Nghị định 15/2022/NĐ-CP từng là một trong những chính sách “tác động ngay lập tức” đến hoạt động lập hóa đơn và kê khai thuế GTGT của doanh nghiệp, khi quy định giảm thuế suất từ 10% xuống 8% cho một số nhóm hàng hóa, dịch vụ trong giai đoạn áp dụng. Trên thực tế, rủi ro không nằm ở việc “không biết giảm thuế”, mà nằm ở chỗ kế toán dễ nhầm đối tượng được giảm – không được giảm, ghi sai thuế suất trên hóa đơn, hoặc thiếu căn cứ tra cứu phụ lục khi hàng hóa có mô tả phức tạp.

Trong bài viết này, bạn sẽ có bản tóm tắt dễ hiểu về Nghị định 15/2022, hướng dẫn cách xác định đối tượng được giảm thuế GTGT, cách lập hóa đơn đúng cho từng phương pháp tính thuế, cùng các tình huống sai sót thường gặp và cách xử lý. Đồng thời, bài viết cũng tổng hợp các tài liệu cần thiết để download Nghị định 15/2022/NĐ-CP (PDF/Word) và tải riêng phụ lục để tra cứu nhanh mã hàng, giúp doanh nghiệp chủ động tuân thủ và giảm rủi ro khi kê khai.

Giới thiệu và tải về Nghị định 15/2022/NĐ-CP

| Information | Content |

| Number of symbols | 15/2022/NĐ-CP |

| Date of issue | 28/01/2022 |

| Thời gian hiệu lực | Từ 01/02/2022 đến hết 31/12/2022 |

| Issuing agency | Government |

| Trọng tâm nội dung | Chính sách miễn, giảm thuế (đặc biệt giảm thuế GTGT theo Điều 1) |

| Phạm vi điều chỉnh | Quy định chi tiết về chính sách miễn, giảm thuế (GTGT và TNDN). |

| Tải công văn | 📥 [Tải về Nghị định 15/2022/NĐ-CP – Bản Word (.doc)]

📥 [Tải về Nghị định 15/2022/NĐ-CP – Bản PDF (.pdf)] 📥 [Tải về Riêng bộ Phụ lục I, II, III, IV để tra cứu mã hàng] |

1. Tổng quan về Nghị định 15/2022/NĐ-CP

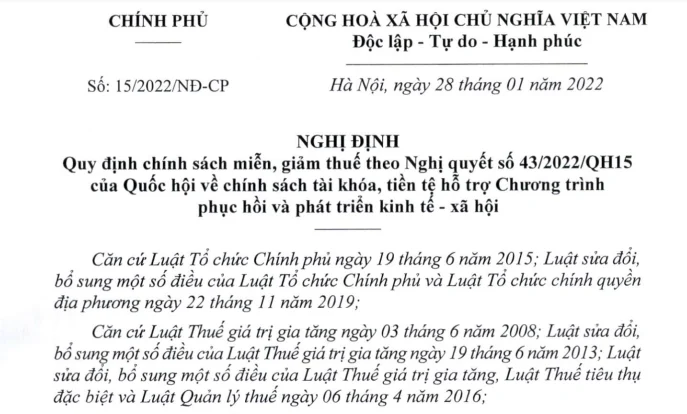

Nghị định 15/2022/NĐ-CP được Chính phủ ban hành ngày 28/01/2022 là văn bản pháp lý quan trọng nhất cụ thể hóa Nghị quyết số 43/2022/QH15 của Quốc hội về chính sách tài khóa, tiền tệ hỗ trợ Chương trình phục hồi và phát triển kinh tế – xã hội.

Đối với cộng đồng doanh nghiệp và Kế toán, Nghị định này mang lại 02 tác động trực tiếp và ngay lập tức:

Thứ nhất, giảm áp lực tài chính và giá thành. Chính sách giảm thuế GTGT (từ 10% xuống 8% cho nhóm đủ điều kiện) giúp giảm chi phí thuế trên hóa đơn bán ra, góp phần kích cầu và cải thiện khả năng cạnh tranh giá. Nội dung giảm thuế GTGT được quy định tại Điều 1 của Nghị định 15/2022/NĐ-CP.

Thứ hai, bắt buộc doanh nghiệp thay đổi cách xử lý hóa đơn và kê khai. Khi thuế suất không còn “một màu”, kế toán phải phân loại đúng hàng hóa/dịch vụ thuộc diện giảm và không giảm; cấu hình đúng thuế suất trên hệ thống; xuất hóa đơn đúng cách; đồng thời lưu hồ sơ giải trình để giảm rủi ro hậu kiểm.

Thông tin thuộc tính văn bản:

- Số ký hiệu: 15/2022/NĐ-CP

- Date of issue: 28/01/2022

- Ngày có hiệu lực: From date 01/02/2022 đến hết ngày 31/12/2022.

- Issuing agency: Chính phủ.

- Phạm vi điều chỉnh: Quy định chi tiết về chính sách miễn, giảm thuế (GTGT và TNDN).

2. Tải về toàn văn Nghị định 15/2022/NĐ-CP (Kèm Phụ lục)

Để thuận tiện cho việc lưu trữ, in ấn và tra cứu mã ngành hàng (HS Code) chịu thuế suất 10% (không được giảm) hoặc 8% (được giảm), Quý doanh nghiệp và các bạn Kế toán có thể tải về bộ tài liệu đầy đủ định dạng .DOC (Word) và .PDF dưới đây:

Bộ hồ sơ bao gồm:

- Toàn văn Nghị định: Quy định chi tiết các điều khoản thi hành.

- Phụ lục I, II, III: List of goods and services KHÔNG được giảm thuế GTGT (Vẫn giữ 10%).

- Phụ lục IV: Mẫu tờ khai các loại hàng hóa, dịch vụ chịu thuế tiêu thụ đặc biệt không được giảm thuế.

Hướng dẫn chính sách thuế theo Nghị định số 15/2022/NĐ-CP

1. Nguyên tắc xác định đối tượng được giảm thuế GTGT

Chính sách trong Nghị định 15/2022/NĐ-CP về giảm thuế GTGT được triển khai theo nguyên tắc: giảm 2% thuế suất GTGT (từ 10% xuống 8%) đối với một số nhóm hàng hóa/dịch vụ đang áp dụng mức 10%, trừ các nhóm thuộc danh mục loại trừ tại phụ lục kèm theo.

Trong thực tế triển khai, rủi ro lớn nhất là “phân loại sai” do danh mục loại trừ rộng và nhiều nhóm dễ nhầm. Các nhóm thường được nhắc tới trong hướng dẫn/tra cứu gồm: viễn thông; tài chính–ngân hàng–chứng khoán–bảo hiểm; kinh doanh bất động sản; kim loại và sản phẩm từ kim loại đúc sẵn; khai khoáng (một số trường hợp); than cốc, dầu mỏ tinh chế; sản phẩm hóa chất; hàng hóa/dịch vụ chịu thuế tiêu thụ đặc biệt… (kế toán cần đối chiếu trực tiếp phụ lục theo đúng tên nhóm).

Để giảm sai sót, nên thiết kế quy trình tra cứu theo 2 lớp:

- Tra cứu theo tên nhóm hàng/dịch vụ trong phụ lục (ưu tiên bản chất hàng hóa).

- Chỉ dùng mã HS/mã ngành như công cụ hỗ trợ tra cứu, tránh “chốt” theo mã khi bản chất hàng hóa khác.

Ở góc độ hệ thống, nếu doanh nghiệp chuẩn hóa danh mục SKU/dịch vụ và mapping thuế suất từ đầu (kèm quy tắc kiểm soát), đội kế toán sẽ giảm đáng kể rủi ro nhầm thuế suất khi nhập liệu hoặc nhận hóa đơn đầu vào.

- Mức giảm quy định: Giảm 2% thuế suất thuế GTGT (từ 10% xuống còn 8%) đối với các nhóm hàng hóa, dịch vụ đang áp dụng mức 10%.

- Danh mục loại trừ (Không được giảm): Cần liệt kê rõ các nhóm “nhạy cảm” mà kế toán hay nhầm lẫn:

- Viễn thông, hoạt động tài chính, ngân hàng, chứng khoán, bảo hiểm.

- Real estate business.

- Kim loại và sản phẩm từ kim loại đúc sẵn, sản phẩm khai khoáng (trừ khai thác than), than cốc, dầu mỏ tinh chế.

- Sản phẩm hoá chất.

- Hàng hoá, dịch vụ chịu thuế tiêu thụ đặc biệt (CNTT).

- Công cụ tra cứu: Hướng dẫn cách đối chiếu mã ngành cấp 7 theo Quyết định số 43/2018/QĐ-TTg để xác định chính xác (nhấn mạnh vai trò của việc tra cứu tự động trên hệ thống Bizzi để giảm sai sót thủ công).

2. Quy định lập hóa đơn đối với Doanh nghiệp tính thuế theo phương pháp khấu trừ

Với doanh nghiệp kê khai khấu trừ, khi bán hàng hóa/dịch vụ thuộc diện giảm, hóa đơn cần thể hiện đúng thuế suất 8% tại dòng thuế suất và tính đúng số tiền thuế tương ứng.

Điểm quan trọng trong thực tế là tách bạch nghiệp vụ: khi cùng lúc bán các mặt hàng áp dụng thuế suất khác nhau, hóa đơn phải thể hiện rõ thuế suất theo từng loại hàng hóa/dịch vụ; nếu không tách bạch đúng, rủi ro bị áp mức thuế suất cao hơn cho toàn bộ phần doanh thu liên quan. (Doanh nghiệp nên kiểm tra quy tắc thể hiện trên phần mềm hóa đơn điện tử đang sử dụng.)

Cách thể hiện trên hóa đơn

- Cách ghi hóa đơn: Tại dòng thuế suất thuế GTGT, ghi rõ mức thuế suất là “8%”.

- Số tiền thuế: Tính toán dựa trên 8% của giá trị hàng hóa/dịch vụ chưa thuế.

- Tổng thanh toán: Giá chưa thuế + Tiền thuế (8%).

Lưu ý trọng yếu: tách dòng/tách hóa đơn

Khi một hóa đơn có cả hàng hóa 8% và 10%, kế toán phải thể hiện rõ theo từng dòng hàng hóa/dịch vụ và thuế suất tương ứng. Nếu gộp không tách rõ, rủi ro bị áp thuế suất cao cho phần không chứng minh được là rất lớn khi hậu kiểm. Nội dung về giảm thuế và nguyên tắc áp dụng được quy định trong Điều 1 Nghị định 15.

3. Quy định đối với Cơ sở kinh doanh tính thuế theo tỷ lệ % trên doanh thu

Với hộ kinh doanh hoặc doanh nghiệp áp dụng phương pháp trực tiếp, Nghị định 15 quy định cơ chế giảm theo tỷ lệ để tính thuế GTGT. Nguyên tắc là thể hiện rõ số tiền trước giảm và số tiền được giảm, đồng thời ghi chú theo đúng quy định để làm căn cứ kê khai và giải trình.

- Mức giảm: Giảm 20% mức tỷ lệ phần trăm để tính thuế GTGT.

- Cách ghi hóa đơn:

- Tại cột “Thành tiền”: Ghi đầy đủ tiền hàng hóa, dịch vụ trước khi giảm.

- Tại dòng “Cộng tiền hàng hóa, dịch vụ”: Ghi số tiền đã giảm 20% mức tỷ lệ %.

- Ghi chú bắt buộc trên hóa đơn: “Đã giảm… (số tiền) tương ứng 20% mức tỷ lệ % để tính thuế GTGT theo Nghị định số 15/2022/NĐ-CP”.

4. Tính chi phí được trừ khi xác định thu nhập chịu thuế TNDN

Ngoài GTGT, Nghị định 15/2022/NĐ-CP cũng có nội dung liên quan đến chi phí được trừ khi tính thuế TNDN đối với các khoản ủng hộ, tài trợ cho hoạt động phòng, chống dịch COVID-19 (trong bối cảnh chương trình phục hồi). Doanh nghiệp cần đảm bảo hồ sơ chứng từ theo quy định để được tính chi phí được trừ.

Trong thực tế, nhóm này dễ sai ở chỗ ghi nhận “thành tiền” và “số tiền đã giảm” không nhất quán giữa chứng từ – sổ – tờ khai, dẫn đến lệch dữ liệu khi đối soát.

- Doanh nghiệp được tính vào chi phí được trừ khi xác định thu nhập chịu thuế TNDN đối với các khoản chi ủng hộ, tài trợ cho hoạt động phòng, chống dịch COVID-19.

- Yêu cầu hồ sơ chứng từ: Biên bản xác nhận ủng hộ/tài trợ theo mẫu quy định.

Advice: Doanh nghiệp nên chủ động rà soát danh mục hàng hóa đầu vào và đầu ra, thiết lập sẵn mức thuế suất mặc định trên hệ thống quản lý chi phí như Bizzi Expense. Hệ thống sẽ giúp cảnh báo nếu một hóa đơn đầu vào từ nhà cung cấp có mức thuế suất bất thường so với dữ liệu lịch sử hoặc quy định ngành, giúp kế toán loại bỏ rủi ro trước khi kê khai thuế.

5 lưu ý khi lập hóa đơn áp dụng nghị định 15/2022/NĐ-CP giảm thuế GTGT

Trong giai đoạn áp dụng Nghị định 15/2022/NĐ-CP, sai sót thường không đến từ việc “không biết giảm 2% thuế GTGT”, mà đến từ các lỗi nghiệp vụ khi lập hóa đơn: gộp chung hàng 8% và 10%, xuất sai thuế suất do chưa cập nhật hệ thống, hoặc xác định sai thời điểm áp dụng.

Những lỗi này dễ dẫn đến phải điều chỉnh hóa đơn, kê khai bổ sung, thậm chí phát sinh rủi ro bị truy thu/ấn định thuế khi hậu kiểm. Dưới đây là 5 lưu ý quan trọng để kế toán lập hóa đơn đúng ngay từ đầu và giảm tối đa rủi ro.

1. Quy định về việc tách hóa đơn cho hàng hóa, dịch vụ được giảm thuế

Theo quy định tại khoản 4 Điều 1 Nghị định 15/2022/NĐ-CP, cơ sở kinh doanh (đối với phương pháp khấu trừ) khi bán hàng hóa, cung cấp dịch vụ áp dụng các mức thuế suất khác nhau thì phải ghi rõ thuế suất của từng loại hàng hóa, dịch vụ.

Đối với nhóm hàng hóa, dịch vụ được giảm thuế GTGT xuống còn 8%, doanh nghiệp cần lập hóa đơn riêng. Việc này nhằm mục đích:

- Minh bạch trong kê khai: Giúp cơ quan thuế và doanh nghiệp dễ dàng phân loại, kiểm soát doanh thu chịu thuế 8% và 10%.

- Tránh rủi ro bị ấn định thuế: Trường hợp doanh nghiệp không lập hóa đơn riêng hoặc gộp chung mà không tách rõ mức thuế suất, cơ quan thuế có thể yêu cầu áp dụng mức thuế suất cao nhất (10%) cho toàn bộ giá trị hóa đơn, gây thiệt hại cho doanh nghiệp và khách hàng.

- Lưu ý cho người dùng Bizzi: Việc tách hóa đơn nên được thiết lập ngay từ khâu tạo lập đơn hàng trên phần mềm quản lý để hệ thống tự động xuất hóa đơn điện tử chính xác.

2. Hướng dẫn xử lý khi doanh nghiệp được giảm thuế nhưng đã xuất hóa đơn 10%

Đây là lỗi phổ biến nhất trong giai đoạn đầu áp dụng chính sách. Nếu doanh nghiệp thuộc diện được giảm thuế xuống 8% nhưng do sai sót hoặc chưa cập nhật hệ thống đã lỡ xuất hóa đơn 10%, cần xử lý theo các bước sau:

- Step 1: Hai bên (người mua và người bán) cần lập biên bản ghi nhận sai sót hoặc thỏa thuận bằng văn bản về việc xuất sai mức thuế suất.

- Step 2: Seller established Adjustment invoice or replacement bill (tùy theo quy định của phần mềm hóa đơn điện tử và Nghị định 123/2020/NĐ-CP đang áp dụng) để điều chỉnh mức thuế suất từ 10% xuống 8%.

- Step 3: Hoàn trả phần thuế thu thừa cho người mua.

Nếu không điều chỉnh, bên bán phải nộp thuế 10% (bị thiệt), còn bên mua cũng không được khấu trừ 10% (do hóa đơn sai quy định) mà chỉ được khấu trừ đúng mức thực tế là 8% hoặc bị loại chi phí.

3. Xác định thuế suất cho hàng hóa bán trước 01/02/2022 nhưng lập hóa đơn vào tháng 2/2022

Kế toán cần phân biệt rõ giữa thời điểm phát sinh nghĩa vụ thuế and time of invoice.

- Principle: Thuế suất được xác định tại thời điểm chuyển giao quyền sở hữu hoặc quyền sử dụng hàng hóa, dịch vụ (hoàn thành dịch vụ), không phụ thuộc vào thời điểm lập hóa đơn hay thanh toán.

- Analysis: Nếu hàng hóa đã bán, dịch vụ đã hoàn thành và nghiệm thu trước ngày 01/02/2022, thì giao dịch đó thuộc kỳ tính thuế cũ.

Conclude: Dù hóa đơn được lập vào tháng 2/2022 (thời điểm Nghị định 15 đã có hiệu lực), doanh nghiệp vẫn phải áp dụng mức thuế suất cũ là 10%. Không được áp dụng mức 8% cho các giao dịch phát sinh trước thời điểm nghị định có hiệu lực.

4. Quy trình xử lý hóa đơn lập trước 01/02/2022 có sai sót được phát hiện sau thời điểm này

Trường hợp hóa đơn đã lập trước ngày 01/02/2022 (đang chịu thuế 10%) nhưng sau ngày 01/02/2022 mới phát hiện sai sót cần điều chỉnh hoặc thay thế:

- Quy định áp dụng: Thực hiện theo quy định về hóa đơn chứng từ tại Nghị định 123/2020/NĐ-CP.

- Mức thuế suất điều chỉnh: Hóa đơn điều chỉnh hoặc thay thế phải giữ nguyên mức thuế suất tại thời điểm phát sinh giao dịch gốc.

Specifically: Nếu hóa đơn gốc tháng 01/2022 có thuế suất 10%, thì hóa đơn điều chỉnh lập vào tháng 02/2022 (hoặc các tháng sau đó) vẫn phải ghi thuế suất 10%. Tuyệt đối không được điều chỉnh về 8% vì bản chất giao dịch này không thuộc phạm vi điều chỉnh của Nghị định 15/2022.

5. Các bước khắc phục khi cơ sở kinh doanh lập hóa đơn sai mức thuế suất

Khi phát hiện lập sai mức thuế suất (ví dụ: hàng 8% ghi nhầm mức khác hoặc ngược lại) mà không rơi vào các trường hợp chuyển tiếp nêu trên, kế toán xử lý như sau:

- Trường hợp chưa kê khai thuế:

- Người bán thực hiện hủy hóa đơn điện tử đã lập có sai sót.

- Lập hóa đơn điện tử mới thay thế với mức thuế suất đúng.

- Trường hợp đã kê khai thuế:

- Người bán và người mua lập văn bản thỏa thuận ghi rõ sai sót.

- Người bán lập hóa đơn điều chỉnh sai sót.

- Cả hai bên thực hiện kê khai bổ sung (nếu sai sót ảnh hưởng đến số thuế phải nộp/được khấu trừ) theo quy định của Luật Quản lý thuế.

Việc quản lý thủ công các mốc thời gian và danh mục hàng hóa được giảm thuế rất dễ dẫn đến sai sót. Sử dụng các giải pháp tự động hóa như Bizzi Expense sẽ giúp kế toán tự động đối chiếu mã hàng và cảnh báo nếu thuế suất trên hóa đơn đầu vào không khớp với quy định hiện hành, giảm thiểu rủi ro giải trình thuế sau này.

Comparing Decree 44/2023/ND-CP and Decree 15/2022/ND-CP

Dưới đây là nội dung chi tiết cho phần H2: So sánh Nghị định 44/2023/NĐ-CP và Nghị định 15/2022/NĐ-CP, tiếp tục được thiết kế chuyên sâu cho đối tượng Kế toán và Doanh nghiệp sử dụng Bizzi.

Nội dung này không chỉ liệt kê sự khác biệt mà còn đi sâu vào tác động nghiệp vụ để kế toán lưu ý khi chuyển đổi giữa các kỳ chính sách.

Comparing Decree 44/2023/ND-CP and Decree 15/2022/ND-CP

Mặc dù Nghị định 44/2023/NĐ-CP được xem là sự “kế thừa” tinh thần của Nghị định 15/2022/NĐ-CP trong việc giảm thuế GTGT từ 10% xuống 8%, nhưng thực tế triển khai đã có những điều chỉnh quan trọng về phạm vi đối tượng and thủ tục hành chính để khắc phục các vướng mắc của kỳ trước.

Dưới đây là bảng so sánh tổng quan và phân tích chi tiết các điểm mới:

| Tiêu chí so sánh | Decree 15/2022/ND-CP | Decree 44/2023/ND-CP |

| Thời gian áp dụng | 01/02/2022 – 31/12/2022 (11 tháng) | 01/07/2023 – 31/12/2023 (6 tháng) |

| Mặt hàng Than | Khai thác than bán ra được giảm. Không quy định rõ về Tập đoàn/Tổng công ty quy trình khép kín. | Clearly defined: Các Tổng công ty, Tập đoàn thực hiện quy trình khép kín mới bán ra cũng thuộc đối tượng được giảm thuế |

| Xử lý hóa đơn sai sót | Hướng dẫn riêng tại Khoản 5 Điều 1. | Bỏ hướng dẫn riêng, thực hiện thống nhất theo Nghị định 123/2020/NĐ-CP |

| Corporate income tax expense | Có quy định về chi phí ủng hộ, tài trợ Covid-19 được trừ. | Bãi bỏ, không còn quy định này do bối cảnh dịch bệnh đã thay đổi |

| Mã HS & Danh mục | Theo danh mục cũ. | Cập nhật mã HS mới theo Danh mục hàng hóa XNK 2022; Sửa đổi ghi chú cuối Phụ lục để rõ nghĩa hơn |

1. Sự mở rộng đối tượng được giảm thuế: Điểm mới về mặt hàng Than

Nghị định 44/2023/NĐ-CP đã tháo gỡ một vướng mắc rất lớn mà các Tập đoàn Than – Khoáng sản gặp phải ở Nghị định 15.

- Tại Nghị định 15: Chỉ quy định chung chung là “than khai thác bán ra” mới được giảm thuế. Điều này gây tranh cãi khi áp dụng cho các mô hình tập đoàn có quy trình khép kín (Công ty mẹ giao Công ty con khai thác -> Chế biến -> Công ty mẹ bao tiêu -> Bán ra ngoài). Lúc này, khâu bán ra của Công ty mẹ bị coi là “thương mại” chứ không phải “khai thác” nên thường bị áp 10%.

- Tại Nghị định 44: Quy định rõ trường hợp Tổng công ty, Tập đoàn kinh tế thực hiện quy trình khép kín mới bán ra cũng thuộc đối tượng được giảm thuế GTGT.

Lưu ý cho người dùng Bizzi: Nếu doanh nghiệp của bạn nằm trong chuỗi cung ứng than hoặc mua than từ các đơn vị này, cần cập nhật lại thuế suất đầu vào 8% cho các hóa đơn từ sau 01/07/2023 để tối ưu chi phí.

2. Chuẩn hóa quy trình xử lý hóa đơn sai sót về thuế suất

Đây là điểm thay đổi “giảm tải” nhất cho Kế toán về mặt thủ tục.

- Trước đây (Nghị định 15): Khi phát hiện sai sót (đã lập hóa đơn 10% cho hàng 8% hoặc ngược lại), Nghị định yêu cầu phải lập Adjustment invoice hoặc hóa đơn thay thế và có các bước xử lý đặc thù.

- Hiện nay (Nghị định 44): Không còn quy định riêng. Việc xử lý hóa đơn sai sót về thuế suất được thực hiện hoàn toàn theo Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

Impact: Doanh nghiệp có quyền lựa chọn linh hoạt giữa việc lập Adjustment invoice or Replacement invoice tùy theo thỏa thuận giữa hai bên mua bán, không bị cứng nhắc như trước.

3. Cập nhật mã HS Code và Danh mục hàng hóa loại trừ

Kế toán cần đặc biệt lưu ý không được “copy-paste” danh mục hàng hóa từ năm 2022 sang năm 2023 một cách máy móc.

- Thay đổi mã HS: Nghị định 44 đã cập nhật lại các mã số HS trong các Phụ lục I, II, III để đồng bộ với Danh mục hàng hóa xuất khẩu, nhập khẩu Việt Nam mới nhất (ban hành kèm Thông tư 31/2022/TT-BTC). Có nhiều mã hàng đã thay đổi mô tả hoặc mã số so với thời điểm Nghị định 15 ban hành.

- Ghi chú tra cứu: Nghị định 44 sửa đổi phần Ghi chú cuối Phụ lục I và III, khẳng định rõ: “Mã số HS ở cột (10) chỉ để tra cứu. Việc xác định mã số HS đối với hàng hóa thực tế nhập khẩu thực hiện theo quy định về phân loại hàng hóa…”. Điều này nhấn mạnh tính chất ưu tiên của tên và bản chất hàng hóa hơn là mã HS khi xét giảm thuế.

4. Bãi bỏ quy định về chi phí được trừ thuế TNDN (Ủng hộ Covid-19)

Tại Điều 2 Nghị định 15/2022 có quy định cho phép doanh nghiệp tính vào chi phí được trừ khi tính thuế TNDN đối với các khoản chi ủng hộ, tài trợ cho hoạt động phòng, chống dịch COVID-19.

Tuy nhiên, Nghị định 44/2023/NĐ-CP tập trung hoàn toàn vào chính sách giảm thuế GTGT kích cầu tiêu dùng, không còn đề cập đến nội dung này do bối cảnh dịch bệnh đã được kiểm soát. Doanh nghiệp cần lưu ý để không hạch toán nhầm các khoản chi từ thiện, ủng hộ vào chi phí được trừ nếu không có đầy đủ hồ sơ theo quy định chung của Luật thuế TNDN.

Sự thay đổi giữa hai nghị định cho thấy xu hướng “chuẩn hóa” của cơ quan thuế. Các hướng dẫn đặc thù dần được gỡ bỏ để quay về quy định gốc (như Nghị định 123).

Khi thiết lập hệ thống Bizzi Expense hoặc phần mềm kế toán cho kỳ mới, hãy ưu tiên rà soát lại Mã hàng hóa (SKU) thay vì chỉ nhìn vào tên gọi, đặc biệt là các nhóm hàng nhập khẩu có mã HS phức tạp để tránh rủi ro bị truy thu thuế sau này.

Câu hỏi thường gặp (FAQs) về thực hiện giảm thuế GTGT theo Nghị định 15

1. Hóa đơn xăng dầu có được giảm thuế xuống 8% không?

Trả lời: KHÔNG.

Đây là nhầm lẫn phổ biến nhất. Mặc dù xăng dầu là nhiên liệu thiết yếu, nhưng theo Phụ lục I, II, III của Nghị định 15/2022/NĐ-CP, xăng dầu thuộc đối tượng chịu Thuế tiêu thụ đặc biệt (hoặc thuộc nhóm sản phẩm khai khoáng, dầu mỏ tinh chế). Do đó, mặt hàng này vẫn áp dụng thuế suất 10%.

Khi xử lý chi phí công tác phí, xăng xe, kế toán cần lưu ý nếu hóa đơn xăng dầu ghi 8% là sai quy định. Hệ thống Bizzi sẽ cảnh báo nếu người dùng nhập liệu sai mức thuế suất này đối với nhóm nhà cung cấp xăng dầu.

2. Dịch vụ ăn uống, khách sạn có phục vụ rượu bia thì xuất hóa đơn thế nào?

Reply: Cần tách dòng hoặc tách hóa đơn.

- Dịch vụ ăn uống, tiền phòng: Được giảm xuống 8%.

- Rượu, bia, thuốc lá: Là hàng hóa chịu thuế tiêu thụ đặc biệt, giữ nguyên 10%.

Nếu nhà hàng xuất gộp chung một dòng “Dịch vụ ăn uống” với thuế suất 8% cho cả rượu bia là sai. Doanh nghiệp cần yêu cầu nhà cung cấp tách riêng dòng: Món ăn (8%) và Đồ uống có cồn (10%) trên cùng một hóa đơn hoặc xuất ra hai hóa đơn khác nhau.

3. Doanh nghiệp có phải nộp hồ sơ đăng ký giảm thuế với cơ quan thuế không?

Trả lời: KHÔNG.

Chính sách giảm thuế theo Nghị định 15 áp dụng theo cơ chế tự khai, tự chịu trách nhiệm. Doanh nghiệp không cần làm thủ tục “xin” giảm thuế.

Tuy nhiên, điều này đồng nghĩa rủi ro hậu kiểm là rất lớn. Nếu sau này cơ quan thuế kiểm tra và phát hiện doanh nghiệp tự ý giảm thuế cho mặt hàng không thuộc đối tượng giảm, doanh nghiệp sẽ bị truy thu và phạt vi phạm hành chính.

4. Công trình xây dựng nghiệm thu từng phần thì áp dụng thuế suất nào?

Reply: Căn cứ vào thời điểm nghiệm thu.

- Hạng mục nghiệm thu, bàn giao trước 01/02/2022: Áp dụng 10% (kể cả khi xuất hóa đơn sau đó).

- Hạng mục nghiệm thu, bàn giao trong khoảng 01/02/2022 – 31/12/2022: Áp dụng 8% (đối với hợp đồng xây dựng không bao gồm cung cấp hàng hóa chịu thuế 10% như nội thất, thiết bị điện lạnh…).

- Mẹo xử lý: Kế toán cần đính kèm Biên bản nghiệm thu vào hồ sơ thanh toán trên phần mềm Bizzi để làm căn cứ giải trình thời điểm xác định thuế suất.

5. Hóa đơn đầu vào ghi sai thuế suất (thuộc diện 8% nhưng ghi 10%) có được khấu trừ không?

Trả lời: Có rủi ro.

Theo công văn hướng dẫn của một số Cục Thuế, nếu bên bán chưa điều chỉnh hóa đơn:

- Bên bán phải nộp thuế 10%.

- Bên mua chỉ được khấu trừ 8% (theo đúng quy định pháp luật) hoặc có rủi ro bị loại toàn bộ thuế đầu vào nếu không yêu cầu bên bán điều chỉnh.

Do đó, giải pháp an toàn nhất là yêu cầu bên bán lập hóa đơn điều chỉnh hoặc thay thế về đúng 8%.

Conclude

Application Nghị định 15/2022 đòi hỏi kế toán phân loại đúng hàng hóa, dịch vụ; xuất hóa đơn đúng thuế suất; và lưu hồ sơ đầy đủ để phục vụ giải trình. Rủi ro lớn nhất không nằm ở “không biết quy định”, mà nằm ở việc danh mục hàng hóa nhiều, mô tả không chuẩn, và thao tác thủ công khiến sai sót thuế suất khó kiểm soát.

Trong thực tế, doanh nghiệp thường giảm rủi ro bằng cách chuẩn hóa danh mục hàng hóa/nhà cung cấp, thiết lập quy tắc thuế suất theo nhóm hàng và triển khai cơ chế kiểm tra chéo (đối soát chứng từ, cảnh báo sai lệch thuế suất) ngay từ đầu vào—để khi đến kỳ kê khai, kế toán không phải “chữa cháy” trên hàng trăm hóa đơn.

👉 Đăng ký trải nghiệm miễn phí Bizzi ngay hôm nay để “nhẹ gánh” lo âu mùa quyết toán!

Registration link: bizzi.vn/dang-ky-dung-thu

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam

- Youtube: https://www.youtube.com/@bizzivietnam