If you are looking for a sample debt reconciliation statement Standard, easy to use and quickly editable, this article will provide you with the latest debt reconciliation minutes template files in Word and Excel formats. These templates help you track, check and confirm debts between parties accurately and transparently, supporting the process of managing business finances more effectively.

1. Introduction to Debt Reconciliation Minutes

1.1 Concept and Definition

Debt reconciliation minutes is an important document that accurately reflects the debts between a business and its business partners such as customers or suppliers. This document records the results of a comparison between the debt figures in the business's accounting books and actual data from contracts, invoices and payment documents, to ensure transparency and verification from both parties.

As legal evidence, minutes help parties demonstrate the accuracy of the accounting process, and are an essential part of corporate financial management.

To save time and ensure accuracy, many businesses have chosen Sample debt reconciliation report in Excel pre-designed or directly integrated into your accounting automation system Bizzi.

1.2 Purpose and Importance

The debt reconciliation report is not only a financial control tool but also has many legal and operational values, including:

- Is the basis for verifying, checking and agreeing on payment information between related parties.

- Helps businesses track payment status from customers or suppliers proactively and clearly.

- Support checking of transactions VAT invoice from 20 million VND or more, ensuring compliance with cashless payment regulations.

- Helps accountants easily check, compare and detect errors in the process of accounting for receivables and payables.

- Monitor the implementation of contract terms, accurately assess the remaining debt and the parties' ability to pay.

- Support for financial planning and reasonable debt repayment, limiting the risk of overdue debt.

- Contribute to ensure transparency in financial management, enhance the reputation and operational efficiency of the business.

- To be legal evidence important in case of dispute, helps protect business interests.

- Support the tax settlement process and work with state management agencies more conveniently and accurately.

If you are wondering Is a debt reconciliation statement mandatory?, then the answer is: although not always required, this is a document that should be available for risk management, especially for businesses with a large number of transactions. Using the solutions of Bizzi will help you automate the debt reconciliation process, minimize errors and speed up document processing.

2. Popular Debt Reconciliation Minutes Templates

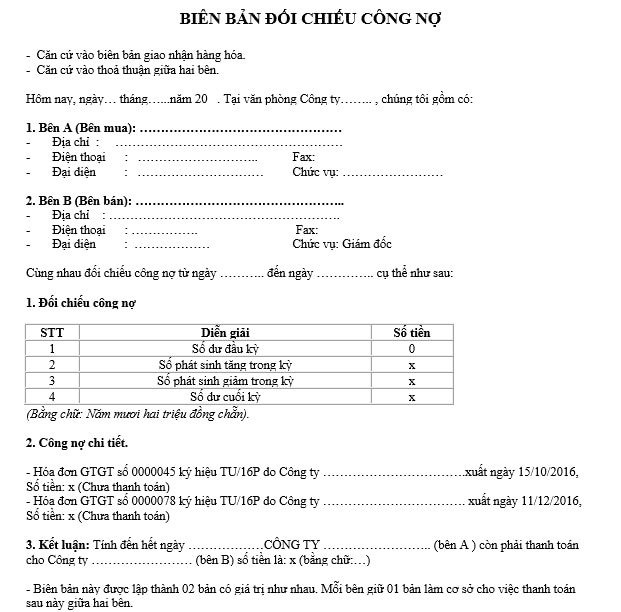

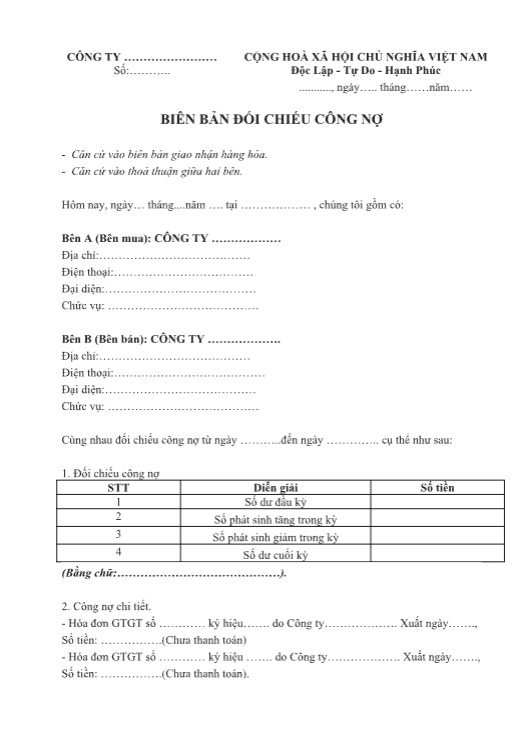

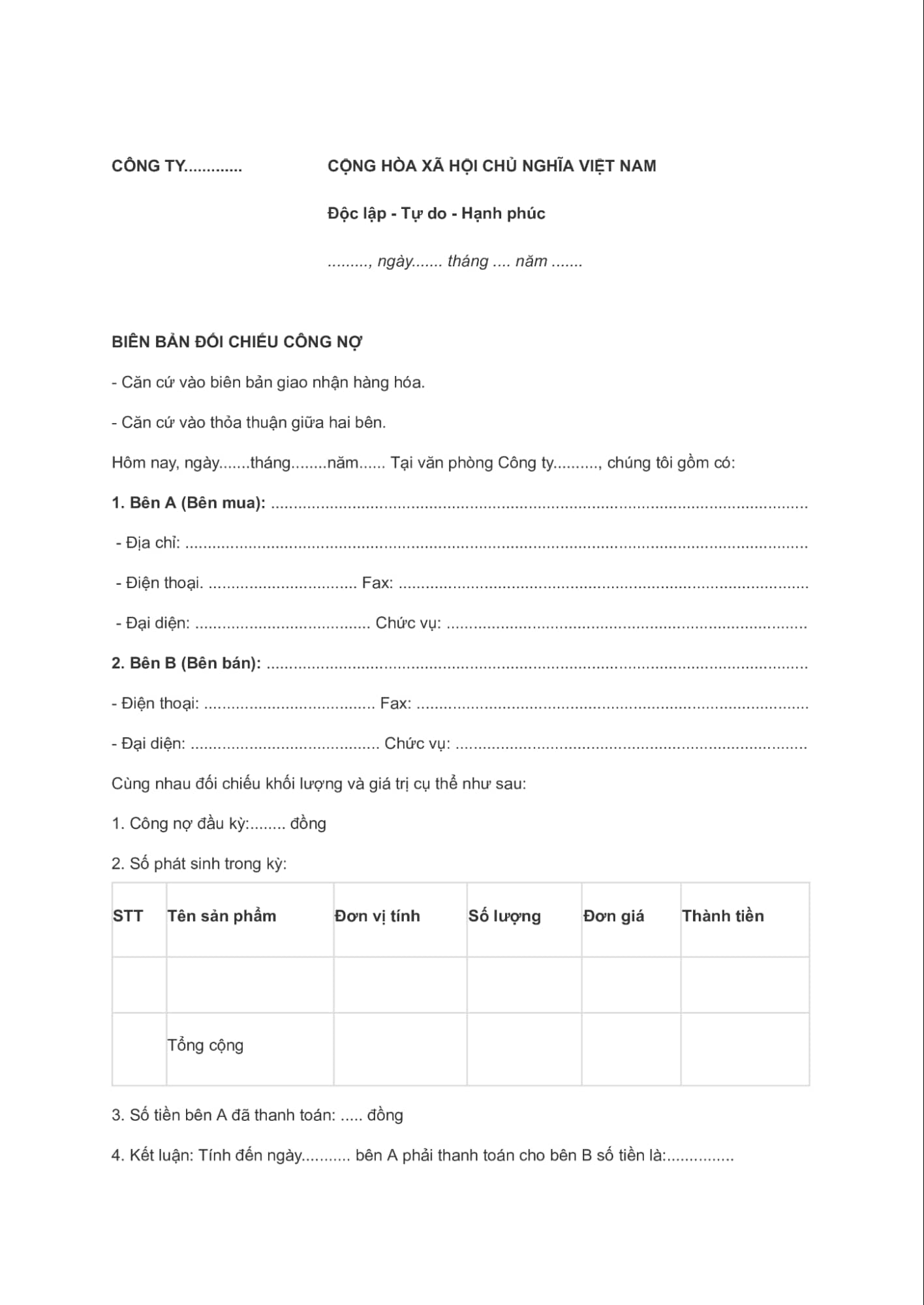

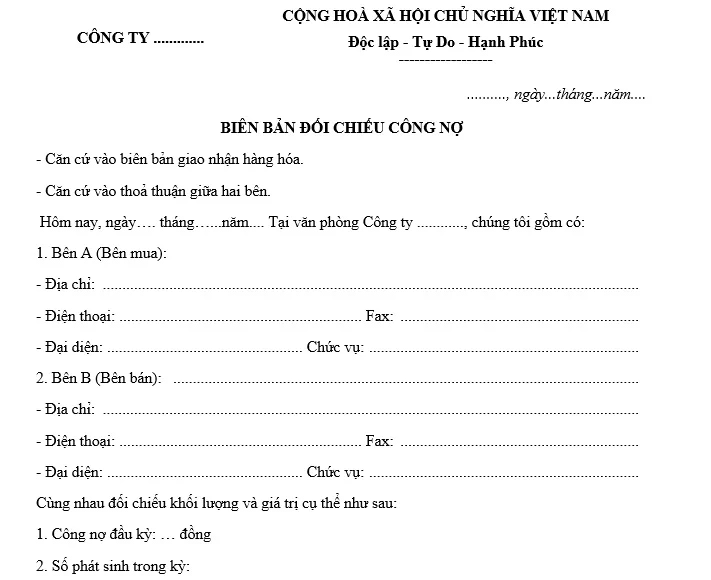

2.1 Sample of regular debt reconciliation report (Vietnamese)

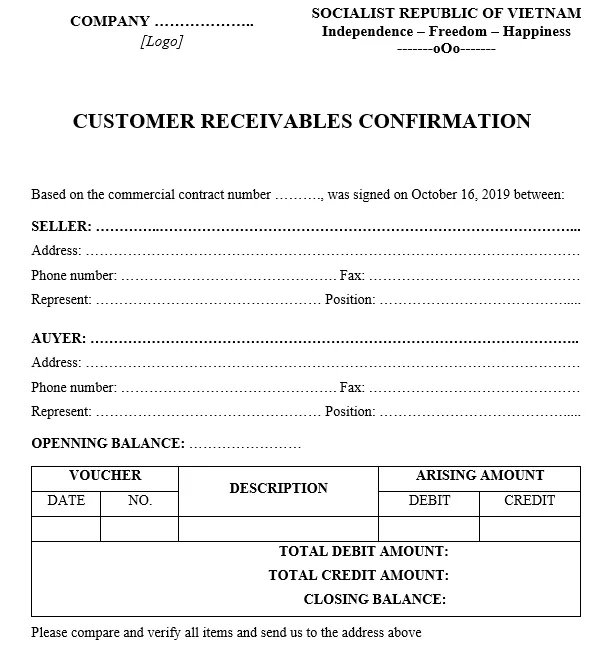

2.2 Sample debt reconciliation report in English

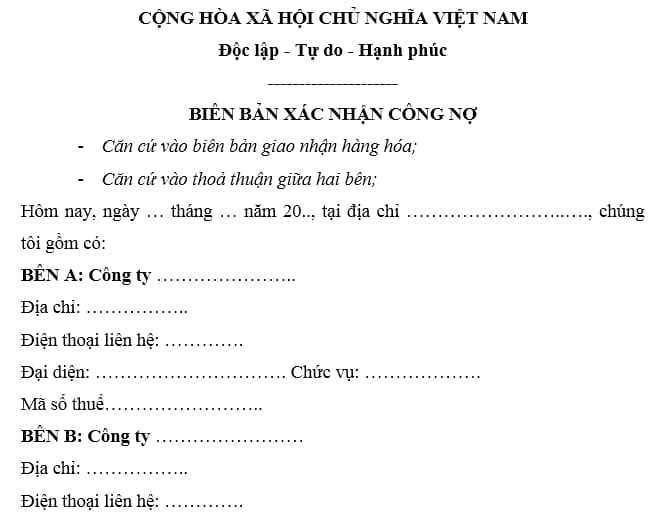

2.3 Debt confirmation form (usually used for specific loans)

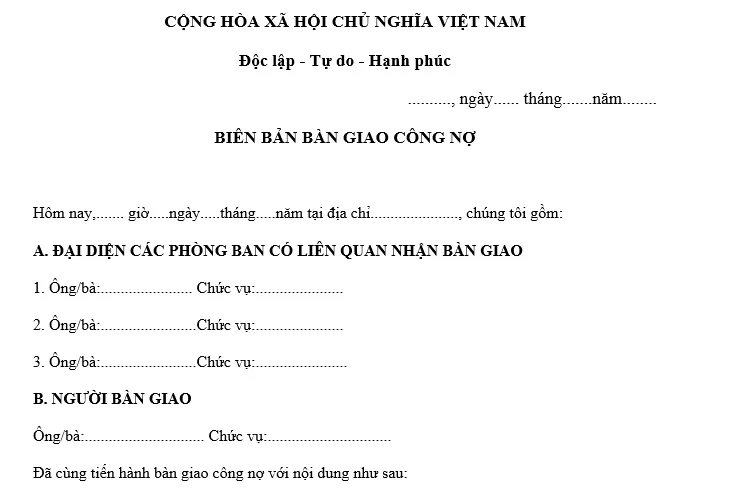

2.4 Debt handover minutes form (often used internally when handing over debt management responsibilities)

2.5 Sample debt reconciliation minutes according to the latest years (for example: Form 2023, Form 2025).

Model 2023:

Model 2024:

Model 2025:

3. When is it necessary to perform a Debt Reconciliation Report?

The debt reconciliation report is an important document that helps businesses and partners accurately control receivables and payables. Timely implementation not only ensures transparency in accounting books but also helps prevent financial risks, especially disputes that may arise later.

Below are the times when businesses should make a debt reconciliation record:

- End of accounting period or end of financial year: This is an important time to reconcile and confirm the debt balance between the parties, ensuring that the data is fully updated before closing the accounting books.

- When a debt dispute arises: In case the data recorded between the two parties do not match or there is a complaint, the minutes will be an important legal basis for dispute resolution.

- Periodically within the business: Many businesses proactively reconcile their debts monthly or quarterly to control cash flow and limit the situation of prolonged debts.

- When working with individual customers or large suppliers: Creating separate debt reconciliation reports for each account helps to easily control each financial relationship, ensuring accuracy and transparency in each transaction.

Although the debt reconciliation minutes not required by law, but again very necessary in the practice of corporate financial management. In particular, businesses use Sample debt reconciliation report in Excel It is necessary to ensure a consistent format, avoid data errors and make it easy to store and check later.

To simplify the process of establishing and managing debt, businesses can refer to the following: standard debt reconciliation form on the digital platform of Bizzi.vnBizzi's solution allows for automated reconciliation of accounts receivable with accounting data systems, easily Download debt reconciliation form in Excel or PDF, helping accountants save time, reduce errors and improve financial control efficiency.

4. Who needs to perform the Debt Reconciliation Report?

The debt reconciliation report is an important accounting document that helps businesses verify the accuracy of debt figures with partners such as customers or suppliers. The implementation of this report not only ensures financial transparency but also serves as a basis for handling disputes if they arise.

Depending on the specifics of the business and the scale, each business will have different frequency and level of application. Below are the groups of businesses that should prioritize regular debt reconciliation:

- Medium and large scale enterprises: With a large number of transactions, many suppliers or customers, periodic debt reconciliation helps minimize the risk of accounting errors and supports effective cash flow management.

- Enterprises operating in the fields of real estate, construction, manufacturing: These are industries with long project life cycles, complex contracts, and multiple payments, so debt reconciliation is mandatory to ensure consistency between stakeholders.

- Trading enterprises - wholesale, retail: Often there are debts for goods with many partners, so a clear debt reconciliation form is needed as a basis for accounting and auditing.

A debt reconciliation statement is a bilateral agreement between a business and its business partners (including customers or suppliers) to confirm the balance and timing of specific debts. Although not legally required in all cases, it is an important document in the accounting records, often required during audits or tax settlements.

If you need a standard, easy-to-customize debt reconciliation form, or want to download a debt reconciliation form in Excel, Bizzi provides a rich library of templates and updates according to the latest regulations. In particular, the Bizzi system helps automate the process of synthesizing and reconciling debt data for each partner, minimizing errors and saving significant time for businesses.

5. Requirements and Contents of Debt Reconciliation Minutes

The debt reconciliation record is an important accounting document that helps businesses confirm debt status with partners, ensuring transparency and avoiding future disputes. To ensure legality and usability, the record must be prepared completely and accurately according to the following criteria:

- Clearly state the company, business or individual name of both parties involved to clearly identify the entity related to the debt.

- There is a specific reconciliation record number for easy reference and storage when needed to check or reconcile in the following accounting periods.

- Clearly note the location and time of making the record to serve as a basis for verifying the time of performing the reconciliation obligation.

- Attach all relevant documents such as economic contracts, invoices, receipts/payment vouchers to prove the validity and accuracy of the debt.

- Provide detailed information of the buyer and seller, including: name of the unit, address, tax code, legal representative and contact method.

- List specific accounts receivable, showing amounts receivable, payable, and accurate reconciliation figures.

- Record any errors discovered during the reconciliation process, if any, for both parties to review.

- Propose clear solutions to the above errors, helping to thoroughly resolve the differences and limit future risks.

- Conclusion on the final debt, clearly showing the total remaining amount, payment status and payment deadline if the obligation has not been completed.

- The minutes are only legally valid when signed and stamped by both the buyer and seller. If there is no signature or stamp, the minutes may be considered invalid before the law.

- The person making the minutes must fill in the information completely and accurately, and comply with current legal regulations to avoid unwanted risks during the audit or inspection process.

Making a debt reconciliation record not only helps businesses control cash flow well but is also an important evidence in financial transactions. Many businesses still wonder Is a debt reconciliation statement mandatory? – In fact, although not required by law in all cases, it is an important tool to avoid legal and accounting risks.

6. Procedure for performing Debt Reconciliation Minutes

Implementation debt reconciliation statement is an important step to help businesses control their financial situation, ensure transparency in transactions and prevent the risk of accounting data errors. Below is a standard and detailed debt reconciliation process for both receivables and payables.

6.1 General procedure of implementation steps:

- Step 1: Prepare a debt reconciliation form Full information such as unit name, partner, debt figures, reconciliation time, confirmation signature, etc. Businesses often use Sample debt reconciliation report in Excel for easy updating, calculation and storage.

- Step 2: Determine the exact debts of both parties including receivables and payables, based on accounting books, invoices, and arising documents.

- Step 3: Compare and check data between businesses and partners to detect differences in recording time, amount, and transaction content.

- Step 4: Record errors (if any) such as mismatched data, missing documents, unrecorded transactions... and determine the cause of the discrepancy.

- Step 5: Unify and correct errors, providing solutions such as deductions, additional payments or adjustments to accounting books.

- Step 6: Sign the debt reconciliation record and archive the records. for auditing, financial reporting and tax settlement.

To simplify the debt reconciliation process and minimize the risk of manual errors, many businesses have applied automated solutions from Bizzi. The system supports quick reconciliation of accounting data with partners, secure electronic record storage, and integrated analytical reports to help businesses make more accurate financial decisions.

6.2 Procedure for receivables (Customers):

- Pre-printed business debt reconciliation statement and detailed accounts receivable ledger.

- Send documents to customers for verification.

- Customers check against their figures, adjusting if necessary.

- After confirmation, the customer returns the signed or stamped minutes.

- The enterprise retains the confirmed reconciliation for use when needed.

6.3 Procedure for accounts payable (Supplier):

- Business preparation debt reconciliation statement and details of accounts payable.

- Send documents to supplier for review.

- Supplier checks and adjusts if there is a discrepancy.

- After confirmation, they send back the signed/stamped reconciliation report.

- Enterprises keep records in accordance with accounting and tax regulations.

6.4 Is a debt reconciliation report mandatory?

According to current regulations, the preparation of debt reconciliation records optional, but again very necessary to ensure accuracy in accounting, avoid disputes with partners and serve internal or independent audits. Many businesses proactively perform this periodically every quarter or at the end of the fiscal year.

7. Compare the Accounts Reconciliation Report with other financial management tools

The debt reconciliation report is a traditional but indispensable tool to officially confirm the debt status between a business and its partners. However, in the context of digital transformation and modern financial management, businesses tend to combine this report with automation tools and platforms to optimize performance and accuracy. Below is a detailed comparison between the debt reconciliation report and popular financial management solutions today.

- Compared to financial management software: Modern financial software is capable of automatically tracking debts, updating data in real time and generating visual reports. However, the software is only a supporting tool. Creating a debt reconciliation form and confirmation between two parties still plays an important role in ensuring legal transparency and data authentication, especially when disputes arise or need to be used as a basis for auditing.

- Compared to financial audit: Auditing is performed by an independent third party, which ensures the highest level of accuracy but is costly and time-consuming. Meanwhile, debt reconciliation is a periodic internal process that is easier to implement and less expensive, suitable for businesses that need to manage debt quickly and effectively while still ensuring information reliability.

- Compared to secure payment methods: Payment methods such as authenticated transfers and corporate e-wallets help reduce transaction risks. However, these methods only support the payment stage. To manage overall debt, businesses still need to make debt reconciliation records to control balances, transaction history and confirm debts between parties.

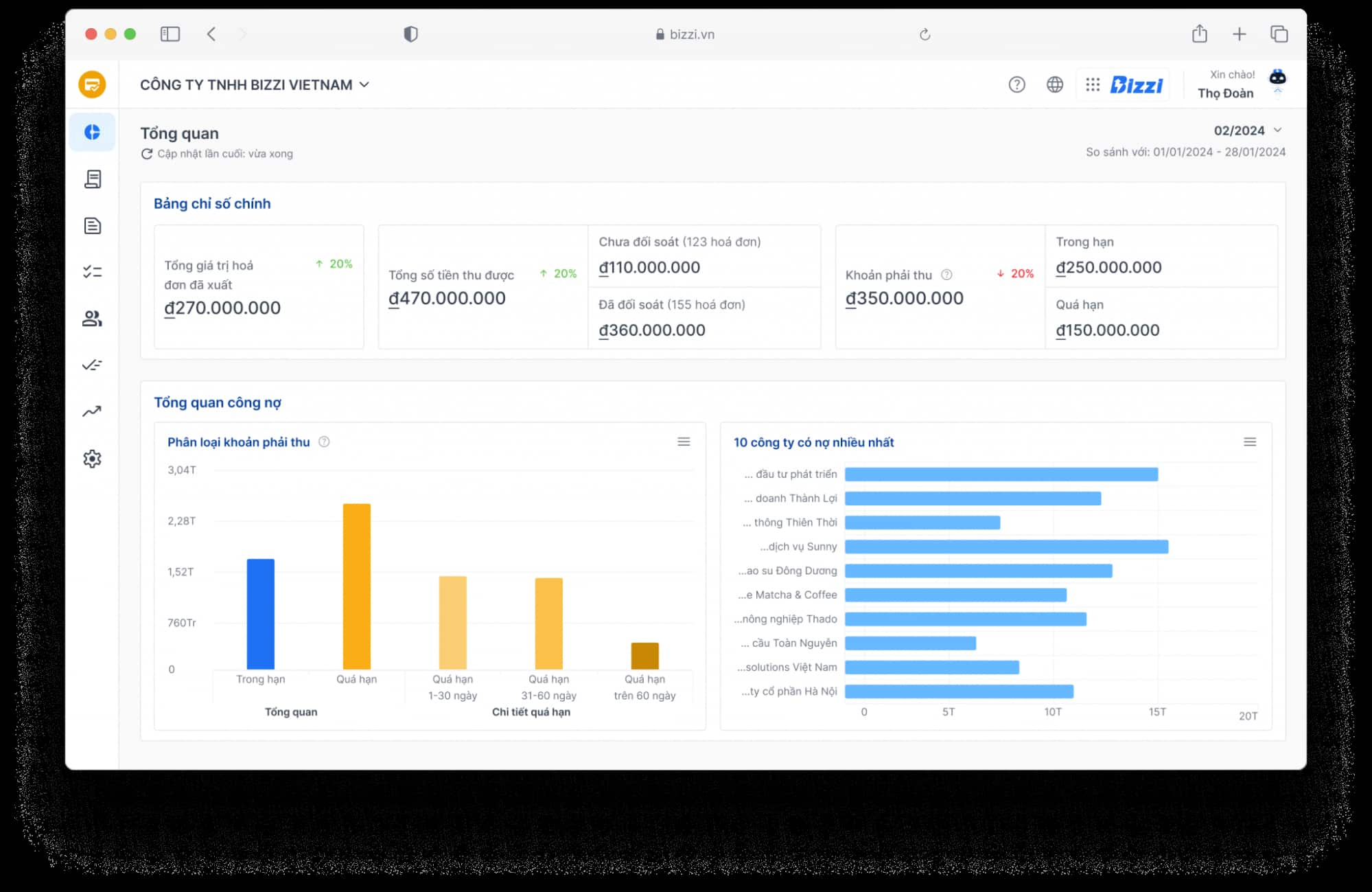

Bizzi's role in supporting debt reconciliation and financial management

With experience in financial automation, Bizzi provides practical tools to help businesses speed up the process of processing and controlling debts accurately, transparently and saving resources.

During the development process, businesses often face many difficulties in controlling debts and reconciling payments. Bizzi offers a comprehensive automation solution, helping businesses handle debts accurately, transparently and save time through the following outstanding features:

- Automatic debt reminder: The system automatically sends debt reminder emails according to scenarios designed specifically for each customer group, helping businesses take the initiative in debt collection, ensuring on-time payment and minimizing risks.

- Effective debt management: Bizzi allows you to track your receivables visually by invoice, contract or customer. By automating the debt collection process, businesses can optimize cash flow and improve operational efficiency.

- Fast and accurate debt reconciliation: The system automatically manages pending payments and compares payment data with bank statements. This not only helps to promptly detect discrepancies but also ensures transparency and accuracy in accounting and financial activities.

- Instant debt status update: Any changes in debt and payment status are automatically notified to relevant departments. This helps departments quickly grasp the financial situation and coordinate effective handling, making timely decisions.

Bizzi's debt reconciliation solution not only helps reduce manual work, but also plays an important role in improving the ability to control corporate finances. Automatic - Accurate - Transparent - That is the commitment from Bizzi in the journey to support businesses in comprehensive digital transformation in debt management.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/

8. Common errors when making a Debt Reconciliation Report

Set up debt reconciliation statement is an important step in financial management, but many businesses still make mistakes that make debt less transparent and difficult to control:

- Low response rate from partners: Businesses send minutes but do not follow up or remind for feedback, leading to delayed confirmation. Solutions such as Bizzi.vn Helps automate reminders and track responses easily.

- Unexplained discrepancies: When the figures between the minutes and the accounting books do not match, manual verification is time-consuming. Integrating debt management software can support more accurate reconciliation.

- No regular reconciliation or lack of object linkage: Many businesses only reconcile when required, or do not link debts to the correct customer/supplier, causing errors in consolidation.

- Missing accompanying documents: Debt reconciliation form Full invoices, receipts/payments, and related contracts are required – especially at the end of the year to ensure legality and transparency.

- Minutes without signature and seal: Lack of confirmation from both parties makes the minutes have no legal value. Use digital signature and store electronically via Bizzi help businesses limit this risk.

If you are in need Download sample debt reconciliation report in Excel or unknown Is a debt reconciliation statement mandatory?, please refer to the smart debt management solution at Bizzi, Full form support, process automation and legal compliance.

Conclude

Set up debt reconciliation statement Complete and accurate financial information is an important step to help businesses control finances effectively, avoiding risks when disputes or audits arise. Correct use debt reconciliation form, especially the latest Word, Excel forms, help accountants save time and ensure regulatory compliance.

If you are still wondering Is a debt reconciliation statement mandatory?, or are looking for ways Download sample debt reconciliation report in Excel Convenient, Bizzi provides automatic debt management and reconciliation solutions, integrating digital signatures, helping businesses quickly and accurately handle all debt-related transactions.

Experience the smart debt reconciliation tool now at Bizzi.vn to optimize accounting processes and improve financial efficiency for your business.