A converted invoice is a paper copy of an electronic invoice, created from the accounting software system or the enterprise's electronic invoice software. This is not an original invoice with legal value, but a copy used for reference, storage, comparison or internal business purposes.

What is the purpose of a conversion invoice and what role does it play in the operation of a business? Let's find the answer with Bizzi in this article!

What is a conversion invoice?

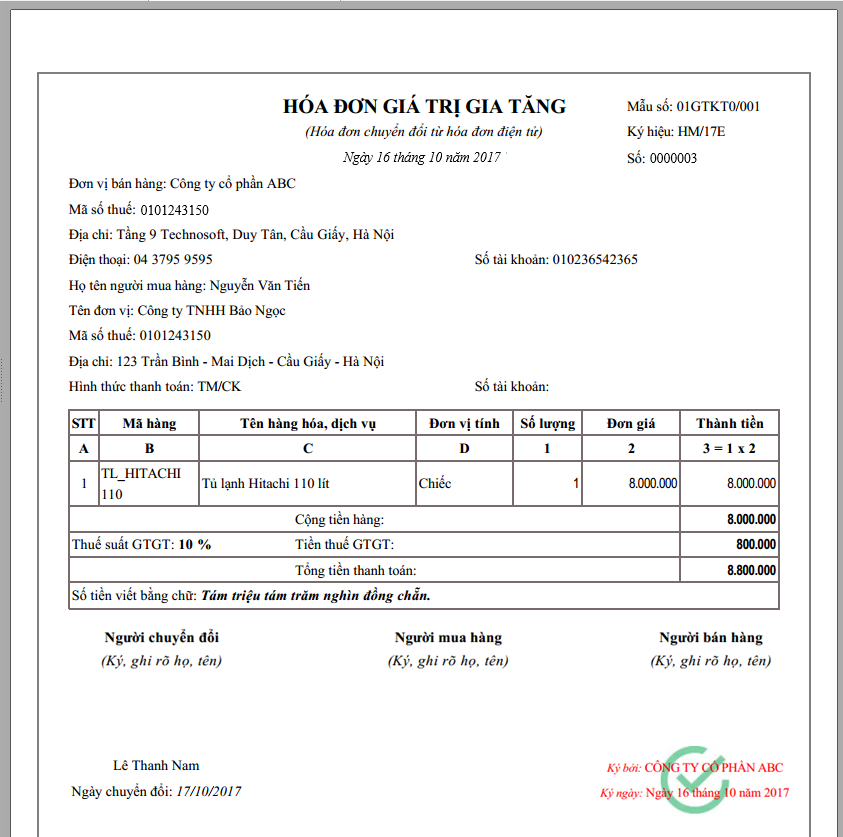

According to the law, a converted invoice is an invoice printed from an electronic invoice to a paper invoice. The main purpose of this conversion is to prove the origin of tangible goods in circulation on the market and to store accounting documents according to the law.

The conversion from electronic invoices to paper invoices is only done once for each original electronic invoice.

The converted invoice does not have the same legal value as the original electronic invoice (XML file + digital signature), but is only used in some supporting situations.

Purpose and cases of converting electronic invoices

Converting electronic invoices to paper invoices brings many benefits and is necessary in specific cases. So what is the purpose of the converted invoice?

- Proof of origin of goods: Support businesses to prove the origin and provenance of goods during transportation.

- Storing accounting documents: Help businesses/organizations store accounting documents in accordance with legal regulations.

- Meet inspection and testing requirements: Serving the work of checking and verifying documents from tax authorities, auditing, inspection, examination and investigation agencies.

- Convenient for customers/partners: Meet the needs of customers or partners who need paper invoices for storage or use.

- Administrative transaction support: Used in some administrative procedures that require paper invoices (e.g. loan applications, bidding, government agency reports).

- Support for businesses that have not yet used the electronic invoice system: It is a suitable solution when working with units that have not yet deployed electronic invoice technology.

- Additional storage: Parallel storage in paper form ensures information is secure and easily retrieved when needed.

There are two mandatory and non-mandatory cases for converting electronic invoices. The mandatory cases according to Decree 123/2020/ND-CP include when there are economic and financial requirements arising or at the request of tax authorities, auditors, inspectors, examiners, and investigators. The non-mandatory case is when the enterprise converts itself according to the needs of its production and business activities.

What are the conditions to ensure the legal validity of the converted invoice within the storage scope?

In addition to understanding the nature of the converted invoice, ensuring the legal value of the converted invoice is also extremely important. To ensure accuracy and serve the purpose of storage, the converted invoice from electronic to paper must meet the following conditions:

- Reflect the integrity, accuracy and completeness of the original electronic invoice content.

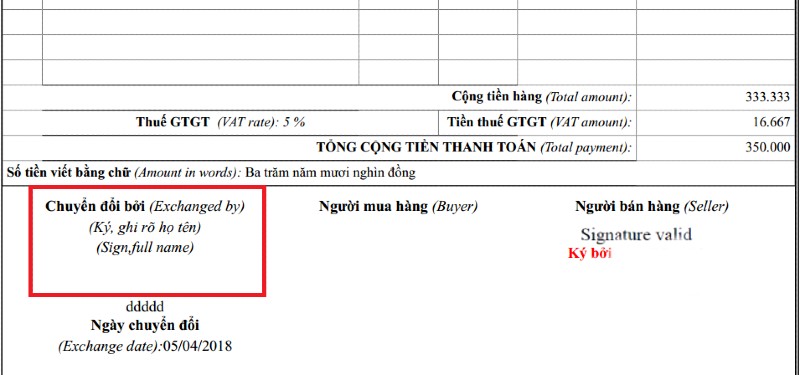

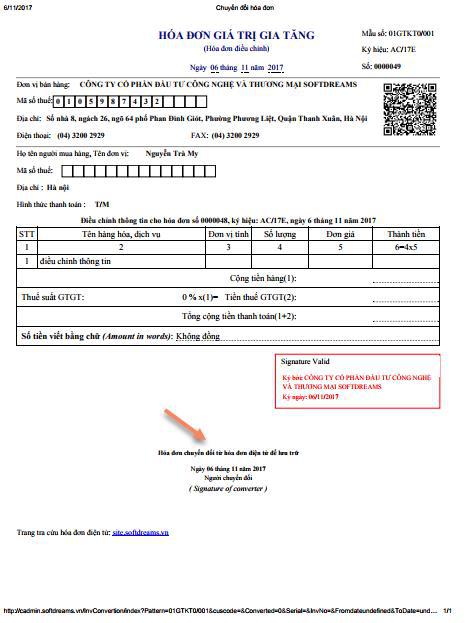

- There is a separate symbol confirming that the electronic invoice has been converted to a paper invoice. Specifically, the converted invoice must clearly state the words: "INVOICE CONVERTED FROM ELECTRONIC INVOICE".

- Each converted electronic invoice must have the signature, full name of the person performing the conversion, invoice code, tax authority authentication code, and time (date, hour) of conversion.

Depending on your business software and processes, the conversion may be done automatically or with internal confirmation.

What is the legal value of a conversion invoice?

This is an important point that needs to be clarified. According to regulations, electronic invoices converted into paper documents are only valid for keeping records and monitoring according to the provisions of the law on accounting and electronic transactions. They are not valid for transactions and payments, except in cases where invoices are initiated from cash registers that are connected to electronic data transfer with the Tax authority.

In other words, the converted invoice (paper copy) itself cannot replace the original electronic invoice in payment transactions between the buyer and seller. If the accountant only receives the converted invoice without the original electronic invoice file, this document is not valuable enough to pay the seller. However, The converted invoice or printout from the electronic invoice lookup can be used as a basis for documents when making payments within the company or for storage and reconciliation purposes..

Distinguish between converted invoices and printed copies from electronic invoice lookup

It is important to distinguish between a converted invoice and a printed copy from an electronic invoice lookup, especially when businesses work with tax authorities, auditors, or partners. Here is a detailed comparison table:

| Criteria | Conversion Invoice | Print reference |

| Source of issue | Created from the business's electronic invoice software. | Print from invoice lookup portal (General Department of Taxation website or supplier's lookup link) |

| Usage Data | From the original XML file, it is possible to integrate digital signatures and authentication codes. | Data displayed is summary from the lookup system, incomplete |

| Used for tax declaration | Not to be used in place of the original electronic invoice. | Not valid for tax purposes. |

| Internal storage documents | Can be stored with accounting records. | Should not be kept in lieu of official receipt. |

| Used for delivery, receipt | Can be used in transportation, real transactions. | Not recommended, can be confusing. |

In short:

- Invoice converted from electronic invoice: To be done by the seller (or the party who needs to convert). Must have the words “INVOICE CONVERTED FROM ELECTRONIC INVOICE” and the signature, full name of the person making the conversion, and time of conversion. Conversion can only be done once from the original file, but multiple copies can be printed from that converted file.

- Printout when looking up electronic invoices: Managed by the Tax Authority database. Anyone with information about the invoice can look it up and print it from the tax authority website or service provider. This printout is just a copy, without any criteria, unique confirmation symbols, signature of the person performing the conversion, or seal/signature of the business representative.

Both types of paper prints are primarily valuable for archival purposes, not for transactions or payments (except in the case of invoices from cash registers connected to tax authorities).

- See more articles about Registering for electronic invoices here

Bizzi – The powerful assistant of modern accounting

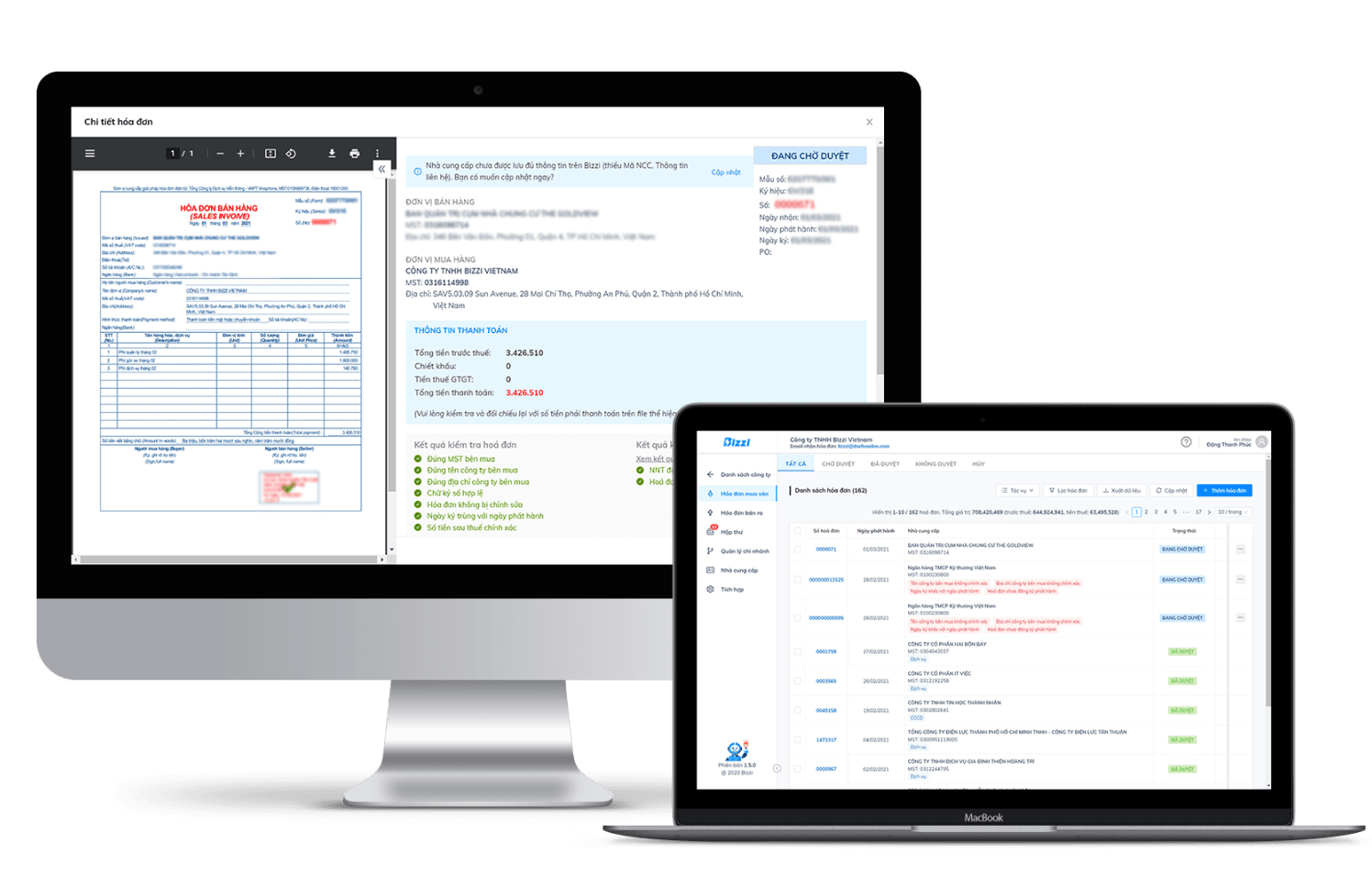

Bizzi is not only an electronic invoice software platform, but also a comprehensive financial & cost management solution, supporting businesses to upgrade their modern workflows - from receiving input invoices, processing costs, managing debts to archiving and responding to tax inspections.

Smart electronic invoice processing & management

Bizzi is the receiving, storing and processing of electronic invoices (input and output). This is the sole legal basis in all accounting and tax operations.

- From the original electronic invoice, Bizzi allows businesses to convert to paper invoices if needed.

- Comply with regulations, avoid legal risks and provide optimal support for other operations such as declaration, reconciliation and auditing.

Cost management & automatic input invoice processing

- Support automatic data extraction from electronic invoices, information comparison, classification and quick cost approval process integration.

- Understanding the legal limitations of a conversion invoice helps Bizzi advise on the correct use for each purpose (internal reference and legal storage).

Manage receivables & valid purchase/sale transactions

- Centrally manage all electronic invoices, automatically record debts and attach them to orders, POs, contracts, etc.

- When checking, comparing or supporting the auditor, the software supports retrieving original invoices or performing valid conversion to paper copies for presentation when needed.

Store electronic invoices, converted invoices

According to regulations, electronic invoices must be stored for at least 10 years. However, for some internal or industry-specific operations, businesses still need to keep paper copies. Bizzi supports in parallel:

- Electronic storage: XML, PDF files, with digital signature and authentication code.

- Print Archive: Conversion invoices are printed from the software system, in the correct format, and can be used internally.

See more articles about Sample of electronic invoice adjustment minutes here

Meeting Inspection/Testing Needs

When requested by tax authorities, auditors or internal audit units, accountants may:

- Quickly look up original electronic invoices, export data in batches, retrieve full XML files.

- Extract the correct converted invoice for storage or presentation on request (if e-invoice software is integrated).

In short, the Bizzi platform supports electronic invoice management, invoice processing and cost management – operations directly related to the origin (electronic invoice) and the intended use (storage, internal) of the converted invoice.

Conclude

Hopefully, this article by Bizzi has clarified the concept of what a conversion invoice is and provided enough information for readers to understand what a conversion invoice is for. In managing the entire invoice lifecycle, from the original electronic invoice to processing paper copies for internal and archival purposes, applying an automated and intelligent solution like Bizzi will help businesses ensure regulatory compliance and optimize workflows.

- Increase productivity and work smarter: Each electronic invoice is processed and data extracted. less than 30 secondsSave hours each week so you and your accounting team can focus on strategic work that creates real value for your business.

- Reduce errors – Eliminate worries about lost invoices: No more manual data entry, no worries about errors, missing lines or lost documents. Bizzi automates the process and stores all converted & electronic invoices in a centralized, scientific system. Easy retrieval, comprehensive control.

- Reasonable cost, flexible according to business scale Fee: The service package is designed to suit all business sizes, from startups to corporations. The cost of a bill is only equivalent to a glass of iced tea - but brings the value of a professional virtual financial assistant.

To experience the features of downloading - checking - reconciling invoices in a snap, register for a trial here:

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/