Recently, the General Department has announced a notable list, including 637 enterprises identified as being involved in risky behavior and illegal invoice sales. The list of 637 risky enterprises and illegal invoice sales will be mentioned in the content of the article. Bizzi hereafter.

List of 637 risky enterprises, buying and selling value added invoices of the General Department of Taxation

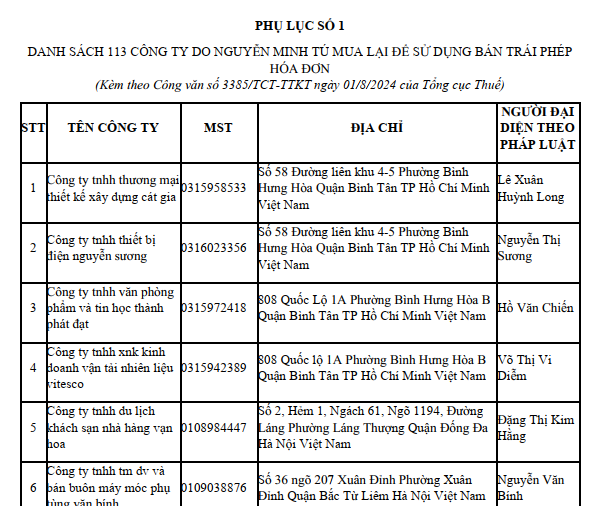

On August 1, 2024, the General Department of Taxation had Official dispatch 3385/TCT-TTKT year 2024 on reviewing and handling illegal invoices.

Accordingly, the content of the dispatch clearly states that in order to continue handling taxes on illegal acts of buying and selling invoices, the General Department of Taxation requests the Tax Departments to:

– Implement electronic invoice data mining, collect paper invoices of 113 companies (in addition to 524 companies that illegally buy and sell invoices at Official dispatch 1798/TCT-TTKT year 2023 out of a total of 637 companies illegally selling value-added invoices according to Judgment No. 115/2023/HS-ST dated December 29, 2023 of the People's Court of Phu Tho province and many other provinces and cities across the country) to apply tax management measures according to regulations

– In case the taxpayer under the management of the tax authority uses invoices of 113 companies announced by the General Department of Taxation to declare taxes, the tax and invoices shall be considered and handled according to the regulations and instructions in Official dispatch 1798/TCT-TTKT year 2023.

The list of 637 businesses involved in risks and illegal sales of invoices includes:

– 524 enterprises with invoice risks, listed in Official Dispatch 1798/TCT-TTKT dated May 16, 2023. Download here

– 113 enterprises illegally selling invoices, as stated in Official Dispatch 3385/TCT-TTKT dated August 1, 2024. Download here

How to prosecute criminal liability for illegal trading of VAT invoices?

Pursuant to Article 203 Penal Code 2015 (Amended by point k, clause 2, Article 2) Law on Amendment of Penal Code 2017) stipulates that the act of buying and selling invoices will constitute the crime of illegal trading. bill when one of the following cases occurs:

– Illegally printing, issuing, buying and selling invoices and documents for state budget payment in blank form from 50 to less than 100 numbers;

– Illegally printing, issuing, buying and selling invoices and documents with content from 10 to less than 30 numbers;

– Illegal profits from 30,000,000 VND to under 100,000,000 VND from the act of illegally printing, issuing, buying and selling invoices and documents for payment to the state budget.

The penalty for individuals and organizations committing the crime of illegally buying and selling invoices is as follows:

(1) For individuals:

– Fine from 50 to 200 million VND, non-custodial reform for up to 03 years or imprisonment from 06 months to 03 years for cases of illegal trading of blank invoices from 50 to less than 100 numbers or invoices, documents with content from 10 to less than 30 numbers or illegal profits from 30,000,000 VND to less than 100,000,000 VND.

– Fine from 200,000,000 VND to 500,000,000 VND or imprisonment from 01 year to 05 years if committing a crime in one of the following cases:

+ Organized;

+ Professional;

+ Abuse of position and power;

+ Invoices and documents in blank form of 100 numbers or more or invoices and documents with recorded content of 30 numbers or more;

+ Illegal profits of 100,000,000 VND or more;

+ Causing damage to the state budget of VND 100,000,000 or more;

+ Dangerous recidivism.

– Offenders may also be fined from VND 10,000,000 to VND 50,000,000, banned from holding positions, practicing a profession or doing certain jobs from 01 to 05 years.

(2) For commercial legal entities

– A fine of VND 100,000,000 to VND 500,000,000 shall be imposed on a commercial legal entity that illegally buys and sells invoices in blank form from 50 to less than 100 numbers or invoices and documents with content from 10 to less than 30 numbers or illegally profits from VND 30,000,000 to less than VND 100,000,000.

– Fine from 500,000,000 VND to 1,000,000,000 VND if committing one of the following crimes:

+ Organized;

+ Professional;

+ Invoices and documents in blank form of 100 numbers or more or invoices and documents with recorded content of 30 numbers or more;

+ Illegal profits of 100,000,000 VND or more;

+ Causing damage to the state budget of VND 100,000,000 or more;

+ Dangerous recidivism.

– Permanent suspension of operations if the crime falls under the provisions of Article 79 Penal Code 2015

– Commercial legal entities may also be fined from VND 50,000,000 to VND 200,000,000, banned from doing business, banned from operating in certain fields from 01 year to 03 years or banned from raising capital from 01 year to 03 years.