Currently, Account Payable involves many parties with large amounts of data and many manual processes, so it is considered quite complicated. However, with the advent of new technologies and innovative solutions, the accounts payable administration process has changed significantly in recent years.

In this article, Bizzi will cover the latest Account Payable trends for 2023 and how businesses can take advantage of these advances to streamline finance and accounting operations to increase efficiency. High productivity, optimized costs.

Latest Account Payable trends 2023

Here are some of the top accounts payable trends in 2023:

- Automation and AI

- Increasing adoption of electronic payments

- Use data analytics and reporting

- The importance of data security

- Apply blockchain technology

Automation and artificial intelligence (AI)

One of the biggest trends in Account Payable for 2023 is increased use of automation and AI. Automated account settlement systems can streamline the process by reducing manual errors and increasing efficiency. AI algorithms can analyze invoices, identify patterns and anomalies, and make predictions based on previous data. This will help organizations save time, improve accuracy and reduce the risk of fraud.

For example, AI-powered tools can be used to automatically process and reconcile invoices, which is often a manual and time-consuming process. By automating the process, organizations can reduce invoice processing time, improve accuracy, and eliminate manual errors.

Increasing adoption of electronic payments

Electronic payments are becoming more and more popular in the accounts payable process as they offer many benefits over traditional payment methods. Electronic payments can be made by various methods such as credit or debit cards, mobile payments and online banking, and can be processed faster and more securely than paper payments.

In addition to the added convenience, speed, and security that come with electronic payments, they help reduce the risk of fraud and error, and provide businesses with enhanced visibility and control over their cash flow.

Use data analytics and reporting

Data analysis and reporting can help businesses better understand their payments process and identify areas for improvement. As PwC's report shows, 68% CFO recognizes the growth of this trend and is investing in analytics technology to gain a competitive position in the future.

By analyzing data such as payment times, supplier performance, and trends in invoice volume and volume, businesses can identify bottlenecks and inefficiencies, and address them. Make informed decisions about their accounts payable strategy.

To effectively leverage data analytics to improve and refine reporting in accounts payable, businesses may need to invest in data visualization and management tools and train their employees on analyze and interpret data.

Supply chain management

Another accounts payable trend for 2023 is an increased focus on supply chain management. As organizations strive to optimize cash flow and reduce payment times, they are looking for ways to better manage their supply chains. This includes working closely with suppliers to understand their payment requirements, as well as exploring new payment methods that can help streamline the process.

Organizations can use electronic invoices to automate the receipt and approval of invoices. By digitizing invoices, organizations can reduce invoice processing time and improve the accuracy of payment information. This can help organizations better manage their cash flow and reduce payment times.

> See more: The first automated invoice processing platform in Vietnam

The importance of data security

As businesses increasingly adopt technology to manage their AP processes, the importance of data security will continue to grow. Hackers and cybercriminals are constantly looking for ways to access sensitive financial data, and it's important for businesses to take steps to protect themselves from such financial disasters. In 2023, we could see enterprises invest in stronger cybersecurity measures to protect their AP data.

With an increasing amount of sensitive financial information involved in the accounts payable process, organizations are placing more emphasis on data security and privacy. This includes protecting sensitive information, such as payment information, from unauthorized access and data breaches.

Applying blockchain technology – Blockchain

Blockchain has the potential to revolutionize the way businesses manage their Account Payable processes. By using a secure, decentralized ledger to track financial transactions, businesses can reduce the risk of fraud and error, while improving transparency in their AP processes. In 2023, we may see more businesses adopting blockchain technology in their AP processes.

From the growing adoption of AI and ML (machine learning) technologies to the growing importance of data security, there are many exciting developments to look forward to in the AP world.

By keeping up with these trends, embracing the latest technologies, and leveraging high-quality employee enhancement solutions like those Bizzi offers, businesses can hopefully optimize their processes. your AP program to improve cash flow and manage supplier relationships.

> See more: Global fever – ChatGPT

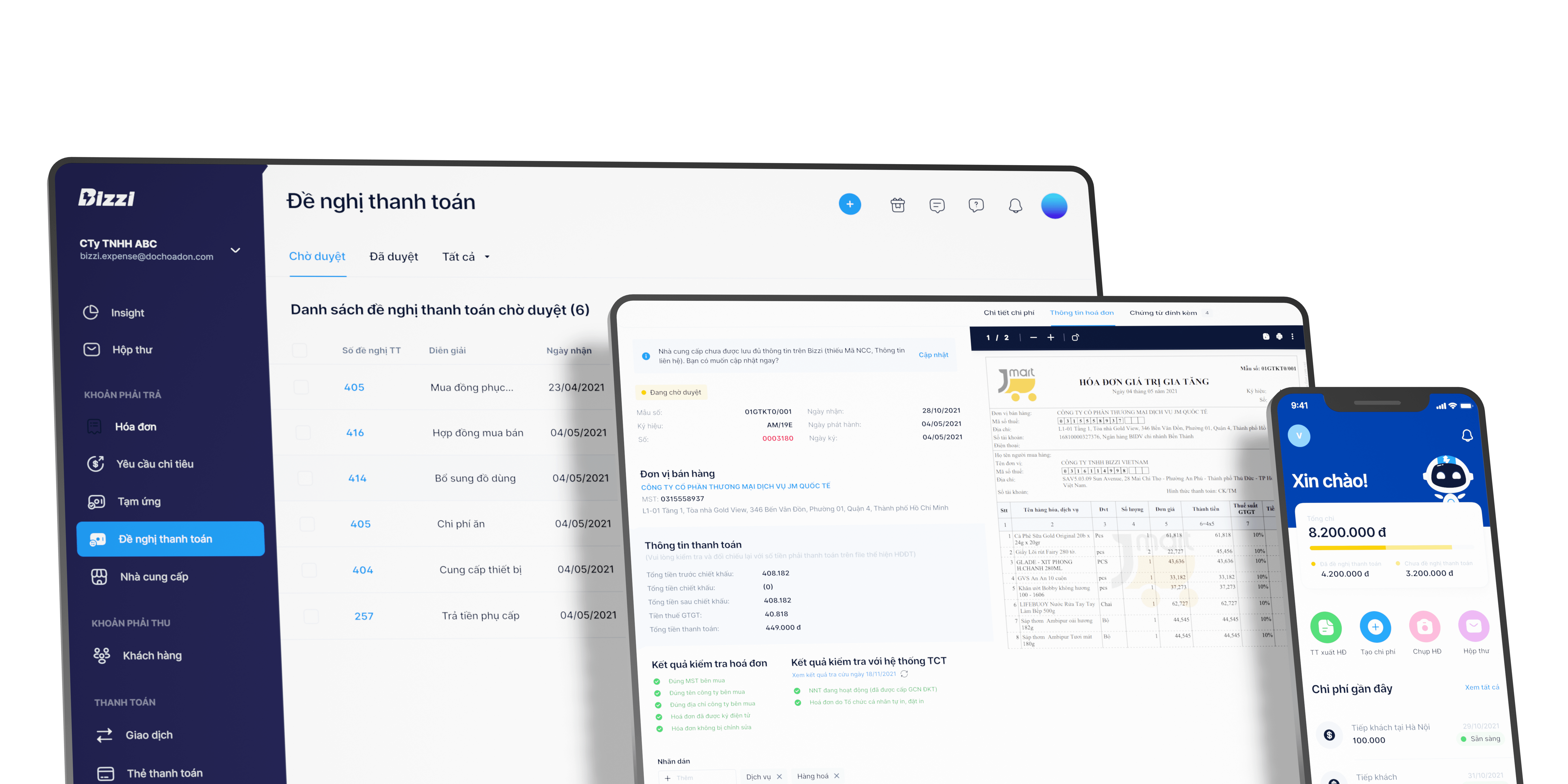

With Bizzi – Cost control and management platform for businesses that helps manage payables, with just a few taps you can easy lookup, monitor and control debt per supplier invoice. Accountants only need to enter supplier and debt information, then select a supplier to be able to record debts automatically.

Based on the automation platform of Machine Learning applications, Bizzi helps businesses automatically receive and store electronic invoices with a streamlined invoice loading and management process. Accountants can extract data that matches the accounting software and system they are using for reconciliation. In parallel with Bizzi, software Automatic payment due reminder of the business to the supplier

Bizzi's automation solution for processing incoming invoices along with the ability to manage payables to suppliers according to invoices can help accountants save up to 80% time compared to manual processing.

Above is the latest information about Account Payable trends in 2023. Hopefully the information Bizzi provides will be useful to you and your business!

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam