After Official Dispatch No. 1798/TCT-TTKT dated May 16, 2023 on reviewing and handling illegal invoices issued by the General Department of Taxation related to 524 businesses on the "black" list with many chemical risks. application, many opinions believe that this Official Dispatch has put taxpayers in a difficult position in the process of pursuing invoice violations.

Many problems occur when pursuing businesses that violate invoices

Faced with the complicated situation related to the illegal purchase and sale of invoices, the General Department of Taxation has requested tax authorities to review and handle tax violations related to this behavior.

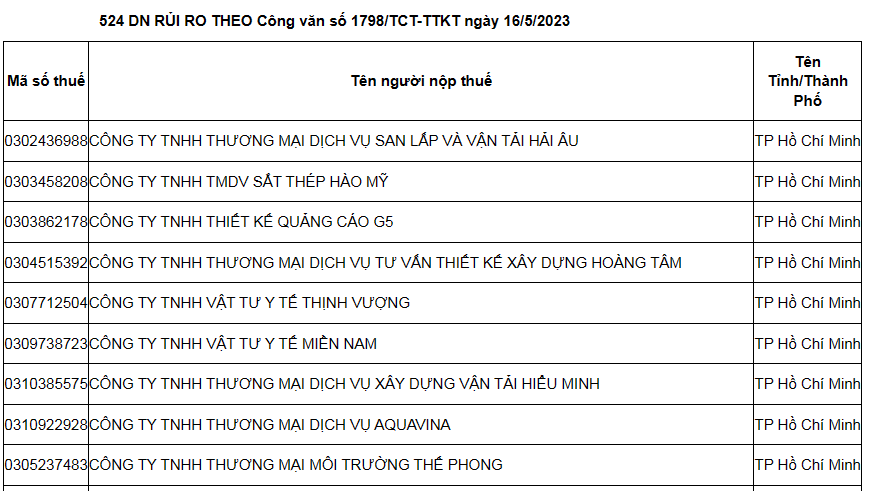

According to Official Dispatch No. 1798 of the General Department of Taxation, a "black" list of 524 businesses with higher risk potential has been selected, and tax authorities are recommended to focus on reviewing sales invoices. of these businesses.

In cases where an enterprise is discovered to have used an invoice from one of these 524 enterprises, the tax authority requires the enterprise to provide a detailed reason and explanation for the use of this invoice. The process of deducting value-added tax/refunding value-added tax, including the cost of calculating corporate income tax, as well as the legality of goods purchased illegally or related to smuggling.

Based on the specific violation and current provisions of the law, the tax agency will conduct tax handling according to regulations, or strengthen the process of document preparation to transfer to the police agency for review and investigation. handled according to the provisions of law.

In addition, tax authorities directly managing enterprises on the list of 524 enterprises will also conduct a review. In case a business is discovered to have issued sales invoices to businesses in other localities in 2020, 2021, or 2022, but this information does not appear in the General Department of Taxation's electronic invoice data, there will be The official written notification is sent to the corresponding tax authority to enter information into the invoice verification system. This is to facilitate coordination, comparison, review, and handling of violations according to the provisions of law. The General Department of Taxation emphasizes the importance of implementing these measures to ensure accuracy and compliance with tax regulations.

Although cracking down on counterfeit invoice trading activities is a necessary measure to ensure integrity in the tax process, during the implementation process, there have been reactions and controversies from tax authorities. The business operates honestly and complies with tax regulations.

There is information that many businesses have encountered difficulties when tax officials continuously require them to explain invoices that were confirmed and qualified by the General Department of Taxation some time ago. This situation often occurs when a business closes, stops operating or is reviewed and put on the "black list" due to a variety of different reasons.

There are opinions that requiring the buyer to explain invoices arising before the date the seller stops operations or absconds may not be reasonable in some cases. This may be related to the fact that tax authorities have not promptly monitored and managed businesses during their operations, creating conditions for this situation to occur.

Request information instead of inspection

Recently, many businesses have complained about the inconvenience when tax authorities continuously ask them to explain the use of invoices that have been certified by the General Department of Taxation and are eligible for use. This situation often occurs when businesses stop operating or are put on the "black list" due to a variety of different reasons.

However, the Ministry of Finance has informed that in recent times, tax authorities have cooperated with other State management agencies to identify businesses involved in buying and selling fake invoices. to legalize transactions of floating goods on the market and ensure accuracy in calculating corporate income tax.

The Ministry of Finance has also emphasized that resolving disputes and creating favorable conditions for businesses are important goals, especially for small and medium-sized enterprises. Instead of conducting inspections and tests at businesses, tax authorities can request relevant organizations and individuals to provide relevant information and documents to resolve tax liability issues and coordinate with the authorities. tax authorities to comply with the provisions of law.

The tax authority also issued Official Dispatch No. 1798/TCT-TTKT dated May 16, 2023 to encourage businesses with input invoices from 524 businesses selling illegal invoices to self-review and remove these invoices. application is not legal. This helps adjust tax declaration and accounting correctly for the state.

The Ministry of Finance reminds that taxpayers are responsible for complying with the decisions, notices and requests of tax authorities, and the use of illegal invoices may be punished according to the provisions of Articles 1 and 2 of this Article. 142 and 143 of the Law on Tax Administration No. 38/2019/QH14.

It should be noted that businesses need to declare taxes based on invoices consistent with actual transactions, ensuring compliance with current tax regulations. This will help avoid trouble and handle tax-related matters legally.

Bizzi supports reviewing invoices issued by 1,500 risky businesses

In order to accompany and support customers using Bizzi's services to minimize risks, customers who need to review the list of invoices issued by the above 1500 businesses, please send the request information to Bizzi's customer care team:

Applying advanced technology, Bizzi's automatic invoice processing software (IPA) helps businesses Automatically check the status and synchronize invoices with the system of the General Department of Taxation, quickly detect invoices. incorrect invoices and send timely warnings to help businesses ensure the legal validity of invoices. The software quickly processes only 10s/each invoice with the ability to store invoices scientifically, safely and securely for up to 10 years.

In addition, the software also supports businesses to synchronize order data and warehouse receipts from accounting software / ERP system to Bizzi and support accounting for accounting systems. All invoices are centrally stored and managed on an easy searchable system. Besides, the system supports automatically extracting invoice data according to the standard excel file format of each type of accounting software.

According to Bizzi's statistics, an average business will cost from 5,000 VND to 8,000 VND/invoice if done manually. If businesses use Bizzi's digital conversion solution for accounting, this cost is only about 1,000 VND/invoice, Bizzi will save at least 50% in costs for businesses, that is, only 1-2 employees are needed to process the transaction. physical. With Bizzi bot, the risk is minimized to the lowest level with an almost absolute accuracy of 99.9%. Bizzi is one of the few software on the market that can check the validity and validity of digital signatures and digital certificates.

Besides, the jobs that need 2-3 people to handle, now just need Bizzi to be able to balance the entire accounting department with 24/7/365 productivity without taking time off. Therefore, it can be said that Bizzi contributes to reducing work pressure for accounting staff if before, businesses often needed 2-3 employees to perform repetitive tasks. Now, it only takes Bizzi and 1 employee to be able to handle jobs with higher efficiency.

Currently, Bizzi has been trusted and used by +1200 large enterprises and corporations such as Tiki, GS25, Circle K, PNJ, P&G, VNG, Grab, Ikea, Sabeco, Pharmacity, etc.

- Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam