In the context of the digital economy, understanding information and complying with tax laws is extremely important for both individuals and businesses. Tax Identification Number (MST) acts as an “identity card” in the tax field, and knows How to look up tax code Quickly and accurately is a necessary skill. This not only helps to fulfill tax obligations but also lays the foundation for businesses to effectively manage costs and save time according to professional processes.

This article is from Bizzi will provide search guide comprehensive about How to look up tax code individuals and businesses, and suggests solutions to optimize financial management, in accordance with international standards.

What is a tax code (MST) and why is it important?

Tax identification number (MST) is a series of numbers, characters or letters. only issued by the competent Tax Authority (General Department of Taxation, directly under Ministry of Finance) for each Taxpayer (individual or organization, enterprise) when registering for tax in Vietnam. This is the basic identification purpose, helping to distinguish this taxpayer from other taxpayers in the tax management system and economic transactions.

- Uniqueness: Each individual and legally operating business only owns one tax code. This feature ensures that there is no confusion in determining tax obligations and related transactions.

- Legality: Registration and use of MST is obligatory according to the provisions of Vietnamese law. Tax code is the basis for the State to manage taxes and business activities, showing legality its.

- Structure:

- Personal Tax Code: Usually a 10-digit string.

- Business Tax Code: Usually available 10 digit structureIn addition, there is also a 13-digit tax code, often issued to dependent units such as branches, representative offices or business locations, showing the connection with the 10-digit tax code of the parent company.

- Associated with identifier: MST is associated with a specific individual or business entity. All registration information such as name, address, legal representative (for businesses), information Citizen identification card (CCCD) or Identity card (ID) (for individuals) are closely linked to this MST in the National Database and the system of the General Department of Taxation.

Why you need to know How to look up tax code?

Understanding and knowing How to look up tax code of individuals or businesses brings many practical benefits, directly affecting legal compliance and financial activities:

- Tax Compliance: MST is the key to fulfilling tax obligations such as tax declaration, tax payment for HKD (eg Value Added Tax – VAT, Corporate Income Tax – CIT) accurately and on time, avoiding unnecessary fines.

- Transaction and Invoice Authentication: Tax code is mandatory information on VAT invoices (Electronic invoice). Correctly recording the tax code of both the seller and the buyer ensures the validity of the invoice, is the basis for tax deduction and reasonable cost accounting, contributing to effective cost management.

- Perform administrative procedures: Tax code is required for most administrative procedures related to individuals and businesses such as banking transactions, signing contracts, participating in bidding, applying for subsidiary business licenses, etc.

- Transparency of operations: Using MST helps business activities and personal financial transactions become transparent, building credibility with partners, customers and state management agencies.

Misuse of MST or operation without MST can lead to serious legal and financial risks. Therefore, it is important to understand How to look up tax code and management tax information is extremely necessary.

Guide 3 How to look up tax code fast online personal

With the development of information technology, Look up personal tax code online has become extremely convenient. You only need a CCCD/ID number and an internet-connected device to be able to do it. Below are the method popular:

first. How to look up tax code individuals via the General Department of Taxation's Electronic Information Portal

- Step 1: Visit the official website of the General Department of Taxation at: http://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp. This is search channel orthodox

- Step 2: In the “Information about personal income tax payer” section, enter the number CCCD/CMND (input data) in the box "ID card number/Citizen identification card".

- Step 3: Enter the displayed captcha code exactly (case sensitive).

- Step 4: Click the “Search” button. The system will display result including: Tax code, Taxpayer's full name, Tax authority, Registered ID card/CCCD number, Date of most recent information update.

2. How to look up tax code Individuals via the Electronic Tax (eTax) website

- Step 1: Visit the General Department of Taxation's e-Tax website at: https://thuedientu.gdt.gov.vn/.

- Step 2: Select “PERSONAL” on the “SYSTEM LOGIN” bar.

- Step 3: Click on “Look up taxpayer information”.

- Step 4: Enter the CCCD number (12 digits) or ID card number (9 digits) in the "Document number" box, then enter the verification code (captcha).

- Step 5: Click the “Search” button. The system will display the tax code information and related details.

3. How to look up tax code Individual via eTax Mobile application

- Step 1: Download and install the “eTax Mobile” application from CH Play (Android) or App Store (iPhone) released by the General Department of Taxation.

- Step 2: Open the application, at the login screen, select “Utilities” (or maybe “Look up NNT information” or “Forgot account (tax code)?”).

- Step 3: Select the function to look up taxpayer information by identification number. Enter the CCCD/CMND number and verification code (if any).

- Step 4: Click “Search”. The returned information includes the tax code and the taxpayer's full name.

5 How to look up tax code popular business

Get it How to look up tax code Quick Business helps you verify partner information, check invoice validity, or simply find your own company's tax code. Here are some popular and reliable methods:

first. How to look up tax code Enterprises on the General Department of Taxation's Electronic Information Portal

This is the most official and reliable channel for looking up business information.

Steps to follow:

- Step 1: Visit the website: Open your web browser and enter the address: https://tracuunnt.gdt.gov.vn/tcnnt/mstdn.jsp

- Step 2: Enter the information you want to find: On the main interface, you will see boxes to enter information. You can enter one of the following information (no need to fill in all):

- Tax ID: If you already know your tax ID.

- Name of tax paying organization/individual: Enter the full name or part of the name of the business.

- Business headquarters address.

- Representative's ID card number/Citizen identification card number.

- Step 3: Enter the Verification Code (Captcha) and click “Search”: After entering the information, click the “Search” button.

- Step 4: View results: Search results will be displayed in the table. Click on the company name to view detailed information such as: full name, address, business lines, legal representative, tax code issuance date, tax authority.

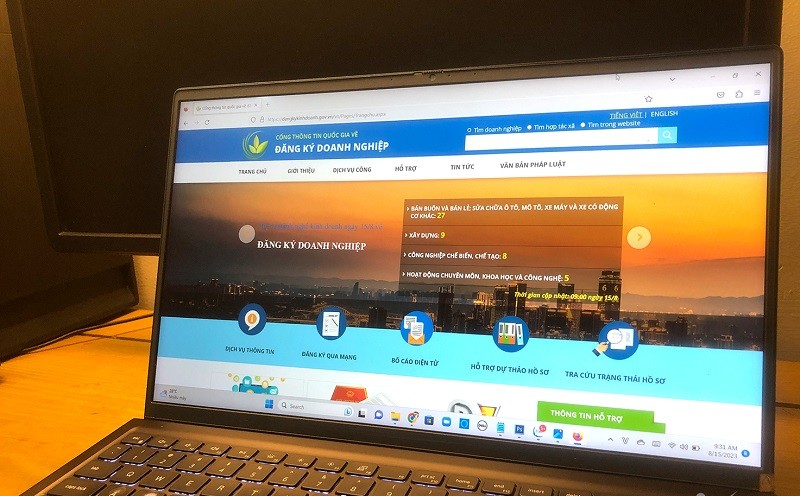

2. How to look up tax code on the National Business Registration Portal

This portal provides business registration information, including tax identification numbers.

Detailed instructions:

- Step 1: Visit the website: Open your web browser and enter the address: https://dangkykinhdoanh.gov.vn/

- Step 2: Enter search information: On the main interface of the website, you will see a search box. Enter the business name or business registration number (if any) in this box.

- Step 3: View results: The system will automatically suggest suitable businesses. Select the business you want to find to see detailed information, including tax code, business name, legal type, date of establishment, representative, head office address, and more.

3. How to look up tax code on Masothue.com

Masothue.com is a third-party website that aggregates tax code information. Although it is not an official channel, it can be useful for quick lookups.

Steps to follow:

- Step 1: Visit the website: Open your web browser and enter the address https://masothue.com/ into the address bar.

- Step 2: Enter the information you want to find: On the main interface of the website, you will see a search box. Enter the business name, representative name, or representative's ID card/CCCD number.

- Step 3: Get results: After entering the information, press Enter or the search button. The system will display a list of suitable businesses. Please check carefully to find the information you need.

Note:

- Accuracy of results: Always prioritize cross-checking information with official sources from the General Department of Taxation or the National Business Registration Portal.

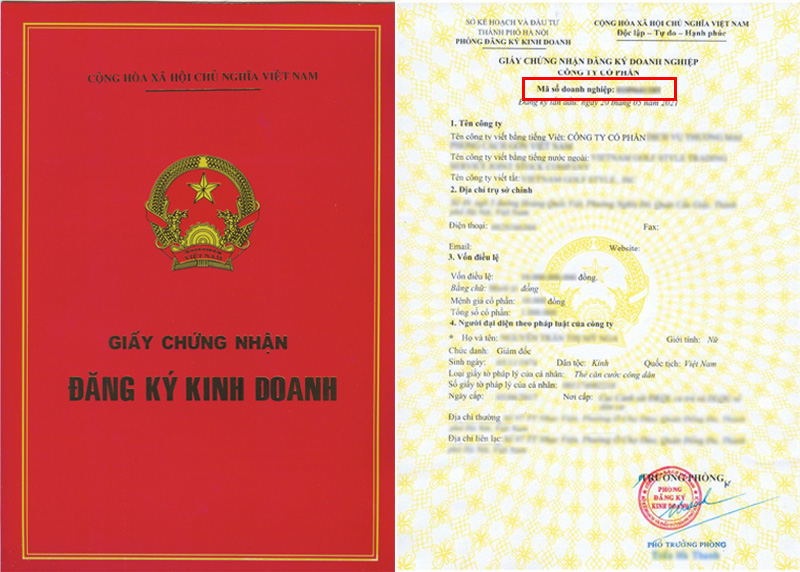

4. How to look up tax code Business on the Business Registration Certificate

The simplest and most direct way is if you have this document available. A unique tax code is issued to each business when registering to establish a company and is clearly stated on the Certificate of Business Registration.

In addition to the above methods, you can now also Look up business tax code using Zalo application very convenient. With Bizzi's Get Invoice mini app, you can save a lot of time and effort, no need to look up in many places anymore.

Important notes when performing How to look up tax code

- Always prioritize using the search channel official of the General Department of Taxation or the National Business Registration Portal to ensure accuracy and security information.

- Prepare fully and enter the correct information. input data necessary information such as CCCD/ID number, full name of the business, or other identifying information.

- When searching online portals, enter the correct Captcha code for the system to process your request.

- If you cannot find the MST, please check the information you entered. If the information is correct but you still cannot find it, the MST may not have been issued, has been revoked, or there is a system error. In this case, you should contact the tax authority directly for assistance.

Learn more about status and special cases of MST

In addition to knowing How to look up tax code Basically, understanding the MST status and special cases is also very important, especially for businesses:

- Active status: The business is operating normally as registered.

- Suspended Status: The tax code still exists but the business has registered to temporarily suspend business operations for a period of time.

- Dissolved/Inactive: The tax code is no longer valid because the enterprise has completed dissolution procedures or had its license revoked.

- 13-digit tax code: For dependent units (branches, representative offices, business locations), helps manage taxes for each specific unit.

- Information change history: Changes in address, representative, charter capital, etc. are all recorded and updated in the national database, linked to the tax code. Some official portals may allow lookups. information change history This.

Manage Tax Codes effectively with professional solutions from Bizzi

Mastering How to look up tax code and accurate management of MST information is an indispensable part of modern business administration, especially in cost management. Ensuring that MST is always correct on all invoices and documents helps businesses:

- Optimize tax deductions: A valid invoice with full tax code information is the basis for input VAT deduction.

- Minimize legal risks: Avoid penalties for tax information errors.

- Improve process efficiency: Automating the checking and comparison of tax code information on invoices helps save time and resources.

Solutions comprehensive cost management like of Bizzi can help businesses automate the process of processing input invoices, including checking the validity of invoices and tax code information. This helps ensure that data is always accurate, complies with regulations and optimizes financial and accounting processes according to professional standards, helping businesses save time and operate more efficiently.

Conclude

Mastering the How to look up tax code personal and business not only helps you fulfill your legal obligations but is also an important skill in financial management and business operations. From searching on official portals of General Department of Taxation to direct checking on legal documents, each method has its own advantages, meeting the diverse needs of users.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam

See more: