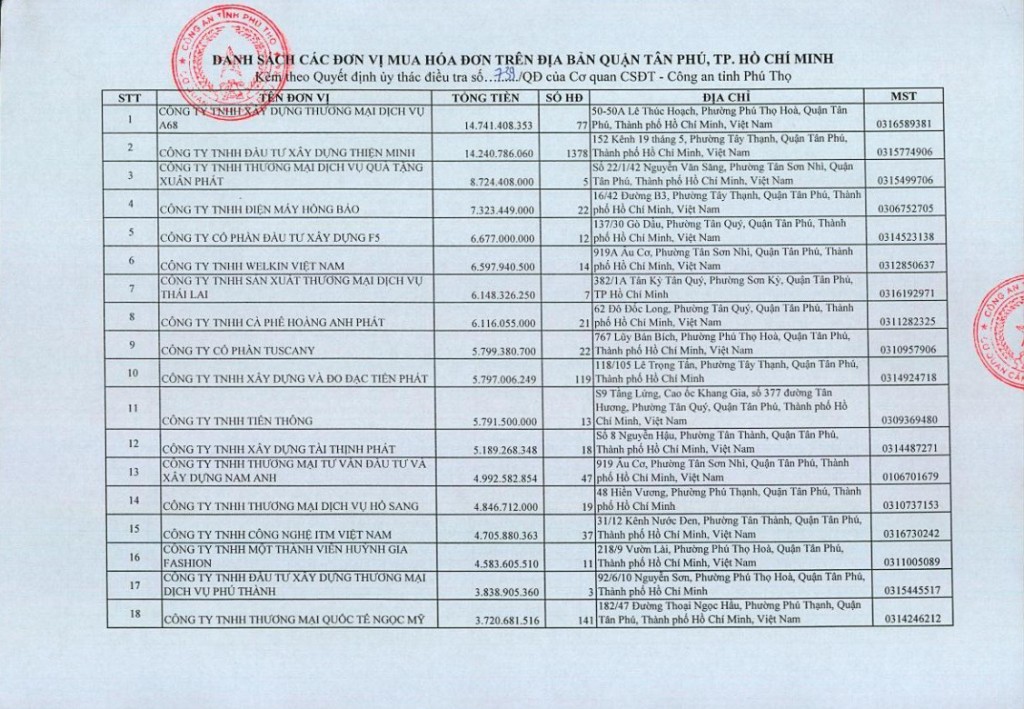

Tan Phu District Police has issued Official Dispatch 1328/ĐCSKT to the District Tax Department regarding the list of 1,520 businesses buying and selling invoices from ghost companies. Bizzi Find out in this article!

List of 1,520 businesses that purchased invoices from "ghost" companies established to sell invoices

According to the content of the document, the Investigation Police Agency of Phu Tho Province Police provided a list of 1,520 enterprises in Tan Phu district that purchased invoices from "ghost" companies established to sell invoices.

See the full list of 1520 companies here

Among them, there are about 1,386 enterprises with serial numbers from 135 to 1,520 according to the attached list. Official dispatch 1328/ĐCSKT Invoice value of purchase under 1 billion VND (with signs of VAT evasion under 100 million VND) is not enough to constitute a crime. "Tax evasion" as provided for in Article 200 Penal Code 2015 amended and supplemented 2017.

How is tax evasion punished?

Pursuant to Article 200 Penal Code 2015 amended and supplemented 2017 The provisions on tax evasion are as follows:

– Fine from 100,000,000 VND to 500,000,000 VND or imprisonment from 03 months to 01 year: for any person who commits one of the following acts of tax evasion with an amount from VND 100,000,000 to under VND 300,000,000 or under VND 100,000,000 but has been administratively sanctioned for tax evasion or has been convicted of this crime or of one of the crimes specified in Articles 188, 189, 190, 191, 192, 193, 194, 195, 196, 202, 250, 251, 253, 254, 304, 305, 306, 309 and 311 of the Law on Tax Administration. Penal Code 2015 amended and supplemented 2017, not yet cleared of criminal record but still violating

+ Failure to submit tax registration documents; failure to submit tax declaration documents; submission of tax declaration documents after 90 days from the deadline for submitting tax declaration documents or the expiration of the tax declaration dossier extension according to the provisions of law;

+ Not recording in the accounting books the revenues related to determining the amount of tax payable;

+ Not issuing invoices when selling goods or services or recording a value on the sales invoice lower than the actual payment value of the goods or services sold;

+ Using illegal invoices and documents to account for goods and input materials in activities that generate tax obligations, reducing the amount of tax payable or increasing the amount of exempted tax, the amount of reduced tax or increasing the amount of deductible tax, the amount of refunded tax;

+ Using other illegal documents and vouchers to incorrectly determine the amount of tax payable or the amount of tax refunded;

+ Falsely declaring exported and imported goods without supplementing the tax declaration after the goods have been cleared through customs, if not falling under the cases specified in Articles 188 and 189 of the Law. Penal Code 2015 amended and supplemented 2017;

+ Intentionally failing to declare or falsely declaring taxes on exported and imported goods, if not falling under the cases specified in Articles 188 and 189 of the Law. Penal Code 2015 amended and supplemented 2017;

+ Colluding with the shipper to import goods, if not falling under the cases specified in Article 188 and Article 189 of the Law. Penal Code 2015 amended and supplemented 2017;

+ Using goods that are not subject to tax, are exempt from tax, or are considered for tax exemption for purposes other than those prescribed without declaring the change of purpose of use to the tax authority.

– A fine of VND 500,000,000 to VND 1,500,000,000 or imprisonment of 01 to 03 years for tax evasion in one of the following cases:

+ Organized;

+ Tax evasion amount from 300,000,000 VND to less than 1,000,000,000 VND;

+ Abuse of position and power;

+ Committing the crime 02 times or more;

+ Dangerous recidivism.

– Fine from 1,500,000,000 VND to 4,500,000,000 VND or imprisonment from 02 years to 07 years: for tax evasion with an amount of 1,000,000,000 VND or more

– The offender may also be fined from VND 20,000,000 to VND 100,000,000, banned from holding positions, practicing a profession or doing certain jobs from 01 to 05 years or have part or all of his/her assets confiscated.

– For commercial legal entities committing tax evasion, the penalties are as follows:

+ Performing one of the acts specified in Clause 1, Article 200 Penal Code 2015 amended and supplemented 2017 Tax evasion with an amount from VND 200,000,000 to under VND 300,000,000 or from VND 100,000,000 to under VND 200,000,000 but has been administratively sanctioned for tax evasion or has been convicted of this crime or of one of the crimes specified in Articles 188, 189, 190, 191, 192, 193, 194, 195 and 196 of the Law. Penal Code 2015 amended and supplemented 2017, whose criminal record has not been cleared and who still commits a violation, shall be fined from 300,000,000 VND to 1,000,000,000 VND;

+ Committing a crime in one of the cases specified in points a, b, d and dd, Clause 2, Article 200 Penal Code 2015 amended and supplemented 2017, shall be fined from 1,000,000,000 VND to 3,000,000,000 VND;

+ Committing a crime under the provisions of Clause 3, Article 200 Penal Code 2015 amended and supplemented 2017, shall be fined from VND 3,000,000,000 to VND 10,000,000,000 or have its operations suspended for a period of 06 months to 03 years;

+ Committing a crime under the provisions of Article 79 of the Penal Code 2015 amended and supplemented 2017, shall be permanently suspended;

+ Commercial legal entities may also be fined from VND 50,000,000 to VND 200,000,000, banned from doing business, banned from operating in certain fields or banned from raising capital from 01 to 03 years.

Thus, depending on the level, behavior and nature of the crime, tax evaders may be prosecuted with appropriate penalties, with the highest penalty being a fine from VND 1,500,000,000 to VND 4,500,000,000 or imprisonment from 02 to 07 years.