The business financial plan form is considered a “financial map” that helps businesses determine where they are, where they want to go and how many resources they need to achieve that goal. Each business financial plan is a tool that helps businesses convert strategic goals into specific numbers, thereby monitoring, controlling and optimizing the efficiency of resource use.

This article by Bizzi will analyze in detail the nature and characteristics of a corporate financial plan template, and suggest some corporate financial plan templates by industry.

What is a business financial plan? Why do businesses need a standard form?

The Financial Planning template includes:

- Revenue forecast: from products, services or sales channels.

- Cost estimate: fixed costs, variable costs, operating costs, marketing, personnel, etc.

- Estimate Cash Flow: see if the business has enough money to operate and invest.

- Profit and investment plan: determine expected profits, reinvestment plans or dividends.

- Risk scenarios and response plans: such as changes in exchange rates, raw material prices, reduced market demand, etc.

In other words, Financial planning helps businesses translate strategic goals into concrete numbers., for easy measurement and control.

Why do businesses need a standard form for financial planning?

Form corporate financial planning standards to help businesses systematize and standardize financial data, ensuring that planning is not subjective or inconsistent.

- Ensure consistency and comparability

-

- Each department (sales, marketing, manufacturing, finance…) uses the same form framework.

- Data can be easily aggregated without having to “patchwork” from multiple Excel files, allowing management to compare across periods, departments, or projects.

-

Save time and reduce errors

-

Formula structure and format are available, staff only need to enter data.

-

Reduce errors when copy-pasting or calculating manually.

-

- Easy to integrate and automate

-

- Standard forms are the foundation for integration with ERP or EPM (Enterprise Performance Management) system, helps automatically synthesize, analyze and make quick decisions.

-

Improve the quality of forecasting and decisions

-

- When the input data is accurate and consistent, indicators such as ROI, ROA, EBITDA, cash flow forecast become more reliable.

- Help the board have a vision instant and comprehensive on corporate financial health.

What is the goal of financial planning in business?

Financial planning is not just about estimating costs or profits, but is the foundation for businesses to manage effectively, make accurate decisions and maintain sustainable growth. Having a clear business financial plan form will bring the following core goals:

Data-driven Decision Making

- When all revenue, costs, budgets, and profits are quantified, management can make decisions based on facts, rather than gut feelings.

- For example, choosing which products to invest in, which channels to expand marketing spending on, or when to cut operating costs.

- Thanks to financial planning, businesses can easily simulate multiple business scenarios (scenario planning) and evaluate the impact of each decision on financial results.

With Bizzi, spending and cash flow data are updated automatically, helping managers see the “financial picture” in real time.

Reduce the risk of underfunding or overspending

A tight financial plan helps businesses clearly identify short-term and long-term capital needs, thereby being proactive in borrowing, mobilizing, and allocating resources. At the same time, estimating and monitoring costs helps prevent overspending, cash flow shortages, or insolvency. This is a vital factor for businesses that grow rapidly or have many parallel projects.

Bizzi allows businesses to set budget limits for each department or project, and automatically alerts when there are signs of exceeding spending thresholds.

Is the basis for setting KPIs and operating plans

Financial planning is the foundation for Convert strategic goals into specific indicators (KPIs) for each department: revenue, profit margin, marketing costs, production costs, etc. From there, businesses can measure implementation efficiency, detect deviations early and adjust plans promptly. This is also the basis for coordination between departments – finance, sales, marketing, operations – in the same budget direction.

In short, the goal of creating a business financial plan is to help businesses forecast accurately – control closely – and make quick decisions based on data. When combined with Bizzi, businesses can optimize capital resources and promote sustainable growth thanks to:

- Detailed budget allocation by department/project.

- Track actual spending in real time.

- Instant over budget warning.

How to Create a Business Financial Planning Template

The financial planning form is a tool that helps businesses plan, monitor, and evaluate financial performance systematically. A complete form usually includes 5 main tables, corresponding to the core financial activities chain: Revenue - Expenses - Profit - Cash flow - Investment (CAPEX).

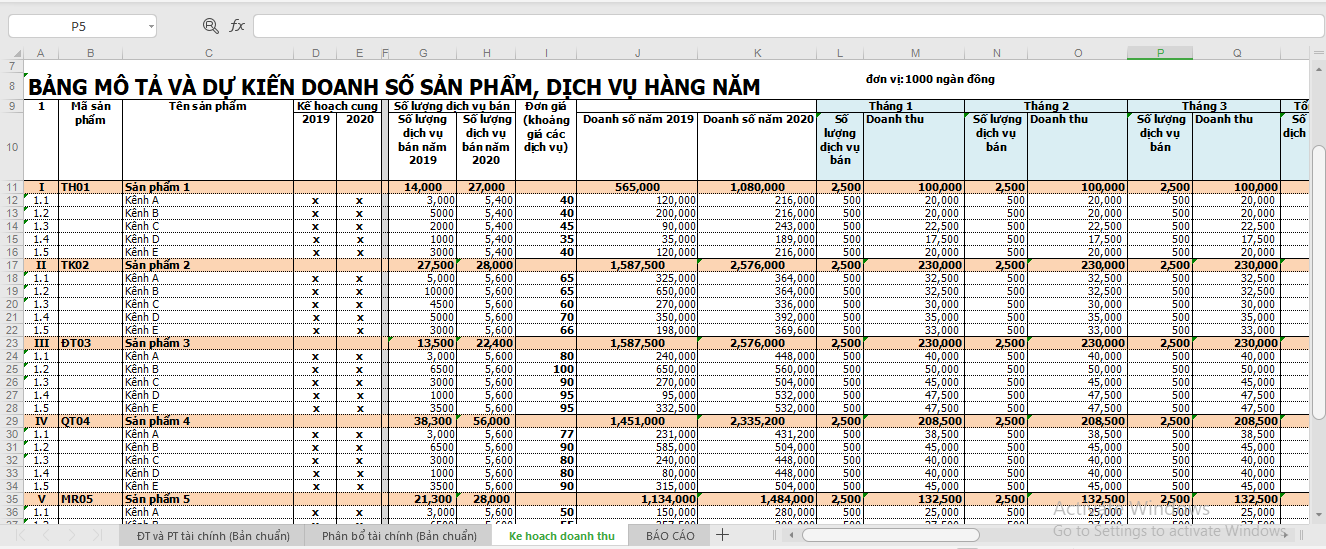

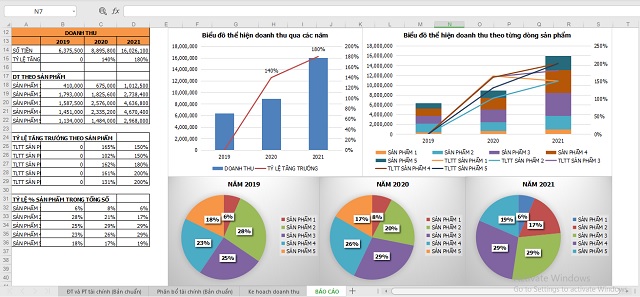

Revenue: Forecast by product, region

This is the first and most important part of the financial plan, aiming to accurately estimate revenue for the period, as a basis for planning costs and cash flow.

Businesses need to forecast revenue by product, service, customer group or geographic area, based on:

- Past sales data.

- Market trends and marketing plans.

- Seasonal or new product launch campaign.

Costs: Operating cost plan, human resources, marketing

The cost section on the corporate financial plan shows total operating budget that the business plans to spend during the period, including:

- Operating Expenses (OPEX): office, logistics, maintenance, utilities,…

- Personnel costs: salary, bonus, benefits, training,...

- Marketing & sales costs: advertising, promotions, events, commissions,...

Cost planning helps businesses:

- Control the ratio of expenses to revenue (Cost Ratio).

- Avoid overspending or misallocating priorities.

On Bizzi Expense, each expense is tied to a department/project budget and automatically alerts when there are signs of overspending.

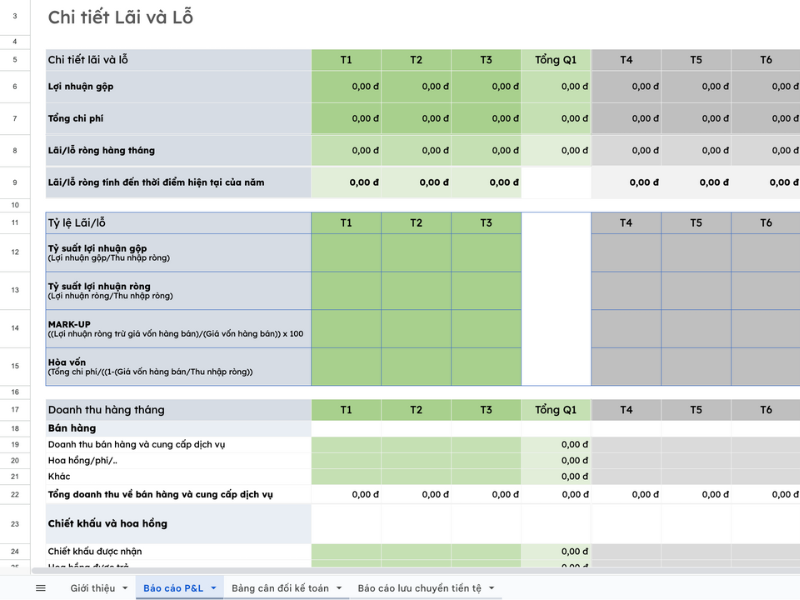

Profit: Gross and net profit targets

This is a core business performance indicator that reflects the value creation capacity of the enterprise. Setting clear profit targets helps the enterprise easily link with KPIs and bonus plans for each department.

Based on revenue and expense data, the business financial planning template will calculate:

- Gross Profit: Revenue – Cost of Goods Sold (COGS).

- Net Profit: After deducting all operating, financial and tax costs.

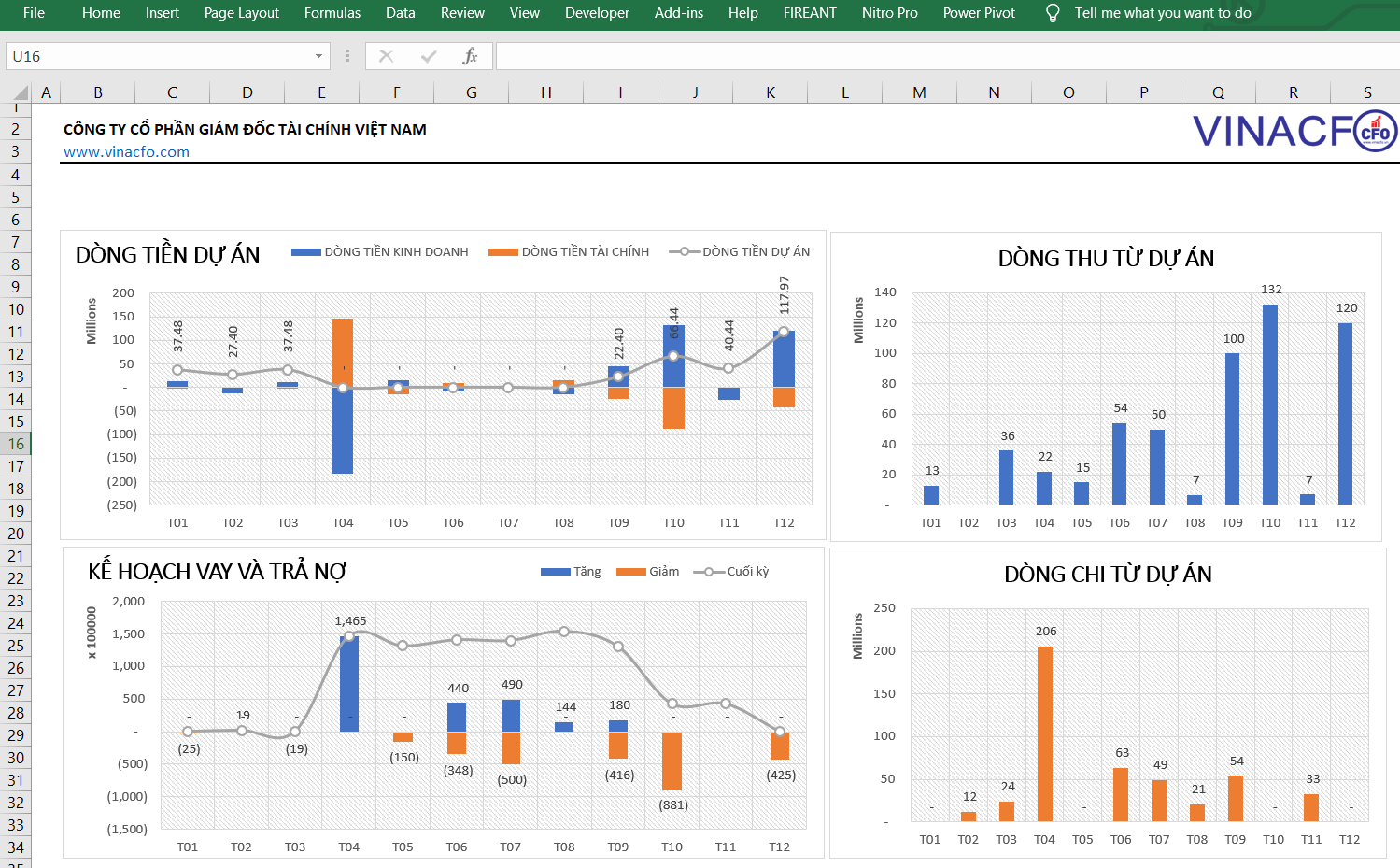

Cash Flow: Periodic Income and Expenditure, Net Cash Flow Forecast

Cash Flow helps ensure that the business always maintains its solvency and working capital reserves. Cash flow analysis helps detect early risks of capital shortages, especially during peak production periods or large marketing expenditures.

- Cash flow structure includes:

- Cash In: from revenue, tax refund, investment capital.

- Cash Out: expenses, debt repayment, asset purchases, dividends.

- Net Cash Flow: monthly or quarterly difference between income and expenditure

Investment (CAPEX): Purchasing plan, production expansion

CAPEX (Capital Expenditure) is the recorded part long-term investments like:

- Purchase of machinery, equipment and technology.

- Upgrade infrastructure, open new branches.

CAPEX planning helps businesses evaluate return on investment (ROI) and cash flow, avoiding the situation of "overspending" in expansion. At the same time, it creates the basis for depreciation planning, directly affecting future net profits.

Bizzi helps businesses manage spending categories and track approval status, ensuring spending is on track and on budget.

In short, one standard financial planning form not just a table of numbers, but comprehensive management toolkit help businesses:

- Accurate forecast of revenue - cost - profit.

- Effectively control budget and cash flow.

- Transparent strategic investment planning.

Bizzi Expense helps your expense management plan become a living, breathing operating tool, not just an Excel file., businesses can:

- Perform the entire financial planning process right on a digital platform.

- Automate spending tracking, data updates, and over-budget alerts in real time.

Financial planning templates by industry and business size

There is no “one size fits all” financial template for every business. Every industry and size of operation will have different characteristics in how to manage expenses, cash flow, and investments. Therefore, customizing a financial planning template is a key factor in helping businesses control expenses and maintain a healthy cash flow.

- Download free business financial planning templates in excel here

Manufacturing

Features: Continuous production - inventory - sales cycle, need to balance between production capacity and market demand.

The form should focus on:

- PSI (Production – Sales – Inventory): Manage production planning, sales forecasting and optimal inventory levels.

- Cost of raw materials and labor: Monitor loss rates and input price fluctuations.

- CAPEX Plan: invest in machinery and production lines

With Bizzi Expense, businesses can track purchasing costs, machine maintenance, and production budgets in real time – reducing stuck inventory and wasted costs.

Retail Industry

Features: Multi-point of sale, continuous cash flow, need to monitor revenue and expenses for each store.

A business financial plan template should include:

- Revenue by branch/sales channel: store, online, agent.

- Operating costs for each point of sale: rental space, staff, display, promotion.

- Branch profit report: Identify effective branches and points for optimization.

Bizzi helps automatically consolidate spending data from multiple branches, supports over-budget alerts and analyzes individual store performance.

Startup

Features: Limited capital, priority given to managing operating costs and “runway” time (the time a business can maintain operations with the current amount of cash available).

The business financial plan template focuses on:

- Operating Expense Plan (OPEX): human resources, marketing, technology.

- Runway & Burn Rate: track the “burn rate” and the number of months of capital maintenance.

- Investment and fundraising estimates: Determine the break-even point and further capital needs.

Bizzi Expense helps startups automate expense management, avoid overspending, and optimize budgets to extend runway without a complex finance team.

Small and Medium Enterprises (SME)

Features: Need form flexible, easy to update and easy to understand, does not require a large accounting team.

A business financial plan should include:

- Simple consolidated budget: revenue - cost - profit

- Track actual vs planned spending: monthly updates

- Short-term cash flow statement: help business owners control liquidity.

Bizzi Expense provides a standard expense management form, allowing SMEs to enter data directly on the platform or from Excel, the system will automatically reconcile and warn of budget overruns.

Group / Corporation

Features: Having multiple subsidiaries or business units, need to consolidate financial data and master budget planning.

The business financial plan form must meet:

- Financial plan of each subsidiary.

- Consolidated Planning.

- Track centralized cash flow and internal circulation (Intercompany).

Bizzi ARM (Account Receivable & Management) allows businesses to consolidate debts, revenues and expenses, and financial plans of multiple subsidiaries, ensuring consistent and transparent data across the system.

In short, every industry and every business size needs a separate financial planning form, but the general goal is:

- Tight cost control.

- Maintain a steady cash flow.

- Make decisions based on real data.

When possible digitization on Bizzi Expense and Bizzi ARM, businesses can:

- Manage your budget, expenses, and debt on one unified platform.

- Monitor, alert, and adjust plans in real time.

- Turn your financial forms into smart operational tools – not just static Excel spreadsheets.

Automate your business financial planning forms –– from Excel to your EPM system

For most businesses, Excel is the starting point for all financial planning. However, as the scale grows, the amount of data increases, and the need for faster forecasting becomes more pressing, Excel becomes overloaded, unmanageable, and difficult to consolidate.

That's when businesses need to switch to the EPM (Enterprise Performance Management) system - a modern financial performance management platform that helps fully automate the financial planning, forecasting and consolidation process.

Excel Phase – Flexible but Error-Prone

Excel is suitable for small or early stage business, but when the revenue scale exceeds 200 billion VND/year and has its own FP&A team, Moving to EPM was the inevitable step.

- Advantage:

- Easy to use, familiar to all financial staff.

- Flexibility in building forms, formulas, and forecasting scenarios.

- Limit:

- Distributed data: Each department has a file, difficult to synthesize.

- High error: formula errors, data entry errors, or data overwriting.

- Lack of ability to track edit history and versions.

- It takes a lot of time to compile and check before each budget period.

When should a business move to an EPM system?

When businesses need:

- Fast and multi-scenario forecasting (What-if Scenario).

- Consolidate plans from multiple units or subsidiaries.

- Automate budgeting & forecasting processes.

- Ensure transparency, version control, and approvals.

EPM data transparency not only replace Excel, but Standardize the entire financial planning process, helping CFOs and FP&A teams focus on analysis and strategic decision-making instead of manual data processing.

For dEnterprises with revenue >200 billion/year, or already have an FP&A department → should consider implementing EPM as follows: Sactona, to:

- Standardize financial planning processes.

- Speed up forecasting and decision making.

- Reduce errors, increase data transparency.

Introducing Sactona software – Japanese standard EPM solution

Sactona is an EPM (Enterprise Performance Management) software developed by Outlook Consulting – a leading financial management consulting company in Japan. With over 25 years of experience implementing for corporations such as Panasonic, Fujifilm, LIXIL, Marubeni, Outlook Consulting has helped hundreds of businesses completely automate the process of planning, forecasting and financial consolidation.

In Vietnam, Bizzi is the exclusive partner to deploy and support Sactona, providing a Japanese standard solution - but optimized for the Vietnamese market.

Outstanding advantages of Sactona:

| Feature | Benefit |

| Familiar Excel interface | Financial users can get to work right away without having to relearn a new system. |

| Reasonable cost, fast implementation | 50% shorter deployment time than other EPM software. |

| Automate Budgeting, Forecasting, Consolidation | Reduce data aggregation and planning time by up to 70%. |

| IT independent | FP&A teams can customize forms, formulas, and authorizations without programming. |

| Fast ROI | Most businesses achieve Return on Investment (ROI) after only 12 months of implementation. |

Bizzi and Outlook Consulting provide a complete consulting - implementation - training package, helping Vietnamese businesses smoothly transition from Excel to EPM without disrupting existing operating processes.

Benefits of standardizing corporate financial planning forms

Standardizing financial planning forms helps businesses control costs, forecast accurately, and make faster decisions based on reliable data.

Outstanding benefits:

- Shorten budgeting time: unified process, eliminate duplication.

- Reduce manual errors: data is entered once, used across departments.

- Increased data transparency: easily check, compare, and reconcile between planning periods.

- Strategic decision support: providing consistent financial information for forecasting and scenario planning.

Frequently Asked Questions About the Business Financial Plan Form

Below are answers to questions about how to create, download financial planning templates and software to support effective budget planning.

1. Where to download the corporate financial plan template?

You can download free excel business financial planning templates here

2. How is a financial planning form different from a financial statement?

- Financial planning form: used to forecast and plan the future (revenue, expenses, cash flow).

- Financial statements: reflect the results that occurred during the period.

→ These two tools complement each other to help businesses both look back at the past and predict the future.

3. When should businesses use EPM?

When you need to consolidate data across multiple departments or subsidiaries, create complex financial forecasts, or evaluate multiple what-if scenarios to support strategic decisions.

4. Is Sactona EPM suitable for medium-sized businesses?

Yes – especially for businesses with revenue over 200 billion VND, already have an FP&A department and need to standardize and automate financial planning.

Optimize your business financial plan with Bizzi

In the context of businesses needing to make faster, more transparent and accurate decisions, Bizzi offers a comprehensive financial automation solution, helping businesses automate the planning process, control budgets and spend effectively - towards transparent financial management and sustainable growth.

The system allows businesses to proactively create and control financial plans, helping to:

- Standardize planning & budgeting forms, easy to track and compare.

- Increase transparency and control costs by department, project, or branch.

- Warn of budget overruns, optimize cash flow and capital efficiency.

For businesses that have entered a strong growth phase and need multidimensional financial forecasting or data consolidation of multiple units, Bizzi suggests businesses use Sactona - a financial performance management solution according to Japanese standards, designed specifically for businesses with revenue of 200 billion VND or more.

Conclude

In short, a standard business financial planning form not only helps businesses "record numbers", but is also a professional financial management thinking system, helping businesses be proactive - transparent - grow sustainably.

Excel is a planning tool. EPM is a smart financial management system. As a business grows, moving from Excel to EPM is not just an upgrade in tools, but a step forward in strategic financial management capabilities.

To experience Sactona solution and receive specialized advice for your business, register now here!