In today's business environment, debt report is an indispensable tool to help business owner and accountant Cash flow control, clear distinction between accounts receivable and accounts payable, thereby making timely financial decisions. This report also supports analysis debt age, identify due or overdue debts, helping businesses avoid the risk of losing capital and proactively plan debt collection.

Mastering How to make customer debt report not only ensures accurate data reconciliation but also contributes to credit risk mitigation, improve payment reputation and maintain stable relationships with suppliers. In this comprehensive guide, Bizzi will help you understand: what is a debt report, common types of reports, detailed report preparation process and how to software applications for automation debt management in business

1. What is an Accounts Receivable Report? Why Should Businesses Care?

In the context of businesses increasingly needing tight and transparent financial management, debt report become an indispensable tool. Not only does it help track receivables and payables effectively, this report also helps businesses control risks and optimize cash flow.

1.1. Definition of debt and debt reporting

In business activities, debt is an inseparable factor because it reflects the financial relationship between the business and its partners. Understand debt and how to set up debt report is the first step to help businesses manage finances effectively and prevent bad debt risks.

Debt is the amount of money that the business receivables from customers or payable to supplier, arising in the process of trading goods or providing services.

Debt report is a detailed summary of debt situation by each subject (customer or supplier), including:

- Opening balance: remaining debts from previous period carried over.

- Occurred during the period: such as sales, collection, discount, payment.

- Closing balance: remaining debt after deducting arising expenses.

Depending on management needs, debt reports can be prepared daily, weekly, monthly or quarterly. Report content is usually divided into two main types:

- Accounts Receivable Report: reflects the amount of money customers owe the business.

- Accounts Payable Report: shows the amount of money the business still owes to suppliers.

1.2. The role of debt reporting in business

Establishment and analysis debt report bring many practical benefits:

- Financial control and limiting bad debt risk: Helps accounting and management departments identify overdue debts early, thereby providing appropriate recovery plans.

- Cash flow optimization: Closely monitor income and expenditure to ensure the business always maintains sufficient working capital and avoids sudden cash shortages.

- Make accurate business decisions: Based on debt data, leaders can evaluate partners' payment performance, adjust payment terms or credit policies.

- Compliance with legal regulations and financial transparency: Accounts receivable report is a mandatory part of accounting records, helping businesses to compare with customers, suppliers and tax authorities.

2. Instructions for Preparing Detailed Debt Reports

Debt report To be financial management tools important, helping businesses control cash flow well, limit bad debt risks and improve debt collection efficiency. Below is a step-by-step guide to setting up customer debt report methodically and accurately.

2.1. Prepare necessary information and data

Before preparing a report, accountants need to collect and review all information related to transactions with customers:

- Collect documents such as sales invoices, receipts, payment vouchers, debt reconciliation statement.

- Define a clear reporting period (monthly, quarterly or yearly).

- Review accounting data, opening balance and transactions during the period.

- Check with the contract, payment terms and customer confirmation (if any).

2.2. How to make a debt report using Excel

Using Excel is a popular way to create customer debt report with simple, easy-to-follow layout:

- The basic columns include: No., Partner name, Customer code, Opening balance, Increase, Decrease, Closing balance, Note.

- Clear classification: Accounts receivable and accounts payable.

- Make sure to reconcile the figures with the general ledger, journal and related accounting accounts such as 131, 331.

- Updated regularly to ensure information is always up to date.

2.3. Excel functions to support debt reporting

To save time and increase accuracy, you can use Excel functions such as:

- SUM, SUMIF: Calculate total balance, total arising according to conditions.

- IF, COUNTIF: Filter and classify debts.

- VLOOKUP: Look up customer information from the catalog table.

- DATEDIF: Calculate debt age by number of overdue days, helps classify debt.

2.4. Steps to create a debt summary table on Excel

Debt reporting should be done according to a specific process:

- Step 1: Create a debt object catalog sheet including name, code, contact information.

- Step 2: Enter data generated by each sales transaction, collection, debt reduction adjustment.

- Step 3: Use the summary function to calculate the ending balance, separating due and overdue debts.

- Step 4: Create detailed reports for each subject, with charts or debt age tables for easy tracking.

2.5. Notes when preparing debt reports

Some important notes to help the debt report reflect the financial situation correctly:

- Ensure accounting data is updated regularly and accurately.

- Clear debt classification (short-term, long-term, by debt age).

- Comply with accounting standards, legal regulations on documents and record keeping.

- Regularly reconcile customer debt to promptly handle discrepancies or overdue debt.

3. Popular Debt Report Templates

Debt report templates are designed to help businesses summarize, monitor and analyze debt situations with customers and suppliers. Depending on the purpose of use, accountants can apply different report templates to ensure effective and transparent debt management.

3.1. Sample debt report at the beginning of the year

The beginning of year debt report form is used to summarize all outstanding debt balances of customers and suppliers at the beginning of the accounting period. This report is usually prepared immediately after the end of the previous fiscal year, helping businesses:

- Overall assessment of outstanding debt situation.

- Serve as a basis for comparing data for the new fiscal year.

- Identify which debts need to be prioritized for collection or settlement.

The report template usually includes: name of debtor, code, balance receivable/payable at the beginning of the period, payment deadline and notes if there are any problems.

3.2. Accounts receivable report form

The accounts receivable report is an important tool that helps businesses closely monitor the amounts owed by customers. This is an indispensable part of How to make customer debt report effective. Accounts receivable reporting helps:

- Manage payment deadlines and timely debt reminders.

- Assess the risk level of each debt.

- Provide appropriate debt collection plans.

Information required in the report: customer name, invoice number, date of issue, payment due date, amount collected, remaining balance and status (current or overdue).

3.3. Accounts Payable Report Form

The accounts payable report shows the payment obligations of a business to its suppliers. Preparing accounts payable reports regularly helps:

- Avoid late payment, affecting reputation.

- Optimize cash flow and payment plans.

- Check with suppliers as needed.

Common information columns: supplier name, object code, document number, transaction date, payment due date, amount paid, ending balance.

4. Effective Debt Handling Process

Building a systematic debt handling process helps businesses control cash flow, limit bad debt and improve financial efficiency. Below are instructions on the process of handling receivables and payables, along with steps for transparent and scientific debt reporting.

4.1. Accounts receivable processing process

- Identify and check debt: Businesses need to periodically review receivables from customers based on invoices, contracts, delivery notes and related documents. This is the first step in preparing customer debt report Exactly.

- Send notifications and track payments: After confirming the debt, the business needs to send payment notices (via email, SMS or text) to customers before the due date. At the same time, monitor the payment status to promptly detect overdue payments.

- Exception handling and reporting: For late payments or disputes, there should be a clear solution (such as negotiation, discount, litigation). At the same time, update the situation on customer debt report to serve internal meetings or as a basis for future customer reminders.

4.2. Accounts payable processing procedure

- Identify and select payment method: Businesses need to summarize the debts payable to suppliers, compare with the contract and input invoices. Then determine the appropriate form of payment such as transfer, cash or debt offset.

- Prioritize and prepare payment information: Make a list of payments in order of priority (based on deadline, importance of supplier). Prepare all documents, tax codes, account numbers, etc. to ensure smooth payment process.

- Make payments and track: After making a payment, it is necessary to save the invoice, payment order, payment voucher and update it in the accounting system. Close monitoring helps ensure that there are no errors or duplicate payments.

- Problem solving and reporting: If there is a discrepancy in amount, time or voucher information, the accountant needs to work with the supplier to make timely adjustments. All data should be updated on debt report to ensure transparency and serve internal audits.

5. Analyze Debt Report to Improve Management Efficiency

Establishment and analysis debt report It is not only a tool for recording data but also a tool to help businesses assess their financial status, control risks and optimize cash flow. Below are in-depth analysis steps to help improve debt management efficiency.

5.1. Debt classification to assess risk

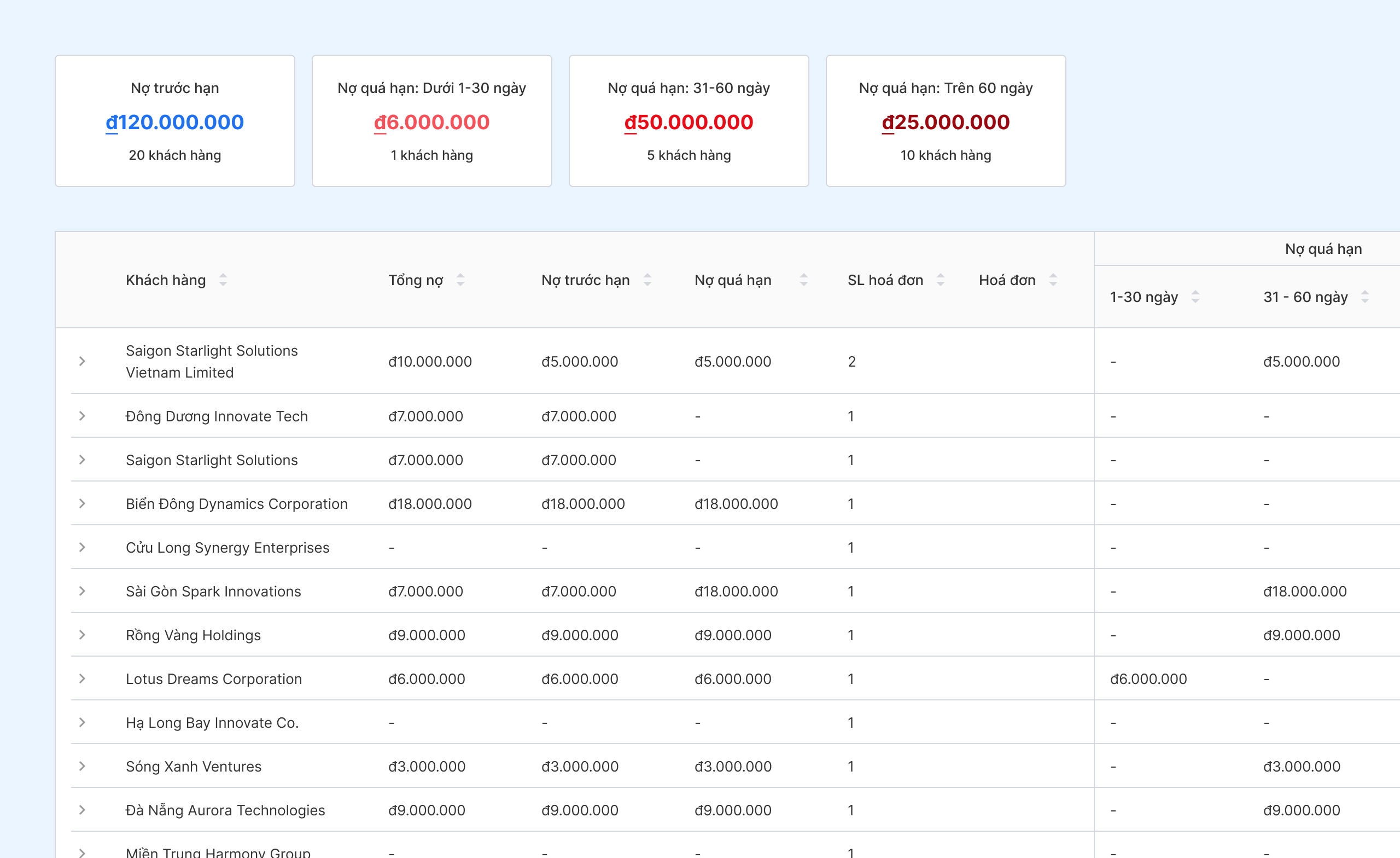

When researching How to make customer debt report, an important step is to classify debts according to many criteria to assess the level of risk:

- By debt age: short-term debt group (under 30 days), medium-term (30-90 days), long-term (over 90 days) to determine the ability to recover.

- By payment status: paid, partially paid, overdue, disputed.

- By nature of debt: regular debt, advance debt, guaranteed debt.

- By debtor: individual customers, large businesses, distributors.

- By risk level: based on payment history and financial credit of the customer.

Detailed classification will help businesses identify early accounts at risk of becoming bad debt.

5.2. Calculation of key indicators

One debt report Quality should include quantitative indicators to reflect management effectiveness:

- Debt collection rate = (Amount collected / Total amount receivable) × 100% – assesses the ability to collect debts during the period.

- On-time payment rate = (On-time payments / Total debts due) × 100% – helps measure customer compliance with contracts.

- Additionally, it can be used receivables turnover to analyze the recovery rate.

These indicators help businesses adjust sales and credit policies to suit each customer segment.

5.3. Financial risk analysis

Debt analysis also helps assess potential risks that impact cash flow and operating performance:

- Credit risk on receivables: Occurs when customers are unable to pay or delay payment, affecting cash flow and financial planning.

- Financial risk for payables: If a business does not pay its suppliers on time, it may lose its reputation, be fined under the contract or stop supplying.

Regular and systematic analysis will help businesses proactively control risks and maintain stability in operations.

6. Effective Debt Management Software Application – Bizzi

In the context of businesses increasingly focusing on cash flow management, applying debt management software helps optimize the monitoring and scheduling process. debt report become an inevitable trend. Not only support How to make customer debt report In addition, the software improves debt collection efficiency and financial risk management.

6.1. Limitations of manual debt management

Debt control Using Excel or traditional books has many potential disadvantages:

- Time consuming data entry and comparison

- Prone to manual errors

- Difficult to control payment status, debt term and debt age of each receivable

- Lack of overdue debt warning system or customer reconciliation

6.2. Benefits of debt management software

Switching to debt management software brings many advantages to businesses:

- Automate the collection and payment process and debt reconciliation, reduce manual errors

- Save time on reporting, support accountants to process data quickly

- Provide diverse, intuitive reports such as accounts receivable report by customer, debt aging report, DSO index...

- Help finance departments make decisions based on accurate and up-to-date data

6.3. Bizzi's debt management solution (ARM)

Bizzi ARM is a smart debt management platform, designed specifically for businesses looking for a solution to automate and standardize reconciliation work. Some outstanding features:

- Automatic debt reminder via email, custom scheduled messages

- Debt management and reconciliation Real-time, supports tracking of key metrics such as DSO (Days Sales Outstanding)

- Debt due warning, overdue debt, helps control financial risks

- Generate detailed debt reports by customer, customer group, time and payment status

- Support How to make customer debt report Systematically, transparently and easily export files on demand

7. Conclusion

Proper setup customer debt report Not only does it help you reconcile accurate data, it also supports effective management. cash flow – debt age – customer relationship. By collecting complete data, clearly categorizing, periodically checking and applying technology, you will optimize debt collection process and minimize financial risk. Read this comprehensive guide to Bizzi, you will have a systematic and practical method to proactively manage your business finances intelligently.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/