Free cash flow (FCF) is an important indicator that reflects the ability to generate cash after paying the necessary expenses for business operations. Understanding what free cash flow is will help businesses be flexible in paying debt, investing, and paying dividends.

Let's learn about the role and effective management of free cash flow in business through this article of Bizzi ok

Understand what free cash flow is in corporate finance?

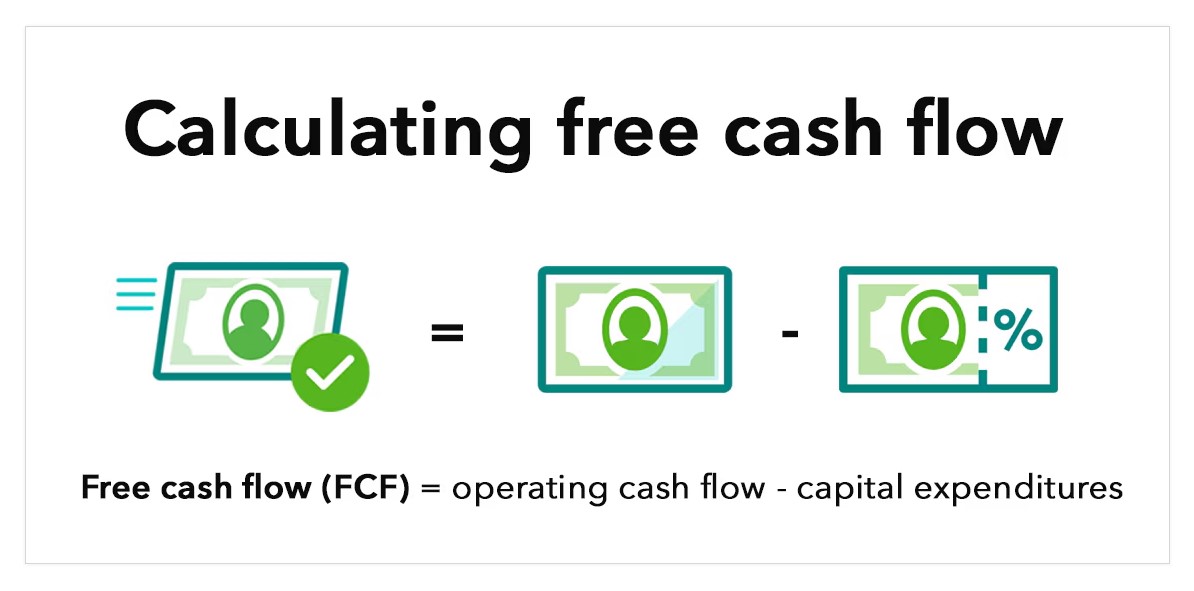

Free Cash Flow (FCF) FCF is the amount of cash left over after a company has subtracted its capital expenditures (CapEx) from its operating cash flow (OCF). In other words, FCF represents the amount of money a company has at its disposal after ensuring that its core operations are maintained and growing. This money can be used to pay down debt, pay dividends, buy back shares, or reinvest in new opportunities.

FCF is considered a more accurate measure of profitability cash versus net income, as it eliminates the effects of non-cash accounting factors (such as depreciation) and directly reflects the amount of cash available.

Learn the characteristics of free cash flow

After understanding what free cash flow is, businesses need to grasp the important characteristics of this financial indicator to use it effectively in management and development strategy.

- Free cash flow can be negative or positive.

If FCF is positive, the business has enough money to expand, pay dividends, or reduce debt. Conversely, the business is spending more money than it generates, possibly due to heavy investment in assets or financial difficulties.

- Flexibility

Businesses can use FCF for a variety of purposes such as debt repayment, make long term investments, pay dividends or buy back shares.

- Not displayed directly

FCF is not an indicator that appears directly in the corporate financial report according to GAAP or IFRS standards, but can be calculated from figures in the cash flow statement and income statement.

- Not affected by accounting factors

Unlike net income and EBITDA, FCF is not affected by accounting factors such as depreciation, provisions or other accounting adjustments.

- Subject to change

If a company changes its investment strategy or experiences fluctuations in its working capital management, what is the role of free cash flow? It can change. For example, during an expansion phase, FCF can decrease due to a company investing heavily in assets (increased CapEx). Conversely, during a stabilization phase, FCF can increase due to a decrease in capital expenditures.

- Important in business valuation

Financial analysts often use free cash flow in valuation through model discounted free cash flow (DCF) to estimate the intrinsic value of the company.

The role and significance of free cash flow analysis

Understanding the role and significance of free cash flow helps businesses evaluate their financial performance, autonomy and long-term growth potential. Below are the key roles of free cash flow analysis. FCF:

The Meaning of Free Cash Flow for Business

- Financial Health Assessment: Consistent positive FCF is a strong indicator of financial independence, sustainable profitability and low dependence on external funding.

- Support capital allocation decisions: Help management decide what to use the money for: paying down debt to reduce interest expenses, paying dividends to attract investors, buying back shares to increase value, or reinvesting in R&D, M&A for growth.

- Financial planning and forecasting: FCF is an important basis for budgeting, forecasting the ability to pay future obligations and building long-term financial strategies.

- Measuring investment performance: Compare FCF generated with the amount capital investment (CapEx) helps evaluate the effectiveness of fixed asset investment projects.

- Financial risk management: Businesses with strong FCF will have better buffers to deal with economic fluctuations or unexpected events.

The Meaning of Free Cash Flow for Investors

- Business Valuation: Valuation by FCF (via DCF model) is considered one of the reliable methods to determine the real value of a stock, based on its ability to generate cash in the future.

- Earnings quality assessment: FCF helps investors look beyond accounting profit figures to assess whether those profits are actually converted into cash.

- Assessing the ability to pay dividends and buy back shares: FCF is the primary source for sustainable dividend payments and share buyback programs.

- Financial risk assessment: Companies with strong FCF typically have lower debt ratios and are less likely to default. Investors should carefully consider the reasons if negative free cash flow lengthen.

- Identify investment opportunities: Companies with consistently growing FCF are often attractive investments over the long term.

Formula and how to calculate free cash flow correctly

What is the discounted free cash flow method? Understanding this helps determine the intrinsic value of a business based on its future cash-generating potential. There are two Free Cash Flow (FCF) Formula popular:

Formula 1 (From operating cash flow)

FCF = OCF (Net Cash Flow) – CAPEX (Capital Expenditure).

- OCF (Operating Cash Flow – Cash flow from business activities): Is the amount of cash generated from a company's core business activities. This figure is taken directly from Cash Flow Statement. What is OCF? It reflects money received from customers minus money paid to suppliers, employees and other operating expenses.

- CapEx (Capital Expenditures): Is the amount of money a business spends to purchase, maintain or upgrade long-term fixed assets such as factories, machinery and equipment. What is CapEx? It is usually calculated by taking the ending Fixed Assets (PPE) minus the beginning PPE, then adding back the Depreciation for the period (taken from the Cash Flow Statement or Income Statement).

-

CapEx = Ending PPE – Beginning PPE + Depreciation during the period

-

For example: Company A has OCF of 15 billion VND and CapEx in the period is 4 billion VND. So FCF = 15 – 4 = 11 billion VND.

Formula 2 (From profit after tax)

FCF = Net Income (NI) + Depreciation & Amortization – Change in Net Working Capital* – CapEx

- Net Income (NI): Taken from the Income Statement.

- Depreciation & Amortization: Non-cash expenses, added together.

- Change in Net Working Capital: Reflects the change in investment in current assets (such as Accounts Receivable, Inventory) minus Current Liabilities (such as Accounts Payable). If working capital increases (for example, inventory increases), it will decrease cash flow, and vice versa.

- CapEx: Calculate as above.

Note: Change in Net Working Capital = (Ending Current Assets – Ending Current Liabilities) – (Beginning Current Assets – Beginning Current Liabilities). The minus sign before it in the FCF formula means that if working capital increases, FCF decreases, and vice versa.

What are the basic steps in discounted free cash flow?

- FCF Forecast: Estimate FCF for the coming years (usually 5-10 years).

- Calculate the weighted average cost of capital (WACC): Determine an appropriate discount rate that reflects the risk of the business. WACC is the average cost of capital (debt and equity).

- Calculate Terminal Value (TV): Estimate the value of all FCF after the forecast period.

- Discount FCF and TV to present: Bring future cash flows to present value using WACC.

- Calculate Enterprise Value (EV) and Equity Value: The sum of the present value of FCF and TV is EV. Subtract Net Debt to get Equity Value.

Formula: WACC = Rd × Fd × (1 – t) + Re × Fe.

In there:

- Rd: Cost of debt of the enterprise.

- Fd: Ratio of long-term debt to total long-term capital.

- t: Corporate income tax rate.

- Re: Cost of equity.

- Fe: Ratio of equity to total long-term capital.

- Step 3: Forecast terminal value (TV).

- Step 4: Calculate Enterprise value.

Limitations of using free cash flow

- Impact on working capital and capital expenditure: Changes in working capital and capital expenditures can have a strong impact on free cash flow (FCF).

- No forecast of profitability: FCF cannot predict future earnings growth or maintenance.

- Complex calculations: Calculating FCF requires careful analysis of factors such as pre-tax profit, changes in working capital, capital expenditures and taxes.

- Difficult to compare across industries: FCF can be difficult to compare across businesses in different industries.

- High free cash flow is not always good and vice versa: High FCF is sometimes a sign that a company is not investing enough in its business. And if FCF is negative, it may be that the company is investing heavily to expand its market share.

How to improve free cash flow for business?

To improve FCF, businesses can focus on the following aspects:

Increase operating cash flow (OCF)

- Increase revenue (expand market, launch new products, increase reasonable selling prices).

- Optimize cost of capital sales (find better suppliers, improve manufacturing processes).

- Tight control of operating expenses (OpEx): CReducing unnecessary expenses, automating processes to reduce labor costs, and managing budgets effectively will directly increase OCF.

Effective working capital management

- Collect receivables faster.

- Optimize inventory levels (avoid over or under inventory).

- Negotiate to extend payment terms with suppliers (within reasonable limits).

Optimize capital expenditure (CapEx)

- Only invest in projects with high profitability (positive ROI, NPV).

- Carefully evaluate investment needs to avoid waste.

- Consider leasing options instead of buying assets if it is more efficient.

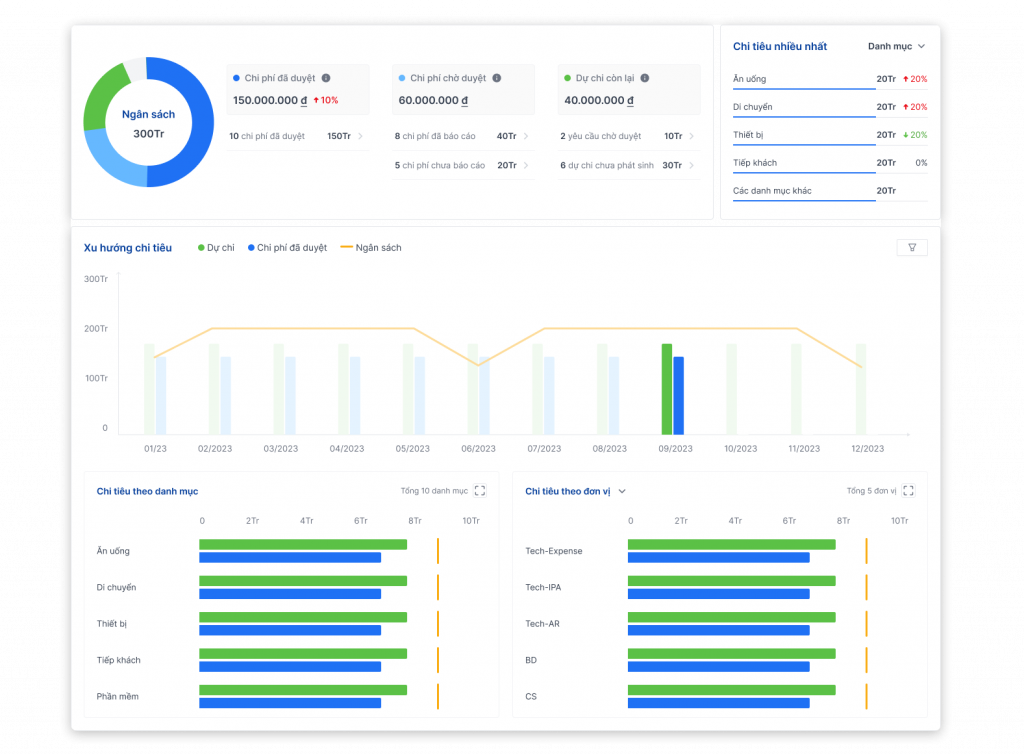

Manage your finances effectively with Bizzi

Use cash flow management tools modern helps businesses solve cost and budget problems effectively. Bizzi is one of the tools corporate financial management leading solution today, providing automation solutions for business expense reporting processes, easy to track and Cash flow management smartly without spending much time and effort.

Outstanding features of Bizzi:

- Track and Real-time cost management: The system updates transactions and expenses as they occur, helping managers stay on top of the company's financial situation in real time.

- Cost and budget reporting dashboard: Intuitive interface, automatic reporting, easy to track spending and budget in real time.

- Set spending policy: Customize by department/project, control limits and warn when spending exceeds.

- Flexible expense approval process: Approval flows are set up based on level and expense type, users can request configuration design to meet internal needs, ensuring approval processes are done quickly, anytime, anywhere.

- Budgeting for departments and projects: Bizzi helps businesses allocate and manage detailed budgets for each department, project, or specific spending category.

- ERP integration: Bizzi seamlessly integrates with major ERP systems, helping to synchronize cost and budget data from multiple sources into one platform.

Benefits of using Bizzi – A powerful free cash flow management tool for businesses

Automate cost management processes, optimize cash flow:

- Minimize manual operations, automate invoice and document processing, helping businesses reduce data entry time by 80%.

- Optimize operating costs, eliminate traditional paperwork, reduce errors and save accounting staff.

- Standardize approval and spending processes flexibly, helping to control budget effectively.

Improve free cash flow (FCF) through tight expense control:

- Real-time expense tracking: Automatic reports help businesses control costs instantly, thereby optimizing free cash flow (FCF) positive.

- Reduce budget loss: Verify transactions and control invalid charges instantly.

Flexible integration with accounting and ERP systems

- Easily connect with accounting software such as MISA, SAP, Oracle, helping to automatically synchronize cost data.

- E-invoice integration: Supports electronic invoice processing, reduces errors and increases transparency.

- Multi-platform management: Use on mobile & web, convenient for businesses with many branches.

Support smart financial decision making

- Detailed, intuitive reports: Provide financial analysis by department and project, helping managers easily adjust budgets.

- Optimizing FCF for reinvestment: By effectively controlling expenses, businesses can increase FCF to expand their business without borrowing.

- Improve supplier relationships: Pay on time, take advantage of better deals and discounts.

Clearly understand What is free cash flow?, How to calculate FCF and influencing factors are the foundation for effective corporate financial management. FCF is not only a measure of financial “health” but also a guideline for investment decisions, debt repayment and profit distribution.

Bizzi is a powerful support tool that helps businesses manage and optimize free cash flow (FCF), ensuring strong finances for sustainable development.

Sign up for a free trial now at: https://bizzi.vn/dang-ky-dung-thu/

Read more: