Managing finances using Excel files is a popular method, especially for individuals or small businesses, effective support for administration & management. This article by Bizzi will summarize more than 18 most applicable excel file templates for corporate financial management.

Excel file template for corporate financial management

Based on information from the provided sources, below is a summary of the names of Excel file templates for corporate finance management and revenue and expenditure:

-

Excel file for company financial management

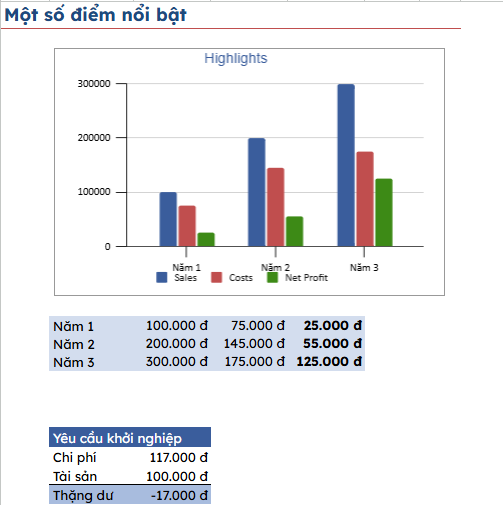

The Excel financial plan template with simple business plan is a comprehensive document for small businesses and startups. Contents include: Business information: History description, mission and core values; Market analysis; Business strategy; Financial plan: Summary of revenue, expenses, expected profits and cash flow.

Download here

-

Excel file to manage overdue debt records

Sample to track arising, due and overdue debts: Using this company financial management excel file, manage detailed reports on sales and collection of sales staff; purchase and sale of goods for customers and suppliers; debts for each customer, supplier, each order and at each time.

Download here

-

Excel file to manage accounts payable records

Use this company financial management excel file to manage customer/supplier catalog information including name, address, data when starting to use the software, customer/supplier code, phone number,...

Download here

-

Excel file for corporate financial management and financial forecasting

Financial forecasting excel file template is one of the useful tools to define and shape financial strategy. Financial forecasting templates can be customized and adjusted to suit each specific business. Businesses often use tools such as financial management excel file, financial software or financial management systems to create financial forecasts and analysis.

Download here.

-

Balance sheet Excel file

The Balance Sheet is a consolidated financial report. The preparation of the Balance Sheet is intended to reflect the overall value of the enterprise's existing assets and the sources of those assets at a given point in time. The data on the Balance Sheet shows the total value of the enterprise's existing assets according to the structure of the assets and the structure of the capital sources that form those assets. Based on the Balance Sheet, it is possible to comment on and evaluate the general financial situation of the enterprise.

Download here

-

Excel file for break-even analysis

The Excel break-even point calculator is a popular and especially useful tool in financial management, helping managers calculate the efficiency of business operations. From there, make strategic decisions to optimize profits and effectively manage risks.

Download here

-

Excel file cash flow statement

Cash flow statement is a report summarizing the cash flow situation of a business in a certain period of time. The cash flow statement shows changes in assets, the ability to convert assets into cash as well as the ability to pay.

Download:

-

Excel File Business Results Report

The income statement (also known as the profit and loss statement) is a report that reflects the business situation and results of the enterprise, including the results of the main business activities and the results from the financial activities and other activities of the enterprise.

Download:

-

Excel file of income and expenditure management table

Excel file template for managing income and expenditure helps track detailed transactions arising in the company by day, month, and year. Understanding how money is received and spent will help the company understand how cash flow works in order to have a reasonable spending plan.

Download here.

-

Excel file of capital reserve table

Establishment Excel file for capital backup brings many practical benefits in financial management, especially for businesses that are preparing to expand, invest or operate in a volatile environment. Based on the data, you can be more proactive about cash flow, identify capital shortages as well as make timely financial decisions.

Download here

-

Excel file predicting profit and loss for 12 months

Creating an Excel file to forecast profit and loss brings many practical benefits to both individuals and businesses, especially in making financial decisions and business planning. When you have both forecasts and actual data, you can easily: Measure performance; Learn from experience for next time; Know whether you are "over-performing" or "under-performing".

Download here

-

Excel file to manage store income and expenses

Every day, the store can have dozens, hundreds of transactions made by different employees in each shift. At that time, the store can use Excel files to manage business finances to support tracking and managing income and expenditure, avoiding the situation of employees taking advantage, confusing management, leading to losses and even bankruptcy.

Download:

-

Excel file to manage sales revenue and expenditure

Creating a sales revenue and expense spreadsheet template requires a lot of time and effort, and the results may not be as expected. Below is a free Excel file template for managing business finances on sales revenue and expenses that every business can refer to.

Download here here

-

Internal accounting Excel file

Managing internal revenue and expenditure with Excel is a useful tool to help businesses closely control cash flow and minimize budget loss. With the internal accounting Excel file template, businesses can make more accurate and effective business decisions.

Download here

-

Reference Excel file to support cash receipt and expenditure management

The cash book is a book used by accountants or cashiers to reflect the revenue and expenditure situation, and the use of the enterprise's cash fund. During the accounting period, any cash receipts or expenditures that the enterprise incurs will be recorded by the cashier or cash accountant in the cash book and will be responsible for managing the receipt and disbursement of this fund. In case of any discrepancy, the cashier and accountant need to find out the cause and propose timely solutions.

The basis for recording cash fund is: Payment vouchers, Receipt vouchers, Invoices that have been made to import and export cash fund.

Download According to TT200 and Theo TT133

-

Excel file to help manage coffee shop revenue and expenditure (Excel file template to manage revenue, cost and profit for coffee shops)

Find how to make income and expense table in excel for coffee shops will help track and control daily income and expenses. With the simple design of the Excel file template, shop owners can quickly grasp the income and expenditure situation, limit confusion and manage the coffee shop effectively.

Download here

-

Excel file for managing personal income and expenses

Managing personal income and expenses with Excel files helps you grasp the spending situation, balance between income, spending and savings. The Excel file template for managing personal income and expenses is simple, with fewer information fields than the company but still brings high efficiency.

-

Excel file for project cost management

Excel file template for project cost management A construction spreadsheet is a spreadsheet designed to track all income and expenses related to a construction project. This template usually includes columns such as date, income and expense, amount, payer, and balance, helping managers easily control finances and ensure transparency during the construction process.

>> Download here

Advantages and disadvantages of financial management using Excel files

Managing finances with Excel files is a popular choice, especially for individuals, startups or small and medium-sized businesses because of its simplicity and flexibility. However, Excel also has clear limitations when the scale of data and financial operations become increasingly complex.

Advantages of excel file for corporate financial management

Using Excel to manage finances in a business has some outstanding advantages, especially suitable for small businesses, startups or businesses that need flexible, cost-saving tools. Here are the main advantages:

Free and accessible

- Excel is usually available on your computer (or you can use Google Sheets for free).

- No need to invest in professional financial software.

Flexible customization

- Easily create tables, add formulas and charts according to your needs.

- You can design financial reports, cash flow tables, balance sheets as you wish.

- Cost management and analysis.

- Track cash flow.

Complete data control

- No reliance on third parties.

- Self-host and secure as you wish.

Suitable for people with basic knowledge of Excel

- For those who know how to use functions, pivot tables, data validation… can create a pretty powerful financial system.

Can be integrated with other tools

- Integrate with Google Forms, AppSheet, or export data from other software to Excel.

Disadvantages of excel file for company financial management

Besides the advantages of being free and easy to access, when businesses apply Excel to manage finances, depending on the scale and needs, they will encounter difficulties such as:

Not fully automated

- Manual data entry is error prone and time consuming.

- Cannot automatically sync with banks, e-wallets or accounting software.

- Requires knowledge of mathematical functions.

Difficult to control when data is large and complex

- When the transaction volume is large or there are many sheets, the file can easily become confusing and difficult to retrieve information.

- High risk of file corruption and formula errors if you do not have good Excel skills.

Lack of advanced features

- No bill reminders, habitual spending analysis, financial forecasts like dedicated financial apps.

Not suitable for large groups

- Difficult to work in groups at the same time (unless using Google Sheets but still limited).

- It's hard to control who edits what without a decentralized system.

Less secure than dedicated systems

- Easily copied and edited without security measures (such as setting passwords, encrypting files, etc.).

- Not as safe and secure as dedicated software.

When to use financial management software

Switching from traditional financial management using Excel to using professional financial management software is a necessary upgrade when a business or individual begins to expand and requires higher accuracy, automation, and security.

As the volume of data grows larger

- Excel can easily get confused or slow when working with thousands of rows of data and multiple sheets.

- Searching, filtering, and summarizing data becomes time consuming.

=> Use software to help with automatic management, centralized storage and easy retrieval.

When multiple people need to work together (teamwork)

- Offline Excel is difficult to coordinate if there are many accountants and managers accessing it at the same time.

- Prone to overwrite errors, data loss, or out-of-sync versions.

=> Financial software has clear authorization functions, everyone's actions are tracked.

When you need fast, visual, in-depth reporting

- Excel must manually create charts and summary tables.

- It is difficult to have standard financial reports (P&L, balance sheet, cash flow…) without effort.

=> The software allows automatic report export with just a few steps — standard, beautiful, easy to analyze.

When security & backup is needed

- Excel files can easily be lost, damaged, or deleted by mistake if not backed up.

- If you set a password, there is still a risk of it being cracked if shared via email or drive.

=> Software often has automatic backup mechanism, higher cloud security.

When there is a need to integrate with other systems

- Excel cannot be integrated with POS, CRM, e-commerce platforms, banks...

=> Modern software can synchronize orders, invoices, and payments, saving hours of manual data entry.

When you want to comply with accounting or tax regulations

- For audited businesses, Excel storage is no longer sufficient.

=> The software usually has standard forms according to circulars, making it easy to settle taxes.

Although creating an Excel file to manage business finances is simple and easy to do, in the long run, when the scale increases with large amounts of data, managing with this traditional form will cause many problems and easily lead to errors.

To increase the efficiency of corporate finance processes with lean cost management, businesses can apply cost management software. Bizzi Expense is a comprehensive cost management tool that supports real-time tracking, recording, reporting of costs and budget management with centralized cost management.

| Manage with Excel | Use Bizzi Expense |

| Manual entry, prone to errors | Automatic bill scanning, AI recognition |

| Lack of security, weak authorization | Clear authorization, high security |

| No approval process | Has smart approval workflow |

| Time consuming synthesis | Get instant dashboards & reports |

Bizzi provides many outstanding features in business cost management such as:

Control costs strictly according to policies and budget

- Complete and valid invoices and documents

- Prepare budgets by department, project and spending category

- Warning when costs and payment requests do not/do exceed the budget

- Display quick reports of spending information, updates on estimated spending - actual spending in focus

- Dashboard for intuitive, multi-dimensional cost management in real time across multiple platforms

Approve documents conveniently and transparently

- Approve anytime, anywhere cross-platform

- Approval reminders to keep work from getting delayed

- Understand clearly the status of compliance with regulations and budget before making decisions

- Record approval/rejection history with valid reasons

Simplify the invoice collection – expense creation process:

- Reduce time spent receiving and checking invoices – initiate expenses in just 2 taps

- Proactive mass expense reporting helps streamline processes

- Automatically navigate the browsing flow according to established units, regulations, and decentralization

Send work request/advance quickly:

- Automatically calculate work norms

- Clearly plan your expenses

- Easily request advances

Conclude

Planning an excel file to manage business finances is familiar and necessary in any business, especially small and medium-sized enterprises. Excel is a free tool that allows users to set up tables according to management needs, but it is necessary to operate carefully and systematically to avoid errors.

Above is a free summary Excel file management template corporate finance, if your business is looking for a comprehensive, automated management support tool, sign up for a trial of Bizzi Expense now. Bizzi Expense has been trusted by many large and medium-sized companies in many fields such as Mondelez, kewpie, MASAN Group, Pierre Fabre

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/