Accounting documents are legal evidence and the sole basis for accounting entries, reflecting all economic and financial transactions that have arisen and been completed. Therefore, understanding and applying How to manage accounting documents Proper implementation not only ensures compliance with the law but also forms the foundation for a transparent and strong financial system. Mastering this process helps businesses optimize operations, control risks and is the first step towards business cost management strategically

Join Bizzi to learn more about How to manage accounting documents professional and efficient, thereby building a solid cost control system for your business.

What is an accounting document?

Accounting documents are documents and information carriers (such as invoices, receipts, payment vouchers, warehouse receipts, etc.) that record economic and financial transactions that have arisen and actually been completed, serving as the basis for accounting entries. These are original documents, with high legality, proving all transactions and expenditures of the enterprise.

The role of effective accounting document management in business

One How to manage accounting documents Efficiency brings many strategic benefits, especially in controlling cash flow and costs:

- Provide accurate information: Is the original data source to record information, ensuring honesty and accuracy for the entire system. financial report.

- Solid legal basis: Valid documents are legal evidence to protect businesses in inspection, auditing, tax settlement and economic dispute resolution activities.

- Internal control tools: Helps managers closely monitor revenue and expenditure activities, detect errors and prevent fraud. This is the first and most important step to internal expense control, ensuring all expenses are valid and within budget.

- Decision making platform: Data from documents provides reliable input for analyzing performance, evaluating costs, planning business strategies and optimizing budgets.

Legal regulations on How to manage accounting documents

The 2015 Accounting Law and its guiding documents have very strict regulations on How to manage accounting documents that every business must comply with to ensure the validity of all expenses.

1. Regulations on document preparation

- Uniqueness: Each economic transaction can only have one single accounting document.

- Timeliness and completeness: Enterprises must prepare documents as soon as a transaction occurs, filling in the content completely, clearly and accurately according to the prescribed form.

- Transparency: Content must not be abbreviated, erased, or edited. If written incorrectly, it must be canceled by crossing it out and a new document must be created.

- Responsibility: The creator, approver and relevant parties must sign and take full responsibility for the content of the document.

2. Signature regulations

- Documents must have sufficient signatures according to the prescribed titles, signed with an indelible ink pen. It is strictly forbidden to use red ink or pre-engraved signature stamps.

- Payment vouchers must be approved by the authorized person and signed by the chief accountant (or authorized person) before implementation.

- Electronic documents must have a valid digital signature according to the provisions of law on electronic transactions.

3. Regulations on storage period

Enterprises must store accounting documents to serve inspection and auditing work. The storage period is clearly specified:

| Type of document | Minimum storage period | For example |

|---|---|---|

| Documents not directly used for recording and payment | 5 years | Receipts, payment vouchers, warehouse receipts, and warehouse delivery vouchers are not kept in the accounting department's accounting document set. |

| Accounting documents used for bookkeeping and settlement | 10 years | Sales invoices, annual financial statements, settlement reports, documents related to asset liquidation. |

| Documents have historical significance and long-term significance | Forever | Documents related to establishment, dissolution, bankruptcy, separation of enterprises; state audit records. |

Reference 7 electronic invoice templates according to regulations to ensure validity right from the document creation stage.

Required elements on accounting documents

According to Article 16 of the 2015 Accounting Law, a valid accounting document must include the following 7 basic elements:

- Name and number of accounting document.

- Date of document creation.

- Name and address of the unit or individual creating the document.

- Name and address of the unit or individual receiving the document.

- Summary of economic and financial transactions.

- Quantity, unit price and total amount are written in numbers; total amount (for receipt/payment voucher) is written in both numbers and words.

- Signature, full name of the creator, approver and relevant persons.

In addition, depending on the type of business, the document may have additional elements such as: payment method, accounting entries, delivery location, etc.

Classification of common accounting documents

To How to manage accounting documents Scientists and accountants often classify them according to the following criteria:

- By function: Order documents (Payment orders), execution documents (VAT invoices), procedural documents (Lists), and joint documents.

- In order of establishment: Original document (first created) and summary document (summary of many original documents).

- According to economic content: Documents on currency, inventory, sales, fixed assets, labor and wages.

- By form: Paper documents (traditional) and electronic documents (electronic data, with digital signature).

4 Step Process How to manage accounting documents standard

The process of managing and circulating accounting documents includes 4 core steps, ensuring that information is processed accurately, continuously and securely, especially documents related to payables.

Step 1: Prepare and receive documents

All accounting All arising documents must be immediately recorded. The accounting department receives documents, especially input invoices, to begin the processing and payment process.

Step 2: Check and complete documents

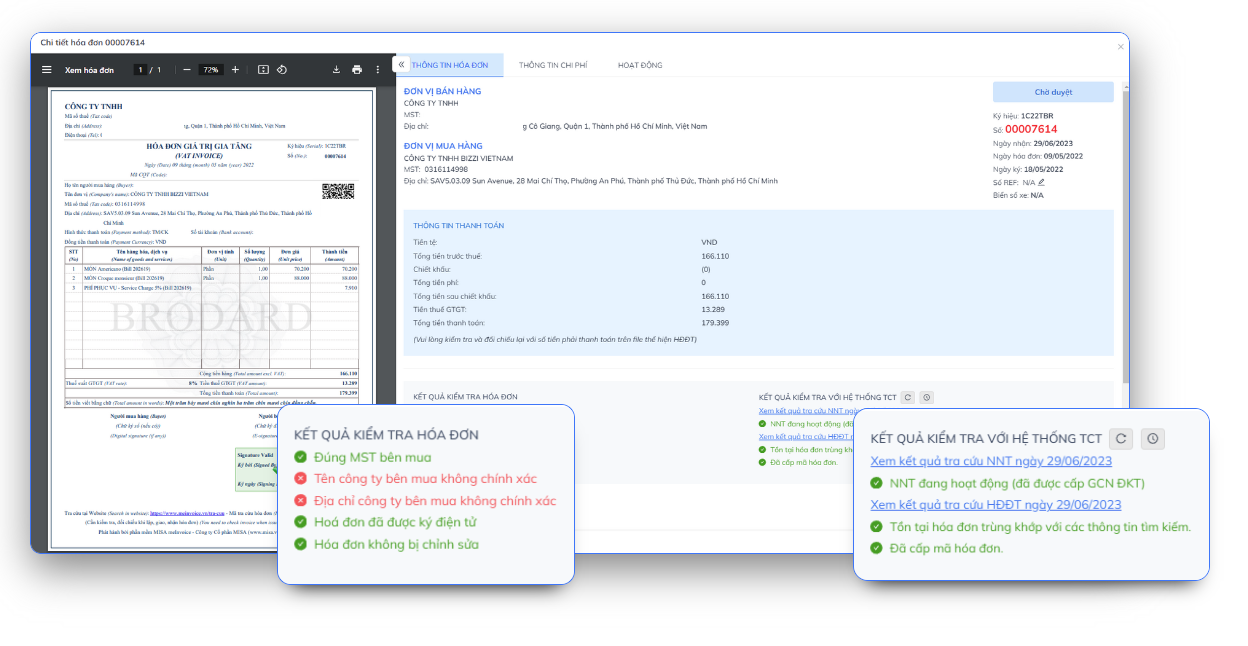

Accountants check the validity, legality and reasonableness of the vouchers. This stage is extremely important to prevent wrong payments, payment for invalid invoices, directly protect the finances of the business and is the core of the Accounts Payable Management.

Step 3: Use vouchers to record accounting

After validating, accountants use the documents as a basis for accounting, making entries and recording them in the accounting books. This helps accurately reflect the company's expenses and debt situation.

Step 4: Store, preserve and destroy documents

After being recorded, documents must be organized and stored securely. Digitizing and storing on a cloud platform not only helps keep them safe but also optimizes search when it comes to cost reconciliation or auditing.

5 common mistakes when managing accounting documents and solutions to overcome them

Errors in document management can lead to financial loss and legal risks. Here are some common errors and how to avoid them:

- Missing signature or unauthorized signature: Causes expenses to be out of control. Solution: Build an electronic expense approval process with a clear approval flow for each level and each expense type.

- Incorrect information, erasure, correction: Leads to incorrect payments or exclusions of expenses when filing taxes. Solution: Apply OCR technology to extract data automatically, minimizing errors due to manual data entry.

- Lost or damaged documents: Risk of duplicate payments and loss of evidence of expense recording. Solution: Digitize all documents and store them on a secure cloud platform like Bizzi.

- Unscientific storage: Causes time-consuming searching, difficulty when needing to reconcile debts or audit. Solution: Using management software allows searching and filtering documents according to many criteria quickly.

- Failure to comply with retention period: May be subject to administrative penalties. Solution: Develop an internal spending and document storage regulation, which clearly specifies the retention period for each type of document.

Applying technology to How to manage accounting documents

In the digital age, How to manage accounting documents Manual work is no longer effective and carries many risks. Applying automation solutions is not only a trend but also an urgent requirement to optimize cost management.

Bizzi – AI assistant for finance and accounting department, Provides a comprehensive cost control system, automates processes from collecting, processing to storing documents, helping businesses thoroughly solve management problems.

- Automate input invoice processing: Bizzi Bot automatically collects, validates, and performs 3-way reconciliation (invoices – orders – receipts). This is the core solution for invoice processing automation, which reduces 80% time and prevents 99% errors.

- Smart business expense management: Allows you to set up budgets, create and approve spending requests online, track expenses in real time, ensuring all expenses are under control.

- Secure electronic storage: All documents and invoices are digitized and securely stored on the cloud platform for 10 years, easy to look up and retrieve for auditing purposes.

- Flexible integration: Bizzi easily integrates with other Accounting ERP solution and popular accounting software, seamlessly synchronize data, eliminate manual data entry.

In short, How to manage accounting documents It is not only a compliance activity but also a strategic management activity, which is the foundation of effective cost management. Building a tight process, combined with modern technology like Bizzi will help businesses ensure transparency, minimize the risk of loss and create sustainable competitive advantages.