2023 is an important year with many changes in tax policy in Vietnam. In that context, Decree 44/2023/ND-CP on VAT reduction and accompanying annexes were issued. In this article, let's Bizzi Learn in detail about the 2023 VAT reduction appendices under this Decree, and consider their impact on businesses.

VAT reduction rate

Business establishments that calculate value-added tax by the credit method may apply the value-added tax rate of 8% for goods and services specified in Clause 1 of this Article.

Business establishments (including business households and business individuals) calculate value-added tax according to the method of % ratio on revenue reduced by 20% at the rate of % to calculate value-added tax when exporting. invoices for goods and services eligible for value-added tax reduction specified in Clause 1 of this Article.

>> See more: List of goods eligible for VAT reduction in 2023?

Appendix to reduce VAT 2023 Decree 44/2023/ND-CP?

Issued together with Decree 44/2023/ND-CP are the appendices related to the reduction of VAT 2023, specifically:

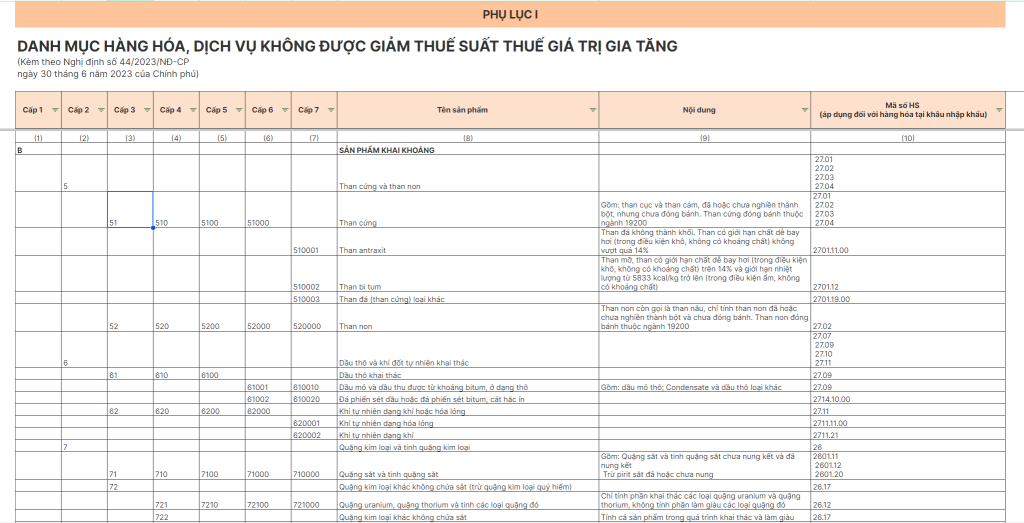

Appendix I. List of goods and services not eligible for value-added tax reduction. Load here.

List of goods and services not eligible for value-added tax reduction.

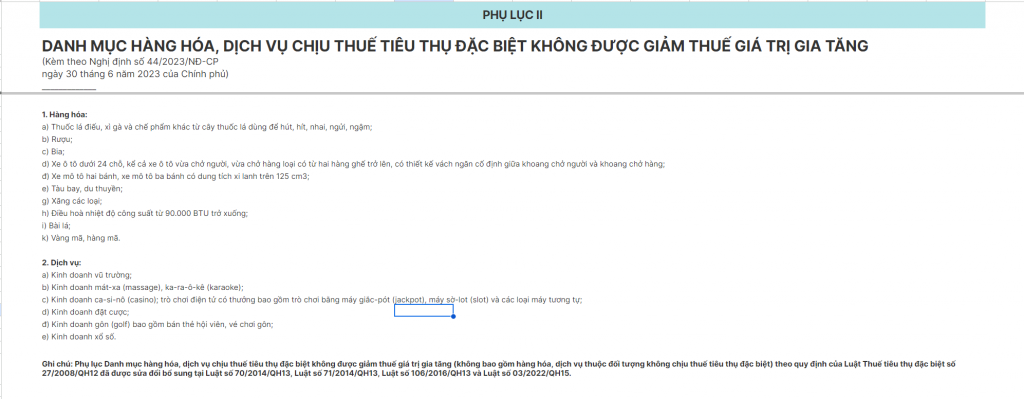

Appendix II. The list of goods and services subject to special consumption tax is not eligible for value-added tax reduction. Load here.

