An invoice is an accounting document created by an organization or individual selling goods or providing services, recording information about the sale of goods or provision of services. help save costs and time. Clearly understand What is an electronic invoice?, classification, creation, issuance and usage are mandatory in any business, regardless of size.

In this article, Bizzi will provide a multi-dimensional perspective to answer the question of what an electronic invoice is along with related information.

What is an electronic invoice? How to use electronic invoices in business?

Electronic bill is a type of document that is created, sent, received, stored and managed entirely by electronic means. It plays a central role in many modern business systems and processes:

- As a core component of Enterprise financial management system.

- Is an important document confirming a purchase and sale transaction, especially in e-commerce system.

- Plays an essential role in digitizing the supply chain.

- Usually integration tight on the ERP system (Enterprise Resource Planning) to manage overall operations.

- Connected and integration enter Electronic tax management system of tax authorities to serve tax management and compliance.

Thus, an electronic invoice is not only a simple financial document but also an important link connecting different management systems of enterprises and state management agencies.

Classification of electronic invoices

Electronic bill classified based on various criteria, including legal, purpose of use, and type of enterprise. In Article 5 of Decree No. 119/2018/ND-CP, which officially took effect from November 1, 2018, the Government has regulated and classified electronic invoices in detail.

Here are some common classifications:

Classify by invoice content

- Value Added Tax (VAT) Invoice: For organizations and businesses that declare taxes using the deduction method.

- Sales invoice: For organizations and individuals declare and pay taxes online by direct method

- Export invoice: Applicable to businesses exporting goods and services abroad.

- Special invoice: Special fields such as petroleum, electricity, water, telecommunications, finance.

Classification by form of use

- Electronic invoice with tax authority code: Businesses need to send invoices to the tax authority to get a code before using.

- Electronic invoices without tax authority codes: For eligible businesses to self-generate invoices without an authentication code.

Classification by function

- Original invoice (original invoice): The official invoice issued in the transaction.

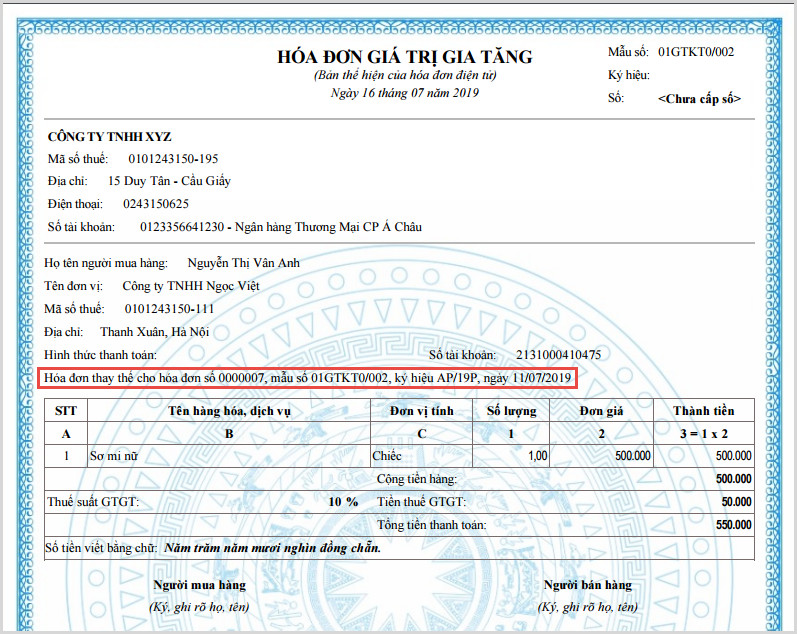

- Adjustment invoice: Used to correct incorrect content of the original invoice.

- Replacement invoice: Created to replace the original invoice when there is a serious error.

- Invoice Cancellation: Invoice is canceled because it is no longer valid.

Sort by format

- Digitally signed PDF invoice: Stored and Automatically send to buyers via email but cannot be edited.

- XML Invoice: Standard format for sending to tax authorities and accounting systems.

What is an electronic invoice?

An electronic invoice representation is a visible version of the original electronic invoice in a readable format, usually as a PDF file or printed on paper. The representation helps users (businesses, customers, tax authorities) easily check the invoice content, but has no legal value if it lacks authentication elements.

| Criteria | Original Electronic Invoice | Electronic Invoice Presentation |

| Format | XML file (digital data) | PDF, image or paper printout |

| Legal value | Legally valid if there is an electronic signature and tax authority code (if required) | No legal value without digital signature, for reference only |

| Used for tax declaration | Used | Not used |

| Edit, save | Stored on accounting software systems and tax authorities | Can be printed or stored on a computer but has no legal value without the original XML file. |

| Look up, check | Readable only with specialized software | Easy to read, easy to check information with the naked eye |

In short, it is necessary to understand what an electronic invoice is and distinguish it from the electronic invoice representation. The original electronic invoice has legal value and is used as a basis for transactions, payments, accounting, inspections, and checks. Meanwhile, the electronic invoice representation is only valid for keeping records and monitoring, and is not valid for transactions and payments.

Conditions for electronic invoices to be recognized

For electronic invoices (E-invoices) to have legal value and be recognized in transactions, businesses need to ensure compliance with the following regulations:

- There is sufficient assurance of the integrity of the information contained in the electronic invoice.

- The information contained in an electronic invoice is accessible and usable in its complete form when necessary.

- Regarding format, electronic invoices must be created in standard XML format as prescribed by the General Department of Taxation. There may be a PDF version, but XML is the legal original.

- When there is a change in the invoice system, businesses must update information with the tax authorities.

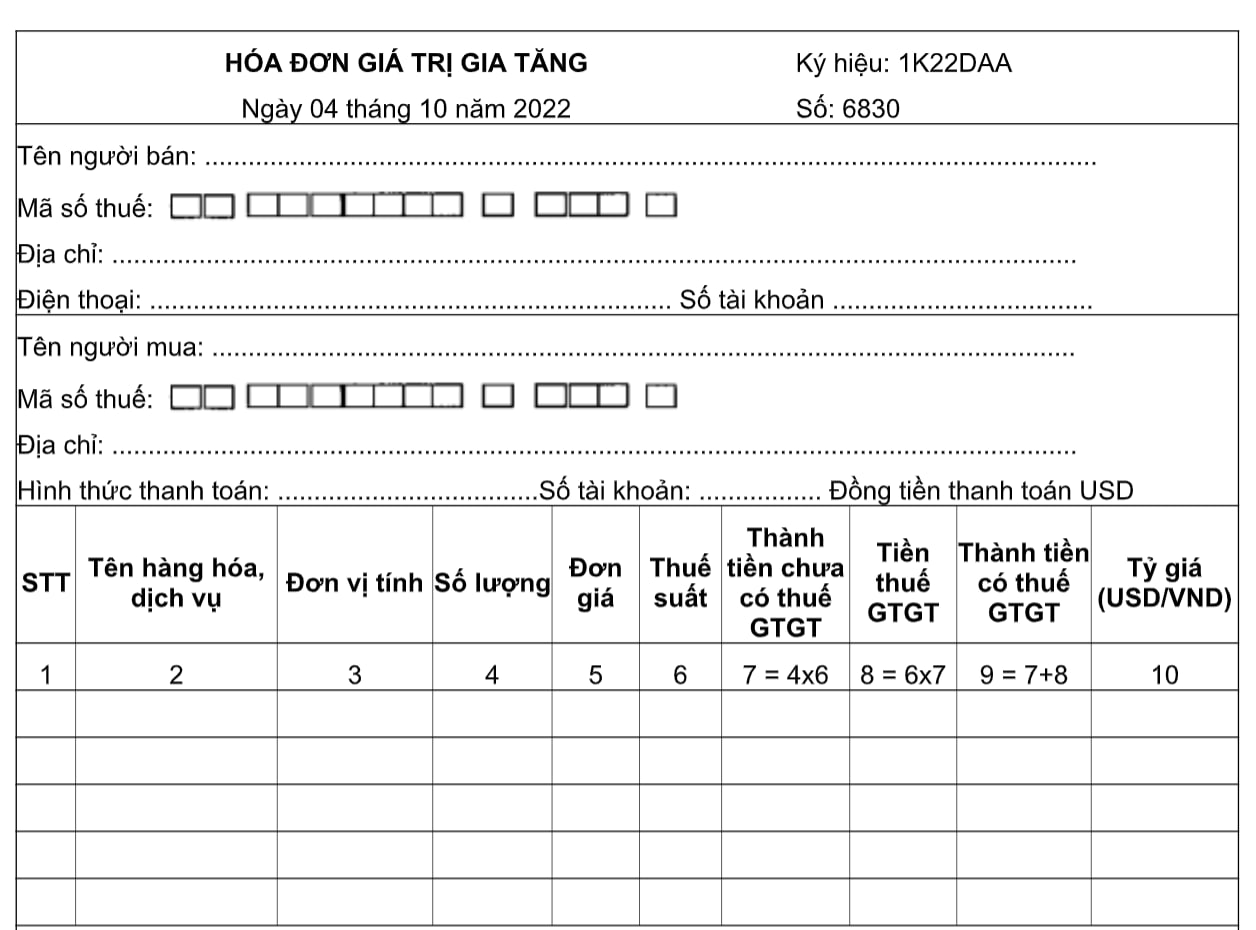

Necessary contents of electronic invoice

- Invoice name, invoice symbol, sample symbol, invoice serial number.

- Name, address, tax code of the seller.

- Name, address, tax identification number of the buyer.

- Tax rate, VAT amount (if any).

- Name of goods and services; unit, quantity, unit price of goods and services; total amount in numbers and words.

- Electronic signature according to the seller's law; date, month and year of making and sending the invoice.

- Invoices are presented in Vietnamese.

Electronic invoices according to Decree 123

According to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, organizations that want to initiate electronic invoices must meet the following conditions:

- Is an economic organization that meets the conditions and is conducting electronic transactions in tax declaration with the tax authority; or is an economic organization that uses electronic transactions in banking activities.

- There are locations, information transmission lines, information networks, and transmission equipment that meet the requirements for exploitation, control, processing, use, preservation, and storage of electronic invoices.

- There is a team of qualified and capable executors to perform the creation, establishment and use of electronic invoices according to regulations.

- Have cDigital signature in commercial transactions as prescribed by law.

- There is software for selling goods, managing customers and services connected to business accounting software, ensuring that data of electronic invoices for the sale of goods and provision of services is automatically transferred to the accounting software (or database) at the time of invoice creation.

- There are data backup and data recovery procedures, lStore electronic data according to the law.

How to issue electronic invoices

- Enterprises must have a decision to apply electronic invoices.

- Notice of electronic invoice issuance, sent to management agency, posted on the General Department of Taxation's website.

- Sign the sample invoice and send it to the tax authority.

Instructions for using electronic invoices

- Step 1: Create electronic invoice.

- Step 2: Send electronic invoices to buyers of goods and services.

- Step 3: Handling erroneous electronic invoices.

Should we switch to electronic invoices?

Legal electronic invoices and electronic documents are converted into paper invoices and documents when required by economic and financial operations or at the request of tax authorities, auditing, inspection, examination and investigation agencies and in accordance with the provisions of law on inspection, examination and investigation.

The conversion of electronic invoices and electronic documents into paper invoices and documents must ensure the correctness between the content of the electronic invoices and electronic documents and the paper invoices and documents after conversion.

Electronic invoices and electronic documents converted into paper invoices and documents are only valid for keeping records and monitoring according to the provisions of the law on accounting and the law on electronic transactions, and are not valid for transactions and payments, except in cases where invoices are created from cash registers connected to transfer electronic data to tax authorities according to the provisions of this Decree.

Frequently asked questions

How is an electronic invoice different from a traditional paper invoice?

Electronic invoices are faster, more cost-effective and safer than traditional paper invoices, with features such as:

- Electronic data (PDF, XML files)

- Stored on computer systems, accounting software or tax authority systems

- Automatically update with tax authorities

Is electronic invoice mandatory?

Yes. From July 1, 2022, according to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, all businesses, organizations and individuals are required to use electronic invoices, completely replacing paper invoices. Some special cases (small businesses, areas without IT infrastructure) may be extended according to the guidance of the tax authorities.

How to create and use electronic invoices?

- Step 1: Register to Use Electronic Invoice

- Step 2: Choose a Billing Software Provider

- Step 3: Configure and Create Invoice

- Step 4: Send and store Invoice

Are electronic invoices safe and secure?

Yes. Electronic invoices are safer than paper invoices thanks to security mechanisms such as digital signatures that ensure integrity and cannot be edited; data encryption prevents falsification or theft of information. Strictly managed by tax authorities, helping to reduce tax fraud and fake invoices.

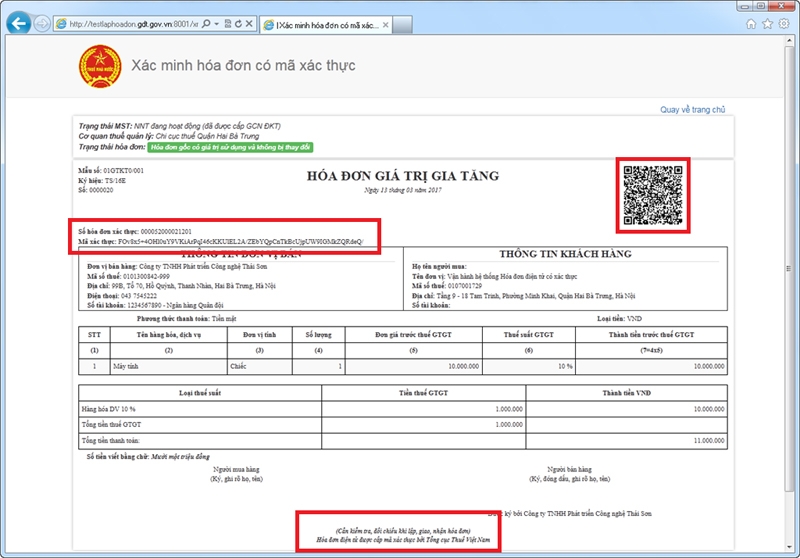

Where to look up electronic invoices? YesEasy to look up anytime, anywhere?

You can easily look up electronic invoice anywhere, just need internet. Here are 2 ways for your reference:

- Method 1: Look up on the General Department of Taxation's Information Portal

Access: https://hoadondientu.gdt.gov.vn

- Method 2: Look up on the invoice lookup system website

Access: https://tracuuhoadon.gdt.gov.vn/tc1hd.html

Criteria for selecting units to register to use electronic invoices

- The supplier must be on the list licensed by the General Department of Taxation, ensuring the system complies with Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

- Have a system of equipment and techniques to ensure the provision of electronic invoice solutions that meet business requirements and legal regulations on invoice issuance.

- Ability to detect, warn and prevent illegal access and attacks on the network environment to ensure the security and integrity of data exchanged between participating parties.

- High Security & Reliability: Valid digital signature, ensuring information encryption, anti-counterfeiting and unauthorized access; Backup & recovery system for at least 10 years according to legal regulations, avoiding data loss.

- There is a software program for creating, creating and transmitting electronic invoices to ensure that the electronic invoices are created in accordance with the prescribed content.

- Deployed a system providing information technology solutions to serve electronic data exchange between businesses or between organizations.

- There are transparent and reasonable costs, no hidden fees, and many flexible service packages according to business needs.

B-Invoice – Electronic invoice solution integrated with POS

B-Invoice is the solution electronic invoice software Okay General Department of Taxation recognized, fully meeting the professional requirements as prescribed by law. In addition, B-Invoice also brings many outstanding benefits to businesses.

B-Invoice electronic invoice includes:

- Regular electronic invoice: Fully comply with current regulations of the Ministry of Finance on electronic invoices, helping businesses issue electronic invoices quickly, accurately and legally.

- Electronic invoices generated from cash registers (POS):Easily issue electronic invoices from sales transactions at the point of sale when B-Invoice integrates with popular cash registers (POS) on the market.

- Electronic ticket: Businesses can manage ticket sales and create electronic ticket invoices effectively.

Advantages of B-Invoice electronic invoice:

- Diverse models, designed according to business needs

- Easy integration and customization with Enterprise resource planning (ERP) system, accounting software,…

- Easily search and retrieve original invoices, saving time and effort in management.

- Supports digital signatures and digital signing methods

- Security according to ISO 27001 standard, ensuring information security for businesses.

- Store invoices for 10 years as required by law.

To choose the right e-invoice provider, businesses need to prioritize legality, security, good integration with accounting software, and reasonable cost. Based on the essential needs of the market, Bizzi has built and developed invoice processing software to support businesses in which the first step is automatic invoice processing software to replace the check solution. and traditional data entry.

Since its launch, Bizzi has attracted customers from large-scale corporate enterprises in various fields such as: Grab, GS25, Circle K, Tiki, Guardian, Medicare, Pharmacity, to SMEs together with with more than 4,000 vendors using the platform daily. As of 10/2021, the total value of monthly invoices processed through Bizzi platform reaches more than 300 million USD.

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/

You may be interested in: