In an increasingly volatile business world, CFOs are facing new challenges and need to adjust their strategies to ensure business sustainability. A notable shift appears on CFO priority lists for 2023, raising questions about the role of financial cost control in the current economic environment.

Let's look back at this transition process with Bizzi!

Notable change in CFO's priority list

New research shows that corporate finance departments are returning to the basics in 2023, with a clear shift focused on controlling corporate finance costs. The focus on cost control has pushed revenue growth KPIs lower on CFO priority lists this year.

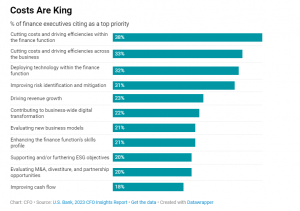

According to a survey by US Bank with the participation of 1,420 senior finance experts, the top priority of CFOs today is cost control in the finance department. This is a priority ranked above controlling financial costs across the entire enterprise, the second concern.

More than ⅓ (38%) of CFOs said they are prioritizing cost reductions in their departments. In addition, 33% CFO prioritizes cost reduction across the enterprise.

A similar 2021 banking survey put cost cutting at number 8 on the list of concerns for financial experts.

A focus on costs becomes mainstream, forcing many companies to succumb to prevailing economic conditions.

Why does the CFO rate financial cost control higher than organization-wide cost efficiency? Some notable reasons include the finance department's direct reporting to the CFO. CFOs understand that they cannot ask other departments to cut spending if they themselves cannot set an example. This poses a challenge for them as they need to balance focusing on efficiency and investing to drive business growth.

The balancing challenge and the innovation deficit

More than half (56%) of CFOs participating in the survey expressed difficulty in achieving a balance between focusing on efficiency and investing for growth. Cost control efforts appear to be negatively impacting innovation and creativity activities.

Only 26% CFOs are evaluating new business models, down from 42% two years ago. Enterprise-wide insights generation activities decreased from 39% to 23%, and capital allocation process improvements were only 27%, down from 38% two years ago. And only 27% CFOs are involved in improving the capital allocation process, while two years ago, this proportion accounted for 38%.

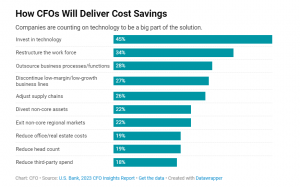

In particular, the leading factor in creating cost efficiency is the fact that finance departments are looking for technology platforms that apply to work processes. In fact, according to the survey report, 54% CFO said artificial intelligence could completely redefine the way the finance function team operates.

Different from the trend two years ago, only 19% CFOs are planning to reduce their workforce, a sharp decrease compared to 40%. It seems that reducing headcount is no longer the preferred strategy, and businesses are focusing on other measures such as process optimization and technology integration to achieve maximum efficiency.

In a difficult economic climate, the shift in CFO priorities provides a clear picture of the business's strategic adjustment. Controlling costs, especially in the finance department, becomes a top priority, while also posing the challenge of balancing efficiency and investment to drive growth.

The integration of technology, especially artificial intelligence, is emerging as a decisive factor in reshaping the way finance functions work. The next challenge for businesses is how they can maintain a balance between cost control and innovation to ensure sustainability and growth going forward.

Prepare scenarios for the challenge of controlling financial costs in 2024

Preparing a plan for cost control in 2024 becomes extremely important. Faced with a remarkable shift in CFO priorities, businesses need to look to technology to help them control costs effectively and sustainably. Cost management tools for businesses are becoming an integral part of business strategy, with AI playing a key role in the process.

Applications integrated with artificial intelligence are capable of analyzing financial data in detail and automatically, helping businesses better understand the origin and origin of costs. At the same time, intelligent data analysis helps CFOs make quick and accurate decisions, based on detailed and complex information from many different sources.

Besides, integrating financial cost control and innovation strategies will help businesses thrive in a challenging context and create strong steps in the uncertain future of business.

Businesses can consider Bizzi Expense - a smart expense management application and artificial intelligence integration, helping businesses control budgets strictly and effectively.

With Bizzi Expense, businesses can:

- Digitize and streamline the business expense management process: claim per diem, refunds, and advances

- Control costs with flexible policies and approval flows

- Tight and detailed budget control down to each cost item, department, and project with many dimensions of analysis such as estimates and actual expenses.

- Warning when spending exceeds budget

- Get an overview of business expenses quickly thanks to the expense reporting dashboard, actual and projected expenses updated in real-time

Additionally, Bizzi Expense's user interface is designed to be simple and easy to use. This helps users quickly get acquainted and take advantage of all features effectively without having to dig deep into the training process.

Bizzi Expense Able to integrate with many different systems in the business, including accounting and ERP software. This helps ensure synchronization and alignment of financial information across the entire enterprise. More than that, Bizzi Expense focuses on security and compliance. Business financial data is strictly protected, while ensuring compliance with regulations and industry standards.

Bizzi Expense is not only a cost management tool but also a reliable partner, helping businesses be more confident in controlling financial costs and creating transparency in financial management.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam