Here is how to write the contract invoice for each payment installment:

Determine the number and timing of payments according to the contract

First, you need to carefully check the terms of the contract regarding the number of payments and the specific time when each payment takes place. For example, the contract may stipulate payment in 3 installments: installment 1 is an advance payment, installment 2 after completing 50%, installment 3 is the completion of the contract. Each payment usually has a specific value that is clearly stated in the contract, you need to record this value correctly on the invoice.

Invoice for each payment

- For advance invoices: Upon receiving an advance payment from a customer, the enterprise must prepare and issue an invoice for that advance payment. The advance payment invoice must clearly state that it is an advance payment invoice, detailing the advance payment received, along with information about the contract number and date of signing the contract (for example: “Advance payment 1 according to contract No. 01/HD-KT dated January 1, 2024, advance payment value: 200 million VND”).

- For invoice issuance according to contract for subsequent payments: Invoice the payment amount for that period. Clearly state the quantity of work/goods performed, the payment amount for this period, the contract number, the date of signing the contract (for example: “Payment for the second period according to contract number 01/HD-KT dated January 1, 2024, payment value: 300 million VND”).

- For invoice settlement according to contract: After completing the entire contract, issue a settlement invoice for the remaining part of the contract. Clearly state the total contract value, previous payments, and the remaining amount to be paid (for example: "Contract settlement No. 01/HD-KT dated January 1, 2024, settlement value: 500 million VND").

Procedure after recording invoice content according to contract (recording, archiving)

After invoicing for each payment, the process of performing the following steps will be similar to the basic contract invoice:

- Send invoice to customer: Via email/electronic invoice system or post/hand delivery for paper invoices.

- Record invoices in accounting books: Record revenue from sales/service provision, record VAT payable in account 3331, and record amount receivable from customers in account 131 if payment has not been received immediately.

- Invoice storage: Electronic invoices must be securely stored in the system as prescribed (usually for at least 10 years). Paper copies of invoices must be stored with the contract.

Consequences of not issuing invoices or issuing invoices incorrectly

Invoicing according to contract is an important factor that cannot be ignored in every business transaction.

Cases where it is mandatory to issue invoices according to the contract

Enterprises are required to issue invoices according to contracts when:

- Delivery of goods/services completed.

- Get advance payment.

- Invoice according to contract progress (agreed payment according to progress).

Penalties and legal risks

Failure to issue invoices according to the contract or issuing invoices incorrectly can lead to serious consequences:

- Fine: From 10 to 20 million VND if not issuing invoices when selling goods/providing services; from 20 to 50 million VND if continuing to violate. Fine from 3 to 5 million VND if issuing invoices 1-10 days late; from 10 to 20 million VND if late over 21 days (according to Article 24, Decree 125/2020/ND-CP).

- Collection of tax and late interest: Collect VAT, CIT and late tax payment interest of 0.03%/day on the amount of late tax payment (according to Article 142, Law on Tax Administration 2019).

- Criminal liability: In serious cases, the offender may be fined up to VND 4 billion or imprisoned from 3 months to 7 years (according to Article 200, Penal Code 2015 - amended and supplemented in 2017).

Optimize contract invoicing process with e-invoicing solution

To ensure that contract invoicing is accurate, fast and legally compliant, the application of electronic invoicing solutions is essential.

Benefits of electronic invoices in contract management

Using electronic invoices brings many outstanding benefits:

- Process automation: Reduce invoice export, sending, and storage time by up to 70%.

- Minimize errors: Reduce 99% data errors by directly integrating with accounting software.

- Fast and efficient: Automatically issue numbers, sign, send emails, and help retrieve invoices in 3 seconds.

- Regulatory compliance: Meets 100% format standards and connects directly to Tax Authorities.

- Cost savings: Businesses can save from 100-300 million VND/year compared to traditional invoice process.

Introducing B-invoice Electronic Invoice Solution

Bizzi provide solutions B-invoice electronic invoice as an AI assistant for the finance and accounting department, helping to automate the collection and payment process and cost management. Outstanding features of B-invoice include:

- Create electronic invoices according to prescribed standards: Meet tax authority requirements, XML/PDF format.

- Custom Invoice Template: Allows businesses to design invoices with their own logo and brand.

- Batch invoice: Support issuing multiple invoices at the same time according to orders and customers.

- Authentication code from tax authority: Connect directly to the tax authority system to authenticate invoices.

- Store invoices according to regulations: Minimum 10 year storage system, ensuring legal compliance.

- Easy invoice lookup: Search invoices by number, issue date, customer, tax code.

- Download & print invoices anytime: Export invoices in PDF, XML format, integrated with digital signature.

- Manage invoice status: Track invoices issued, sent, paid, canceled or adjusted.

- Integration with accounting & ERP software: Synchronize data, improve management efficiency.

Conclude

Recording invoice content according to contracts is an important accounting practice, requiring accuracy and strict compliance with legal regulations. Mastering the principles, timing and detailed recording of each criterion will help businesses operate effectively and avoid unnecessary legal risks.

Applying modern e-invoice solutions such as Bizzi B-invoice will be a powerful tool, supporting businesses to optimize processes, ensure legality and improve financial management efficiency. Accurate invoice content is not only a legal requirement, but also a key factor in risk management, tax optimization and protection of business interests.

Schedule a demo and sign up for a trial of Bizzi's products here: https://bizzi.vn/dang-ky-dung-thu/