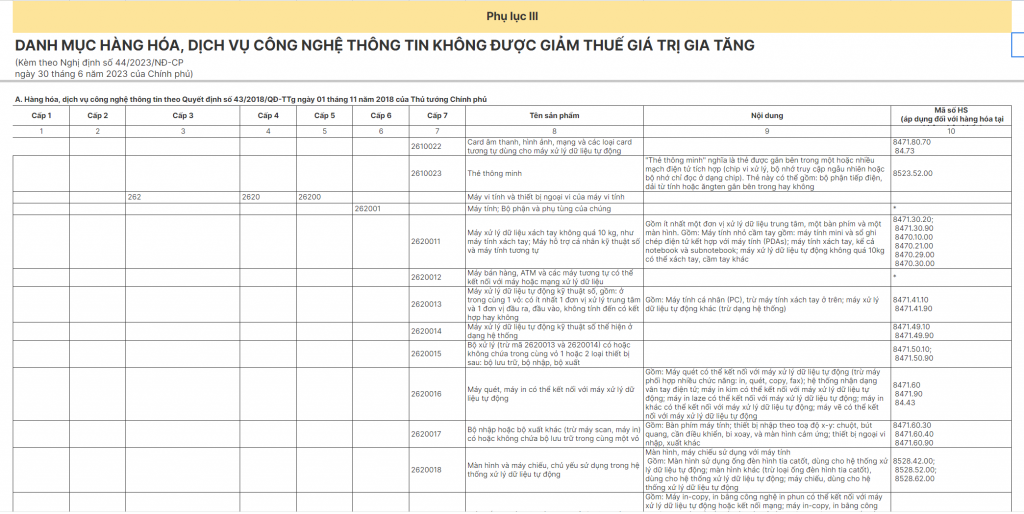

Appendix III. List of information technology goods and services not eligible for value-added tax reduction. Load here.

List of information technology goods and services not eligible for value-added tax reduction

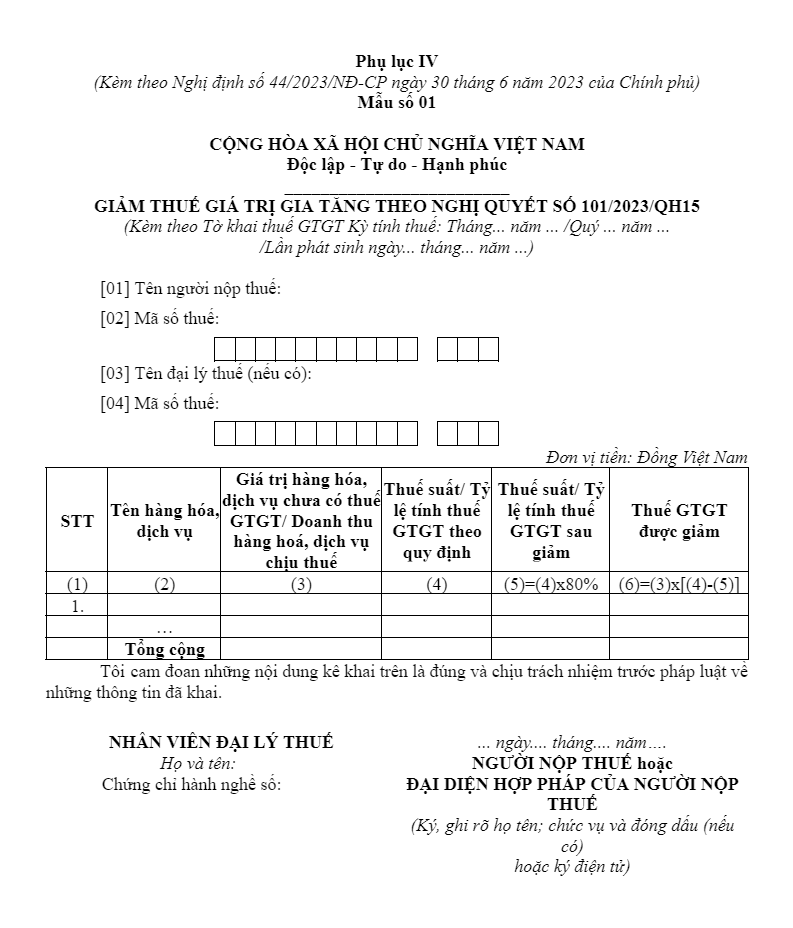

Appendix IV. Form No. 01 Value-added tax reduction according to resolution 101/2023/QH15. Load here.

Form No. 01 Reduction of Value Added Tax under Resolution 101/2023/QH15

Order and procedures for VAT reduction 2023

According to the provisions of Clause 3, Article 1 of Decree 44/2023/ND-CP, the VAT reduction 2023 is as follows:

- For business establishments specified at Point a, Clause 2 of this Article, when making value-added invoices providing goods and services subject to value-added tax reduction, at the value-added tax rate line write “8%”; value added tax; total amount to be paid by the buyer. Based on value-added invoices, business establishments selling goods and services shall declare output value-added tax, and business establishments purchasing goods and services shall declare and deduct input value-added tax. according to the reduced tax amount written on the value-added invoice.

- For business establishments specified at Point b, Clause 2 of this Article, when making sales invoices for the provision of goods and services eligible for value-added tax reduction, in the column “Income money” write the full amount of goods and services. Before the reduction in goods and services, in the line "Adding money for goods and services" write the number that has decreased by 20% at the rate of % on revenue, and at the same time note: "reduced... (amount) corresponding to 20% level. rate % to calculate value added tax according to Resolution 101/2023/QH15”.

In case a business establishment specified at Point a, Clause 2 of this Article, when selling goods or providing services, applies different tax rates, the value-added invoice must clearly state the tax rate of each good. , services as prescribed in Clause 3 of this Article.

In case the business establishment specified at Point b, Clause 2 of this Article, when selling goods or providing services, the sale invoice must clearly state the amount of the reduction as prescribed in Clause 3 of this Article.

In case the business establishment has issued an invoice and declared at the tax rate or the rate of % to calculate the value added tax that has not been reduced as prescribed in this Decree, the seller and the buyer shall process the invoice. have been prepared in accordance with the law on invoices and vouchers. Based on the invoice after processing, the seller declares and adjusts the output tax, and the buyer declares the adjustment of input tax (if any).

Business establishments specified in this Article shall declare goods and services eligible for value-added tax reduction according to Form No. 01 in Appendix IV issued with this Decree together with the value-added tax declaration. .

This Decree takes effect from July 1, 2023 to the end of December 31, 2023.

Issues to note when applying VAT reduction 2023

The appendices to reduce VAT under Decree 44/2023/ND-CP bring great benefits to businesses. The reduction of VAT rates reduces input costs, enhances competition and profitability. At the same time, businesses in preferential industries will have the opportunity to develop stronger and attract investment.

Although reducing VAT offers benefits, businesses also face a number of challenges and problems. It is important to ensure proper compliance with relevant tax regulations and procedures to avoid violations and legal prosecution. In addition, businesses need to carefully consider how to optimize the use of tax relief benefits and ensure that tax reductions do not affect the quality of products and services.

How to take advantage of VAT reduction annexes to optimize benefits for businesses

In order to take advantage of the VAT reduction annexes under Decree 44/2023/ND-CP, enterprises need to take the following measures:

- Understand the regulations and conditions to enjoy VAT reduction and strictly follow the relevant processes and procedures.

- Carefully evaluate the benefits and costs of applying tax breaks to ensure that the economic benefits are maintained and that the quality of products and services is not compromised.

- Improve tax management and tax compliance by applying technology and professional advice.

Decree 44/2023/ND-CP and its annexes to reduce VAT have brought new opportunities and challenges for businesses in Vietnam. Understanding and properly taking advantage of the provisions and conditions in this Decree will help businesses optimize tax benefits and ensure compliance with tax laws.

According to calculations by the Ministry of Finance, the policy of reducing 2% value added tax will cause a loss of state budget revenue of about 24,000 billion VND. The state budget revenue in 2023 alone is expected to decrease by VND 20,000 billion because the payable value-added revenue of December 2023 will be paid in January 2024.

Citizens are the beneficiaries of this policy. For businesses, the reduction of VAT will contribute to reducing production costs, lowering product prices, thereby helping businesses increase resilience and expand production and business, creating more jobs for businesses. workers.

Follow Bizzi to quickly receive the latest information: