In the digital age, Electronic invoice is becoming more and more popular and is an inevitable trend of every business in Vietnam. check if the invoice is valid not only helps businesses ensure comply with the law, but also limit risks in business transactions.

One valid invoice To be legal basis important, proving the origin of the product, ensuring transparency and reputation in commercial activities. This article will guide in detail How to check if an electronic invoice is valid, helping businesses easily verify invoices and avoid related risks.

I. What is a Valid Electronic Invoice?

Electronic invoice become a mandatory tool for all businesses in Vietnam. Therefore, the use of electronic invoices not only brings benefits in terms of cost saving, increase transparency and convenient storage, but also helps tax authorities easily manage and monitor transactions.

However, not all electronic invoices are recognized by law. If the business use of incorrect or invalid invoices, can lead to many risks such as:

- No input tax deduction, causing cost loss.

- Administrative fines or tax arrears, even affecting business reputation.

Cause difficulties in accounting, auditing and tax settlement.

So, Understanding the concept of valid electronic invoices and evaluation criteria is an important step to help businesses comply with the law and avoid risks.

1. Concept of electronic invoice

According to Decree 123/2020/ND-CP, electronic invoice is a type of invoice that is establish, sign and send by electronic means by individuals and organizations selling goods or providing services, recording transaction information according to the law on accounting and tax.

Electronic invoices can:

- Has tax authority code.

- Or no code, but must be approved by the tax authorities. Notice of Acceptance Before Use.

- Criteria for determining valid electronic invoices

To check if an invoice is valid, the invoice must meet the following requirements: 3 important criteria: legality, validity, and rationality.

a. Legality

- Correct XML format according to the standards of the General Department of Taxation.

- Enterprises/business households registered to use electronic invoices and accepted by the tax authorities.

- Invoice is set up at the right time, complete and accurate information:

- Name, address, tax identification number of seller/buyer.

- Invoice symbol, invoice number.

- Product/service information, total amount, tax rate.

- Digital signature and time of creation/signing.

- With invoice have tax authority code, must be coded before delivery to the buyer.

- Not included in the invoice cases illegal prescribed in Clause 9, Article 3, Decree 123/2020/ND-CP.

b. Validity

- Full content according to the law.

- Has a valid digital signature of the seller.

- Okay establish and manage properly as prescribed by law.

c. Reasonableness

- Invoice reflects actual transactions that arise, directly related to production and business activities.

Note: Bill no tax authority code still valid if notified of acceptance of use and comply with applicable regulations.

II. 4 ways to check if an electronic invoice is valid

Below are 4 ways to check valid electronic invoices, applied according to the latest regulations from Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

1. Search on the General Department of Taxation's Information Portal

This is the most common and accurate way to check if an invoice is valid.

(Applied according to new regulations: Circular 78/2021/TT-BTC, Decree 123/2020/ND-CP):

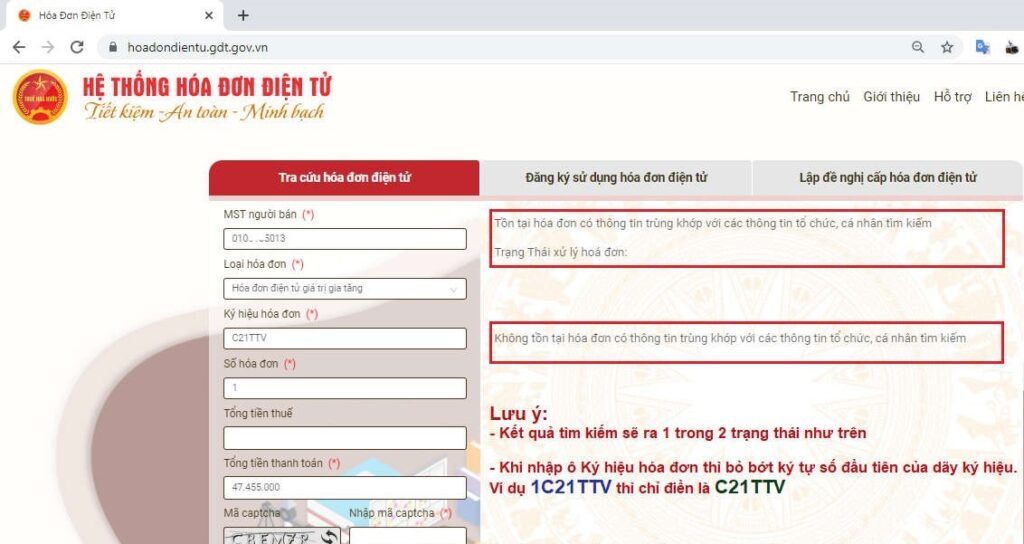

- Step 1: Visit website: https://hoadondientu.gdt.gov.vn/. (Note: Even electronic invoices under the old regulations (Circular 32/2011/TT-BTC) can be looked up on this portal).

- Step 2: Fill in all required information:

- Seller tax identification number.

- Invoice type.

- Invoice symbol.

- Invoice number.

- Total payment amount.

- Captcha code.

- Step 3: Press "Search" and check the results:

- Valid invoice: Notification display “Invoice code issued” and the lookup information and the information on the electronic invoice completely match.

- Invalid invoice: Notification display “There is no invoice with information matching the information the organization or individual is searching for” or only one of the two information fields (“Seller Information” and “Invoice Information”) is displayed or the information does not match.

2. Look up invoices according to old regulations

You can check if the invoice is valid by applying to a paper invoice, a tax authority purchase invoice or an electronic invoice according to Circular 32/2011/TT-BTC.

- Step 1: Access the General Department of Taxation's invoice lookup portal (tracuuhoadon.gdt.gov.vn).

- Step 2: Select function “Invoice and receipt information” => "Bill" => “Look up a bill” (or “Search multiple invoices”).

- Step 3: Fill in all the search information in the "Search conditions" section, including: Tax code of the service seller, Model number, Invoice symbol, Invoice number, Enter verification code.

- Step 4: Press "Search" and check the search results.

- Valid invoice: The system returns results with full information in both fields: "Service seller information" and "Invoice information", and the lookup information and the information on the electronic invoice will completely match.

- Illegal invoices: If the search results only display 1 of the 2 information fields above, or the information does not match the electronic invoice.

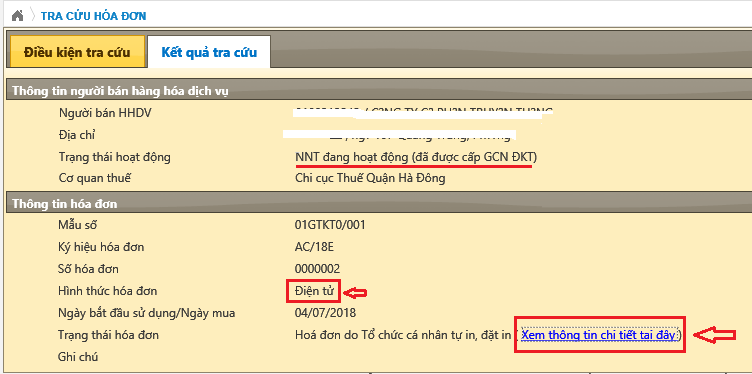

3. Check directly on the enterprise's electronic invoice software

Many businesses use electronic invoice software Directly connected to the tax authorities, this is also an effective way to check the validity of electronic invoices.

- Step 1: Access the electronic invoice system website and log in (according to the information provided by the Tax Authority).

- Step 2: Select item “Lookup” then select “Invoice lookup”.

- Step 3: Select “Look up sales/purchase invoices” and enter the invoice information to look up including: Seller tax code, Invoice type, Invoice symbol, Invoice number.

- Step 4: Select "Search" for the system to display the results.

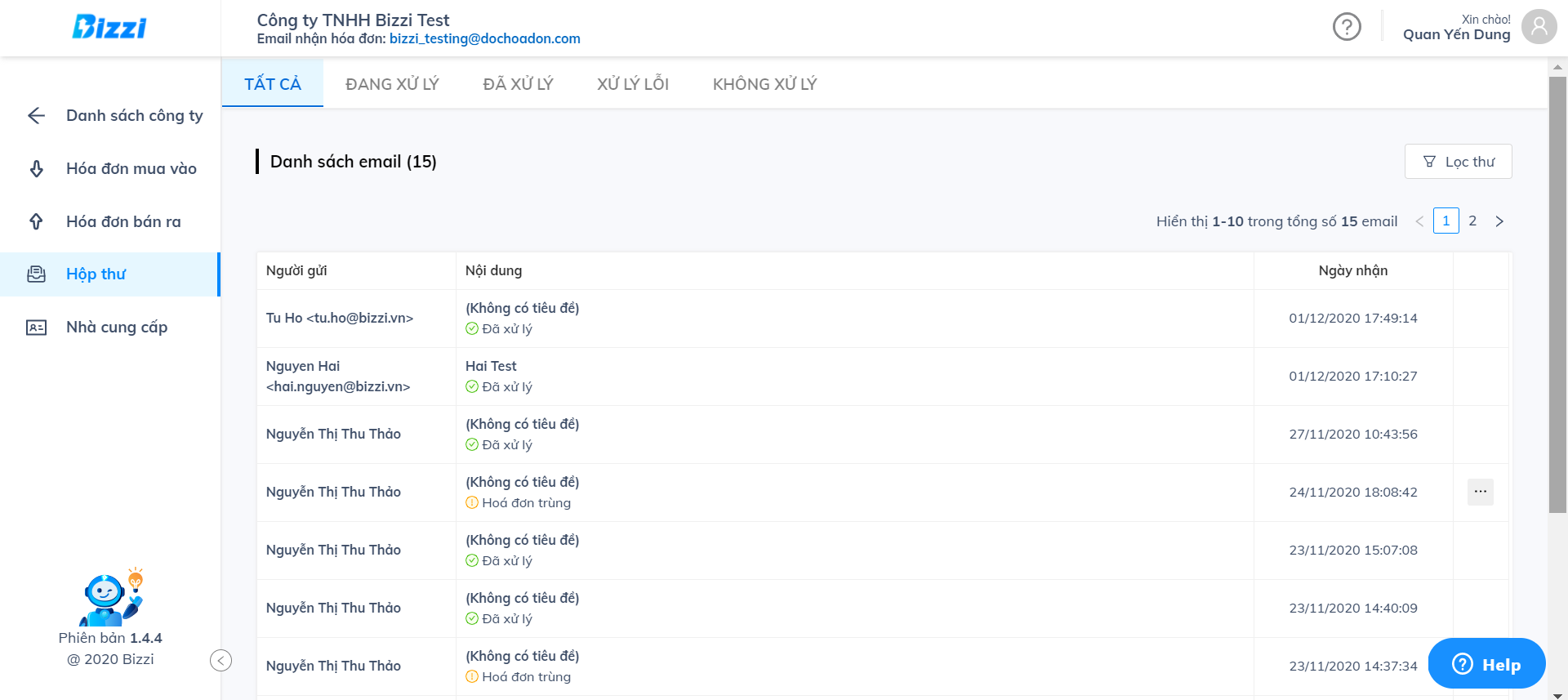

4. Look up invoices via third-party platform – Bizzi.vn

If a business has a large number of invoices, manual checking will be time-consuming and error-prone. Bizzi.vn provide How to check if an electronic invoice is valid automatically.

With Bizzi, you can check electronic invoice Validate with *.xml file of any electronic invoice provider. Steps look up electronic invoice on Bizzi's website is specified as follows:

- Step 1: Visit the page and Upload electronic invoice information Bizzi e-invoice system (file with extension *.xml to check the validity of the invoice.

After receiving the invoice information, Bizzi will automatically process it, including reading the invoice, checking the invoice information with the General Department of Taxation, checking the seller information and other related information. The processing time of an electronic invoice will take from 10 to 30 seconds instead of 5 to 10 minutes for manual processing.

After processing Bizzi will notify the user of the invoice status: Processed, Duplicate Invoice, Error Invoice (Unable to download XML invoice, invalid XML file, no lookup information,…)

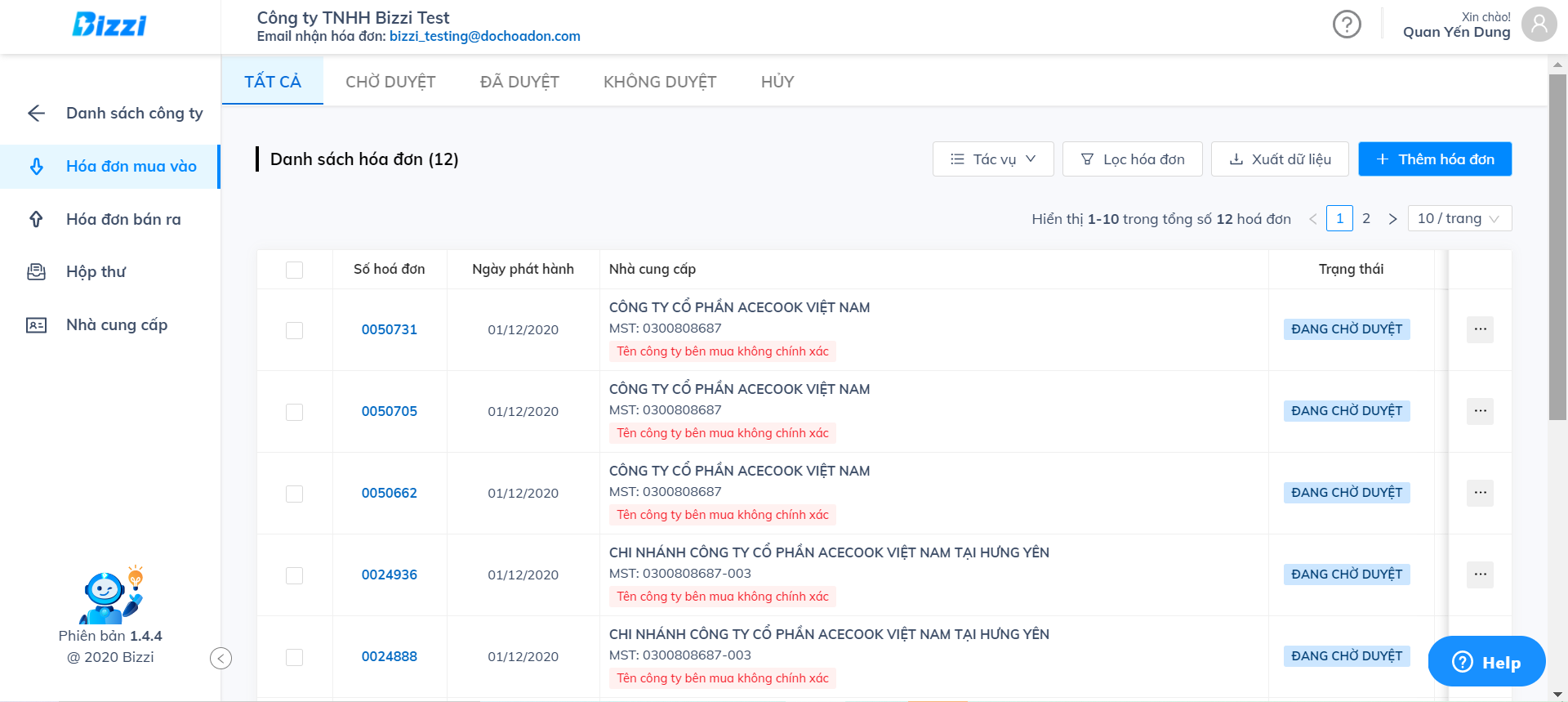

- Step 2: Check invoice information.

Processed invoices will be automatically pushed to the Purchase Invoice menu. Users can view invoice details by clicking on the invoice number.

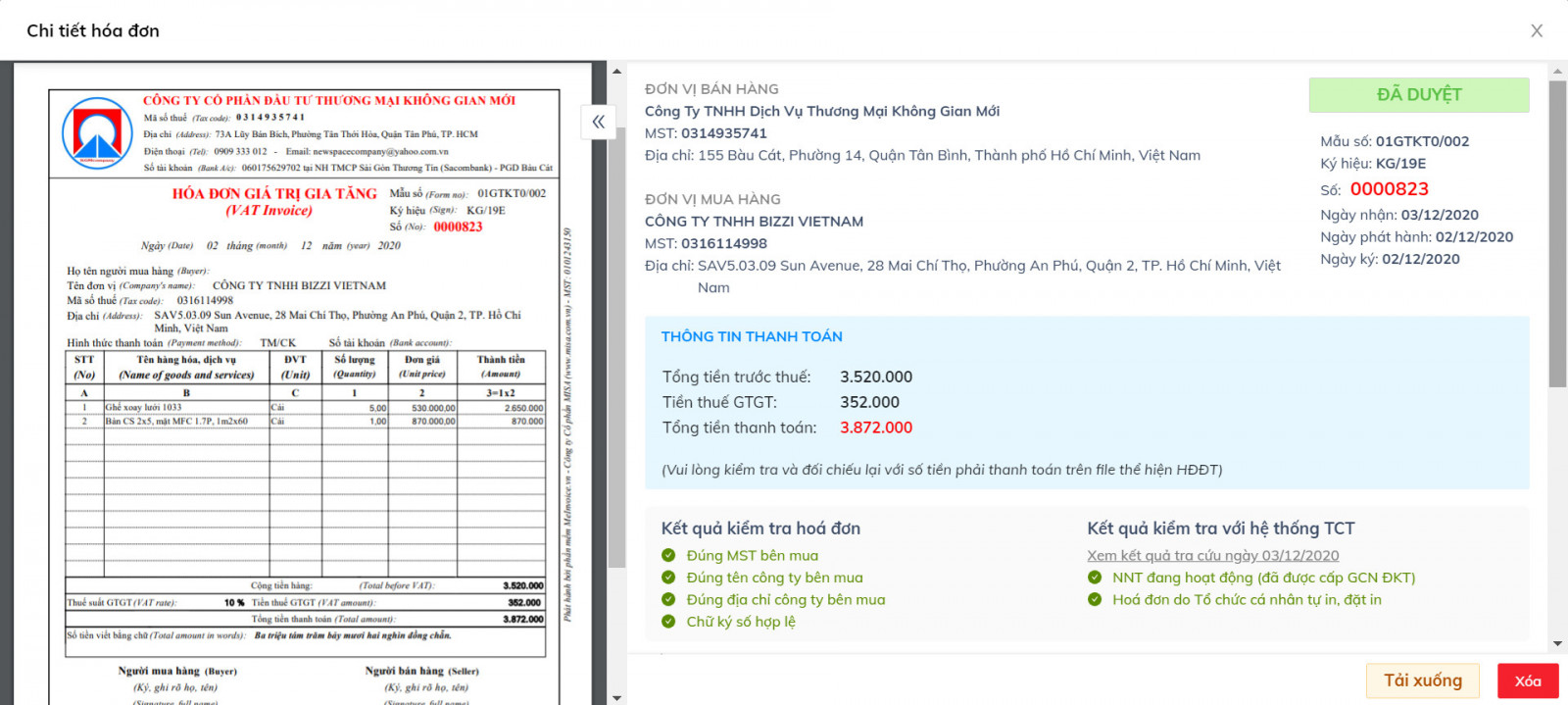

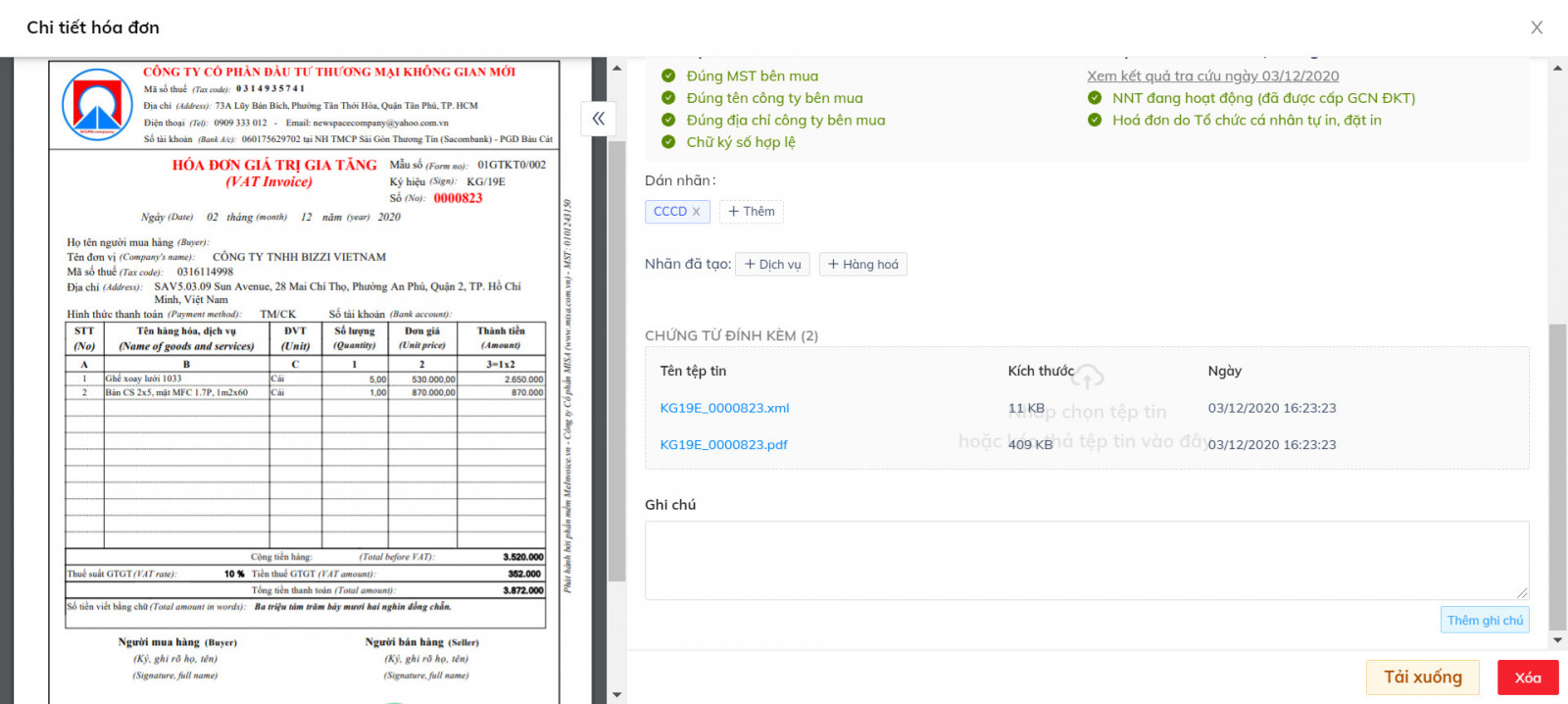

– Invoice details:

In addition to checking invoice information, users can also label and attach other information such as contracts, documents, notes, etc. to this invoice.

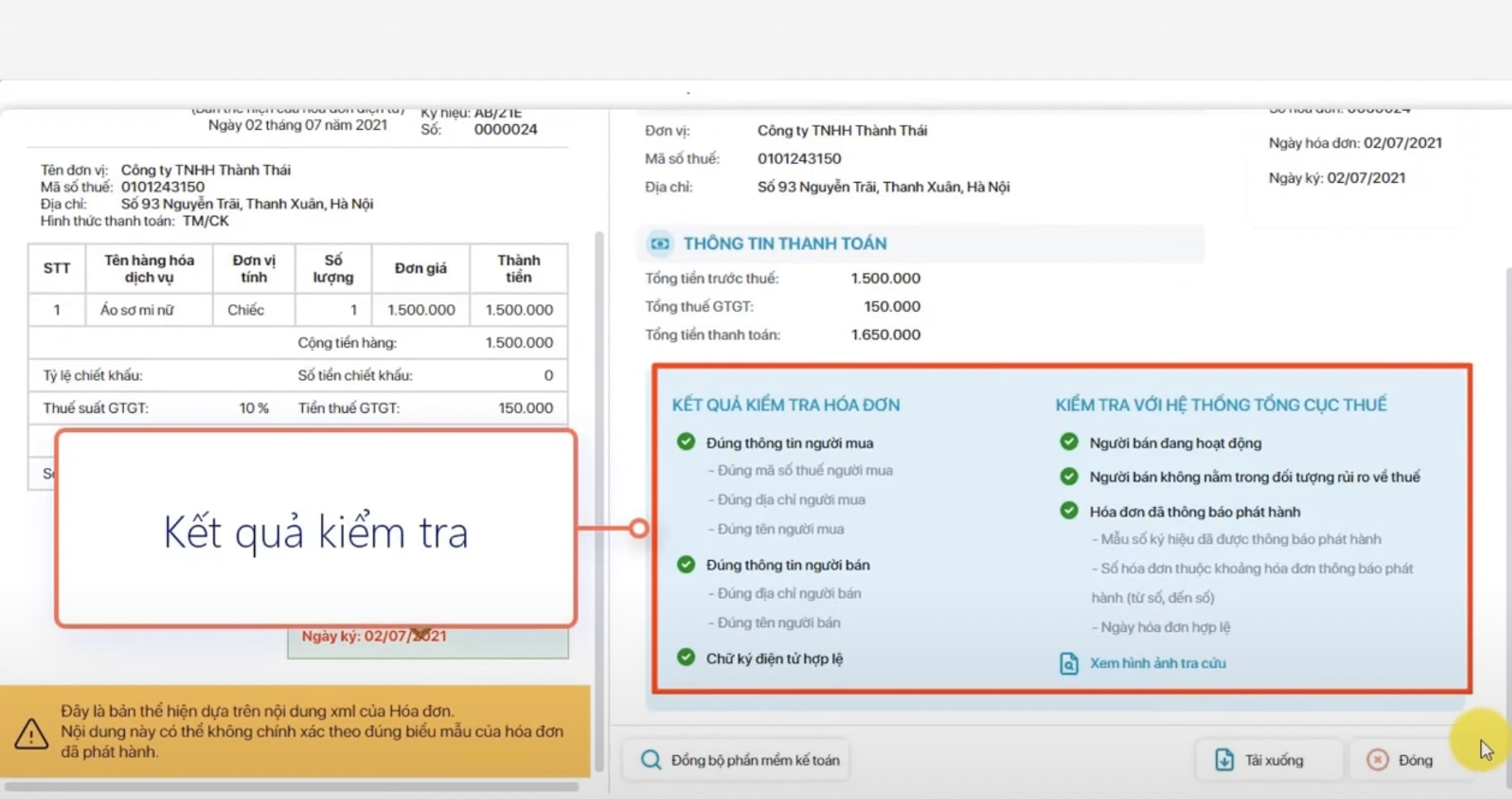

- Step 3: The system returns the invoice check result:

| Invoice check results |

Check with the General Department of Taxation system |

|

|

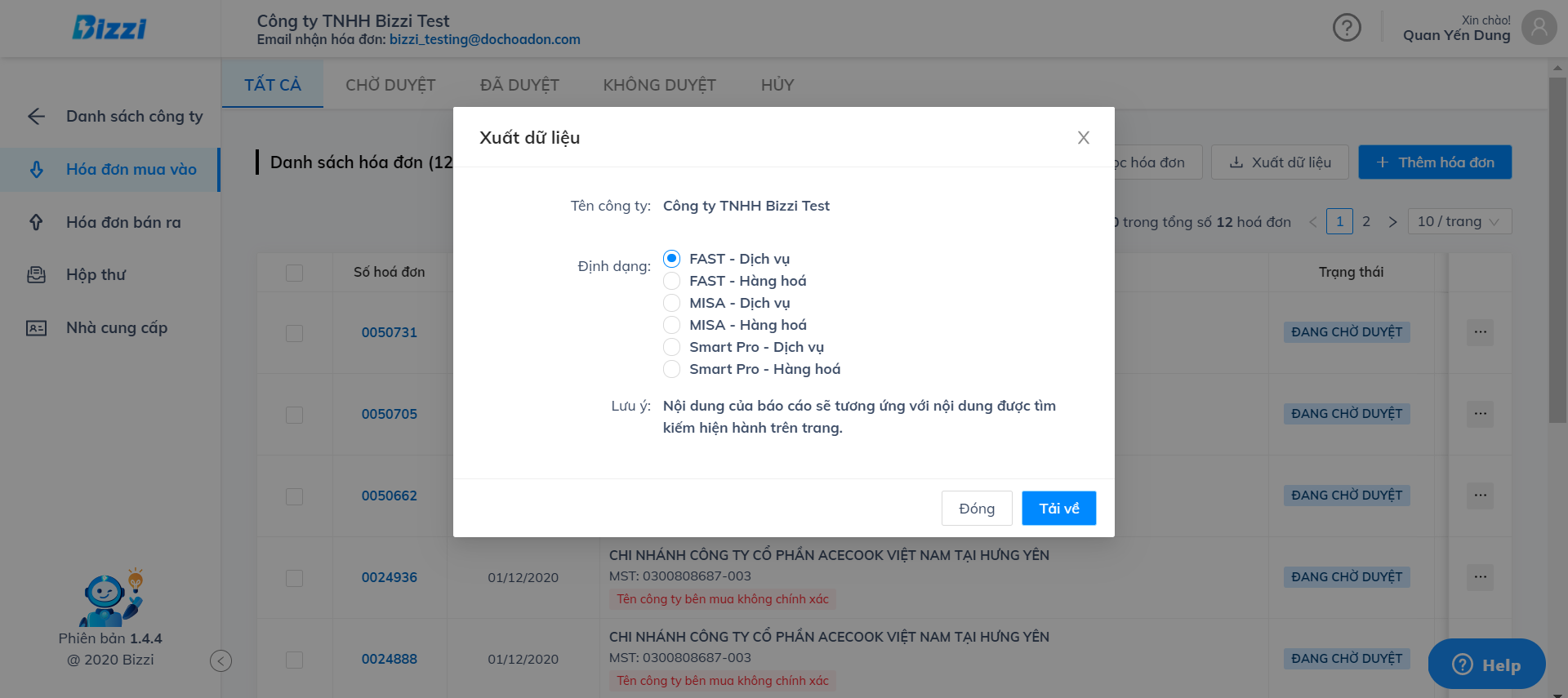

- Step 4: Export data.

Invoice information is rendered in popular formats on the market such as MISA, FAST, SmartPro. To export this data file, click the button in the upper right corner of the screen in the Purchase Invoice Menu, then select the format according to your needs.

Automate Invoice Checking & Management with Bizzi.vn

Manual checking is not only time-consuming but also potentially error-prone and lacks transparency. Especially for large businesses with thousands of invoices each month, manually comparing and checking each invoice is almost impossible. This is the reason why automation solutions were born - helping to check multiple criteria at the same time, ensuring accuracy, safety, and minimizing risks for businesses.

Why automate?

Job manual invoice checking not only time consuming, but also potentially high risk of error, especially for businesses with thousands of invoices per monthCommon risks of manual testing include:

- Incorrect invoice information entered.

- Ignore fake or invalid invoices.

- Failure to promptly detect discrepancies with orders or warehouse receipts.

Solution automate invoice checking from Bizzi.vn helps businesses:

- Check multiple invoices at once in just a few minutes.

- Ensure absolute accuracy, eliminating human error.

- Advanced data transparency and security, meet current accounting and tax standards.

How does Bizzi.vn conduct the inspection?

With advanced technology platform, Bizzi.vn business support Automate the entire invoice checking and management process, include:

1. Automatic invoice authentication

Bizzi.vn automatic system check the validity of the invoice in accordance with accounting regulations and tax laws, including:

- Verify digital signature of the seller.

- Check Invoice status on the tax authority system.

- Detect and warn of invoices that are rejected for code issuance or are not recognized as valid.

2. Verify the supplier

- Automatic testing Tax Identification Number (MST) and operating status of the supplier.

- Early warning of risky invoices, for example from suppliers that have ceased operations or are known to be fraudulent.

This helps businesses be proactive. prevent illegal expenses, protect reputation and avoid tax risks.

3. Smart reconciliation with PO & GR

- Bizzi.vn automatically Compare details of each invoice data line (from XML file) with Purchase Order (PO) and Warehouse receipt (GR) in real time.

- Quickly detect the discrepancies in quantity, value or product information, helping accountants process promptly and accurately.

4. Fully comply with legal regulations

Not only stopping at checking input invoices, Bizzi.vn also provides B-Invoice electronic invoice solution:

- Meet 100% business requirements according to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

- Direct connection to the General Department of Taxation system, ensuring that the process of issuing, sending, storing and managing invoices is carried out safe and standard.

- Help businesses manage both input and output invoices on a single platform, optimizing accounting and financial processes.

Bizzi.vn is comprehensive solution for businesses looking to find ways check valid electronic invoice one way fast, accurate and transparent, while fully complying with current legal regulations.

Thanks to automation, businesses not only reduce the burden of manual testing, but also financial protection, resource optimization, and improve governance capacity in the digital age.

Handling invalid e-invoices with Bizzi.vn

During the process of receiving and processing invoices, businesses may encounter problems. Invalid invoice, for example:

- Invoice code is rejected from tax authorities.

- Incorrect important information such as tax code, amount, or goods.

- Failure to meet legal requirements, leading to accounting and tax risks.

If not handled promptly, these bills can cause data distortion, affecting financial report and increased risk of tax penalties.

Bizzi.vn supports businesses Automatically send email notification to supplier as soon as invalid invoice is detected, making the processing easier. fast and transparent, reducing manual operations for the accounting department.

How Bizzi.vn supports handling invalid invoices

1. Automatically detect invalid invoices

Bizzi's system will automatic input invoice review and detect anomalies, such as invoices that are not coded or information that does not match data from tax authorities.

2. Send automatic notification emails to suppliers

As soon as an invalid invoice is detected, Bizzi will Automatically send email notifications to suppliers.

- Email content includes invoice details and invalid reason.

- Help suppliers proactively check and adjust, reducing the time of communication between the two sides.

3. Centralized monitoring and management

Businesses can track email delivery status right on the Bizzi system, ensuring all notifications have been sent and received in full. This helps the accounting department centralized management, reducing omissions or delays in processing.

Benefits for businesses

- Save time: No need to manually email each supplier.

- Reduce the risk of error: Process automation helps ensure accurate and consistent information.

- Increase transparency: Suppliers receive information immediately, reducing disputes and misunderstandings.

- Increase work efficiency: Accountants can focus on specialized operations instead of manual processing.

Bizzi.vn not only supports the detection of invalid invoices but also automate communication with suppliers, help businesses optimize accounting processes, risk reduction, and ensure compliance with regulations on electronic invoices.

Conclude

Checking the validity of invoices is not only a mandatory requirement to comply with legal regulations, but also a foundation for businesses to ensure transparency and reputation in all financial transactions.

Instead of wasting time and effort with manual inspection methods through the General Department of Taxation's portal, businesses can completely optimize the process by applying automation platforms like Bizzi.vn.

With Bizzi.vn, businesses not only detect errors or risks early, but also automatically send notifications to suppliers, helping to handle quickly and limit disputes. This is How to check if an electronic invoice is valid most effective, helping businesses risk reduction, increase productivity, and sustainable development in the digital age

Investing in automation solutions like Bizzi.vn is a smart move for businesses to tightly control input invoices, optimize operations, and develop sustainably in the digital age.

Experience Bizzi.vn solution for free here: Sign up for a trial