The number of days payable, also known as Days Payable Outstanding (DPO), is an important indicator in evaluating the effectiveness of financial management and cash flow of a business.

This article will give you an in-depth look at DPO, including how to calculate DPO using a simple formula and its applications in various industries.

Let's explore with Bizzi!

What is the number of days payable?

Days payable (DPO) is an important financial indicator, representing the average number of days it takes a business to pay its payables to suppliers. The DPO plays an essential role in evaluating the performance of payments operations, accounts payable (AP) processes, and the overall financial health of a business.

Understand what benefits DPO brings?

DPO analysis helps businesses:

- Evaluate the effectiveness of your current payment process: DPO shows the average time a business takes to pay debts. From there, businesses can identify areas that need improvement in the payment process to optimize efficiency.

- Detect potential late payments: Late payments can result in penalty fees and damage supplier relationships. Monitoring DPO helps businesses detect potential late payment cases early to take timely remedial measures.

- Strengthen commercial position: Paying on time demonstrates the reputation and responsibility of the business, thereby helping businesses build good relationships with suppliers and have an advantage in negotiating prices and payment conditions.

- Cost savings: Quick payment helps businesses take advantage of payment discounts, while minimizing the risk of interest arising due to late payment.

Why is it necessary to calculate DPO - days payable?

Calculate DPO helps business leaders determine the average time needed to pay suppliers, thereby monitoring the effectiveness of cash flow management. High DPO shows that the business is paying the supplier slowly and needs to analyze the cause for improvement. The reason may be due to the business:

- Maintain cash longer for potential investments.

- Having difficulty making payments, leading to increased debt.

On the contrary, DPO is low shows that the business pays faster than usual. However, paying it off early can affect cash flow available for other investments. On the other hand, low DPO can also be a sign that a business:

- Take advantage of early payment discounts to save costs.

- Maintain good relationships with suppliers to improve production times.

Therefore, Regular DPO reviews and accounts payable (AP) process monitoring It is extremely important to determine the cause of high or low DPO and provide appropriate solutions. Automating the AP process provides real-time financial data, helping to effectively analyze the entire payment cycle.

Formula to calculate DPO number of days payable

Days Payable (DPO) is an important financial indicator that evaluates the effectiveness of a business's accounts payable management. It represents the average number of days it takes a business to pay supplier invoices.

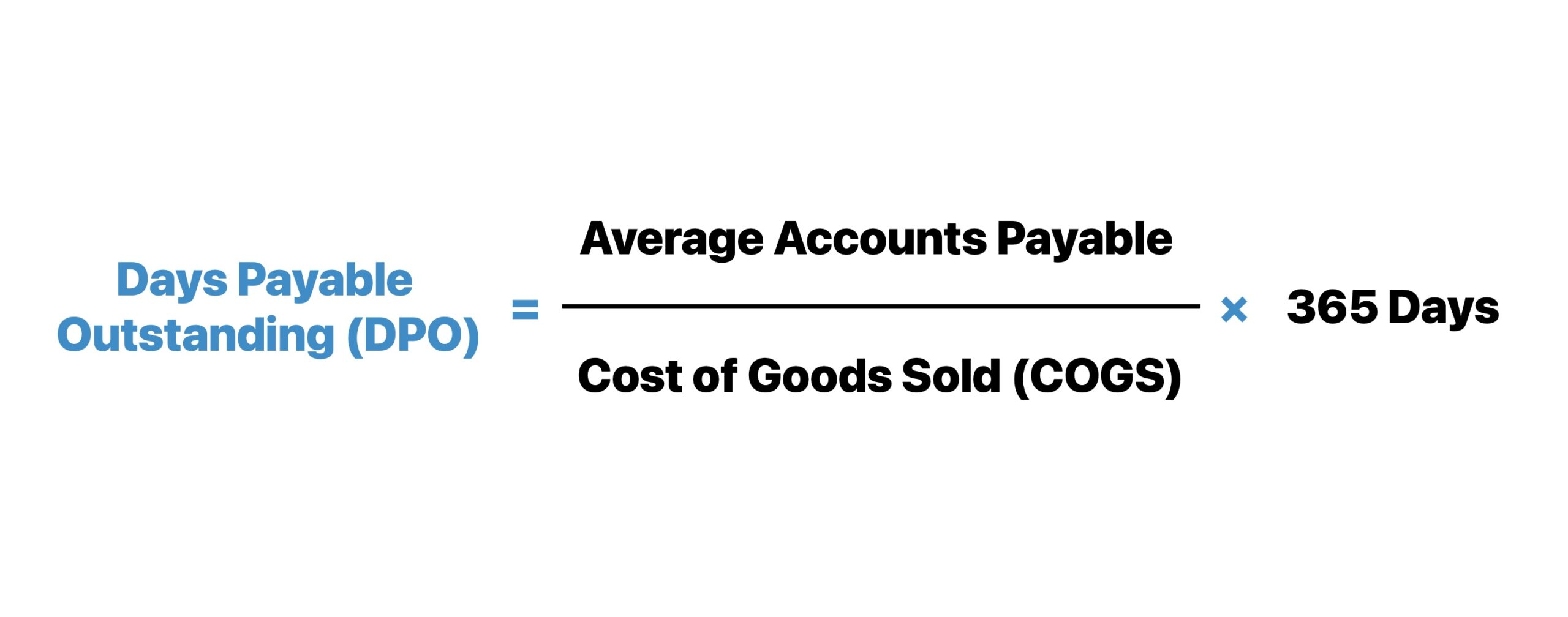

Formula to calculate DPO:

Explanation of each element:

- Average Accounts Payable – Average accounts payable: This is the average amount a business owes its suppliers over a certain period of time. To calculate, add the accounts payable balance at the beginning and end of the accounting period, then divide by 2.

- Cost of Goods Sold – Cost of goods sold (COGS): Includes direct costs related to the production of goods that the business sells.

- Multiply by 365: Convert rate to average number of days.

Illustration:

Suppose a company has an average accounts payable of $50,000 and COGS of $300,000 in a year. Applying formula:

DPO = (50,000 / 300,000) × 365 ≈ 60.83

Result: The average business takes about 61 days to pay suppliers.

Meaning of DPO:

- High DPO: Can show good working capital management efficiency, helping businesses use cash on hand longer. However, it is also possible that businesses intentionally pay slowly to optimize cash flow, leading to risks affecting relationships with suppliers.

- Low DPO: Shows that the business pays its suppliers promptly, demonstrates goodwill, and maintains good relationships. However, it can also affect cash flow, limiting the ability to invest in other activities.

Therefore, businesses need to monitor and evaluate DPO regularly to devise appropriate payment strategies, ensure operational efficiency and maintain good relationships with suppliers.

Payable date (AP) variables

In addition to the calculation formula, there are a number of other factors to consider to ensure your accounts payable (AP) days are high enough. For example:

- Exclude cash payments to suppliers, counting only deferred purchases.

- Automating the AP process simplifies payables date calculations by making relevant financial data available for immediate analysis and processing.

How to calculate daily accounts payable turnover?

Digging deeper into the calculations: Accounts payable turnover per day (also called Payables Days) indicates the average number of days that a payables account remains unpaid. In other words, this is the average time it takes your business to pay a typical invoice.

Formula to calculate DPO Number of days payable: Divide 365 days by the Accounts Payable Turnover Ratio.

Understand clearly the timing of payments to suppliers also helps evaluate an organization's creditworthiness - thereby making the necessary improvements to increase cash flow and creditworthiness.

Days Payable (DPO) Benchmark by Industry

Days Payable (DPO) is not a measure that applies universally to all businesses. DPO varies significantly across different industries, reflecting distinct operations and financial practices. In this section, we will find out DPO benchmark vary across sectors and what these fluctuations say about a company's cash management and supplier relationships.

Understand your industry's benchmarks It is essential for businesses to evaluate their own DPO within the context of the industry and strive for optimization. Businesses need to strike a balance between maintaining a healthy DPO to benefit cash flow and cultivating positive relationships with suppliers.

Automation makes calculations and timely payments easier

Calculating Days Payable (DPO) is just the beginning. After understanding the payment cycle, businesses can make improvements based on cash flow situation and production needs. Continuous assessment is key to maintaining productivity and profitability in an ever-changing global market. Automate your Accounts Payable Process (AP) provides a secure and collaborative environment to share real-time financial data, helping to make important decisions promptly.

Furthermore, modern software solutions brings a new perspective in management payable. These solutions automate data analysis, improve decision making with advanced analytics, and integrate seamlessly with your financial systems.

This level of automation and integration not only simplifies DPO calculations but also provides real-time overview and tracking, ensuring more strategic and effective financial management.

Additionally, tracking milestones compares AP (accounts payable benchmarks) help determine Purchasing department performance, cash flow and overall supplier satisfaction. With AP automation, teams can collaborate anytime, anywhere to make critical decisions that support continuous production and improve brand reputation.

This proactive approach to Days Payable management, supported by advanced software solutions, is key to avoiding payment delays, production disruptions and potential brand damage.

Understanding how to calculate Days Payable and leveraging the right technology to manage it is key to an organization's overall success. Learn more about AP automation and how it helps pay invoices on time, build strong supplier relationships – helping organizations improve cash flow and increase profits.

Streamline the accounts payable process

Adoption of AP automation, especially with solutions like Bizzi, is key for any organization trying to optimize its financial position. These technologies streamline the calculation and management of days payable, ensuring more strategic finance operations and stronger supplier relationships.

Discover how Bizzi's AP automation solutions can support timely invoice payments and strengthen your organization's financial performance. Take this important step to improve your cash flow and boost your profits today.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam