From July 1, 2022, organizations and individuals trading in goods and services must convert to using Electronic invoice (with or without code) according to the provisions of Decree 123/2020/ND-CP. The General Department of Taxation's invoice code issuance system has the function of automatically issuing codes and returning results to the sender.

However, during use, users often encounter many errors that prevent invoices from being coded or used properly. Understanding these common errors is very important to ensure that invoice issuance goes smoothly.

This article by Bizzi will point out the 6 most common errors when using electronic invoices for businesses to avoid.

06 mistakes when using electronic invoices

Below are the Error when using electronic invoice that accountants and businesses often encounter, along with causes and solutions:

-

Error entering data and sending invoice requesting code

| Incorrect or missing buyer information | Entering the wrong phone number format, especially the wrong 10-digit mobile number format.

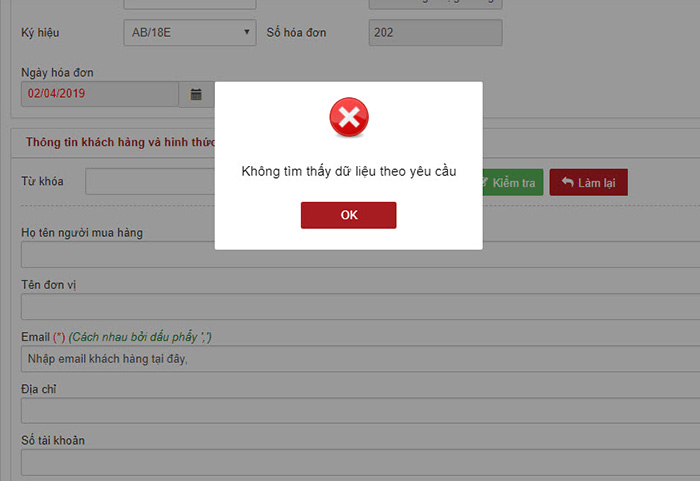

Incorrectly entered buyer email structure (e.g. missing “@” character or domain name). Buyer email is required information because e-invoices are sent and received electronically. Entered the recipient's bank account number in the wrong format or entered more than 30 characters. Leave the buyer name information blank. The tax authority may refuse to issue a code in this case. Entered incorrect format of buyer's tax code (MST). MST must comply with the prescribed structure (N1N2…N10 – N11N12N13). The tax system will reject the request if the buyer's tax code is not in the correct format. The invoice data contains special characters that the system does not support. Entering a recipient email address that is too long, for example due to entering multiple email addresses at once. |

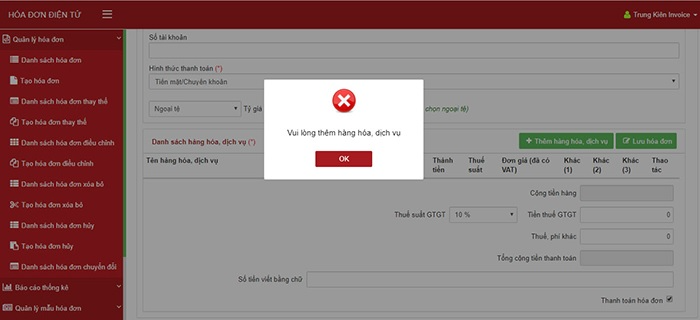

| Incorrect or missing information about goods and services | Missing tax rate information or incorrect tax rate entered.

Have not entered information about sold goods or services or have not clicked to update the line of goods or services just entered before saving the invoice. |

| Invalid invoice date | The date of the first invoice must be after the date the tax authority approves the invoice registration declaration.

The issue date of the new invoice must be greater than or equal to the issue date of the invoice with the smaller serial number. |

| The uploaded data is not in the correct format/tax system standard. | The tax system will refuse to issue an invoice code if the data submitted by the business is not in the correct format or is not up to standard. |

-

Error while registering use electronic invoices

| Select the wrong invoice type (With code/No code) | Enterprises select uncoded invoices while they are required to use coded invoices, or vice versa, depending on the requirements of the tax authority. |

| Selected the wrong object to use the invoice with the non-payment code | Only a few businesses are allowed to use electronic invoices with codes that do not require payment according to regulations. Businesses need to clearly identify and select the right subjects. |

| Incorrect tax calculation method (error code 2006) | This error is common when businesses submit declarations to register for using electronic invoices according to Circular 78.

The solution is to re-check the method of calculating Value Added Tax registered with the tax authority (direct, deduction, or lump-sum method) and recreate the invoice template in accordance with that tax calculation method. |

-

Technical, system and connection errors

| Software system failure | Errors when using electronic invoices may occur due to updates or adjustments from the software supplier.

The system may be temporarily “frozen” due to the user logging in incorrectly. (Note: These errors rarely occur with reputable software). |

| Internet connection problem | Lost connection or weak network connection will affect the export, send or Bill lookup. |

| Computer hardware error | Some damaged computer parts can cause data to not load or not load at all, causing errors when using electronic invoices.

Computer driver errors can also hinder data updates. |

| Error from the organization providing electronic invoice solutions (VAN) | Incorrect message format or incorrect message type code information may occur during invoice transmission. |

-

Error logging in and looking up invoices

| Incorrect login information entered | Incorrect login name entered. The login name is always the company's tax identification number (MST).

Entered wrong password due to typing mistake, forgot password, or turned on CAPS LOCK mode Forgot your system login password. Incorrect email address entered when using the “forgot password” function. This email must be the email registered with the software provider. |

| Incorrect CAPTCHA Code Entered | Typing the verification code displayed when logging in incorrectly, possibly due to difficulty distinguishing special characters. |

| Enter Incorrect Invoice Number When Looking Up | Do not enter the exact sequence of numbers and letters of the invoice when trying to look up. |

| Software expiration date | The license to use the electronic invoice software has expired and has not been renewed. |

| Invoice is incorrect or does not exist | There was a problem during the invoicing process that resulted in an incorrect or non-generated invoice, causing the lookup to fail. |

-

Digital signature error

| Digital signature not found or not installed (Error code 100100) | The USB Token containing the digital signature is not plugged into the computer.

The USB Token has been inserted but the computer system does not recognize it or has not installed the necessary software/driver for the digital signature. |

-

Other procedural and professional issues

| Don't know how to check notices from tax authorities | After registering to use electronic invoices, businesses do not know how to access or check the lookup account on the General Department of Taxation's information portal (https://hoadondientu.gdt.gov.vn) to view notifications. |

| Unknown error handling procedure | Businesses encounter difficulties when they have not received a notification of conversion but want to proactively register, or do not know how to handle errors in issued invoices after submitting a request for a code. Need to update instructions and consult tax officials. |

See more Regulations on input invoices here

Conclude

Accurate data entry and careful checking before sending invoices are the most important factors to avoid many errors when using electronic invoices. During the working process, it is necessary to note some points such as: Ensuring a stable internet connection and a well-functioning computer; login information, CAPTCHA code, and invoice number when accessing and looking up. In addition, errors when using electronic invoices can also be limited by properly installing and connecting digital signatures.

When encountering complex technical problems or procedural difficulties, you should contact the software provider's support department or consult a tax officer for timely support.

The implementation electronic invoice software In general, or specifically, the B-Invoice solution not only helps businesses minimize legal and financial risks, but also contributes to improving the efficiency of accounting and financial management and professionalizing the work process.

This solution B-Invoice is an electronic invoice solution developed on a modern technology platform, ensuring security, stability and flexible integration with many current accounting and sales systems.

B-invoice Fully comply with current legal regulations on electronic invoices according to:

- Decree 123/2020/ND-CP of the Government, regulations on invoices and documents.

- Circular 78/2021/TT-BTC of the Ministry of Finance, providing specific guidance on the implementation of electronic invoices.

B-Invoice not only strictly complies with data format standards (XML, PDF), digital signatures, and invoice issuance processes, but is also designed to comprehensively meet practical accounting operations such as:

- Issue sales and service invoices;

- Create adjustment invoices, replacement invoices;

- Connect to the General Department of Taxation's Portal to get the code and send valid electronic invoices.

With a combination of advanced technology and high customizability, B-Invoice is the right solution for all types of businesses – from SMEs to corporations – looking for a secure, fast and legally compliant e-invoicing platform.

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/