Invoices play a "key" role in the accounting and tax declaration process of businesses. However, many businesses, especially SMEs today, are not aware of the importance of invoices, or if they are aware, it is very difficult to avoid errors if the business has to receive hundreds or thousands of invoices each year. month. Let's learn with Bizzi about 5 common invoice violations!

5 common invoice violation situations

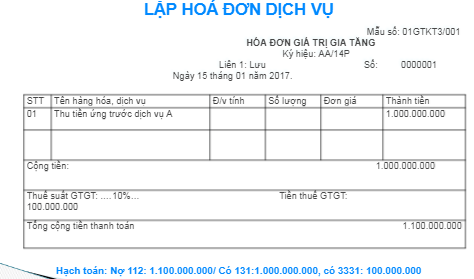

CASE 1: BILLING A SERVICE CONTRACT

- Law on invoices

+ The time of invoice issuance for service provision activities is the time of completion of service provision to the buyer or the time of collection.

+ The time to issue an invoice for property leasing activities is the time of completion of the property leasing activity. In case the lessee pays in advance for many periods, an invoice equivalent to the amount received in advance must be issued.

- Invoice errors

+ Do not issue invoices when receiving money (service).

+ Do not issue invoices when receiving money in advance for renting assets for many periods

Note: Contract fines and deposits are made with payment documents.

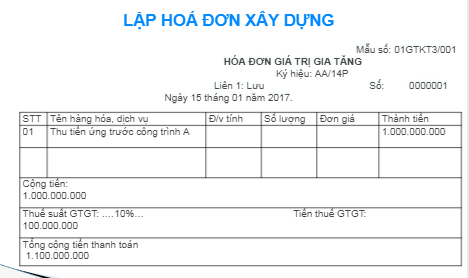

CASE 2: BILLING FOR CONSTRUCTION CONTRACT

- Law on invoices

+ Construction facilities have construction and installation works that take a long time to complete, payment is made according to progress or according to the amount of work completed and handed over, must issue an invoice to pay for the amount of construction and installation handed over. .

+ In case of completed construction work, an invoice has been issued to pay the value of the work, but when approving the final settlement of the value of the capital construction work, the value of the construction volume to be paid must be adjusted, then prepare a contract and documents to adjust the price. The value of the project must be paid.

- Invoice errors

+ Make an invoice at the time of receiving the advance payment according to the contract or the time of payment according to the planned progress for construction activities, while the project, project items, construction and installation volume have not yet been completed. completion, acceptance, and handover.

+ Do not issue invoices when the construction and installation volume is handed over.

+ Do not issue invoices or declare taxes for the unpaid value due to the warranty period under the contract not yet expired.

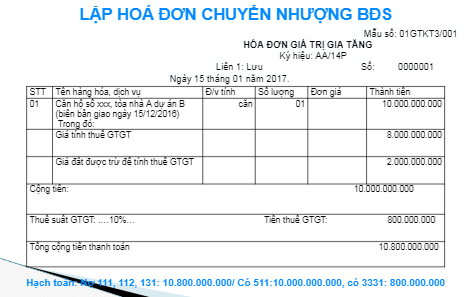

CASE 3: BILLING A REAL ESTATE CONTRACT

- Law on invoices

+ Make invoices upon handing over real estate.

+ In case a real estate business organization, infrastructure construction, house construction for sale or transfer collects money according to project implementation progress or payment collection schedule stated in the contract, the invoice date is the date of payment. collect money.

- Invoice errors

+ Do not issue invoices when collecting money according to schedule.

+ Do not issue invoices when handing over real estate.

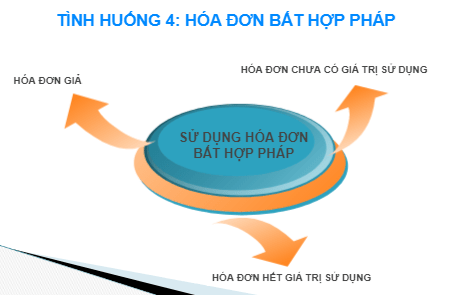

SITUATION 4: ILLEGAL BILL

- Invoice errors

+ Using an invoice that has not yet completed the issuance notification (except in cases where the seller has not established an invoice issuance notice before the invoice is put into the SD card and has complied with the penalty decision, the buyer is entitled to Use invoices to declare, deduct, and calculate expenses according to regulations).

+Using invoices from organizations and branches that have stopped using the tax code (also known as closing the tax code).

+ Using fake invoices.

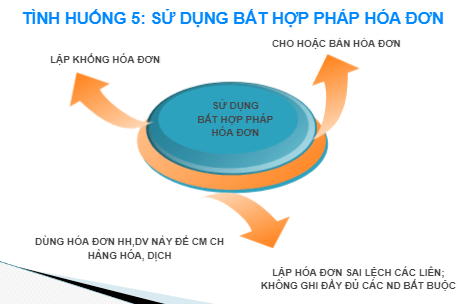

SITUATION 5: ILLEGAL USE OF INVOICES

Some cases of illegal use of invoices

(1) Invoices whose contents are partially or completely untrue;

(2) Using invoices from other organizations or branches to sell goods and services without declaring and paying taxes, tax fraud;

(3) Invoices with differences in value or deviations in mandatory criteria between copies of the invoice;

(4) Using invoices for selling goods and services that QTT, police agencies and other authorities have concluded is an illegal use of invoices.

- Invoice errors

+ Buy goods and services without legal invoices (unreal goods and services), then buy invoices without goods and services (unreal goods and services) to legalize; Normally, the company then sells the invoice and runs away.

+ Buy goods and services from this organization or branch (unreal goods and services), but receive invoices from other businesses (false invoices).

+ Buying invoices (unreal goods and services) to deduct false VAT and declare false expenses.

Signs of illegal use of invoices

- The first: Employees of the purchasing department buy goods and services without legal documents, then illegally buy input invoices (using BHP invoices, or using illegal invoices) to legalize and make payments. .

- Monday: The goods seller illegally purchases invoices (illegal use of invoices, or illegal use of invoices) to issue to the buyer of goods (contractor) usually expressed in the following form:

(1) CN goes to the buyer's address, or makes an offer by phone, or through an acquaintance;

(2) Delivery of goods (real goods) at the construction site, accompanied by contract, invoice, receipt (in case of cash collection).

(3) Request the buyer to transfer money to the account of the invoice seller, then receive the money back from the illegal invoice seller.

- Tuesday: CNs provide services of illegally purchasing invoices (using BHP invoices, or using BHP invoices) to issue goods to the buyer, usually expressed in the following form:

(1) These employees often have a relationship with a number of people in the business purchasing the service, or use acquaintances to negotiate and sign a contract (usually the contract is drafted by one of the two parties and signed by the other party). where the direct signers do not meet).

(2) Providing services (services are real) at the construction site at the address requested by the buyer; Upon delivery of completed services or completed work volume, the seller and buyer shall prepare a delivery record to confirm the volume of work performed; The seller illegally purchased the delivered invoice, so he bought it and requested payment.

(3) Request the buyer to transfer money to the account of the enterprise that illegally sold the invoices, then receive the money back from the party that illegally sold the invoices.

- Wednesday: Contracting parties are construction teams without legal status, carrying out construction works on a "blank contract" basis. To receive the full contracted amount, construction teams must legalize payment documents including:

(1) Illegally buying input invoices to legalize goods and services for business activities (real), but when buying goods and services there are no legal documents.

(2) Prepare bogus seasonal labor salary payment documents to legalize the contracted profits, but must deliver the documents to the contracting enterprise as agreed for the contracting enterprise to legalize. for this expense.

(3) Using illegal invoices or illegally using invoices (illegally purchasing input invoices) to legalize the contracted profit, but must hand over the documents to the contracting enterprise according to the agreement. Agree to let the business contract to legalize this expense.

Above are invoice violations that accountants easily encounter. Understanding these invoice violations, accountants can avoid errors and find appropriate solutions to handle invoices effectively.

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam

- Youtube: https://www.youtube.com/@bizzivietnam