Correct selection and use electronic invoice template is a mandatory requirement, playing a key role in ensuring compliance with tax laws. More importantly, it is also the foundation for optimizing financial accounting processes. One electronic invoice template Standards not only demonstrate professionalism but are also the first step in building a system. business cost management effective.

This article will provide a complete collection of popular electronic invoice templates most, helping accountants and business owners easily download and apply immediately, ensuring absolute compliance with Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC. Discover now!

1. What is an electronic invoice? Its role in business cost management

According to Article 3 Decree 123/2020/ND-CPAn electronic invoice is an invoice with or without a tax authority code, expressed in the form of electronic data created by organizations and individuals selling goods or providing services using electronic means to record information on sales and service provision in accordance with the provisions of law on accounting and tax.

Save money and time

Using electronic invoices helps businesses cut up to 80% in printing, shipping and storage costs. At the same time, automation invoice processing process significantly shortens the time from receipt of invoice to payment, improves cash flow and reduces personnel costs for manual tasks.

Improve management efficiency and control spending

E-invoices allow businesses to instantly access, check and compare information, eliminating errors in tax declarations. When integrated with cost management solutions, data from invoices is automatically extracted and compared, helping businesses have a transparent view of expenses, thereby optimizing the process. Accounts Payable Management and enhance the ability control spending.

Compliance with the law

According to current regulations, 100% businesses must switch to using electronic invoices. Strict compliance not only helps avoid legal risks but also ensures the validity of expenses when settling taxes.

Contribute to environmental protection

Electronic invoices completely eliminate the use of paper, directly contributing to the goal of sustainable development and building the image of a modern, responsible business.

2. How to download standard electronic invoice form from tax authority

To ensure the highest legality, businesses can directly access the General Department of Taxation's Electronic Information Portal. Here, the tax authority provides guidance documents and standard formats of electronic invoice template (usually XML file) for businesses and solution providers to refer to and build a software system to issue invoices in compliance with regulations.

3. Summary of 07 electronic invoice templates according to Circular 78/2021 - Free download file

To make it easier for businesses to choose and apply, below is a summary table of the electronic invoice template most popular with .docx format download file for reference.

| Invoice type | Applicable objects | Legal basis | Reference download file |

|---|---|---|---|

| Value Added Tax (VAT) Invoice | Organizations and individuals declare VAT using the deduction method. | Circular 78/2021/TT-BTC | Download |

| Sales Invoice | Organizations and individuals declare VAT using the direct method. | Circular 78/2021/TT-BTC | Download |

| Warehouse delivery note for goods sent to agents for sale | Businesses export goods to agents to sell at the right price and receive commission. | Decree 123/2020/ND-CP | Download |

| Special VAT electronic invoice | Special industries such as aviation, telecommunications, electricity, water, etc. | Circular 78/2021/TT-BTC | Download |

| Special VAT invoice in foreign currency | Transactions are allowed to collect foreign currency according to the law. | Circular 78/2021/TT-BTC | Download |

| Public property sale invoice | State agencies when selling public assets. | Decree 123/2020/ND-CP | Download |

| National Reserve Sales Invoice | Agencies and units assigned the task of selling national reserve goods. | Decree 123/2020/ND-CP | Download |

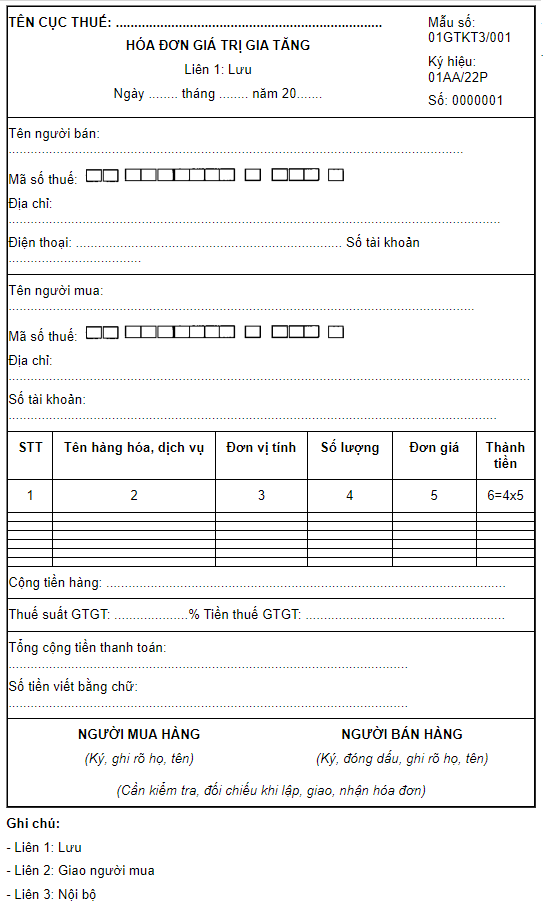

3.1 Value Added Tax (VAT) invoice

Download invoice template here!

3.2 Sales invoice

Download invoice template here!

3.3 Sample warehouse delivery note for goods sent to agents for sale

Download invoice template here!

3.4 Specific VAT electronic invoice form

Download invoice template here!

3.5 Special VAT electronic invoice form in foreign currency

Download invoice template here!

3.6 Invoice for sale of public assets

Download invoice template here!

3.7 National reserve sales invoice

Download invoice template here!

CTA: You can apply these templates directly on Bizzi software to ensure the issuance of invoices in accordance with the General Department of Taxation's standards in just a few seconds.

4. Required content on electronic invoice form according to Decree 123 & Circular 78

According to Article 10, Decree 123/2020/ND-CP, one electronic invoice template Valid must have the following contents:

- Name, symbol, sample number, invoice number: Unique identifiers for invoices.

- Seller and buyer information: Must include Name, address, tax identification number (if applicable).

- Details of goods and services: Name of goods, unit, quantity, unit price, total amount, VAT rate, VAT amount, total payment amount.

- Digital signature: The seller's digital signature is mandatory. The buyer's digital signature is not mandatory in some cases as prescribed in Clause 14, Article 10, Decree 123/2020/ND-CP.

- Invoice time: Must be presented in calendar day, month, year format.

- Time of signing: Record the time of signing by the seller and buyer (if any).

- Tax authority code: Required for electronic invoices with codes.

Missing any of the above contents may lead to the risk of invalid invoices, affecting tax declaration and the validity of expenses. During use, if errors are detected, the enterprise needs to carry out the procedure. Correcting incorrect electronic invoices or cancel electronic invoice in accordance with the instructions of the tax authorities.

5. Important notes when designing and issuing electronic invoice templates

Ensure compliance with invoice designation and symbology

According to the instructions in Circular 78/2021/TT-BTC, enterprises must register and use the correct sample number symbol (1-6) and invoice symbol (6 characters) for automatic classification and management by tax authorities.

Select standard file format

Electronic invoice template A valid invoice must be formatted according to the XML standard prescribed by the General Department of Taxation. This is a file containing the original data with legal value to record expenses. The PDF file is only a representation of the invoice, used for reading and storage.

Use standard electronic invoice software

Choosing a solution provider Electronic invoice Credibility is an important stepping stone to financial automation. A qualified software should ensure:

- Data security and integrity.

- Ability to connect and transmit data directly to tax authorities.

- Seamless integration with accounting software, ERP to automate processes input invoice processing, creating a solid foundation for a comprehensive cost management system.

6. Frequently asked questions (FAQ) about electronic invoice form

- 1. How are XML and PDF electronic invoice templates different?XML files are original data files, which have legal value for tax declaration and cost accounting. PDF files are visual representations of XML files, which are easy for users to read but do not have legal value as a substitute for XML files.

2. Can businesses design their own electronic invoice templates?

Enterprises are allowed to design their own electronic invoice templates (add logos, brand colors, etc.) but must ensure that they have all the required content according to Article 10, Decree 123/2020/ND-CP and must register the template with the tax authority before use.

3. Is there a penalty for using the wrong electronic invoice template?

Yes. Using an electronic invoice template that is not in accordance with regulations is considered an illegal use of invoices and may be subject to administrative penalties according to the provisions of Decree 125/2020/ND-CP, and the corresponding expenses may not be accepted when settling taxes.

7. Bizzi – Comprehensive cost management solution starting with electronic invoices

In the context of businesses increasingly focusing on optimizing operations, Bizzi not only provides a 100% compliant e-invoicing solution, but also offers a comprehensive expense management platform where e-invoicing is the starting point of automation:

- Automate expense processing: Bizzi automatically collects and extracts data from input invoices, eliminating manual data entry, helping businesses establish a process. automatic cost management and accurate.

- Flexible integration with accounting and ERP systems: Automatically synchronize data with popular accounting and ERP software, ensuring consistent and smooth flow of financial information.

- Smart expense control and approval: Build an online expense approval process, helping management easily track and control all expenses, ensuring budget compliance.

- Visual cost reporting: Provides real-time cost reporting and analysis, helping businesses make business decisions based on accurate data.

With Bizzi, the application electronic invoice template It is not just about compliance, but a strategic move to digitize and automate the entire financial management process, helping businesses save costs, improve efficiency and enhance competitiveness.