Borrowing capital is an important part of every business's development journey. However, the business loan procedure is not always simple, especially for small and medium-sized enterprises or newly established businesses. Understanding and preparing carefully for this process will help businesses easily access the necessary capital for development. In this article, we will learn about business loan procedures from A to Z, including loan types, bank requirements, and effective loan support solutions.

1. What are the procedures for business loans?

Procedure business loan is the process by which a business accesses capital from financial institutions such as banks to meet its capital needs for business operations. This process includes preparing documents, appraisal, approval and disbursement.

2. Popular types of loans for businesses

Classification of loan form enterprise

Based on the deadline:

- Short term loans: Usually has a term of less than 12 months, used to supplement working capital, pay short-term debts, purchase raw materials, goods, etc.

- Medium term loan: Term from 12 months to 60 months, often used to invest in fixed assets such as machinery, equipment, factory construction...

- Long term loan: With a term of over 60 months, used to invest in large, strategic projects such as market expansion, research and development of new products, etc.

Based on collateral:

- Mortgage loans: Businesses must mortgage valuable assets such as factories, land, machinery, etc. to secure the loan. Interest rates are usually lower than other forms of loans.

- Unsecured loans: No collateral required, based on the business's reputation and financial capacity. Interest rates are usually higher than mortgage loans.

Based on loan purpose:

- Business loans: Used to supplement working capital, invest in production and business activities.

- Investment loans: Used to invest in new projects and expand production scale.

- Refinancing loans: Used to pay off old debts.

Popular forms of loans

- Loan by credit limit: The bank gives the business a certain credit limit, the business can withdraw money at any time within that limit.

- Overdraft: Businesses are allowed to withdraw money in excess of their current account balance.

- Voucher discount: The bank buys back valuable documents (invoices, receipts, etc.) from the business to pay in advance a part of the value.

- Letter of credit: The bank undertakes to pay a third party upon meeting certain conditions.

- Guarantee: The bank commits to take responsibility for payment on behalf of the enterprise in case the enterprise fails to fulfill its obligations.

3. Preparation steps before proceeding with business loan procedures

Before proceeding with the business loan procedure, the business needs to prepare carefully to ensure that the loan application fully meets the bank's requirements. This preparation process will make it easier for the business to convince the bank and increase the possibility of loan approval.

Identify specific loan needs:

Businesses need to clearly define the loan amount, loan purpose, and repayment period. Clearly defining the capital usage target will help the bank understand the business's plan and evaluate the feasibility of the project.

Verify the financial capacity of the business:

Assessing financial capacity is an important step before borrowing money. Businesses need to check their cash flow, assets, and debts to make sure they can repay their debts on time. A transparent and accurate financial report will help increase the trust of the bank.

Prepare necessary documents:

Loan applications require documents such as business licenses, financial statements, employment contracts, and other financial documents. These are basic elements that banks require to assess the validity of the loan.

Consider suitable banking options:

Each bank will have different loan packages with their own incentives and requirements. Businesses need to carefully research banks to choose the loan package that best suits their needs and capabilities.

4. Business loan procedures for each type of business

Each type of business will have different loan procedures. Below are specific procedures for small and medium enterprises, newly established businesses, and bank loan procedures for businesses.

4.1. Loan procedures for small and medium enterprises

Loan conditions:

Small and medium-sized enterprises are often given priority in loan programs with preferential interest rates and simple procedures. However, enterprises need to meet some basic requirements such as having the ability to pay, full financial reporting, and having a reasonable capital usage plan.

Loan procedures:

The loan process for small and medium-sized enterprises usually includes the following steps: submitting loan applications, financial appraisal, and signing contracts. Banks may also require collateral to secure the loan.

Disbursement time:

Typically, disbursement time for small and medium enterprises will be faster than for other types of businesses, possibly from 5-7 working days.

4.2. Loan procedures for newly established businesses

New businesses will face some difficulties when borrowing money, especially if they lack a credit history. Banks will require businesses to provide a detailed business plan, profit projections and a feasible repayment plan.

Loan conditions:

Banks require startups to have a clear, actionable business plan and a capable management team to run the business.

Loan procedures:

The procedure for borrowing capital for newly established businesses is quite complicated, including preparing legal documents, proving the feasibility of the business plan, and sometimes requiring a guarantor or collateral.

4.3. Procedures for bank loans for businesses

This is the most common loan procedure that businesses must follow. The process of borrowing money from a bank for a business includes many steps from submitting a loan application, financial assessment to signing a loan contract. The bank will require the business to provide financial statements, collateral, and proof of repayment ability.

Bank loan conditions:

Banks will evaluate a business's financial capacity through indicators such as solvency, cash flow, and credit history. Businesses with collateral or good reputation in the market will have an easier time getting approved for loans.

5. Common bank loan conditions for businesses

Banks have their own lending conditions, but there are some general requirements that all businesses must comply with.

Payment capacity:

Businesses need to demonstrate that they have a steady cash flow to repay their debts. This can be demonstrated through financial statements and other documents related to the business's cash flow.

Collateral (if required):

Banks will require businesses to provide collateral if the loan is of large value. Collateral can be real estate, vehicles, or other valuable assets.

Credit history:

A business's credit history is an important factor for banks to assess its creditworthiness. A business needs a good credit history to easily access loans with good terms.

Detailed capital usage plan:

Businesses need to provide a detailed capital utilization plan, demonstrating that the loan will be used for reasonable and profitable purposes.

6. Important notes to prepare successful business loan procedures

To increase the possibility of successful borrowing, businesses need to prepare complete documents, including business license, financial statements for the last 3 years, detailed business plan, and documents proving mortgaged assets (if any).

In addition, businesses also need to have a clear and feasible debt repayment plan to convince the bank of their ability to pay.

- Full and accurate profile: The profile must be complete, accurate and clear for the appraisal process to take place quickly.

- Good financial ability: Businesses need good financial capacity to convince banks to lend.

- Clear business plan: A detailed business plan will help the bank assess the growth potential of the business.

- Collateral: If you have collateral, your chances of getting a loan will be higher and your interest rate will be lower.

- Relationship with the bank: Maintaining a good relationship with your bank will help the loan process go more smoothly.

Note: Loan procedures may vary depending on the bank and time. Therefore, businesses should contact the bank directly for specific advice.

7. Business loan support solution – Bizzi Financing

Bizzi Financing What is that?

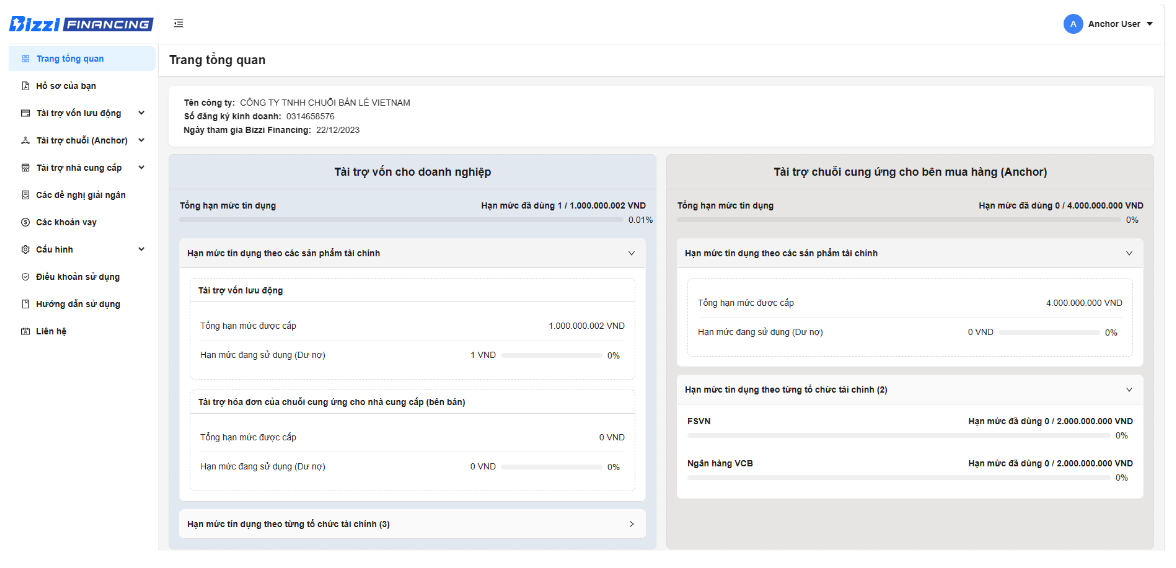

Bizzi Financing is an online financial platform that connects businesses with investors and financial institutions to provide fast, flexible and tailored lending solutions to each business's specific needs. With Bizzi Financing, businesses can access capital more easily and conveniently than traditional forms of borrowing.

Outstanding benefits:

- Quick process, no collateral required.

- Support small loans with fast disbursement time.

- Competitive interest rates and suitable for small and medium sized businesses.

Loan process through Bizzi Financing

- Register an account: Create an account on the Bizzi Financing platform and provide basic information about your business.

- Complete profile: Fill out the loan form completely, including information about the business, capital needs, capital usage plan, etc.

- Application review: Bizzi's system will automatically evaluate profiles and connect businesses with suitable investors or financial institutions.

- Signing the contract: If the application is approved, the business will sign an online loan contract with the investor or financial institution.

- Disbursement: The loan amount will be transferred to the business account within a short time.

Customer target

Bizzi Financing is suitable for all businesses, from startups to small and medium-sized enterprises that need capital to expand their business, invest in new projects or supplement working capital.

Register for Bizzi Financing information here: https://finance.bizzi.vn/

Conclude

Understand and prepare fully for business loan procedures is the decisive factor for businesses to access financial resources effectively. Whether you are a start-up or a small and medium-sized enterprise, carefully researching the steps and choosing the right financial partner will help you easily overcome financial challenges, creating a solid foundation for long-term development.

For businesses looking for a quick, flexible and simple loan solution, Bizzi Financing is the perfect choice. This modern financial platform not only helps businesses save time but also provides diverse loan packages, suitable for each specific need.

Monitor Bizzi To quickly receive the latest information: