Working capital is one of the important factors that help businesses maintain daily production and business activities. Understanding working capital, how to calculate and manage it will help businesses optimize resources, improve business efficiency and minimize financial risks.

Working capital is not only related to the solvency of the business but also directly affects the ability to develop and expand. This article will help you better understand working capital, its classification, how to calculate and how to effectively manage working capital in the business.

What is working capital?

Working capital is the amount of money a business needs to maintain its day-to-day operations, including cash, accounts receivable, inventory, and short-term payables. It helps a business be able to pay short-term operating expenses such as salaries, utilities, raw materials, and other expenses.

Working capital can be distinguished from fixed capital. Fixed capital is long-term assets that can be used for many years such as factories, machinery, and equipment. Meanwhile, working capital is related to highly liquid assets that can be easily converted into cash for use in regular business activities.

Classification of working capital

Working capital can be classified in many different ways, depending on the purpose of use and the management method of the business. Classifying working capital helps businesses have a clearer view of their financial resources, thereby creating effective management strategies. Below are common ways to classify working capital:

Classification by property nature

Working capital can be divided into current assets, that is, assets that can be easily converted into cash within 12 months. Accordingly, working capital includes:

Current assets: Are assets that a business can easily convert into cash in a short period of time (less than 12 months). These assets include:

-

- Cash: Includes cash and funds that can be used immediately to pay short-term expenses.

- Accounts Receivable: Amounts that a business is waiting to pay from customers, such as accounts receivable from customers due within 12 months.

- Inventory: Includes products, raw materials and goods that have not been sold or consumed in the short term. Businesses need to manage inventory properly to avoid costly expenses and ensure uninterrupted production and business operations.

- Short-term investments: Are investments that can be recovered in a short period of time, often used by businesses to optimize cash flow.

Short-term debt: Are debts that a business must pay within 12 months, such as short-term loans, payables to suppliers, salaries and other expenses.

Classification by financial source

Working capital can also be classified according to the source of finance that a business uses to raise capital. Accordingly, there are two main sources:

Internal working capital: Is the capital that a business generates from its own production and business activities, including:

-

- Retained earnings: This is the profit that the business retains instead of distributing to shareholders or using to reinvest in business operations.

- Depreciation of fixed assets: Depreciation is the cost that a business allocates to fixed assets (such as machinery and equipment) over a period of time. This depreciation is considered a source of working capital because it helps create cash flow without having to spend cash.

Foreign working capital: Is the capital that businesses mobilize from external parties to supplement working capital, including:

-

- Bank and financial institution loans: These are short-term or long-term loans from credit institutions and banks, helping businesses supplement capital to maintain operations or expand development.

- Capital raised from shareholders: Businesses can issue stocks or bonds to raise capital from investors.

- Commercial loans from suppliers: These are loans that businesses receive from suppliers, helping to extend the payment period for products or services that the business purchases.

Classification by business cycle

Working capital can also be classified according to the business cycle of the enterprise, especially for manufacturing enterprises. These cycles are often related to the production and consumption of goods, including:

Working capital in the production cycle: Includes investments in raw materials and labor costs during the production process. This is the working capital needed to maintain production and can be reused in the next cycle.

-

- Raw materials: The types of raw materials that businesses need to use to manufacture products.

- Labor costs: The cost that a business must pay to workers during the production process.

- General manufacturing costs: Includes costs that are not directly associated with the product but are still necessary for the production process, such as electricity, water, and machinery maintenance costs.

Working capital in the consumption cycle: Is the capital needed to maintain sales activities and recover capital from receivables. After the product is completed, the business needs to sell the product and collect money from customers.

-

- Consumer goods: Products are completed and brought to market.

- Accounts Receivable: The money a business receives from customers after the product has been sold.

Classify by importance to business operations

Working capital can also be classified according to the importance of its constituent elements in maintaining the business operations of an enterprise:

- Minimum working capital: Is the minimum level of working capital that a business needs to maintain to ensure the ability to pay short-term debts and maintain production and business activities. This is the amount of capital needed to maintain short-term stability without affecting the ability to pay debts.

- Excess working capital: Is the portion of working capital that exceeds the minimum required level, which can be used to invest in other business opportunities, expand scale, or reserve to deal with unexpected financial fluctuations.

Working capital needs of the business

The working capital needs of each business are clearly different and are affected by many factors. Determining the working capital needs accurately not only helps businesses maintain stability in their operations but also supports financial strategy planning, avoiding capital shortages or surpluses. Below are the main factors affecting the working capital needs of businesses:

Enterprise scale

The size of a business is one of the factors that determine the need for working capital. Large businesses usually have higher working capital needs than small businesses because:

- Higher production costs: Large businesses often produce goods and provide services in large quantities, requiring them to maintain larger inventories, pay large staffs, and pay off many debts.

- Higher trading volume: As the size of the business increases, the number of customers and partners providing goods and services will also increase. This leads to the need for a larger amount of working capital to maintain receivables and payables.

Therefore, large enterprises will need a large amount of working capital to ensure continuous cash flow during production and service provision.

Business Line

Working capital requirements also depend on the industry in which a company operates. Different industries have different financial characteristics and operating cycles, leading to variations in working capital requirements. Specifically:

- Manufacturing industry: Manufacturing businesses have a greater need for working capital because they have to maintain a large amount of inventory, pay for labor and raw materials before completing the product. In addition, the production process can last from several weeks to several months, while the revenue from the product only comes when the product is completed and sold in the market.

- Service industry: Businesses in the service industry such as consulting, education, technology often have lower working capital needs because they do not need to maintain physical goods. However, they still need capital to pay for labor costs, marketing and service development.

Thus, the industry directly affects the cost structure and payment cycle of the business, thereby determining the working capital needs.

Season

Seasonality is also an important factor that affects a business's working capital needs. Some businesses have greater capital needs at certain times of the year, especially retail and manufacturing businesses that are seasonal in nature. For example:

- Retail industry: Businesses in the retail industry, especially stores selling consumer goods, clothing, and food, will have a large need for working capital during holidays, Tet, tourist season, new school year, etc. because they need to purchase goods to stock up to serve the increased demand of customers during these peak seasons. This requires businesses to have a clear financial plan to avoid capital shortages during the season.

- Agricultural production industry: Businesses in the agricultural or food processing sectors have working capital needs that fluctuate with the harvest season. During the harvest season, businesses will need capital to purchase inputs and maintain production, while other seasons may not require much working capital.

Determine working capital needs through financial statement analysis

To accurately determine working capital needs, businesses need to perform specific analysis steps from their financial statements. Some methods that help businesses forecast future working capital needs include:

- Financial statement analysis: A careful review of financial ratios such as current ratio, inventory turnover, receipts turnover and payables turnover helps businesses determine the amount of working capital needed in the following accounting periods.

- Revenue and expense forecasting: Businesses need to forecast revenues and expenses for the coming periods to determine how much money is needed to maintain operations. These factors can be based on market analysis, consumer trends, the business's business cycle, and other macro factors.

- Financial planning: After analyzing financial reports and forecasting capital needs, businesses need to develop a reasonable financial plan. This plan will include forecasts of cash inflows and outflows, helping businesses proactively prepare the necessary capital for production and business activities.

How to calculate working capital

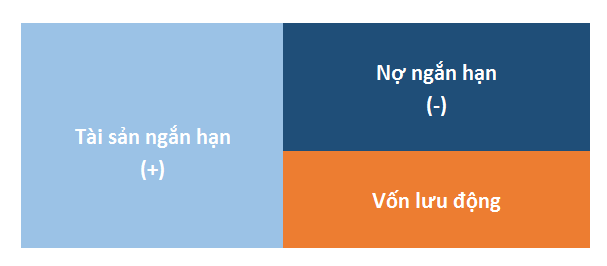

Calculating working capital is quite simple, based on the following formula: Working Capital = Current Assets – Current Liabilities

In there:

- Current assets includes cash, receivables, inventories.

- Short-term debt includes short-term loans and accounts payable.

Illustrative example: Suppose a business has short-term assets of 2 billion VND and short-term liabilities of 1.5 billion VND, then the business's working capital will be:

Working capital = 2 billion – 1.5 billion = 0.5 billion

This means that the business has 500 million VND in working capital to maintain daily operations.

Effective working capital management

Effective working capital management is an important factor in helping businesses maintain stability in business operations and ensure sustainable development. Working capital not only helps businesses maintain daily business operations but also supports in taking advantage of opportunities and handling financial challenges.

To manage working capital effectively, businesses need to monitor and analyze key financial indicators and apply appropriate management measures.

1. Working capital assessment indicators

To effectively manage working capital, businesses need to monitor some basic financial indicators to help assess the use of capital in business activities:

Current Ratio:

The current ratio is a financial ratio that measures a company's ability to pay off its short-term debts with its short-term assets. It is calculated by dividing total short-term assets by total short-term liabilities. An ideal current ratio usually ranges from 1.5 to 2, meaning that the company has at least 1.5 to 2 dollars of short-term assets to pay off 1 dollar of short-term debt.

A ratio that is too low may indicate that the business does not have enough current assets to pay its current liabilities, while a ratio that is too high may be a sign that the business is not using its assets efficiently.

Inventory Turnover:

This ratio reflects the number of times a business sells all of its inventory in a year. Inventory turnover is calculated by dividing the cost of goods sold by the average inventory value. If the turnover is low, it may indicate that the business is having difficulty selling, possibly due to too much inventory or not matching market demand. Effective inventory management will help reduce storage costs and increase profits.

Receivables Turnover:

This ratio measures the average time it takes a business to collect its debts from its customers. A short turnover period helps a business maintain a steady cash flow and have enough capital to reinvest in other activities. A long turnover period can increase the risk of insolvency and affect the business's ability to grow.

2. Working capital management measures

To optimize working capital management, businesses need to take specific measures for each component of working capital: inventory, receivables and payables.

Inventory management:

Inventory management is one of the important factors in working capital management. Businesses need to ensure that the amount of inventory is not too large, avoiding the situation of prolonged inventory or not being able to sell all the goods in time. Some common methods of inventory management include:

- Just-in-Time (JIT): This is an inventory management method that helps businesses minimize inventory by only producing or warehousing products that are needed in the shortest time. This method helps reduce storage costs while improving the efficiency of working capital use.

- ABC Classification Method: Inventory can be classified into groups A, B and C based on the value and importance of each item. Group A items are high-value or fast-selling products, businesses need to focus on managing and ensuring adequate inventory for these items. Group B and C items can be managed less closely but still need to be monitored to avoid surplus or shortage.

Accounts Receivable Management:

Managing receivables is one of the important factors to maintain a stable cash flow for the business. Some measures to help manage receivables effectively include:

- Urge customers to pay on time: Businesses need to have clear policies on debt collection from customers, and at the same time urge customers to pay on time by sending notices, debt reminder invoices or even applying legal measures when necessary.

- Minimize bad debts: Businesses need to check and evaluate the financial capacity of customers before providing products or services. This will help limit uncollectible receivables and minimize credit risk.

Manage accounts payable:

Managing accounts payable is an important part of optimizing a business’s cash flow. Businesses need to find ways to optimize the timing of payments to suppliers without compromising their relationships. Some strategies include:

- Look for suppliers with flexible payment terms: Businesses should look for suppliers that allow flexible payment terms or offer early payment incentives to reduce financing costs.

- Negotiate payment terms: Businesses need to negotiate better payment terms with suppliers, such as delayed payment or discounts for early payment, which helps businesses retain working capital longer.

Business Loan Support Solution – Bizzi Financing

Bizzi Financing – Platform connecting businesses with investors

Bizzi Financing is a financial platform that connects businesses with investors, providing fast and effective lending solutions. This platform supports businesses to access capital easily with competitive interest rates and simple procedures.

Advantages of Bizzi Financing:

- Quick loan process, just register online and the system automatically processes the application.

- Competitive interest rates help reduce borrowing costs for businesses.

- Professional financial consulting services help businesses optimize capital use.

Let Bizzi Financing help your business optimize capital and grow stronger! Sign up for Bizzi Financing consultation here: https://finance.bizzi.vn/

The Importance of Working Capital Management to Business Success

Working capital management is a key factor in ensuring the financial stability and sustainable development of a business. Working capital not only helps a business maintain its daily operations but also plays an important role in exploiting opportunities and dealing with financial challenges. Effective working capital management can make a significant difference between a successful and a failed business.

- Maintain solvency: Adequate working capital helps businesses pay debts on time, avoid credit risks and maintain operations without having to borrow excessively.

- Facilitate development: Working capital helps businesses invest in expanding scale, improving products and services and seizing new market opportunities.

- Seize the opportunity: Good working capital management helps businesses be flexible, take advantage of investment opportunities or reduce costs when necessary.

- Risk reduction: Ensuring adequate working capital helps businesses overcome crises and market fluctuations without facing financial difficulties.

- Asset Optimization: Good working capital management helps businesses use assets more efficiently, reduce waste and increase productivity.

Conclude

Working capital is an indispensable factor in maintaining the daily operations of an enterprise. Understanding and managing working capital effectively will help enterprises minimize financial risks and improve their ability to develop sustainably. Enterprises need to regularly monitor and optimize working capital to achieve long-term success.

With the support of financial platforms like Bizzi Financing, businesses can optimize working capital management, improve operational efficiency and achieve long-term business goals.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam