More than a quarter of those anticipating change say the new job will require a different or previously unknown skill set, according to new data from EY.

While many chief financial officers (CFOs) are seeing their job requirements change over time, one of their most important colleagues—financial controllers—is also thinking about upcoming changes in their roles.

The emergence of new technology, risks, and regulatory compliance requirements are not only changing the way reporting and budgeting are done, but are also leaving some financial controllers concerned about the future of their roles and uncertain about the skills needed to meet the evolving demands of the job.

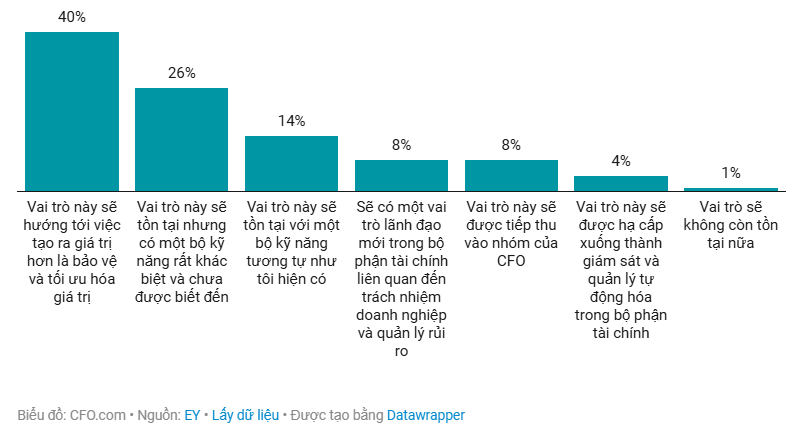

According to the latest EY report, the majority of financial controllers believe their role will change within the next five years. In the survey DNA of the Financial Controller Survey, 86% respondents believe their role will change significantly. Notably, 26% believe their job in the next 5 years will require a completely different and less defined skill set than it does now.

New requirements for future financial controllers

While some of the required skills are still unclear, the way financial controllers create value is likely to change. Instead of simply overseeing operations and reporting functions, 40% financial controllers predict they will act as “value optimizers” across the entire finance function.

The role of the financial controller in the future

Based on current experience, how do you think the role of the financial controller will change in the next 5 years?

Notably, 20% financial controllers said their roles would change or be demoted. Specifically, some said they could take on a new role in corporate social responsibility and risk management (8%), become part of the CFO team (8%), or be demoted to overseeing finance department automation (4%).

In addition, there is a trend toward integrating the financial controller role with other positions in the organization. Some large companies have experimented with combining the financial controller with the strategic management role, creating a more integrated position to optimize resources. This poses a significant challenge as controllers must expand their knowledge into areas such as project management, international business, and even marketing.

Value Creation and ESG Concerns

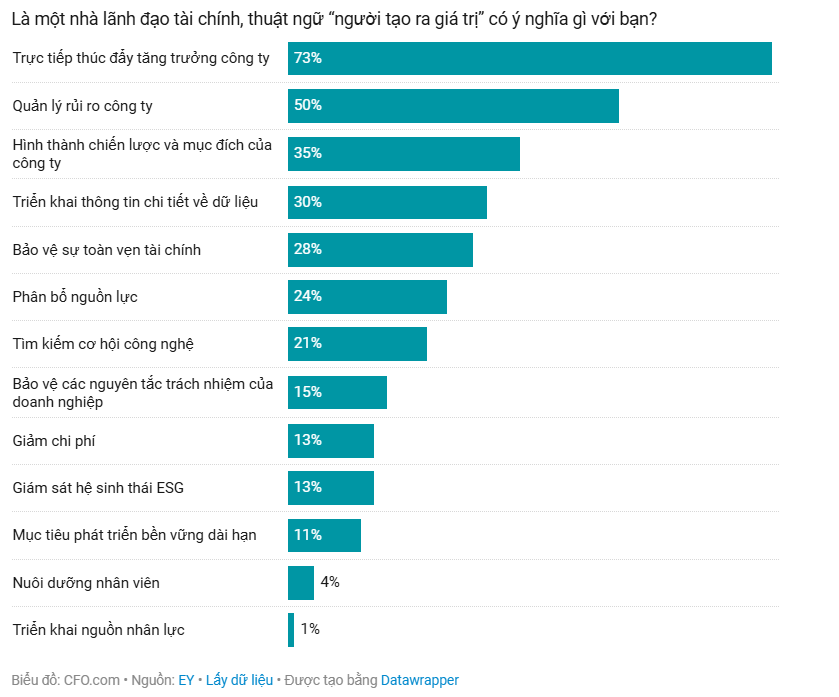

For those financial controllers who want to continue to contribute long-term value to their organizations, the ways in which they believe this can be achieved vary widely. When asked to define the term “value creator,” the most common response (73%) was “directly contributing to business growth.” However, this response became more nuanced when detailed:

- 35% believes in creating value by shaping the company's strategy and goals.

- 30% Choose how to implement deep data analytics.

- 28% emphasize the role of protecting financial integrity.

- Other options include resource allocation (24%), cost reduction (14%), and achieving long-term sustainability goals (11%).

However, to truly become “value creators,” financial controllers need to have a broader view of the entire business process. Using financial data not only for reporting but also to support strategic decision-making will help them strengthen their position within the business. At the same time, close cooperation with other departments such as marketing and R&D is also expected to become an integral part of their work.

On the environmental, social, and governance (ESG) front—an area where CFOs are under pressure to devote resources—less than half (43%) of financial controllers expect to be regularly involved in the next five years. While that’s up from 36% today, ESG-related roles are likely to shrink or be eliminated by the end of the decade as ESG requirements and financial controller responsibilities continue to evolve.

The biggest challenge in engaging with ESG is the lack of alignment between regulatory requirements and each company’s implementation strategy. Financial controllers need to clarify their role in ESG reporting, from risk assessment to information management related to sustainability goals.

Confidence in role

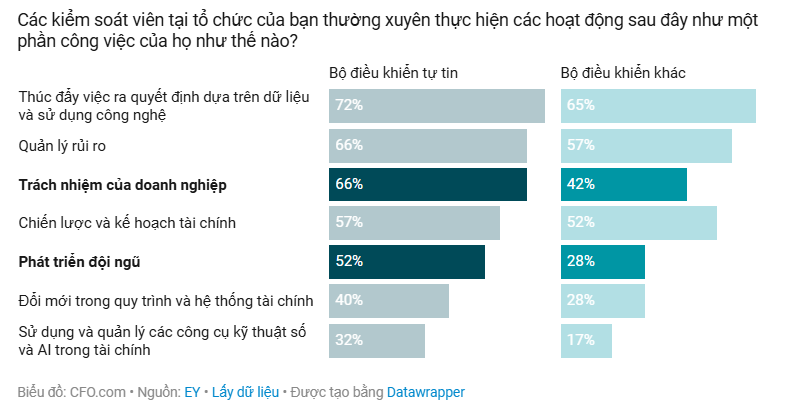

By identifying a subset of their data set, called “confident financial controllers,” the researchers used the quality of individual responses (focusing on factors like technology, advanced data analytics, sustainability, and innovation) to score them from 1 to 100, then selected the top quartile (top 25%). This allowed them to quantify the difference between the confident controllers and the remaining group, called “others.”

The most common actions taken by the confident financial controller group were making data-driven decisions and using technology (72% vs. 65% for the other group). The biggest differences between confident controllers and the other group were in areas such as corporate social responsibility and team development (the confident group was 24% higher in both areas).

Confidence comes not only from technical skills but also from the ability to adapt to change. With the rapid pace of technology and globalization, confident financial controllers are those who constantly learn, seize opportunities to improve processes and contribute more strategic value to the business.

Survey DNA of the Financial Controller Survey conducted anonymously online with 1,000 financial controllers and 280 senior finance leaders, including CFOs, to gain their perspectives on the role of the financial controller.

The rapidly changing business landscape requires financial controllers to move beyond their traditional roles and become strategic value creators. This requires not only highly specialized skills but also flexibility and the ability to continuously learn to adapt to new trends. Finance controllers who leverage technology, data and ESG will be key to leading finance functions further into the future.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam