Tax regulations are regularly updated (e.g. Circular 40/2021/TT-BTC, Decree 126/2020/ND-CP and amendments). Therefore, it is extremely necessary to clearly understand how to declare business household taxes to avoid cases of applying the wrong declaration method or omitting obligations, leading to administrative penalties, tax arrears and late payment interest.

Overview of business tax declaration

Tax Return is the act of a business household declaring revenue and expenses (if permitted), determining the amount of tax payable and paying it to the tax authority according to regulations.

HKD is one of the entities that pay taxes directly to the tax authority, different from enterprises (paying through the full accounting system), playing an important role in the economy.

The importance of business tax declaration

Tax declaration for business households plays an extremely important role, not only for state management agencies but also directly affects the business activities, legality and reputation of business households. Below are the main points explaining the importance:

- Ensuring compliance with the law

-

- Mandatory obligation: According to the provisions of the Law on Tax Administration, business households must declare and pay taxes fully and on time.

- Avoid legal risks: Failure to declare, false declaration or delay can lead to administrative fines, tax arrears, or even business suspension.

- Help manage and optimize costs

-

- Understand the revenue situation: Tax declaration requires businesses to record revenue and expenses, thereby helping to better control business operations.

- Optimizing tax burden: Correct and complete declaration helps avoid being subject to higher tax rates than actual (especially important from 2026 when tax is abolished and declaration is required based on actual revenue).

- Build credibility and credit history

-

- Increased credibility: Having transparent tax records helps businesses build trust with customers and suppliers.

- Support for loans and business expansion: When needing to borrow from a bank or cooperate with a large partner, tax documents are one of the documents proving financial capacity.

- Avoid future risks

-

- Minimize disputes: Having clear tax data will help businesses explain when the tax authority inspects, avoiding unfavorable tax assessments.

- Protecting rights: In case there is a support policy from the State (tax exemption, post-epidemic support, etc.), households that fully declare will easily benefit.

- Responding to the trend of digitalizing tax management

-

- The government is moving to electronic tax management and electronic invoices. Proper declaration from the beginning helps businesses integrate easily and reduces errors when having to switch to the new system.

Methods of tax declaration for business households

To declare business taxes accurately and legally, business owners need to have a basic understanding of some typical declaration methods such as:

Declaration Method

-

- Object: Large-scale businesses (revenue over 3 billion or 10 billion VND depending on the field, or employing 10 or more workers). Businesses that do not meet the large-scale requirements but voluntarily choose to do so.

- Characteristic:

-

- Must implement accounting, invoice and voucher regime according to instructions at Circular 88/2021/TT-BTC.

-

- Tax declaration period: monthly or quarterly.

- Important Note: From January 1, 2026, the lump sum method will be completely abolished and all businesses will switch to paying taxes by declaration or each time they arise.

Tax declaration method for each occurrence

- Object: Individuals doing business irregularly, without a fixed business location.

- Characteristic: Only declare when using individual electronic invoices for each occurrence.

Tax declaration obligations of business households

Business households must fully perform the following obligations:

| Obligation | Detailed content |

| Tax registration | Register for a tax code when starting a business (Article 30, Law on Tax Administration 2019). |

| Periodic tax declaration | Declare revenue and expenses (if any) to determine the amount of tax payable, including: VAT, personal income tax, business license fee (if revenue > 100 million VND/year). |

| Pay taxes on time | Pay taxes according to the tax authority's notice or self-declaration. |

| Keep documents | Keep invoices and documents related to business activities for inspection and examination purposes. |

| Tax settlement | Make settlement when requested by tax authorities or when stopping or temporarily suspending business. |

Legal basis for business household tax declaration

Tax declaration obligations of business households are clearly stipulated in legal documents:

- Tax Administration Law 2019

-

- Article 16: Obligations of taxpayers.

- Article 30: Tax registration.

- Article 42, 43: Tax declaration and calculation.

- Article 55: Tax payment deadline.

- Decree 126/2020/ND-CP

-

- Detailing a number of articles of the Law on Tax Administration, providing guidance on tax declaration, tax payment, and penalties for violations.

- Detailing a number of articles of the Law on Tax Administration, providing guidance on tax declaration, tax payment, and penalties for violations.

- Decree 139/2016/ND-CP (and amended in Decree 22/2020/ND-CP)

-

- Regulations on business license fees and collection rates applicable to business households.

- Circular 40/2021/TT-BTC

-

- Specific instructions on the method of calculating VAT and personal income tax for business households and business individuals (declaration according to actual revenue or contract).

- Circular 88/2021/TT-BTC

-

- Regulations on electronic invoices applicable to business households.

Notes when declaring business tax

Before declaring business tax, business owners need to clearly understand the following notes:

- Business households with revenue ≤ 100 million/year → exempt from VAT, personal income tax, and business license fees.

- From 2026 → most likely abolish lump sum tax, business households must declare actual revenue monthly/quarterly (according to the tax sector's digitalization roadmap).

- Tax authorities have the right tax assessment If the business household does not declare or declares dishonestly

Detailed instructions for declaring business household tax according to the declaration method (applicable from 2026)

Below are instructions on the steps to declare business tax according to the declaration method:

- Business household tax declaration documents include:

- Tax declaration (form number 01/CNKD).

- Appendix: Business activities list (form no. 01-2/BK-HDKD).

- Where and how to submit application

- Place of submission: Direct tax authority.

- Electronic submission form: Electronic Tax Portal (thuedientu.gdt.gov.vn), National Public Service Portal, eTax Mobile application.

- Deadline for submitting business tax declaration

- File: No later than the 20th day of the following month (if declaring monthly) or the last day of the first month of the following quarter (if declaring quarterly).

- Pay taxes: No later than the last day of the tax return filing deadline.

- Timeline & References

- Declaration Form 01/CNKD – Tax declaration for business households and business individuals declaring according to Circular 40/2021/TT-BTC.

- Appendix 01-2/BK-HDKD – Statement of business activities during the period

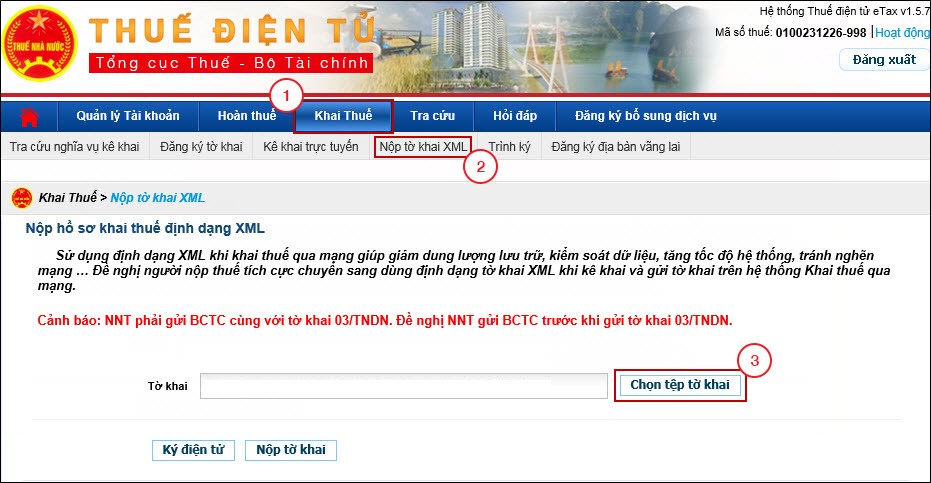

Instructions for electronic tax declaration (example on the Electronic Tax Portal)

Below is a detailed step-by-step guide to filing taxes electronically on Electronic Tax Portal (https://thuedientu.gdt.gov.vn/) – applicable to businesses, business households or individuals with tax codes:

Preparation before electronic tax declaration

Before you begin, you will need to prepare:

- Tax code & password Log in to the Electronic Tax portal.

- Digital Signature (USB Token) within expiry date, registered with tax authorities.

- HTKK or iHTKK software to fill out the form, or use it online right on the portal.

- Stable internet connection and the computer has Java software/digital signature driver installed.

Log in to the Electronic Tax Portal

- Access: https://thuedientu.gdt.gov.vn

- Select Business (or Individual if you file personal taxes).

Enter:- Tax code (or MST + appendix if there is a branch).

- Password.

- Authentication code (CAPTCHA).

- Click Log in.

Note: If you forget your password, select “Forgot password” to receive it via registered email.

Prepare and submit electronic tax returns

There are 2 ways to create a declaration:

- Method 1 – Submit declaration from HTKK file

-

- Go to menu Tax declaration → Submit the declaration.

- Select Select declaration file → download the rendered XML file from the HTKK software.

- The system displays declaration information → click Electronic signature → enter digital signature PIN.

- Click Submit the form → the system reports "Declaration submitted successfully".

