The rapid change in technology and financial situation in a context full of uncertainties makes it necessary for CFOs to accelerate to maximize their strategic role in the organization. By nature, the finance department is highly plan-oriented and structured. However, the current business environment forces finance teams to adapt to new working styles.

Current technology solutions are not only aimed at simplification but also process automation, which directly affects the way we work, innovate and perceive the whole industry.

Biren Shah, CFO of Aurobindo Pharma USA shared: “As we approach the end of fiscal 2022, I can't help but look back at how much has changed over the past few decades since I started the business. his career. In the financial world of about 20 years ago, I remember people still dreading year-end chaos with audits under a manual review process that lasted several weeks. For me, it's still a nightmare."

“I have witnessed and implemented processes and applied technology to simplify and streamline repetitive tasks. And during this time, I always try to keep myself up to date with the latest tools, even when I'm not using them." – Mr. Biren shared more.”

We can see that, in the past two decades, the dizzying change of technology has completely transformed the financial world by leaps and bounds. Not only limited to normal tasks, technological solutions besides simplifying processes also automate them. This has a huge impact on the way we work, innovating in terms of awareness and skills.

Adapt – Automate – Accelerate

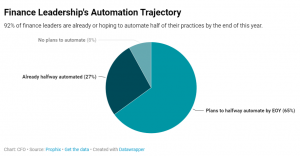

According to data from Survey of financial leaders in 2023 Propix's 700 CFOs show that more than 65% financial leaders plan to automate of their tasks by the end of 2023. As a result, promoting technology integration continues to be at the heart of the initiatives. financial leader. Automation efforts will free up more time so they can focus on high-value tasks.

However, in addition to the challenges that CFOs face in choosing technology solutions, financial leaders also have to deal with external pressures, including: inflation, energy prices and economic recession.

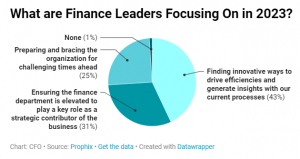

This implementation of automation has also changed the job needs of a finance leader. When asked what best describes their focus within the finance function, 43% CFO said they are finding creative ways to drive efficiency and generate insights.

Also asked this question, 31% CFO said their mission is to ensure the finance department is enhanced to play its role as a strategic contributor to the business. This is a perfect example of how the role of the finance leader is shifting away from traditional accounting and money management duties, towards leading the organization through a financial lens.

In response to market challenges and the economic situation in 2023, 96% leaders agree that agility and adaptability are most important. Business adaptability is demonstrated through a leader who can be proactive in decision-making. CFOs who demonstrate their abilities in a flexible and proficient manner will not only position themselves with the best technical skills, but will also need to take advantage of new types of automation technologies to develop and enhance corporate financial position.

On the other hand, CFOs must accelerate to advance and move towards the automating finance of the finance department or they will fall behind. Besides the need for CFOs to change and upgrade their thinking, another important factor is building a strategy for cross-departmental cooperation. Learn how other financial departments depend and make a plan to work together to achieve desired results.

As a result, CFOs can ensure that their organization stays competitive and makes the best decisions based on real-time data and trends.

Since the current business scenario is fraught with uncertainties, it is imperative for CFOs to take on a more strategic role within the organization. CFOs need to demonstrate their leadership not only by promoting cost control, but also by developing strategies and initiatives that harness the power of technology to improve organizational performance.

Follow Bizzi to quickly receive the latest information:

-

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam

- Youtube: https://www.youtube.com/@bizzivietnam