The General Director of the General Department of Taxation issued Official Dispatch No. 01/CD-TCT requesting the provincial and municipal tax departments and the Large Enterprise Tax Department to resolutely and effectively implement tax management for e-commerce activities and electronic invoices (E-invoices) generated from cash registers.

General Department of Taxation requires drastic implementation of electronic invoices generated from cash registers

Implementing the direction of the Government and the Ministry of Finance in improving the capacity of tax collection management and preventing tax losses for e-commerce activities; continuing to expand the implementation of e-invoice solutions initiated from e-invoices to support people and businesses in using e-invoices quickly, conveniently and economically, while improving management efficiency, preventing tax losses in the retail sector, protecting consumer rights, contributing to promoting the digital transformation of the financial sector, the General Director of the General Department of Taxation requests the Directors of the Tax Departments of provinces and cities, and the Tax Departments of large enterprises to continue to urgently carry out the following tasks:

Implement a synchronous and comprehensive review and inspection of tax declaration, payment, and use of electronic invoices by organizations, business households, and individuals doing e-commerce business, doing business on e-commerce trading floors, affiliate marketing, providing digital information content products, and receiving income from advertising activities, providing software, etc., especially organizations and individuals doing online business, live streaming videos to sell goods and services, etc.

From August 1, apply electronic invoices generated from cash registers to golf businesses

The General Department of Taxation requires implementing solutions to apply electronic invoices generated from cash registers from August 1, 2024 for the following types of businesses: Selling golf course tickets and providing services on the course; trading in golf apparel, tools, accessories, etc.

At the same time, develop plans and implement inspection and examination work for the above types so that businesses clearly understand, fully perceive their responsibilities and commit to seriously implementing tax declaration and payment according to regulations, promote the implementation of electronic invoices generated from cash registers, and prevent loss of state budget revenue.

Resolutely deploy tasks to leaders of the Tax Department, leaders of Tax Departments and Branches and specifically to civil servants managing units to work and propagate policies, legal regulations on tax declaration, payment, use of electronic invoices in transactions to each business establishment in the fields of e-commerce, golf course business, golf course support service business...

In addition, direct the review, statistics, and evaluation of tax management work to plan the application of electronic invoices generated from cash registers for business types with revenue from selling tickets to visit tourist areas, entertainment activities, etc., and report to the General Department of Taxation before August 1, 2024.

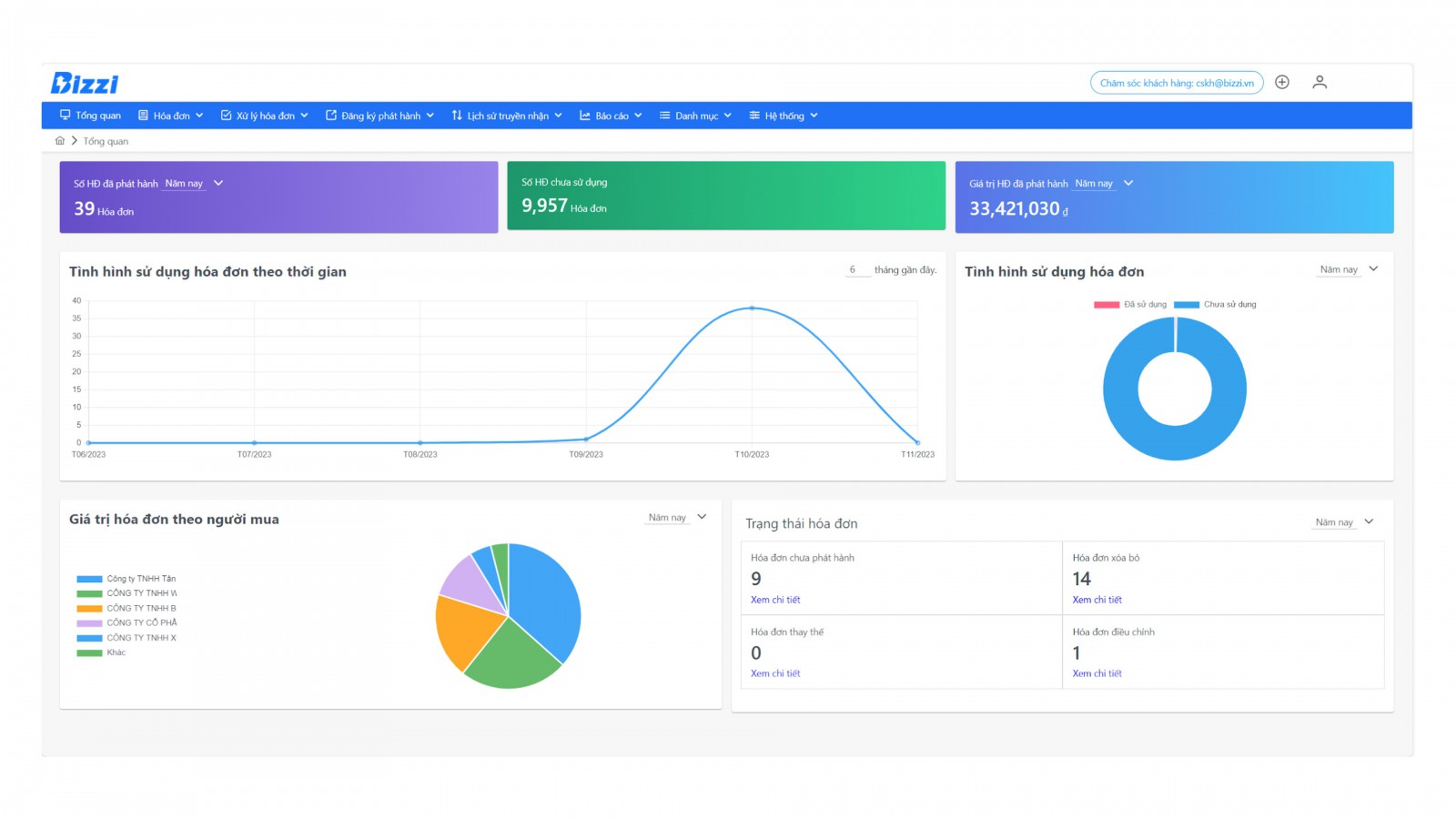

Why businesses should switch to using electronic invoices B-Invoice?

B-Invoice is an electronic invoice solution built on a modern technology platform, fully complying with legal regulations and meeting business requirements according to Decree 123/2020/ND-CP, Circular 78/2021/TT-BTC.

B-Invoice electronic invoice includes:

- Regular electronic invoices: B-Invoice fully meets the current regulations of the Ministry of Finance on electronic invoices, helping businesses issue electronic invoices quickly, accurately and legally.

- Electronic invoice created from cash register (POS): B-Invoice integrates with popular cash registers (POS) on the market, helping businesses easily issue electronic invoices from point-of-sale sales transactions.

- Electronic ticket: B-Invoice provides professional electronic ticket solutions, helping businesses manage ticket sales and create electronic ticket invoices effectively.

Learn more at: https://bizzi.vn/hoa-don-dien-tu/

Currently, there are many providers of electronic invoice solutions on the market. To choose the right solution for your organization, businesses need to consider many different criteria. As mentioned above, B-Invoice is an electronic invoice solution recognized by the General Department of Taxation, fully meeting the professional requirements as prescribed by law.

Bizzi is having attractive offer for customers who register for B-Invoice e-invoice solution. Hurry up and register today to receive this attractive offer!

For direct advice and support, please contact:

-

- Hotline: 028 3622 2368

- Email: [email protected]

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/