To overcome the situation of restaurants, eateries, and hotels avoiding issuing electronic invoices, with potential risks of tax revenue loss, the Ministry of Finance said that it is perfecting the legal basis for sellers to issue invoices to customers. customer per transaction.

Together Bizzi Learn about issues related to issuing electronic invoices for food and beverage services for guests!

Current status of issuing invoices to customers at food service locations?

The status of issuing invoices to customers at food service locations has attracted the attention of the Ministry of Finance, especially on December 6 when the Ministry responded to many restaurants, eateries, and hotels. Failure to issue electronic invoices causes a potential risk of tax loss.

Reality often shows that many businesses in the food and entertainment sector often "forget" to issue VAT invoices to customers, even though tax is still included in the payment invoice. On the contrary, many buyers do not care about receiving invoices, while some businesses do not have the conditions to record costs, so they often request VAT invoices when working with customers to bring in company and expense recognition.

The main cause of this situation, according to the Ministry of Finance, is due to non-compliance with the provisions of Article 90 of the Law on Tax Administration dated June 13, 2019. According to this law, the seller must prepare an electronic invoice with full content according to the provisions of tax and accounting laws. Although electronic invoices have been applied since July 1, 2022 and have been uniformly implemented nationwide, there are still many cases of violations.

To solve this problem, the General Department of Taxation (Ministry of Finance) has proposed a series of solutions. First, they have increased propaganda to sellers and buyers about the rights and obligations of issuing invoices. The tax industry is also deploying electronic invoices from cash registers for retail businesses, such as restaurants and other retail goods and services. At the same time, the General Department of Taxation is drastic in coordinating with agencies and localities to review and handle violations of business establishments that do not issue invoices.

The "Lucky Invoice" program is also continued to be implemented with the goal of motivating consumers to get invoices when purchasing goods and services. At the same time, this program puts pressure on sellers and requires them to issue invoices when selling goods and services. This form of invoice not only helps optimize costs and ease management, but also contributes to improving tax management capabilities for businesses in this field.

Regulations on electronic invoices for food and beverage services

The Ministry of Finance issued Circular 78/2021/TT-BTC on instructions for implementing a number of articles of the Law on Tax Administration and Decree 123/2020/ND-CP regulating invoices and documents with the goal of promoting Deploying electronic invoices for food service businesses.

These businesses must also use electronic invoices with tax authority codes created from cash registers with a data transfer connection to the Tax Authority.

Contents on the invoice comply with Article 6, Circular No. 32/2011/TT-BTC.

- The electronic invoice shows the full list of goods sold, ensuring the information contained in the electronic invoice

- Invoices must be accessible and usable in complete form when necessary

B-Invoice Meet the issue of electronic invoices initiated from cash registers according to Circular 78, Decree 123

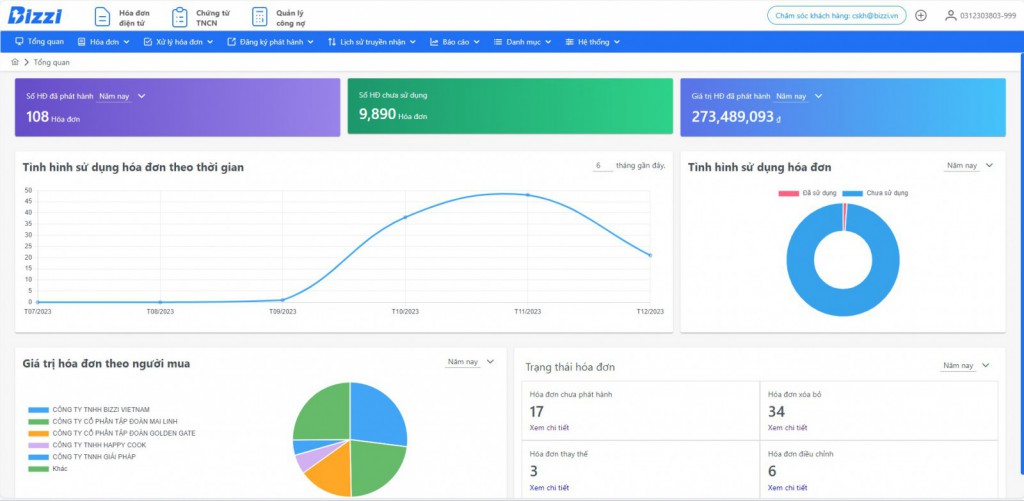

B-Invoice is a comprehensive electronic invoice solution for food service businesses such as restaurants, cafes, and eateries, supporting businesses to issue electronic invoices initiated from cash registers and Connect electronic invoice data to the system of the General Department of Taxation according to the provisions of Circular 78 and Decree 123.

Issuing electronic invoices for food and beverage services initiated from the cash register not only helps businesses optimize costs but also saves time and effort for business owners in accounting and declaring with the Department. Tax.

- Easily connect data between electronic invoice software with POS machines and accounting software

- Fully meets all current circulars and decrees

- Look up invoices quickly, easily, and conveniently

- Ensure safety and security when issuing invoices

- Provide invoice templates according to regulations of the Tax Authority

- Dedicated, fast and professional support team from a reputable electronic invoice software provider

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam