Electronic invoice is an important document in corporate financial management, so understanding the regulations on electronic invoice forms, symbols and numbers is extremely necessary. With changes in regulations under Decree 119/2018/ND-CP, Circular 68/2019/TT-BTC, especially the latest regulations in Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, the following article by Bizzi will help businesses understand correctly what an invoice number is and comply with current regulations.

What is an invoice number? Basic information about electronic invoice numbers

The invoice number is Invoice type code is used. The denominator is usually of the form 01GTKT, 02GTTT, 01DTDT, etc.

The electronic invoice number symbol is a character with a natural number (1, 2, 3, 4, 5, 6) to reflect the type of electronic invoice. Meaning of the number characters according to Circular 78/2021/TT-BTC (Point a, Clause 1, Article 4):

- No. 1: Value Added Tax (VAT) invoice.

- Number 2: Sales invoice.

- No. 3: Invoice for sale of public assets.

- No. 4: National reserve sales invoice.

- No. 5: Other types of electronic invoices (stamps, tickets, cards, receipts, other electronic documents) have the same content as invoices according to Decree 123/2020/ND-CP.

- Number 6: Electronic documents are used and managed as invoices (internal delivery and transportation notes, delivery notes for goods sent to agents for sale).

The role and benefits of using electronic invoice digital symbols are to help businesses easily manage, ensure accuracy, transparency and prevent counterfeiting.

Not only is it important to understand the nature of invoice templates, but it is also important to grasp specific examples. Here are some typical examples:

- 01GTKT: Value added tax invoice

- 02GTTT: Sales invoice

- 01ĐTĐT: Electronic invoice with code

- 07KPTQ: Internal delivery and delivery note

What is the electronic invoice symbol?

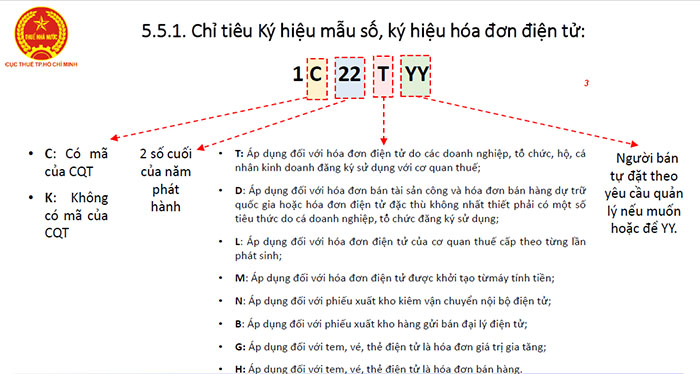

Symbol Electronic invoice is a group of 6 characters including letters and numbers, showing information about the invoice type (with/without CQT code), year of invoice creation, and type of invoice used.

Structure of 6 characters in invoice symbol according to Circular 78/2021/TT-BTC (Point b, Clause 1, Article 4):

- First character (C or K): C is the invoice with CQT code, K is the invoice without CQT code.

- Next two characters (2 Arabic numerals): Represents the year of invoice (last 2 digits of the calendar year, for example 24 for 2024, 25 for 2025).

- The next character (T, D, L, M, N, B, G, H): Indicates the type of electronic invoice used.

- T: Electronic invoices are registered for use by businesses, organizations, households and individuals with the tax authority.

- D: Contracts for selling public assets, national reserve goods, or special investment contracts.

- L: Invoice is issued by the tax authority for each occurrence.

- M: Electronic invoice initiated from cash register.

- N: Electronic internal delivery and warehouse receipt.

- B: Electronic agent delivery note.

- G: Stamps, tickets, and electronic cards are VAT invoices.

- H: Stamps, tickets, and electronic cards are sales invoices.

Last two characters (letters): Determined by the seller according to management needs (for example YY if there is no special need). Used to distinguish different models of the same type.

- Display location on invoice: Top right or in a visible location.

- Compare with old regulations (Decree 119, Circular 68).

How is the electronic invoice number regulated?

The electronic invoice number is the serial number shown on the invoice when the seller creates it.

Regulations on numbering according to Decree 123/2020/ND-CP (Clause 3, Article 10):

- Record in Arabic numerals, up to 8 digits (from 1 to 99,999,999).

- Numbering in order from small to large in the same invoice symbol and invoice sample number symbol.

- Starting from number 1 on January 1 or the date of starting to use the annual invoice, ending on December 31 of each year.

- The new year starts numbering from 1 again.

- Note when converting to new years (eg from 2024 to 2025).

- In case of multiple sales establishments/invoicing systems: Continuously generate according to the time of digital/electronic signature.

- If the invoice number is not created according to the above principles: The system must ensure that it increases over time, each number can only be created/used once, with a maximum of 8 digits.

What is an example of an invoice number:

- Invoice number: 01GTKT0/001

- Invoice symbol: AA/24E

- Invoice number: 0000123

For invoices printed by the tax authority: The invoice number is pre-printed and used up.

The relationship between invoice number and electronic invoice symbol

On the display, the denominator symbol and the electronic invoice symbol are usually presented together as a 7-character string. The first character is the denominator symbol, the next 6 characters are the electronic invoice symbol.

| Content | Meaning and connection |

| Invoice type identification number | Indicate whether this is a VAT, sales, or special electronic invoice. |

| Invoice symbol attached to sample number | A denominator can be accompanied by multiple symbols to distinguish between branches, years, code types (with/without code). |

| Enterprises self-register samples and symbols with tax authorities. | Must ensure no duplication, no confusion in management. |

| The invoice system must clearly show both information on each issued invoice. | Example: Model number: 01GTKT, Symbol: AA/24E. |

Full illustration:

Invoice number: 01GTKT0/001

- 01: VAT invoice

- 0: Electronic invoice form

- 001: Registration form serial number

Invoice symbol: AA/24E

- AA: Enterprises self-regulate (distinguish branches, systems...)

- 24: Year 2024

- E: Electronic invoice with tax authority code

From the invoice number and symbol, tax authorities and businesses can trace, look up, and accurately compare each issued invoice.

Important notes when using electronic invoices

- When registering to use electronic invoices, businesses must declare the invoice number and symbol to the tax authority.

- Do not use duplicate symbols between different types of invoices.

- If there is a change in the model or symbol, a new invoice issuance notice must be created (if using an invoice without a code).

Conclude

Above is all the information about what is an invoice number, regulations on electronic invoice numbers, electronic invoice symbols according to Circular 78 on electronic invoices. To develop sustainably, ensure effective tax management and combat fraud, businesses need to strictly comply with the following regulations: regulations About invoice number, invoice symbol,...

Integrating electronic invoice solutions B-Invoice brings many comprehensive benefits to businesses in the management of electronic invoices, not only helping to ensure legality, but also optimizing operating processes, improving accuracy and professionalism. Below are the specific benefits:

Ensure validity – legality

- Fully comply with legal regulations: B-Invoice meets the standards of Decree 123/2020/ND-CP, Circular 78/2021/TT-BTC, ensuring sample number, symbol, format (XML, PDF), digital signature, date of creation...

- Integrate with the General Department of Taxation system (ETax): Automatically send and receive feedback, confirm tax authority codes → help invoices be accepted when declaring, deducting, and settling.

Increase accuracy – reduce errors

- Automatically retrieve data from accounting/sales systems → avoid manual data entry, reduce customer information errors, tax rate errors, amounts...

- Pre-release checking and warning feature: Helps accountants promptly detect errors such as: incorrect tax codes, duplicate invoices, wrong timing, etc.

Optimize invoice issuance process

- Issue invoices quickly - accurately - in bulk with just a few steps.

- Automatically send invoices to customers via email/SMS → increase professionalism, reduce the risk of forgetting to send or sending incorrectly.

- Centrally manage all electronic invoices on the cloud platform, easy to look up, filter and export reports at any time.

Save money and time

- Cut printing, storage, and delivery costs.

No personnel costs for handling erroneous, lost, or canceled invoices. - Shorten payment and reconciliation processes, increase accounting and financial work efficiency.

Support auditing, settlement, easy tracing

- Easily retrieve invoices by form number, date of issue, tax code...

- Decentralize users, record operation history, increase transparency during internal audits or tax inspections.

Information security and safety

- B-Invoice uses digital signature technology and stores electronic data according to high security standards.

- Invoice data is securely stored in the cloud and can be restored if the device is lost.

Enhance reputation – customer experience

- Customers receive invoices on time, with correct information, and in full format → increasing trust and professionalism from the business.

Easy link integration Bill lookup for customers → convenient, clear, transparent.

Integrating the B-invoice solution will help businesses own a powerful tool to support the issuance of correct - complete - fast - legal invoices, while minimizing risks - increasing productivity - effectively controlling electronic invoices from start to finish.