In business, debt management is an important task. Debt Offset Agreement is a legal and financial tool that helps to reconcile and offset receivables and payables between parties, instead of making multiple payments in cash. This helps to optimize cash flow and reduce risks. Article from Bizzi Provide detailed information and the latest debt offset form in Word, Excel format - including 3-party offset form - to help businesses easily apply it in practice.

Minutes of Debt Offset

Minutes of debt offset A settlement is a document that records the offset of financial obligations between two or more parties, instead of direct payment. This document fully shows information about the amount, the time of offset, and the confirmation of the related parties. This is an important accounting document, has legal value and is the basis for data comparison when needed.

see more: What is debt? Concept, Classification, Importance and how to manage effectively

Businesses need to make this record when there is a two-way debt and there is a need to offset instead of paying separately. In reality, this situation often occurs between partners who are both suppliers and customers of each other.

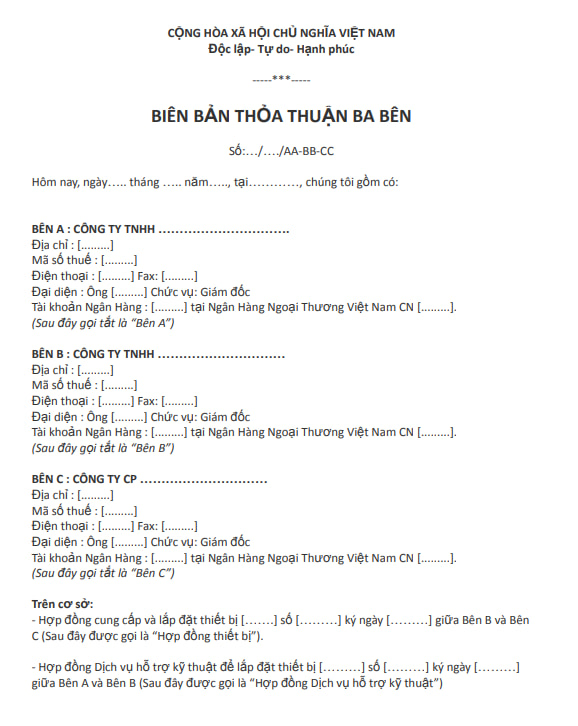

In case there are three parties involved, 3-party debt offset minutes will help clarify the responsibilities and obligations between the parties. For convenience, many units choose to use the Word file debt offset minutes template because it is easy to edit, print and store.

You can easily Download sample 3-party debt offset minutes from trusted sources or use automated accounting software like Bizzi to ensure legality, standard forms and save processing time.

Legal provisions on debt offset

Offsetting debt is a form of non-cash payment that many businesses apply to simplify the transaction process. However, to be accepted by the tax authority, the debt offsetting record and the implementation process must fully comply with legal regulations. Below are the important bases and conditions that business owners and accountants need to understand:

Legal basis related to debt offset:

- Clause 10 Article 1 Circular 26/2015/TT-BTC: Clearly stipulates cases where non-cash payments are still deductible for VAT.

- Clause 2, Article 6, Circular 119/2014/TT-BTC, Article 6 Circular 78/2014/TT-BTC and Article 4 Circular 96/2015/TT-BTC: Guidance on deductions when determining taxable income for corporate income tax, including payments through debt offset.

Conditions for a valid debt offset record and tax deduction:

- Have Sales contract clearly stipulate payment by debt offset.

- Have debt offset confirmed by both parties, or 3-party debt offset minutes in case of payment via third party.

- Have Invoices and legal documents full compliance with current regulations.

- For the remaining value after deduction (if any) of 20 million VND or more, there must be non-cash payment voucher.

- In case of purchase in the form borrow to offset debt, need:

- Loan contract made in writing in advance.

- Document of money transfer from lender's account to borrower's account.

The principle of debt offset must be followed:

- Stakeholders need to Confirm and reconcile debts clearly.

- Offset is valid only when there is consensus of the parties.

- Offset only if the debt amount is equivalent; the difference must be paid clearly.

- Do not let the offset affect the other financial or contractual obligations.

- Need to be done in reasonable time, suitable for the commitment in contract.

Nowadays, for convenience in accounting work, businesses can use debt offset form, 3-party debt offset minutes in the form of Word file or download directly from reputable sources. You can easily Download sample 3-party debt offset minutes suitable for each payment situation.

Documents required when offsetting debt

To ensure legality and transparency in the process of offsetting debts between parties, businesses need to prepare a complete set of related documents. This not only helps avoid disputes but is also an important basis for accounting and tax settlement. Below are the necessary documents:

- Minutes of debt offset: Is the most important document, confirming the parties' agreement to offset debts with each other. Depending on the case, the business can use Sample of 3-party debt offset minutes if a third party is involved, or uses debt offset minutes Word file for easy editing and storage.

- Original invoices and documents: Including VAT invoices, sales invoices or input/output documents proving transactions leading to debt.

- Detailed debt statement or debt reconciliation table: Summary of debts and payments between parties for each period, is the basis for determining the data to be offset.

- Receipt, payment voucher (if any): Record cash receipts or payments that are directly related to payment obligations.

- Ledgers and accounting books: Is a system that records all economic transactions, helping accountants track and compare data accurately.

- Contract or partnership agreement: Is a legal document that clarifies the rights and obligations of the parties, helping to clearly identify the causes and conditions of debt arising.

- Transfer documents (if any): Is the basis for verifying payments made through the bank.

- Loan contracts, borrowing money and money transfer documents: For debts arising from borrowing/lending, this is an indispensable set of documents to conduct valid offset.

Fully preparing the above documents will help the process of making and signing. debt offset takes place quickly, in accordance with regulations and is easy to control when auditing or tax settlement is needed.

Basic content of debt offset minutes

- Minutes name: Must be clearly stated Minutes of debt offset.

- Time and location: Full information on the date of the record, exact hour, minute, day, month, year, at specific location.

- Information of related parties:

- Full name/Company name.

- Address.

- Tax code/CCCD.

- Representative.

- Contact information: Phone number, email.

- Clearly define roles (Party A, Party B, Party C; Seller/Buyer; Creditor/Debtor).

- Debt offset content:

- Clearly state which party is the debtor.

- Total loan/debt amount up to the time of offset.

- How will the debt be offset, clearly stating the amount to be offset.

- Result after debt deduction: still in debt or not, how much is left?

- Contract code (if any) and debt description (reason for occurrence).

- Final payment method (if there is a difference): Bank transfer, cash or other method.

- Commitment of the parties: The parties undertake to ensure the accuracy of the information and the amount of debt.

- Signature and seal (if any): Full signatures of representatives of participating parties.

- Number of copies: Clearly state the number of copies made (usually 02 or 03 copies depending on the number of parties) and the same legal value.

Sample Debt Offset Minutes for reference

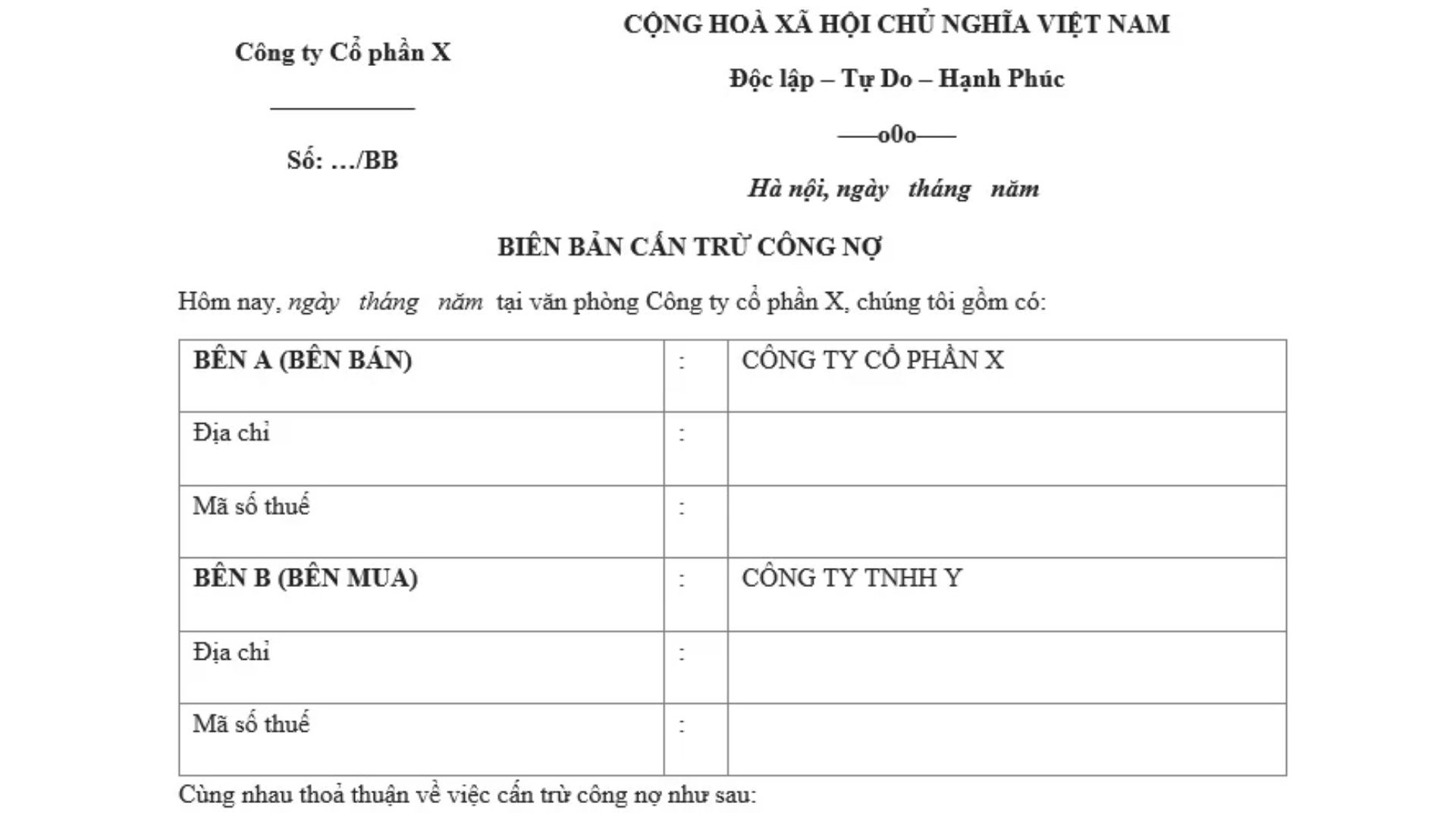

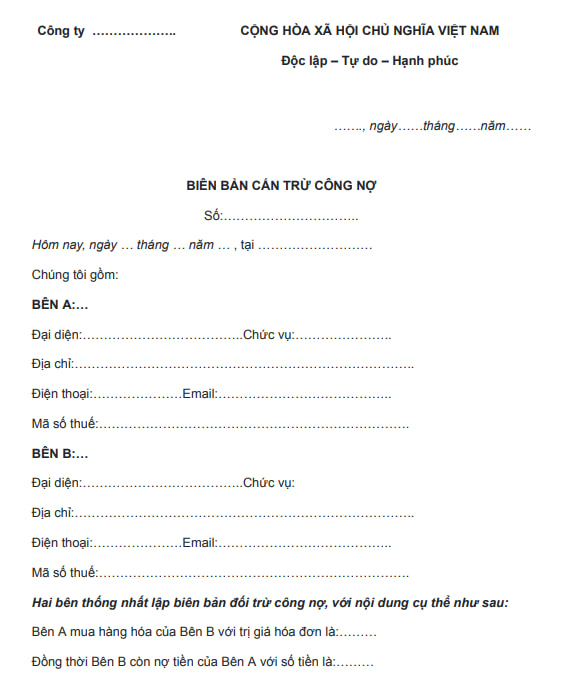

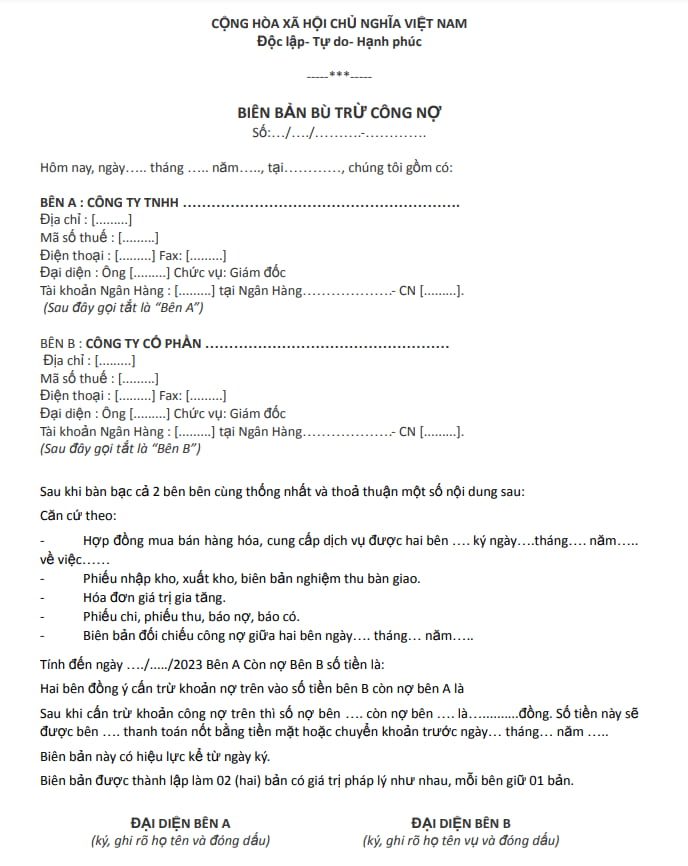

Sample of debt offset minutes of both parties

- The generic form has a basic structure that applies to many situations.

Sample of 2-sided subtraction

- This form applies when two entities offset their debts against each other.

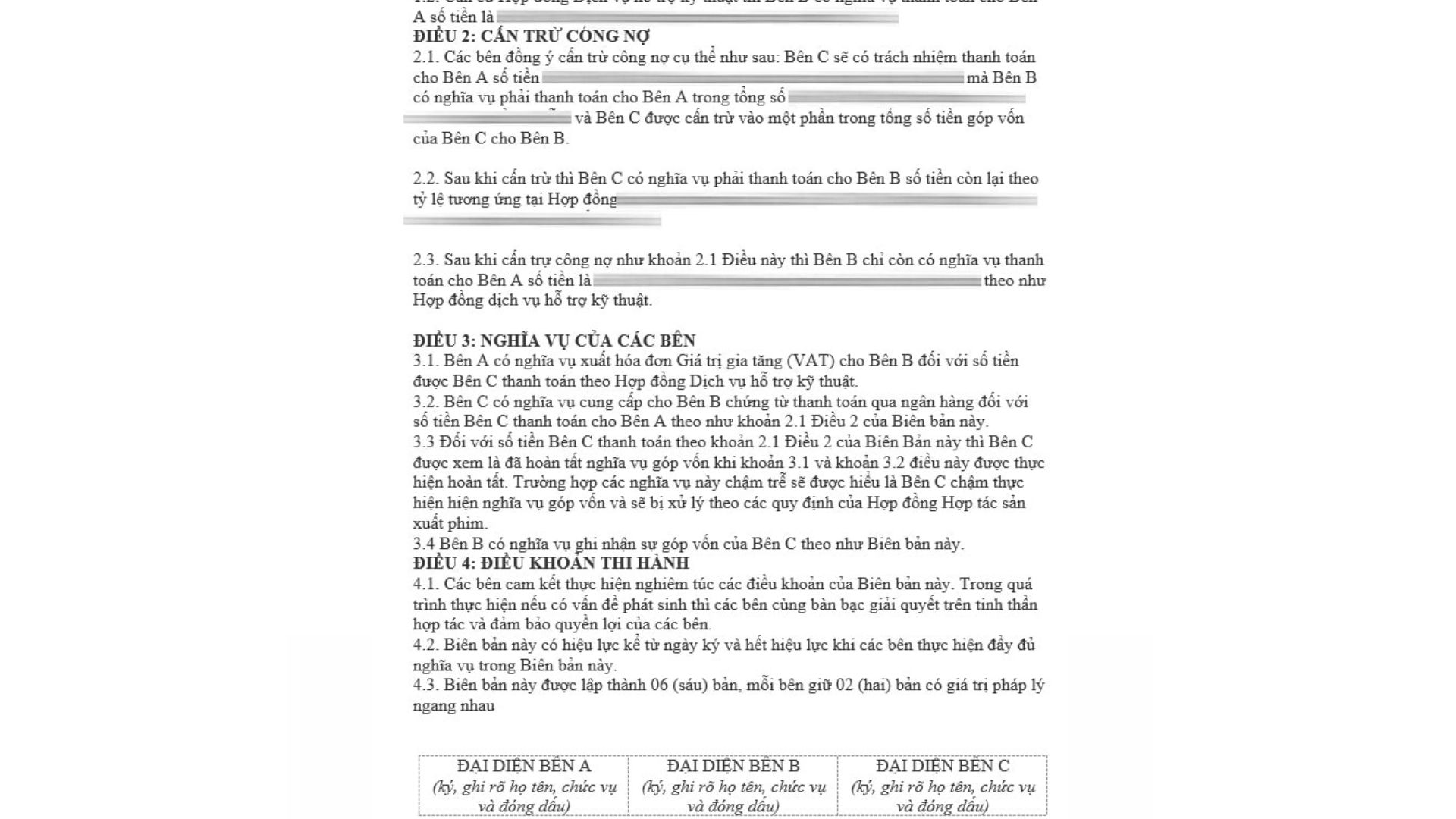

3-sided subtraction model

- Applicable when there are three units involved in the debt offset. (Note: There are currently no specific regulations on this form, the reference forms are built based on the basic required content).

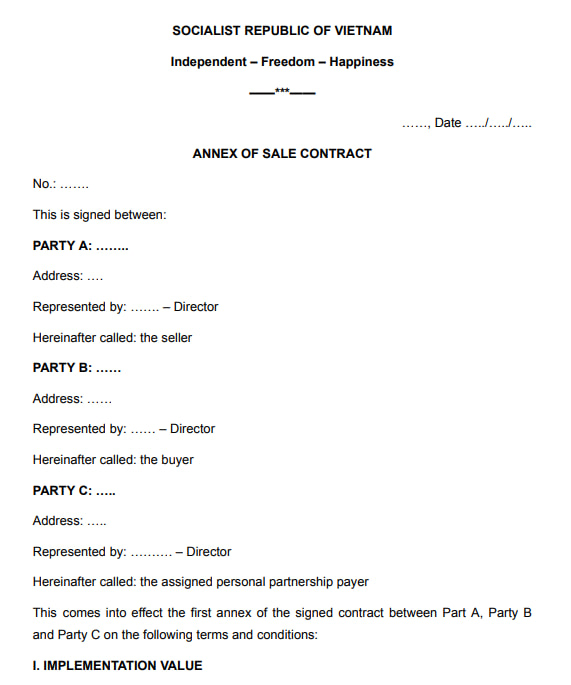

Minutes of debt offset

- Provide a sample of the minutes in English (e.g. ANNEX OF SALE CONTRACT NO… – Confirmation of Liabilities) for reference.

Notes when performing debt offset

Offsetting debt is an important operation that helps businesses manage their finances effectively. However, to ensure legality and avoid risks, the following points should be noted when performing:

- Legality: Offsetting of debts must comply with current accounting and tax regulations. This is a key factor to help parties avoid disputes and legal risks.

- Expert advice: Before doing so, you should consult an accounting expert, lawyer or auditor to ensure the legal process and avoid unnecessary errors.

- Storage and reporting: The debt offset record must be clearly and completely prepared and carefully stored. All transactions must be updated promptly in the accounting books and financial statements. A copy of the record should be sent to the tax authority so that the payment is recognized as valid and tax is deducted according to regulations.

- Regular comparison: The parties need to regularly reconcile debts to detect errors and avoid disputes, and at the same time provide an accurate basis for offset.

- Application of automation tools: Using financial management software with debt control features like Bizzi.vn helps track debts accurately, create payment reminders and support automatic reconciliation. Debt offset records are also stored as official documents in the system, helping businesses work more efficiently and transparently.

If you need a 3-party debt offset record template or a Word file debt offset record, you can refer to and download the standard 3-party debt offset record template, which helps to make records and manage easily and in accordance with regulations.

Conclude

The debt offset record is an indispensable tool in modern corporate financial management. The correct preparation and use of this record not only helps to simplify the payment process, save time and costs, but also increases transparency and reduces disputes related to debts.

With the latest Word and Excel file templates provided by Bizzi, business owners and accountants can easily customize and apply to their operations, ensuring that debt offsets go smoothly and legally. Download and use now to optimize the debt management process for your business.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/