- Method 2 – Fill out the form online

-

- Enter Tax declaration → Prepare declaration online.

- Select the declaration type (eg: 01/GTGT – Monthly/Quarterly VAT declaration).

- Enter data directly on the electronic form.

- Click Complete the declaration → automatic error checking system.

- Sign electronically and submit as above.

Check declaration status

- Enter Search → Declaration.

- Select a time period and declaration type to view status:

- Submitted (valid).

- Not submitted / Error (need to resubmit)

- The declaration form (PDF/XML file) can be downloaded for storage.

Pay taxes electronically (if applicable)

After submitting the declaration, if there is tax payable:

- Enter Pay taxes → Make a payment slip.

- Select: Registered bank account, tax authority, state budget payment.

- Electronic signature → submission confirmation.

- Track your deposit status in the Search → Deposit slip.

Regulations on Electronic Invoices for Business Households

From date June 1, 2025, some business households must use electronic invoices generated from cash registers connected to electronic data transfer with tax authorities in the following cases:

- Business households and individual businesses have annual revenue of 1 billion VND or more.

- Household has cash register.

- Business households with revenue and labor scale reaching the highest level according to the criteria of micro-enterprises, applying tax declaration method.

- Business households in specific industries, especially retail, food and beverage, restaurants, hotels, passenger transport services, entertainment services, cinema activities, personal services that provide direct service to consumers.

From June 1, 2025, Enterprises with revenue of 1 billion VND/year or more are required to use electronic invoices connected to tax authorities. The issuance of electronic invoices must be done through a service provider certified by the General Department of Taxation.

Why do businesses need to focus on electronic invoice management?

According to Decree 70/2025/ND-CP amending and supplementing Decree 123/2020/ND-CP on invoices and documents. It stipulates mandatory electronic invoices generated from cash registers connected to tax authorities for business households if their revenue is ≥ 1 billion VND/year or they have used cash registers, or they meet the revenue/labor criteria of micro-enterprises.

The elimination of lump-sum tax and the shift to declaring taxes based on actual revenue (revenue + expenses) also makes e-invoices more important, because you need documents to prove actual revenue and valid expenses. In addition, the tax industry is developing automated systems based on e-invoice data to create tax declarations, remind tax payment deadlines, and support taxpayers to declare faster.

The role of Bizzi.vn in Electronic Invoice Business

With the new regulations (according to Decree 70/2025/ND-CP amending and supplementing Decree 123/2020/ND-CP), electronic invoices are not only a legal requirement but also an important foundation for correct and transparent tax declaration and avoiding legal risks. In particular, from June 1, 2025, many groups of business households with revenue ≥ 1 billion VND/year or using cash registers will be required to apply electronic invoices directly connected to tax authorities.

In that context, choosing a legal, cost-saving, highly secure solution like B-Invoice Bizzi's will help businesses:

- Be sure to obey the law and avoid penalties.

- Optimize invoice management and tax declaration process.

- Save costs and time, instead of building complex systems yourself.

Reasons why businesses should apply B-Invoice solution:

More than just a publishing tool, it simplifies How to issue electronic invoices for business households in particular and businesses in general, B-Invoice also provides businesses with a comprehensive financial and tax management system. This solution helps simplify operations, save time, reduce operating costs and create a more transparent and professional experience in the eyes of customers and partners.

Legal & absolute compliance

- Recognized by the General Department of Taxation: B-Invoice fully complies with Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, helping businesses to comply with peace of mind without worrying about tax risks.

- Automatically updated when regulations change: The system is always synchronized with new policies, avoiding errors in declaration and invoice issuance.

Optimal cost

- Preferential price when using both output and input invoices – save budget for businesses.

- Reduce storage costs: Invoices are stored electronically for 10 years, in compliance with the law but without physical storage costs.

Technology & Security Integration

- Easy to integrate: Smooth connection with ERP, existing accounting software, helping accountants save data entry time.

- ISO 27001 Security:2022 ensures the security of invoice data and customer information.

Convenient user experience

- Diverse invoice template warehouse and the ability to design according to the business's own identity.

- Modern system, easy to operate, helping accountants and managers easily look up, check, and export reports when needed.

Conclude

Understanding and correctly performing tax declaration procedures is a key factor for the sustainable development of business households. With policy changes and digitalization trends, solutions like B-Invoice bring practical solutions to meet these requirements without having to build complex systems yourself, saving costs and time, especially for small businesses.

Contact Bizzi today to get advice on B-Invoice solutions suitable for your business size and industry.