B2B payment trends in 2021

Automation, AI and Blockchain

By Nuong Ho Pham

No more lengthy payment processes with a ton of complicated paperwork, instead B2B payments are being increasingly digitized. The processes of 20 years ago have given way to a cloud system capable of automatically scheduling payments using a variety of methods. With the changing B2B payments landscape, it's important for financial professionals and others to stay up to date. Join us as we decipher the latest B2B payment trends in 2020 and what companies can do to prepare for the future.

Replace manual payment methods

2020 marks an important milestone for the accounting industry as many invoices are sent electronically instead of manually. In the Ardent Partners' Accounts Payable Metrics that Matter 2020 report, 49.7% invoices were sent manually and 50.3% invoices were sent via email.

Less paperwork, more digital payment methods

While paper checks are still fairly common for B2B payments, according to the Ardent Partners' Accounts Payable Metrics that Matter 2020 report, only 45% organizes to cut checks manually, less than 55% organizations that take advantage of electronic payments. death.

Besides, in a 2020 Payroll Survey of the American Payroll Association with more than 30,000 workers, it shows that 93,87% are paid via automatic deposit while only 3,66% still accepting paper checks.

In fact, a study published at the end of September by Juniper Research found that electronic transactions could rapidly grow to $18 trillion, from the current $3 trillion, by 2025, with the B2B market expected to account for 89% of these transactions.

AI, blockchain and cryptocurrency in B2B payments

A wide range of innovations have emerged in B2B payments, including artificial intelligence (AI), blockchain, and cryptocurrency. Cryptocurrencies may not be a viable option for most institutions as many regulations remain uncertain. On the other hand, AI technology plays an important role in many B2B payment software today.

Artificial Intelligence and Machine Learning

Artificial intelligence, aka AI, has infiltrated so many parts of life in recent years so it's no surprise that it's also making its mark in the financial world.

A financial company's Harvard Business Review uses AI and data to provide a variety of services to consumers. The authors wrote: “The company serves 10 times as many customers as the largest US banks – with less than a tenth of employees.”

As with AP Automation (which automates accounts payable), AI can significantly reduce the time required by AP staff and stakeholders for B2B payments, with smart technologies that can capture and encode invoice information into accounting systems and do more. Machine learning is also useful with its ability to look through countless lines of accounting data and workflow patterns to learn trends and make recommendations. As one author recently noted in Payments Magazine: “In the real world (machine learning) is the only technology that can keep up with the pace.”

Blockchain

Blockchain, the technology that forms the backbone for cryptocurrency payments, is also affecting B2B payments. Blockchain is also on the radar of the Society for Worldwide Interbank Financial Telecommunication, or SWIFT, as moderator David Scola once said: “We have been looking at using blockchain for things like controlling corporate operations and linking up with a number of growing trade finance systems around the world.”

Electronic money

It's no surprise that cryptocurrencies are starting to show up in B2B payments, although it's only been a small part so far. PFI 2019 shows 8.1% companies are using cryptocurrencies as payment method with 3.9% respondents reporting as “very” or “extremely satisfied” with this method.

Mastercard's vice president of Blockchain and Digital Assets told an industry website in September that the company had 90 blockchain-specific patents pending.

The CEO told this website: “Until crypto becomes a mainstream solution, we will look at what we can use today. We are not waiting until crypto becomes a lot more popular.”

Switch legacy system

For companies to keep pace with the various transformations currently taking place, one of the smartest things they can do is consider upgrading their accounting systems.

Perhaps companies are trying to build in-house systems that are long outdated. That was a mistake. Payments Journal noted in August: “Old payment processing systems built specifically to process payments can only process very small amounts of data and provide some additional capabilities.”

But today, thanks to cloud computing, companies have more options than ever to eliminate costly and inefficient internal systems.

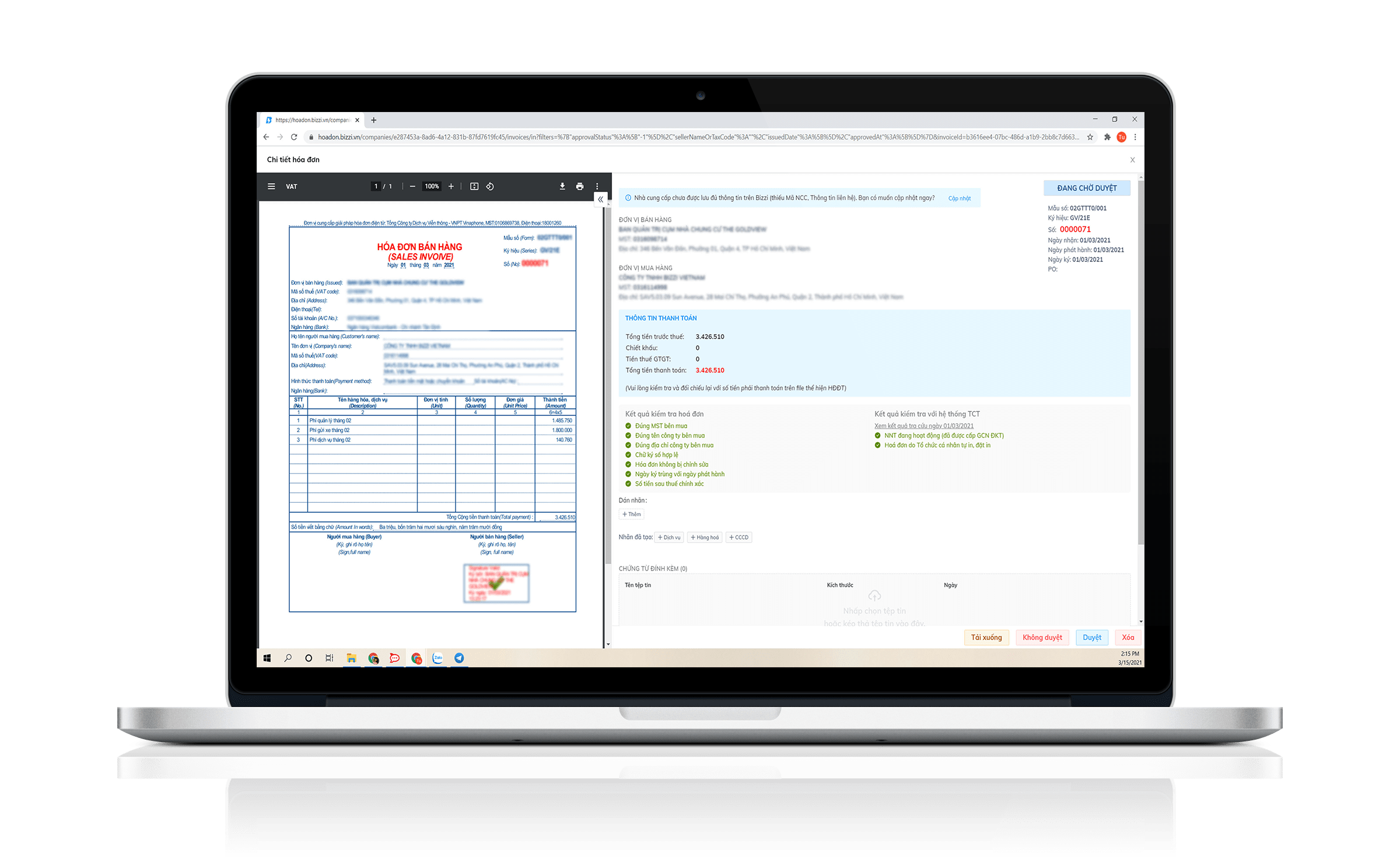

Bizzi - Automated and comprehensive Invoice management technology solution

- Automatically extract, check the validity of Invoices.

- Reduce 80% time to process incoming e-invoices.

- Manage and store invoices efficiently and scientifically.