Supply chain finance for businesses is becoming an important financial solution, especially in the context of businesses facing pressure to manage cash flow and increasingly fierce competition. This is not only a tool to optimize finance but also improve the operational efficiency of the supply chain, ensuring sustainable development.

Understanding supply chain finance and how to apply it in practice will help businesses maximize the benefits of this tool. Let's explore more in the article below.

1. What is a supply chain?

Before delving into the concept of supply chain finance, we need to understand What is supply chain?. Supply chain is a system linking activities from the stage of input material production, processing, distribution until the product reaches the consumer. Each stage in the supply chain is closely connected to each other, from raw material suppliers, manufacturers, distributors to retailers.

Main components of the supply chain:

- Supplier: Ensure input materials.

- Manufacturer: Converts raw materials into products.

- Distributor: Brings products to retail channels or customers.

- Customer: End consumer.

Understanding what a supply chain is helps businesses identify the role of each link and find ways to optimize the flow of finances and goods in the system.

2. What is supply chain finance?

Supply chain finance is the use of financial solutions to support the flow of cash between links in the supply chain, thereby improving the operational efficiency of the entire system.

Supply chain finance is a form of financial financing that focuses on providing capital for activities within the supply chain. Instead of borrowing from banks to invest in inventory, businesses can use this form of financing to free up working capital, improve liquidity, and reduce financial risk.

Popular forms of funding:

- Inventory financing: Helps businesses maintain appropriate inventory levels to meet customer demand.

- Accounts receivable financing: Help businesses quickly collect receivables from customers.

- Accounts Payable Financing: Support businesses to pay payables to suppliers in a timely manner.

Supply chain finance for businesses not only helps reduce financial pressure but also builds sustainable cooperative relationships between stakeholders.

3. Benefits of supply chain finance for businesses

Supply chain finance brings many important benefits to businesses:

- Increase cash flow: Supply chain finance helps businesses improve cash flow, freeing up capital tied up in receivables, which can then be invested in other business activities.

- Improve competitiveness: With abundant capital, businesses can invest in technology, improve product and service quality, thereby increasing competitiveness in the market.

- Business expansion: Supply chain finance helps businesses scale production, meet customer needs and tap into new markets.

- Effective risk management: By spreading risk across the supply chain, businesses can minimize the impact of market fluctuations.

These benefits not only support businesses in operating their supply chains but also help them achieve their long-term development goals.

4. Subjects suitable for supply chain finance

Businesses of all sizes and industries can take advantage of supply chain finance. Supply chain finance is suitable for many types of businesses, especially those in the manufacturing, trading and service sectors.

However, this form of funding is particularly suitable for businesses that:

- Has a long and complex supply chain.

- Working capital is needed to meet production and business needs.

- Want to improve cash flow management efficiency.

- Want to minimize financial risk.

Businesses can take advantage of this form of funding to:

- Increase working capital: Meet short-term capital needs to pay payables, purchase raw materials, and pay employee salaries.

- Invest in technology: Upgrade production technology, improve product and service quality.

- Market expansion: Access new markets, increase competitiveness.

5. Challenges in supply chain finance

Despite the many benefits, supply chain finance for businesses also faces some challenges:

- Credit risk: Credit risk is one of the biggest challenges in supply chain finance. Businesses need to carefully assess the payment capacity of customers and suppliers.

- Market risk: Market fluctuations such as interest rates and exchange rates can affect the effectiveness of supply chain finance operations.

- Operational risk: Incidents such as production disruptions, natural disasters, and epidemics can cause disruptions in the supply chain and affect a business's ability to repay its debts.

To overcome this, businesses need to look for flexible funding solutions and reliable financial partners.

6. Steps to Successfully Implement Supply Chain Finance

To effectively utilize supply chain finance, businesses should take the following steps:

To maximize the potential of supply chain finance, businesses need to systematically implement the following steps:

6.1. Comprehensive capital needs assessment:

- Define clear goals: Clearly define the purpose of capital use, for example: supplementing working capital, investing in new technology, expanding the market, etc.

- Detailed analysis: Detailed analysis of costs in the supply chain, from raw materials to transportation, storage, and payments to suppliers.

- Capital requirement forecast: Based on business plan and influencing factors, forecast capital needs in the coming period.

6.2. Choosing the right funding model:

- Inventory financing: Suitable for businesses with large inventories, helping to improve liquidity and reduce storage costs.

- Accounts receivable financing: Suitable for businesses with many large customers, helping to quickly recover capital and increase cash flow.

- Accounts Payable Finance: Suitable for businesses that want to extend payment time to suppliers, reducing cash flow pressure.

- Project funding: Suitable for large investment projects, helping businesses raise capital to carry out production expansion and technology upgrade projects.

6.3. Compare and choose reputable partners:

- Selection criteria: Choose financial institutions with experience in supply chain finance, reputation, professional working process and competitive interest rates.

- Compare service packages: Compare service packages from different financial institutions to choose the service package that best suits your business needs.

6.4. Building long-term cooperative relationships:

- Information transparency: Provide financial partners with full information about the business, business plan and financial reports.

- Guarantee of payment: Demonstrate your business's solvency to increase the trust of financial partners.

- Build a debt repayment plan: Make a clear debt repayment plan and keep your commitments.

6.5. Monitoring and adjustment:

- Cash flow tracking: Closely monitor cash flow to ensure solvency.

- Effectiveness evaluation: Evaluate the effectiveness of loan use and adjust plans as necessary.

- Update information: Update information about the market and business situation to make timely decisions.

Supply chain finance is an effective financial tool that helps businesses optimize their operations. By following the above steps correctly, businesses can maximize the potential of supply chain finance, improve competitiveness and achieve sustainable growth goals.

7. Supply Chain Finance Solution for Businesses – Bizzi Financing: Optimize Cash Flow, Sustainable Growth

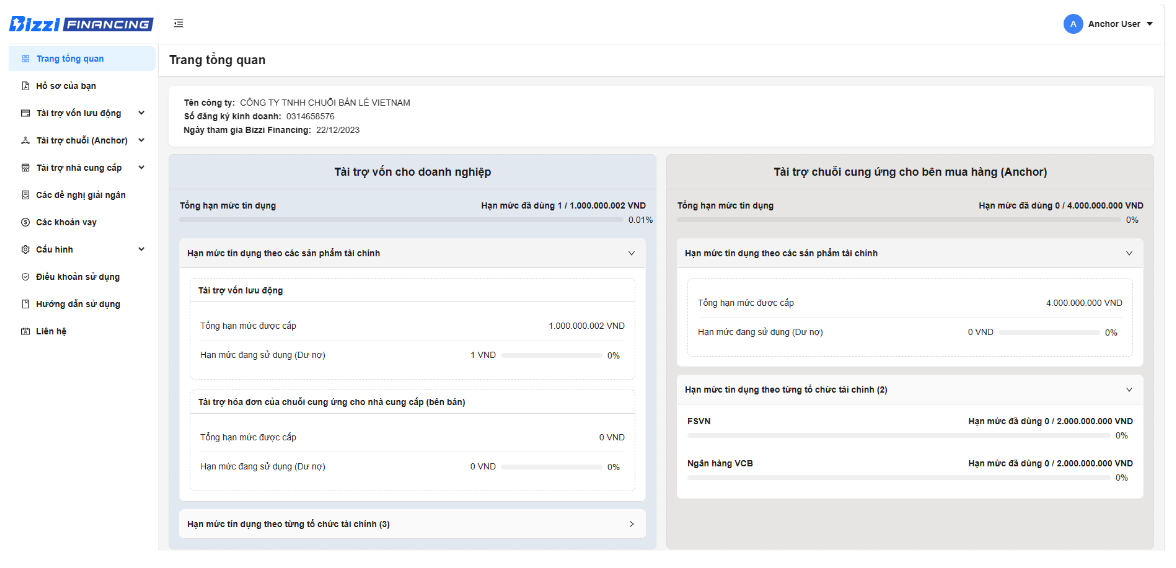

Bizzi Financing is a modern financial platform, providing flexible supply chain financing solutions, helping businesses access capital quickly and easily.

Outstanding benefits:

- Support capital according to transaction turnover: Bizzi Financing provides capital based on a business's sales. This helps businesses proactively manage cash flow and flexibly adjust the loan size according to business needs.

- Increase sales: With abundant capital, businesses can increase production, expand markets, thereby promoting revenue growth.

- Maximum invoice advance rate 100%: Bizzi Financing allows businesses to advance up to 100% of invoice value, helping businesses quickly recover capital and invest in other business activities.

- Save operating costs, simple documentation: The loan process at Bizzi Financing is simple and fast, helping businesses save time and money.

- Competitive interest rates: With the participation of many financial institutions, Bizzi Financing offers businesses many options for loan packages with competitive interest rates.

- Flexible loan term: Businesses can choose a loan term that suits their business cycle.

- Professional customer support: Financial advisory team

Other benefits that businesses can receive when using Bizzi's supply chain financing services:

- Enhance competitiveness: With abundant capital, businesses can invest in technology, improve product and service quality to compete more effectively in the market.

- Enhance reputation: Cooperating with Bizzi Financing helps businesses build a professional and trustworthy image in the eyes of partners.

- Effective risk management: Bizzi provides risk management tools, helping businesses minimize risks in the business process.

How it works:

- Registration and information: Businesses register an account on the Bizzi Financing platform and provide necessary information about the business and its operations.

- Application review: Bizzi Financing will review the application and make a loan decision.

- Signing the contract: If the application is approved, the business will sign a loan contract with Bizzi Financing.

- Disbursement: The loan amount will be transferred to the business account within a short time.

Bizzi Financing is a comprehensive financial solution that helps businesses solve financial problems and focus on business development. With a simple, fast process and competitive interest rates, Bizzi Financing is a reliable choice for businesses looking for capital to grow.

Register for Bizzi Financing information here: https://finance.bizzi.vn/

Conclude

Supply chain finance for businesses is not only a financial tool but also a key factor to improve operational efficiency and competitiveness. With the support of modern solutions such as Bizzi Financing, businesses can solve cash flow challenges, optimize the supply chain, and aim for sustainable development in the future.

Explore and apply for supply chain financing today to take your business to the next level!

Monitor Bizzi To quickly receive the latest information: