The year 2023 with the economic recession will be one of the problems that are threatening the development of many businesses. In this situation, debt management becomes more important than ever. However, payables are listed as the top digitization priority of the financial team.

Businesses must focus on managing their liabilities effectively, to avoid financial risks and to help businesses continue to thrive in this difficult economic environment. In the article below, Bizzi will send you information to help manage liabilities to ensure the sustainable development of the business in 2023 and the coming years.

1. What is debt management?

Accounts payable management or in other words accounts payable management is the management of payments and debts to suppliers. The accounts payable process includes everything from collecting invoices, obtaining approvals, updating records and supplier information, initiating bill payments, and reconciling accounts.

2. Challenges in debt management

- Human error: The working process of the debt management department will easily make mistakes in the process of entering data, comparing information and making payments. It is very easy to go wrong in any part of the process. When invoices can be sent in multiple formats, it can lead to duplicate payments. Small mistakes can also lead to fraud, putting the company at risk. In fact, according to PYMNTS and Mastercard, 53% companies are looking to invest in accounts payable automation with the hope of reducing errors. Mistakes that occur not only waste the AP department's usual time, but also waste additional resources to fix. These errors can frustrate both the provider and the AP team.

- Waste of time: In addition to frequent errors, manual debt management also takes a lot of time for businesses. More than 61% CFOs surveyed said that improving efficiency is the reason to speed up the process of automating their accounts payable management. For CFOs who have gone digital, 91% says they see a positive impact on AP team performance.

- Difficulties when expanding business: As the AP team grows, the AP team will have more invoices, more vendors to process, so with existing manual processes, they will feel the stress and pressure that growth creates. Adding more employees is not a sustainable option for businesses that want to optimize costs, increase work productivity and improve their revenue. Therefore, automating accounts payable management helps businesses handle more invoices than before without adding additional human resources.

- Stressful relationships with suppliers: Manual processes create errors that cause businesses to delay payments causing frustration for suppliers. According to MineralTree's 2022 AP Status Report, 71% companies agree that their supplier relationships have become more strategically important than they were the previous year. To reduce stress and build good relationships with suppliers, businesses need to have an effective debt management process and ensure payments are made on time.

>> See more: Top 5 benefits of automating accounts payable

3. Effectively manage liabilities through Automation

As technology evolves rapidly, keeping manual processes inefficient, AP departments can become a hindrance to the flow and progress of a business. To avoid this, organizational leaders should consider adopting automation platforms and evolving their processes to better meet the needs of the modern market.

Here are 5 steps that can help your team effectively manage accounts payable with automation.

3.1. Scan bill

There are many ways to capture invoice information using digital processes regardless of how the invoice is received. Invoices can be submitted directly to the AP platform by the vendor through the vendor portal. Invoices received via email can be sent straight to your business's dedicated invoicing inbox. With automation, the entire invoice is processed from receipt to payment:

- Almost completely eliminated human error

- Reduce overpayments and duplicate payments

- Automatically warn wrong bill

- Reporting, budgeting, and auditing have become much more efficient and accurate.

>> See more: The first automatic invoice processing software in Vietnam

3.2. Faster Invoice Approval

Using automated processes allows for much faster invoice approvals. Invoices can be routed to the right approvers, reviewers can receive instant notifications and submit their approvals from any internet-connected device – whether they're at the office or away on business.

3.3. Storage and management

With all the information in one system, document management becomes much easier. Everything is accessible from one centralized location, and anyone with access can instantly identify where any invoices are being processed.

3.4. accreditative

By automating the accounts payable process, your business can easily arrange payments in installments with similar priority or payment deadlines to allow for approval and scheduling of payments. based on existing cash management priorities. In addition, payment authorization can be activated from any device, meaning that even if your authorizer does not have access to their computer, they can easily approve payments. from their phone.

3.5. Analysis of accounts payable data

By having all the details and data in one system, it is possible to combine tools that enable analysis of this data. Detailed analytics provides powerful insights that can help businesses optimize cash flow, view KPIs and internal metrics, and improve supplier relationships.

Dealing with recession risks is a challenge for all businesses. Managing liabilities is one of the effective ways for businesses to deal with this risk. The use of automated payables management technologies and processes can also help reduce recession risk by improving the accuracy and speed of the payables management process.

4. Better management with Bizzi – Accounts payable management platform for businesses

Thanks to the application of AI and machine learning technology, the Bizzi Cost Management & Automatic Control Platform for businesses with the automatic input invoice processing solution (Bizzi IPA) has Supports businesses to automatically receive, process, analyze, compare and store electronic invoices with a quick invoice download and management process.

With Bizzi, for invalid invoices, the system will send a warning to the user, and automatically notify the supplier via email of errors on the invoice. Through a smart 3-way comparison system between invoices - orders - warehouse receipts, Bizzi supports the AP team with all information on the invoice and the seller's operational status to help minimize risks. risks and errors in the payment process. Bizzi also helps create and approve payment requests quickly and easily, supporting payment to suppliers on time.

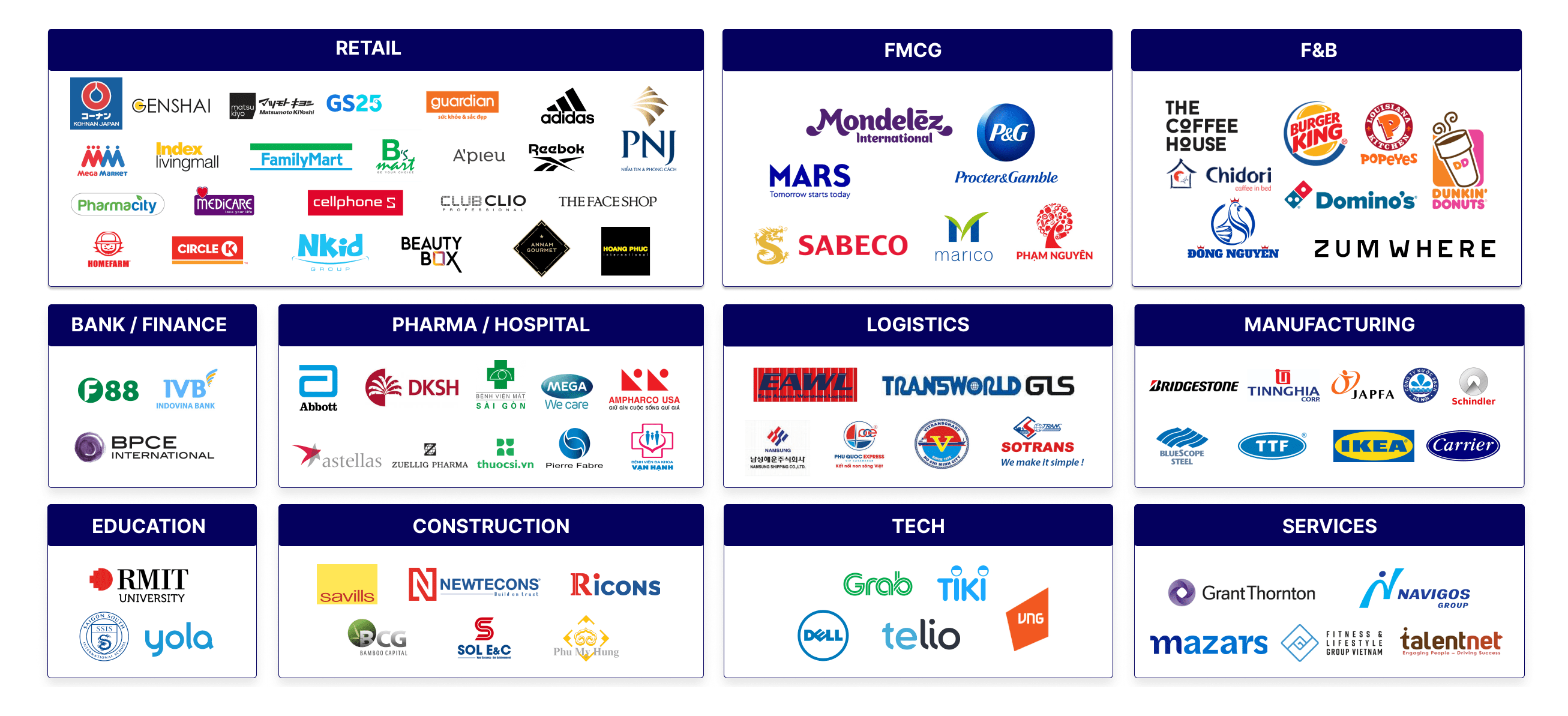

After more than 3 years of establishment and development, Bizzi is serving more than 1,200 corporate customers, major corporations/organizations including Genshai, Kohnan Japan, Matsumoto Kiyoshi Grab, GS25, Tiki, Guardian, Sabeco, Pharmacity, P&G, PNJ, Mondelez, VNG, Circle K, Family Mart,… and 38,000 suppliers are using the platform every day.

Businesses can register to experience Bizzi's products today!

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam