Recently, Thai Binh Tax Department has announced a list of 66 companies illegally selling invoices. Bizzi Vietnam sends you information about the list of companies with invoice risks.

List of 66 companies illegally selling invoices announced by Thai Binh Tax Department

On September 16, 2024, the Thai Binh Provincial Tax Department had Official dispatch 5108/CTTBI-TTKTI on coordinating the review and handling of illegal invoices of 66 enterprises.

Accordingly, implementing the direction of the General Department of Taxation on reviewing 66 enterprises "Illegal purchase and sale of invoices" and "Tax evasion" occurring in Hoa Binh province, Thai Binh province and other provinces and cities in Official Dispatch 3917/TCT-TTKT dated September 5, 2024 on strengthening the prevention of violations of the Law related to the tax sector. The Tax Department of Thai Binh province has coordinated with the Provincial Business Association and posted the List of 66 enterprises on the Electronic Information Portal of the Thai Binh Provincial Tax Department (Official Dispatch No. 5030/CTTBI-TTKT1 dated September 11, 2024) at the address http://thaibinh.gdt.gov.vn.

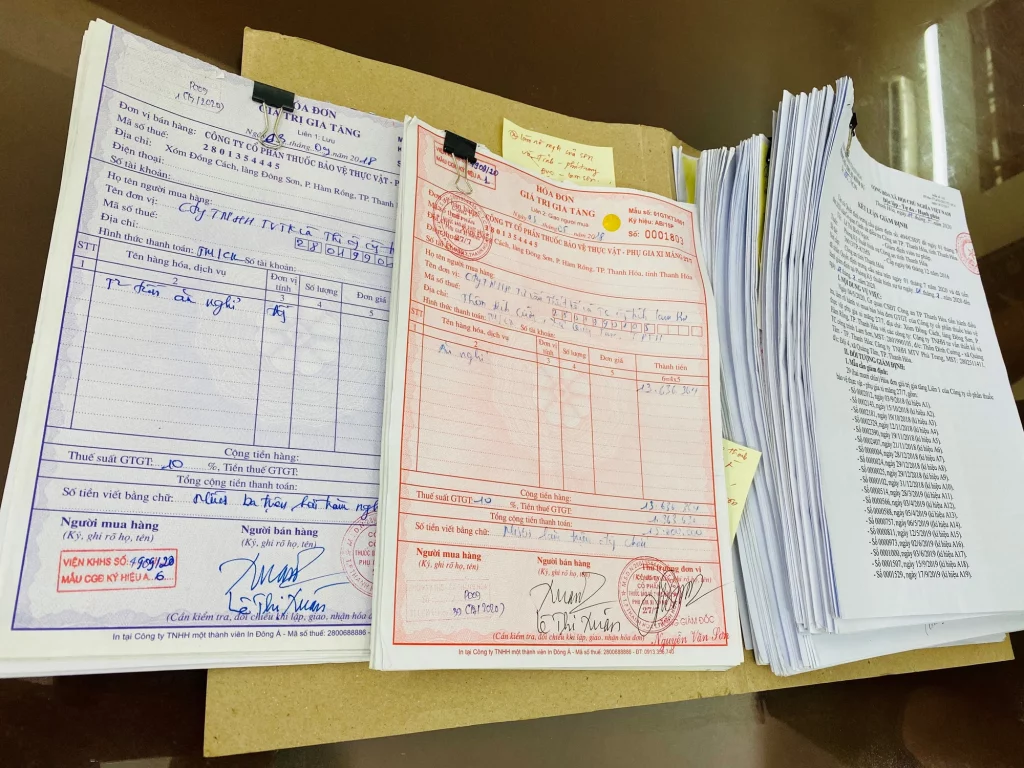

The following is a list of 66 companies illegally selling invoices announced by the Thai Binh Tax Department.

List of 66 companies illegally selling invoices

At the same time, the Thai Binh Provincial Tax Department also requested businesses to coordinate in reviewing Value Added Tax Invoices from 2020 to 2023, specifically:

– In case of purchase or sale, please provide:

+ Copies of purchase and sales invoices and documents related to the use of invoices.

+ Tax declaration, payment, accounting for the above used invoices.

– In case there is no purchase or sale with 66 enterprises, please coordinate in writing, including a specific commitment and take responsibility before the law for not having any purchase or sale transactions of goods or using invoices.

See details in Official Dispatch 5108/CTTBI-TTKTI dated June 19, 2024.

What acts are prohibited in the field of invoices and documents?

As provided in Article 5 Decree 123/2020/ND-CPProhibited acts in the field of invoices and documents include:

– For tax officials

+ Causing trouble and difficulty for organizations and individuals coming to buy invoices and documents;

+ Covering up or colluding with organizations or individuals to use illegal invoices and documents;

+ Accept bribes when inspecting and checking invoices.

– For organizations and individuals selling and providing goods and services, organizations and individuals have related rights and obligations.

+ Committing fraudulent acts such as using illegal invoices, illegally using invoices;

+ Obstructing tax officials from performing their duties, specifically acts of obstruction that harm the health and dignity of tax officials while inspecting and checking invoices and documents;

+ Unauthorized access, falsification, destruction of information systems on invoices and documents;

+ Giving bribes or performing other acts related to invoices and documents for illegal profit.