According to the newspaper Digital World

The retail industry is facing a decisive crossroads as the turbulent economic landscape, unpredictable consumer behavior, and fierce domestic and international competition put many businesses in an increasingly difficult position. So how can businesses seize the opportunities and overcome the challenges, ready to take the initiative in this game?

Challenges and solutions for the retail industry in the face of consumer spending tightening trends

At the event “Decoding the Future of Vietnam Retail: Crossing Boundaries and Capturing New Trends” organized by Bizzi Vietnam in collaboration with partners on August 7, the aim was to help retail leaders update trends and grasp breakthrough solutions in the industry, especially when this is the final time to plan for the year-end shopping season.

According to a survey on the retail market in Vietnam, Ms. Ngoc Dung, Head of Nielsen IQ's Vietnam SMB Group, said that recently, everyone has easily noticed that most foods have increased in price, with the number up to 82%, meaning that out of 10 foods, 8.2 have increased in price.

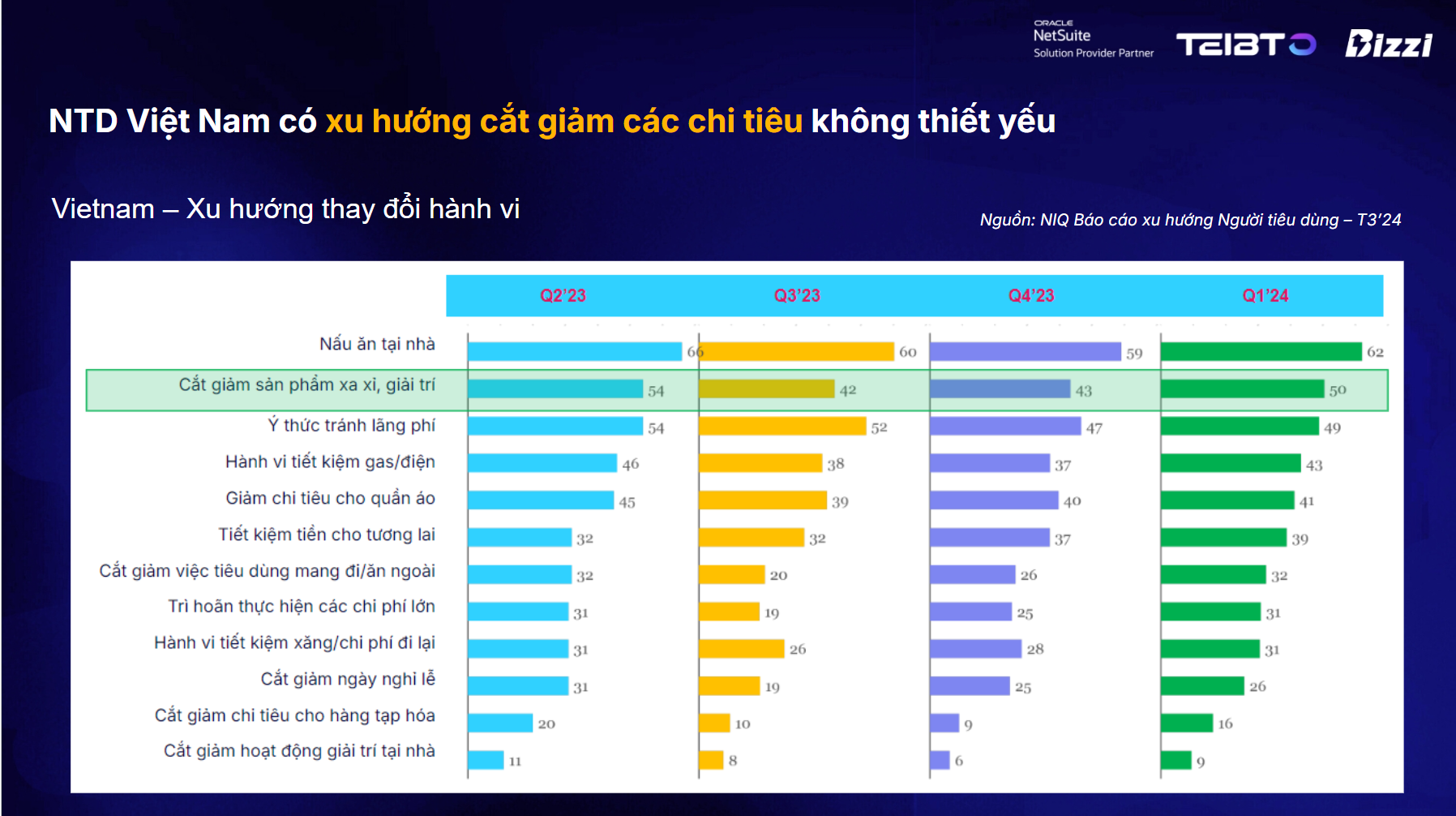

Nielsen's survey also shows that the majority of consumers still feel financially secure, but there are still concerns about the unstable economic situation and job losses. While many countries in Asia-Pacific are most concerned about food prices, Vietnamese consumers' top concern is the economy. They are very careful when considering the impact of the economy and tend to tighten spending and increase savings. Vietnamese consumers are also tending to cut down on non-essential spending.

Looking back at the FMCG industry in Q1 2024, growth was still maintained, however, this growth was mainly due to the increase in specific product categories during Tet, specifically only the Essential Food and Tobacco industries maintained stable growth compared to Q1ʼ23.

The survey also shows that traditional distribution channels (GT) tend to stagnate, only increasing in Q1'2024 due to Tet, but modern distribution channels (MT) still achieve stable growth. In addition, there is a decline between regions of traditional channels and a shift in consumption to modern channels. In the South, the pace of activities during Tet of media channels is also slower than other regions.

Price sensitivity has led to a change in shopping trends, 68% Vietnamese people check the prices of most products. Ms. Ngoc Dung also emphasized that consumer needs always change over time, to be successful, businesses need to have good ideas (determine needs, interests), good products (ensure products meet consumer expectations) and good promotion programs (learn about popular promotion models in the market).

Vietnamese consumers prioritize offline shopping for Food and Beverage products, while online shopping is purely for Non-Food and personal health care products. Even offline shopping channels have changed in shopping choices at store models, which is a trend of reducing shopping at large supermarkets, instead they increase spending at Minimarts (small supermarkets).

Nowadays, consumers are also getting used to the presence of new brands and products, however, they are no longer as eager to experience new products as before, most of them choose to buy their favorite products. Promotional programs today have little impact on brands and stores, because consumers are often only interested in promotional programs with brands and stores that they love.

Sharing from the consumer perspective, Nielsen IQ believes that consumers today are increasingly more careful in spending and increasingly interested in product details and product prices.

Consumers are willing to look for sales channels with preferential prices, looking for good deals to cope with the situation of increasing product prices. In addition, consumers pay a lot of attention to the quality of the product, according to the criteria of "buying the right value of the product". Therefore, brands need to prove the value of the products to consumers and convince them that the product is worth buying.

For manufacturers or retailers, it is necessary to have an effective sales strategy that meets the following criteria:

Right Point of Sale (Identify prime areas and stores with the highest consumer concentrations), Right Product (Plan the right product mix for each area), Right Price (Develop daily best-price and promotion strategies with detailed information and benchmark pricing), Right Display (Drive fact-based, consumer-centric merchandising and shelf decisions), Right Promotion (Measure in-store performance to adjust conditions for maximum return on investment).

Representing Oracle, onPoint, and Bizzi, they also introduced supply chain optimization and management visualization solutions to improve the shopping experience, increase customer loyalty, optimize order and inventory management, streamline workflows across multiple systems, and bridge the gap between manufacturers and consumers.

Bizzi is a Vietnamese startup founded in 2019, providing automation solutions applying 4.0 technology (Robotic process automation, machine learning, AI) for accounting and finance, helping to increase productivity and reduce costs for businesses.

With the orientation of developing comprehensive solutions from payables to receivables, Bizzi Vietnam provides software to automate the collection and payment process, helping to save 80% of time and 50% of costs compared to manual implementation. Up to now, the company has more than 2,000 corporate customers, including many domestic and multinational corporations, and banking and financial institutions, large retail chains, etc.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam