Did you know that by 2024, the artificial intelligence (AI) market in the financial sector is worth $38.36 billion, with a forecast to grow significantly to $190.33 billion by 2030, driven by a robust compound annual growth rate (CAGR) of 30.6% (according to Yahoo Finance).

With over 3,876 mentions globally, these intelligent tools are increasingly popular among banks and insurance companies, making processes smoother and more efficient. McKinsey estimates that AI could help banks add up to $1 trillion a year by improving efficiency. As more companies adopt AI Agents in finance, they are better equipped to meet customer needs.

Let's explore how these AI Agents work and the ways they are being used in the financial sector.

How do AI Agents in Finance Work?

AI Agents in Finance can:

- Information Collection: Understand customer needs and collect important data.

- Make a Decision: Use past patterns and data to decide on loan approval.

- Keep Learning: Get smarter every time you interact with customers so you can keep improving.

How do they help people?

Imagine asking an AI agent to check if you can get a loan. AI Agents quickly review your financial data and tell you if you qualify, and what documents you need. This saves time and makes the process incredibly simple.

⚠️For example, when Klarna (a popular payment service provider) used AI for customer support, they were able to answer questions faster and make their customers happier.

Another real-world example is where HSBC has integrated AI into its customer service and fraud detection processes, using machine learning to identify suspicious transactions and alert customers in real-time. This proactive fraud detection has reduced losses and improved customer confidence in HSBC’s digital security.

>> See more: CFO's Guide: The Future of Accounts Payable (AP)

What are the applications of AI Agents in Finance?

AI Agents can process large amounts of data, detect patterns, and handle repetitive tasks, making them particularly useful in the financial sector. Here are some of the key applications and roles of AI in finance:

Application 1: Claim Adjustment in Insurance

In insurance, AI Agents handle claims adjustment, making it easier for people to file claims, especially after incidents like accidents. To maximize the efficiency of such AI-driven processes, companies can benefit from AI keyword research for the insurance business, ensuring targeted strategies to effectively address customer needs.

AI Agents collect details from the insured, such as incident type, parties involved, and required documentation.

- Customer Interaction: Users can initiate a claim by saying, “I’ve had an accident and need to file a claim.” The AI checks to see if all conditions are met, such as confirming the policy is active.

- Information Collection: AI Agents ask for specific details, make sure to collect all the necessary details.

- Real-Time Verification: Atlas Engine verifies information in the background, creates a claim record, and ensures everything follows pre-set actions.

- Approve: Once all checks are complete, approvals are processed faster, resulting in faster customer resolution.

Application 2: Automated Regulatory Compliance

With ever-changing regulations, financial institutions face the challenge of compliance. AI Agents continuously monitor regulatory changes, analyze data, and flag potential compliance issues, ensuring banks and organizations meet regulatory standards without manual oversight.

- Real-Time Monitoring: AI Agents monitor and report transactions or activities that deviate from regulatory standards.

- Automatic Reporting: Regular reports and audits are automatically generated, saving time for compliance teams.

- Quick Update: AI Agents adapt to new regulatory changes instantly, reducing the risk of non-compliance.

Application 3: Fraud Detection and Prevention

AI Agents in fraud detection analyze transactions to find unusual patterns that may signal fraud. By scanning data and detecting anomalies, AI Agents reduce the risk of fraud and keep financial systems safe.

- Pattern Recognition: AI Agents detect suspicious activity by comparing transactions with historical data, such as high volume transactions from new locations.

- Real-Time Alerts: If unusual behavior is detected, AI Agents will immediately send an alert to the security team for further investigation.

- Improve Decision Making: AI Agents can recommend measures based on the severity of the detected fraud risk, guiding human agents to act quickly.

Application 4: Personalized Asset Management

AI Agents help provide financial advice based on client profiles, risk tolerances, and investment goals. They manage portfolios, execute trades, and tailor investment strategies, making wealth management more accessible.

- Customized Investment Plan: AI Agents create plans that match clients' financial goals and risk levels.

- Real Time Updates: Investment recommendations are adjusted based on current market conditions, maximizing profit potential.

- Effective Implementation: Trades are executed automatically, saving time and potentially increasing profits.

Application 5: Financial Chatbot for Customer Service

AI-powered financial chatbots interact directly with customers, answering questions, providing account details, and guiding users through complex processes like opening a new account or setting up investments.

- Available 24/7: Chatbots provide instant support, regardless of time or location.

- Personalized Interaction: By understanding user preferences, chatbots make customized recommendations.

- Improve Customer Satisfaction: Rapid responses to frequent requests reduce wait times and improve the customer experience.

Real-world example: At Capital One, the AI-powered chatbot Eno helps customers check balances, review transactions, and monitor accounts for potential fraud. Eno’s learning algorithms allow it to better understand customer queries with each interaction, providing more efficient service over time.

Benefits of AI Agents in Financial Services

AI Agents offer several key advantages to financial institutions by streamlining operations, enhancing decision-making, and providing tailored solutions. The growing use of AI Agents for personalized financial planning highlights their ability to create customized strategies that align with individual financial goals and preferences.

- Increase Efficiency: By automating routine tasks, AI Agents free up employees for high-value tasks, like in-depth customer consulting or financial planning.

- Enhance Customer Experience: AI Agents provide round-the-clock support, personalized advice and reminders, helping to improve response times and increase customer satisfaction.

- Improved Accuracy: Machine learning models ensure accurate responses and continuously improve as the AI interacts with more customers.

- Scalability: AI Agents can handle high volumes of requests, allowing financial institutions to serve more customers without increasing staff.

- Stronger Security: AI Agents are equipped to detect unusual activity, such as fraud attempts, adding an extra layer of protection to financial transactions.

Challenges with AI Agents in Finance

While AI Agents offer many benefits, they also come with challenges. Here are the main issues companies face:

- Managing Multiple Agents: When different departments adopt AI Agents, it can result in a confusing setup with overlapping or redundant functions. Understanding how AI Agents work across different domains can provide insight into better integration.

- Integration and Coordination: Businesses need a well-organized plan to ensure all AI Agents work together without creating conflicts or gaps.

- Data Security and Privacy: Protecting customer data is essential. Companies must establish strong protocols to keep sensitive information safe from misuse.

- Human Supervision: AI Agents require careful supervision to avoid errors and adhere to ethical principles in customer interactions.

What is the Future of AI Agents in Finance?

AI is set to drive growth in financial services. As businesses move online and rely on digital tools, the need for personalized, relationship-based customer interactions is more important than ever. Here’s what the future holds for AI Agents in finance:

- Personalized Customer Support: AI will help banks give each customer personalized attention, making them feel important and understood. It’s like having a banking assistant who remembers your needs and gives you tailored advice.

- Smart Choices with Data: AI Agents can review customer information to recommend products or services that are best suited to people, helping them make safer and smarter decisions about their money.

- Building Customer Profile: Banks can create secure digital profiles that store important customer details, such as preferences and history. This helps banks provide more useful and friendly services based on customer preferences.

- Smooth service and connectivity: With AI connecting different parts of the bank, customers get seamless, uninterrupted assistance. No matter who they talk to at the bank, they get quick answers and solutions when they need them, like having a helpful assistant who knows everything about their needs.

AI Agents are revolutionizing finance with automation and personalization. Discover how these advancements fit into the Future of Generative AI to reshape industries.

Real-world examples: For example, digital banks like Revolut have used AI Agents in Finance to improve customer engagement by sending real-time alerts and providing personalized product recommendations.

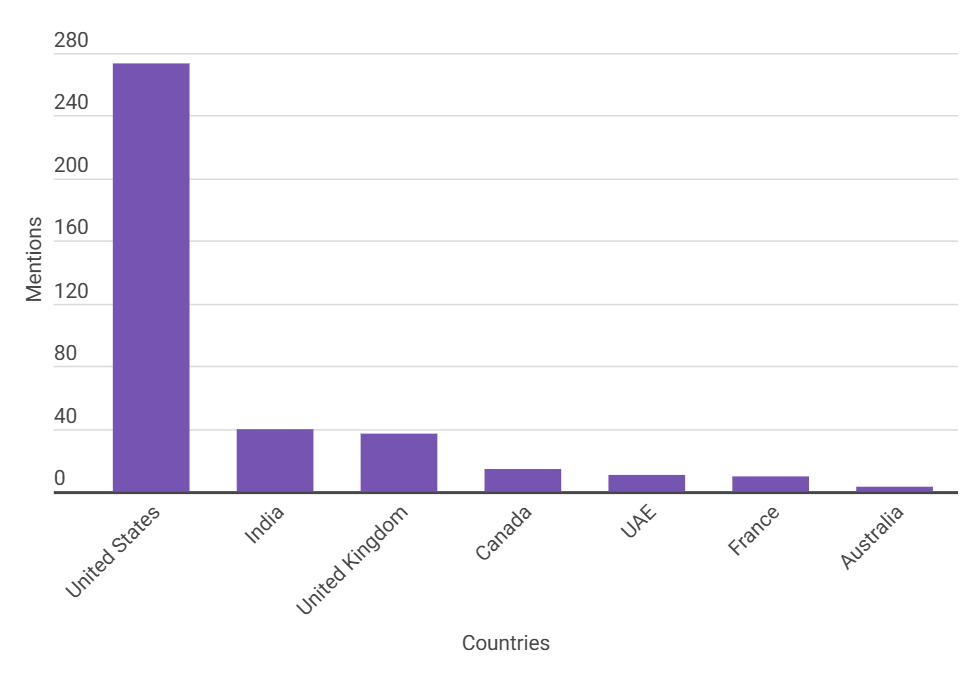

Regional Analysis of AI in Finance Covered (2021–2024)

We looked at 805 mentions of AI in finance from different countries and found that people around the world are interested in using this technology. Some countries are leading the way, while others are just getting started.

This research shows which regions are ahead, who is catching up, and which trends are making finance smarter from 2021 to 2024.

Here's a breakdown of the top areas leading the conversation about AI in finance:

- USA: Leading with 34% mentions (273 mentions), the US reflects its dominance in AI-driven financial technologies, supported by a strong fintech ecosystem and innovation hubs.

- India: With 4,97% mentions (40 mentions), India shows an increasing focus on AI to revolutionize digital payments, financial inclusion, and banking services.

- United Kingdom: Accounting for 4,60% mentions (37 mentions), the UK highlighted its leadership in integrating AI for banking, investment and regulatory compliance.

- Canada: With 1,74% mentions (14 mentions), Canada highlights its role as a hub for AI-powered fintech solutions and innovation.

- United Arab Emirates: Contributing 1,24% mentions (10 mentions), the UAE demonstrates its ambition to lead the adoption of AI in smart financial hubs and digital banking.

- France: With 1,12% mentions (9 mentions), France highlights its focus on AI for financial analytics and improving customer experience in banking.

- Australia: Representing 0.37% mentions (3 mentions), Australia expressed interest in using AI to improve operational efficiency in finance and investment.

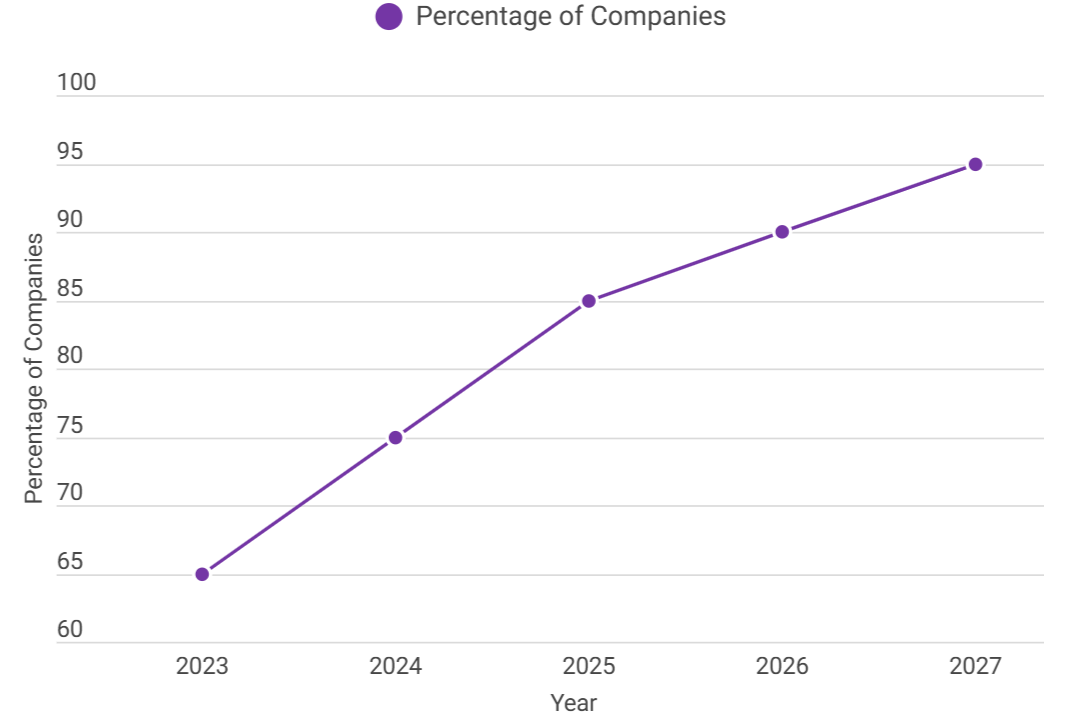

Will AI become essential for Finance Companies by 2025, moving beyond a Support role?

By 2022, more than half of financial firms will consider AI essential, and even more are expected to consider it essential by 2025. New AI-powered chatbots can now converse naturally with customers, but they must be carefully monitored to avoid providing inaccurate information.

Conclude

AI Agents in finance are changing the way banks and other financial services work, making things faster, safer, and easier for everyone. These intelligent agents help with tasks like loan approvals, claims processing, and helpful investment advice, making it easier for people to get the help they need.

With the ability to process tasks and detect unusual activity, AI Agents in finance are opening up new ways for banks to serve customers and make the financial industry more useful and secure.

Source: allaboutai

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam

- Youtube: https://www.youtube.com/@bizzivietnam